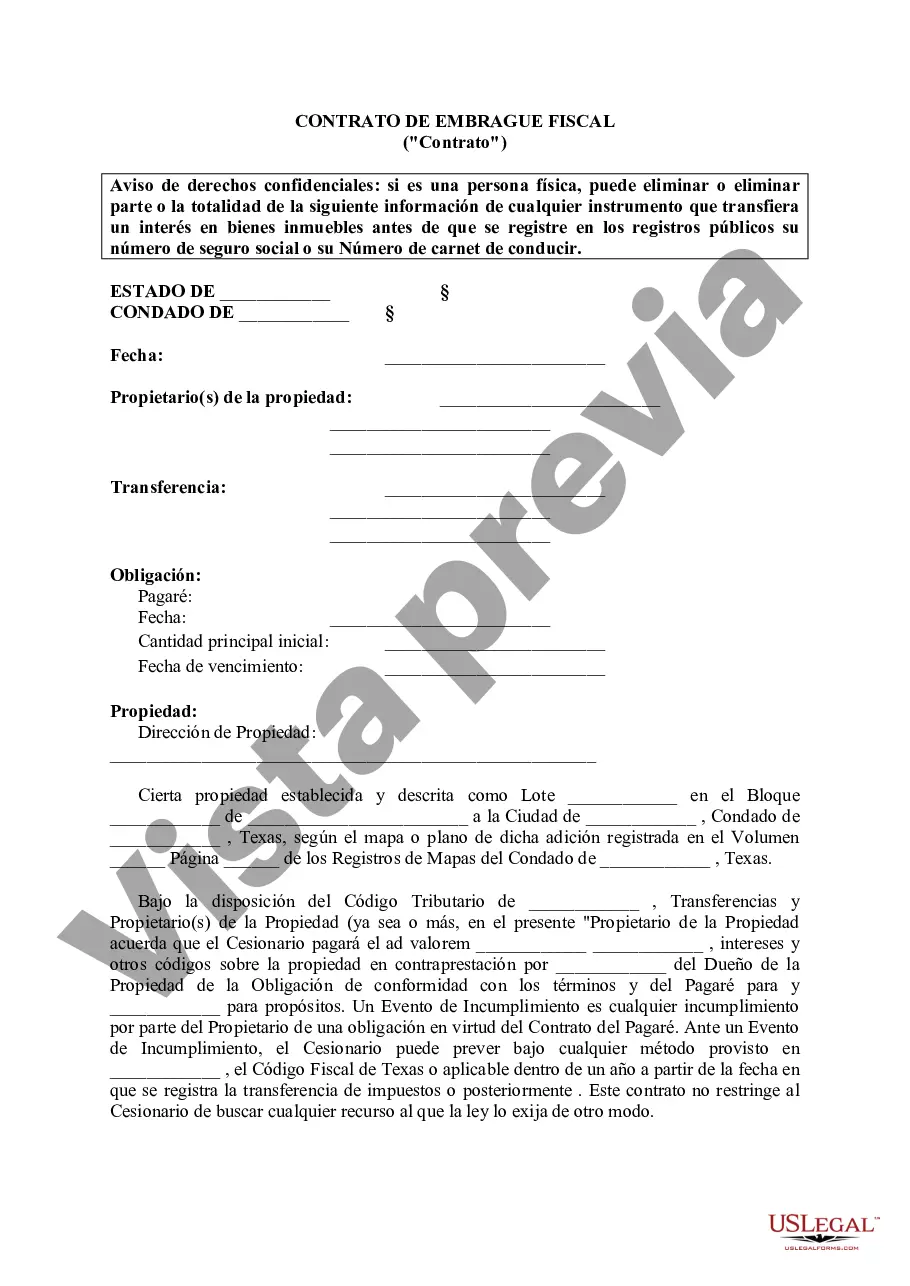

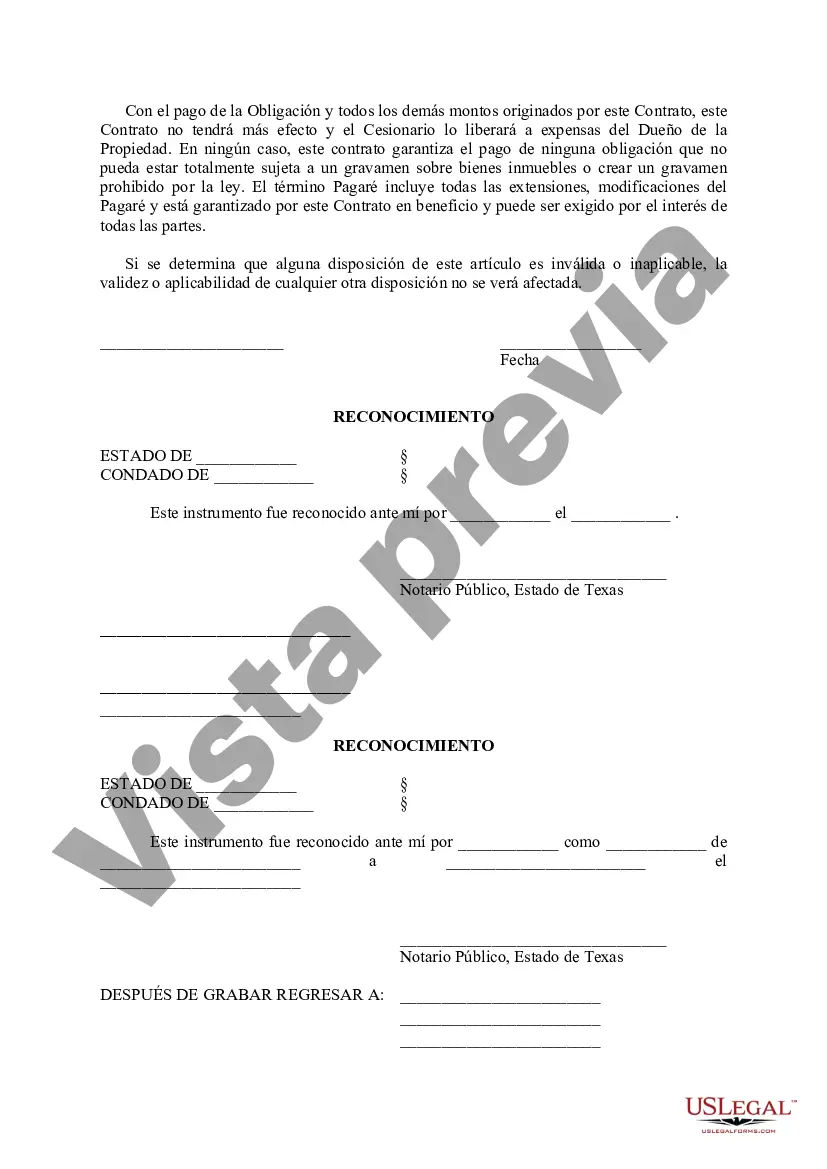

Killeen Texas Tax Lien Contract: A Comprehensive Overview The Killeen Texas Tax Lien Contract refers to a legal agreement entered into between the local government authorities, represented by the Killeen Texas County, and a property owner who has failed to pay their property taxes on time. This contract allows the county government to place a tax lien on the property, granting them certain rights and privileges. When a property owner falls behind on their property taxes in Killeen, Texas, the county government may initiate the tax lien process. A tax lien is a legal claim against the property, giving the county the right to collect the overdue taxes owed. The purpose of this contract is to establish the terms and conditions for the tax lien, including the amount owed, interest rates, and repayment options. The Killeen Texas Tax Lien Contract typically states the specific amount of taxes owed, including any delinquent fees or interest charges. It outlines the timeline for the owner to repay the outstanding balance, which is often required within a certain period. Failure to comply with the terms of the contract may result in additional penalties or even foreclosure. Different types of Killeen Texas Tax Lien Contracts may exist depending on the specific circumstances. Here are a few notable variations: 1. Installment Payment Agreement: This type of tax lien contract allows the property owner to pay off the delinquent taxes over a designated period, typically through monthly installments. The agreement sets forth the repayment schedule, including the amount and frequency of payments. 2. Lump Sum Payment Agreement: Some property owners may choose to repay the delinquent taxes in a single lump sum payment. This type of contract specifies the due date and the consequences of non-payment. 3. Tax Lien Auction Contract: In certain cases, the county government may opt to sell the tax lien to a third-party investor through an auction. The tax lien auction contract outlines the terms and conditions for the sale, including the minimum bid amount, interest rates, and redemption periods. 