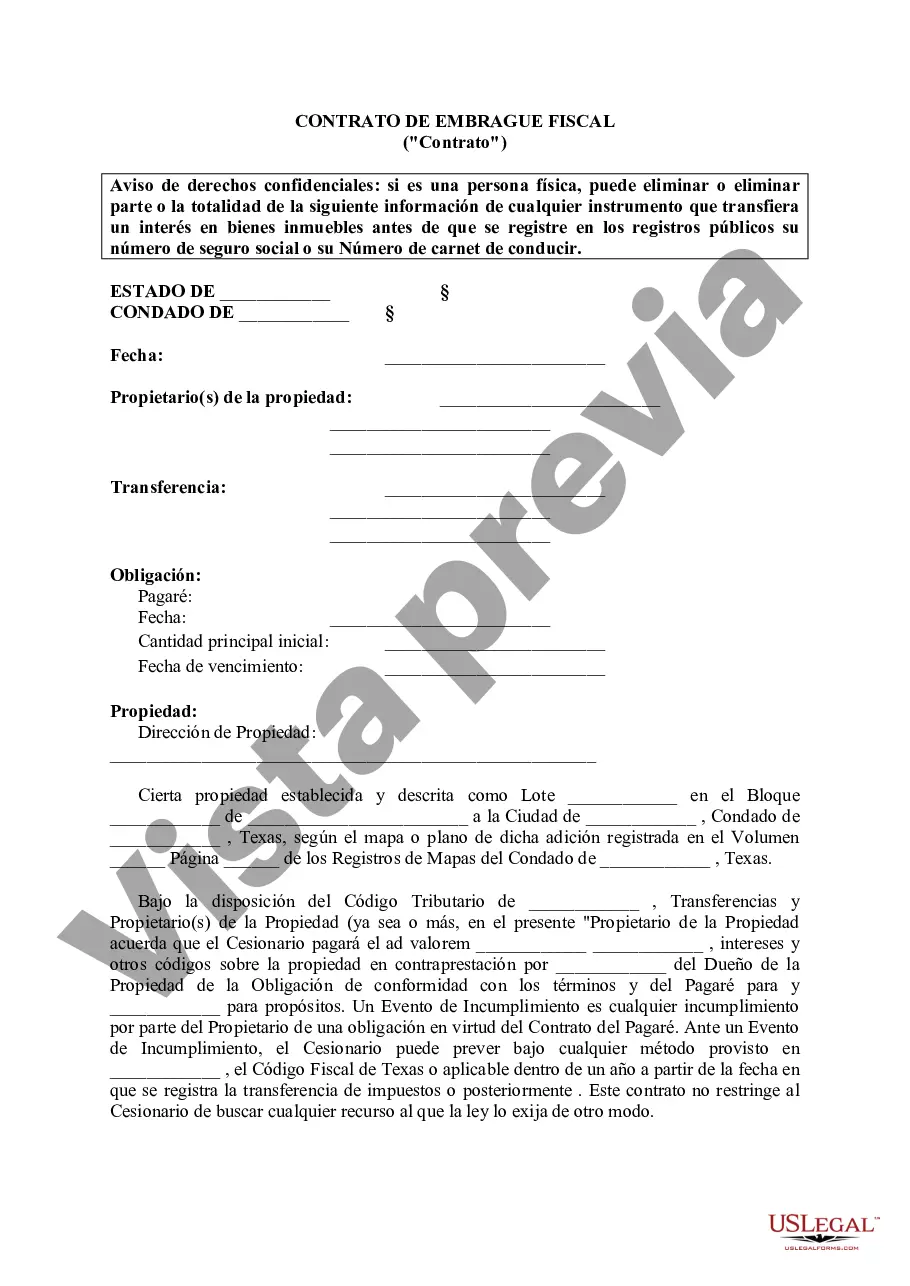

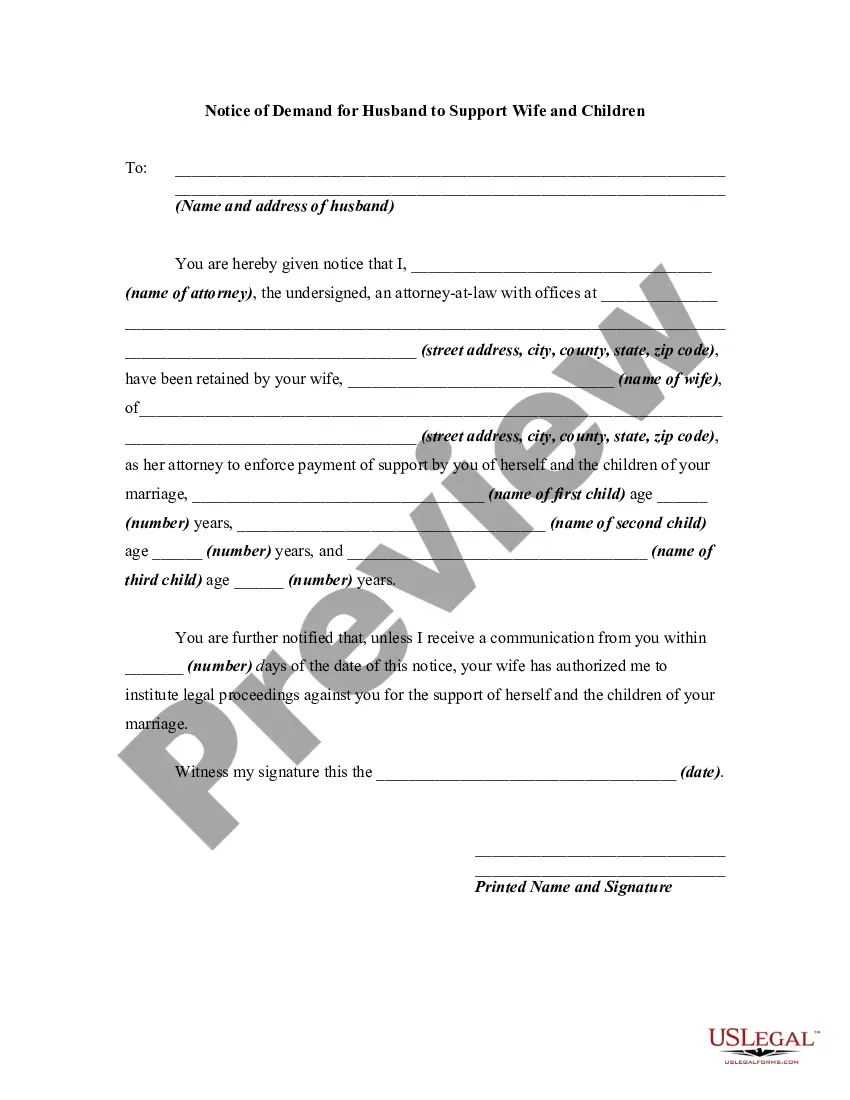

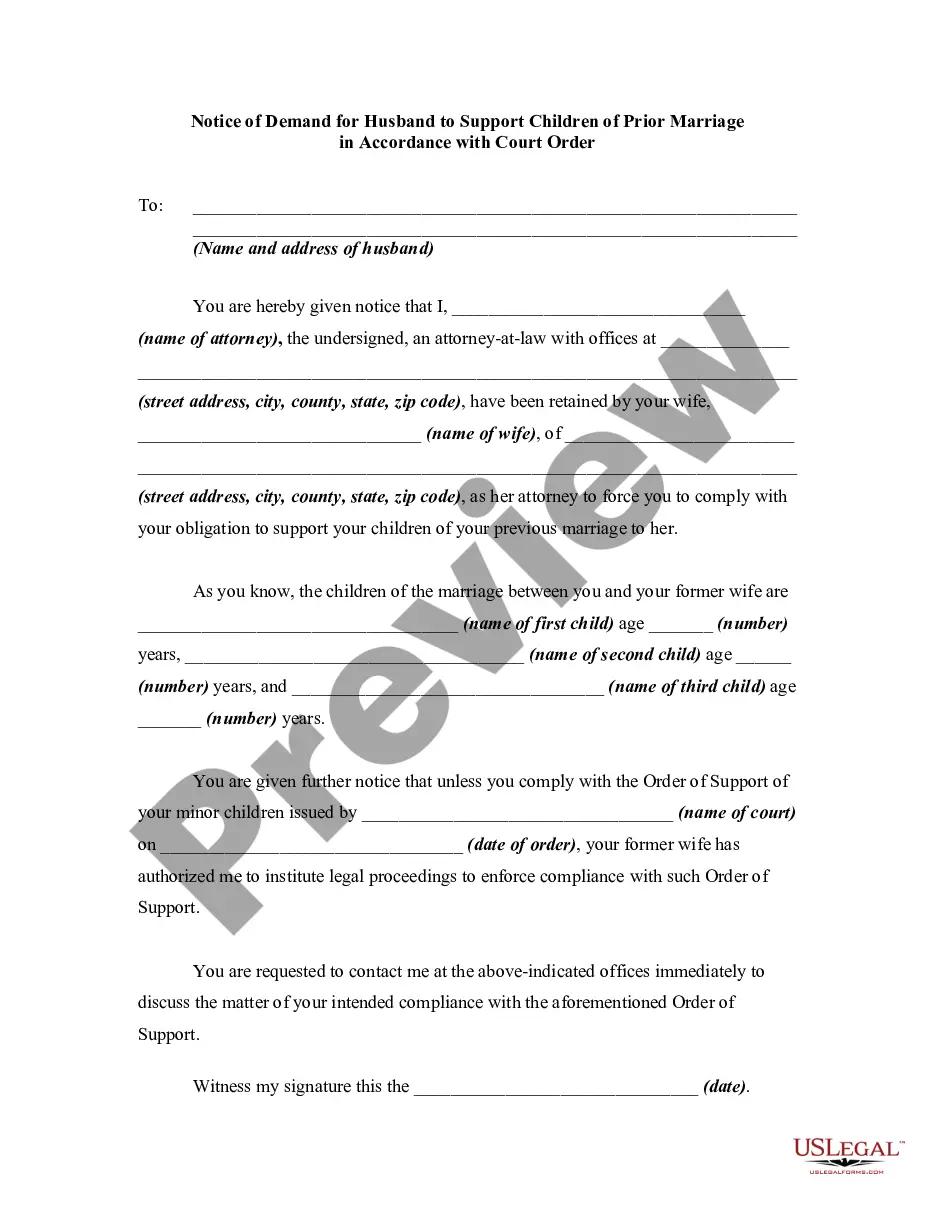

McAllen Texas Tax Lien Contract refers to a legal agreement that is entered into by the City of McAllen, Texas, and a property owner who is delinquent on their property taxes. This contract aims to resolve the unpaid taxes by allowing the city to place a lien on the property until the debt is repaid. The McAllen Texas Tax Lien Contract is designed to protect the interests of the city by ensuring that property owners fulfill their tax obligations. When property taxes go unpaid for an extended period, the city may initiate a tax lien sale, which allows investors to purchase the delinquent tax lien. The property owner then enters into a tax lien contract with the lien purchaser, transferring the debt to them. There are several types of McAllen Texas Tax Lien Contracts, including: 1. Redemption Period Contract: This type of contract permits the delinquent property owner to pay off the tax debt, including any accrued interest, within a specified redemption period. Once the debt is repaid, the lien is released, and the property owner regains full ownership. 