4. Property Redemption Agreement: This type of tax lien contract applies when a third-party investor has purchased the tax lien on a property. The property owner may have the opportunity to redeem their property by repaying the investor the unpaid taxes, plus any accrued interest. It is important for property owners and potential buyers to carefully review the terms and conditions of a Killeen Texas Tax Lien Contract before entering into an agreement. Seeking legal advice is recommended to ensure proper understanding and compliance with the contract. Failure to adhere to the terms can have severe consequences, including losing ownership rights to the property through foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Killeen Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Category:

State:

Texas

City:

Killeen

Control #:

TX-LR051T

Format:

Word

Instant download

Description

This Lien document state Property Owner agrees that Transferee shall pay Ad valorem taxes, interests and other codes within terms of Promissory Note.

Killeen Texas Tax Lien Contract: A Comprehensive Overview The Killeen Texas Tax Lien Contract refers to a legal agreement entered into between the local government authorities, represented by the Killeen Texas County, and a property owner who has failed to pay their property taxes on time. This contract allows the county government to place a tax lien on the property, granting them certain rights and privileges. When a property owner falls behind on their property taxes in Killeen, Texas, the county government may initiate the tax lien process. A tax lien is a legal claim against the property, giving the county the right to collect the overdue taxes owed. The purpose of this contract is to establish the terms and conditions for the tax lien, including the amount owed, interest rates, and repayment options. The Killeen Texas Tax Lien Contract typically states the specific amount of taxes owed, including any delinquent fees or interest charges. It outlines the timeline for the owner to repay the outstanding balance, which is often required within a certain period. Failure to comply with the terms of the contract may result in additional penalties or even foreclosure. Different types of Killeen Texas Tax Lien Contracts may exist depending on the specific circumstances. Here are a few notable variations: 1. Installment Payment Agreement: This type of tax lien contract allows the property owner to pay off the delinquent taxes over a designated period, typically through monthly installments. The agreement sets forth the repayment schedule, including the amount and frequency of payments. 2. Lump Sum Payment Agreement: Some property owners may choose to repay the delinquent taxes in a single lump sum payment. This type of contract specifies the due date and the consequences of non-payment. 3. Tax Lien Auction Contract: In certain cases, the county government may opt to sell the tax lien to a third-party investor through an auction. The tax lien auction contract outlines the terms and conditions for the sale, including the minimum bid amount, interest rates, and redemption periods. 4. Property Redemption Agreement: This type of tax lien contract applies when a third-party investor has purchased the tax lien on a property. The property owner may have the opportunity to redeem their property by repaying the investor the unpaid taxes, plus any accrued interest. It is important for property owners and potential buyers to carefully review the terms and conditions of a Killeen Texas Tax Lien Contract before entering into an agreement. Seeking legal advice is recommended to ensure proper understanding and compliance with the contract. Failure to adhere to the terms can have severe consequences, including losing ownership rights to the property through foreclosure.

Free preview

How to fill out Killeen Texas Contrato De Gravamen Fiscal?

If you’ve already used our service before, log in to your account and download the Killeen Texas Tax Lien Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Killeen Texas Tax Lien Contract. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!