2. Installment Agreement Contract: In this contract, the property owner agrees to pay off the delinquent taxes in monthly or periodic installments over a specified period. This option provides flexibility to property owners who may struggle with paying off the full amount upfront. 3. Deed-in-Lieu Contract: This type of contract involves the property owner voluntarily granting the property title to the lien holder in exchange for debt forgiveness. The lien holder assumes ownership of the property, and the original owner is relieved of the tax debt. 4. Foreclosure Contract: If the property owner fails to fulfill the terms of the tax lien contract, the lien holder may proceed with foreclosure. This contract outlines the process by which the lien holder can take legal action to obtain ownership of the property and recover the unpaid taxes. It is important to note that the specifics of McAllen Texas Tax Lien Contracts may vary depending on the local regulations and guidelines set by the City of McAllen. Property owners considering entering into a tax lien contract should consult with legal professionals or tax advisors to understand the specific terms and implications for their situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McAllen Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out McAllen Texas Contrato De Gravamen Fiscal?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any legal background to draft this sort of paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform provides a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you need the McAllen Texas Tax Lien Contract or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the McAllen Texas Tax Lien Contract in minutes employing our reliable platform. If you are already an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps before obtaining the McAllen Texas Tax Lien Contract:

- Be sure the form you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and look for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment method and proceed to download the McAllen Texas Tax Lien Contract once the payment is through.

You’re good to go! Now you can proceed to print out the form or complete it online. In case you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.