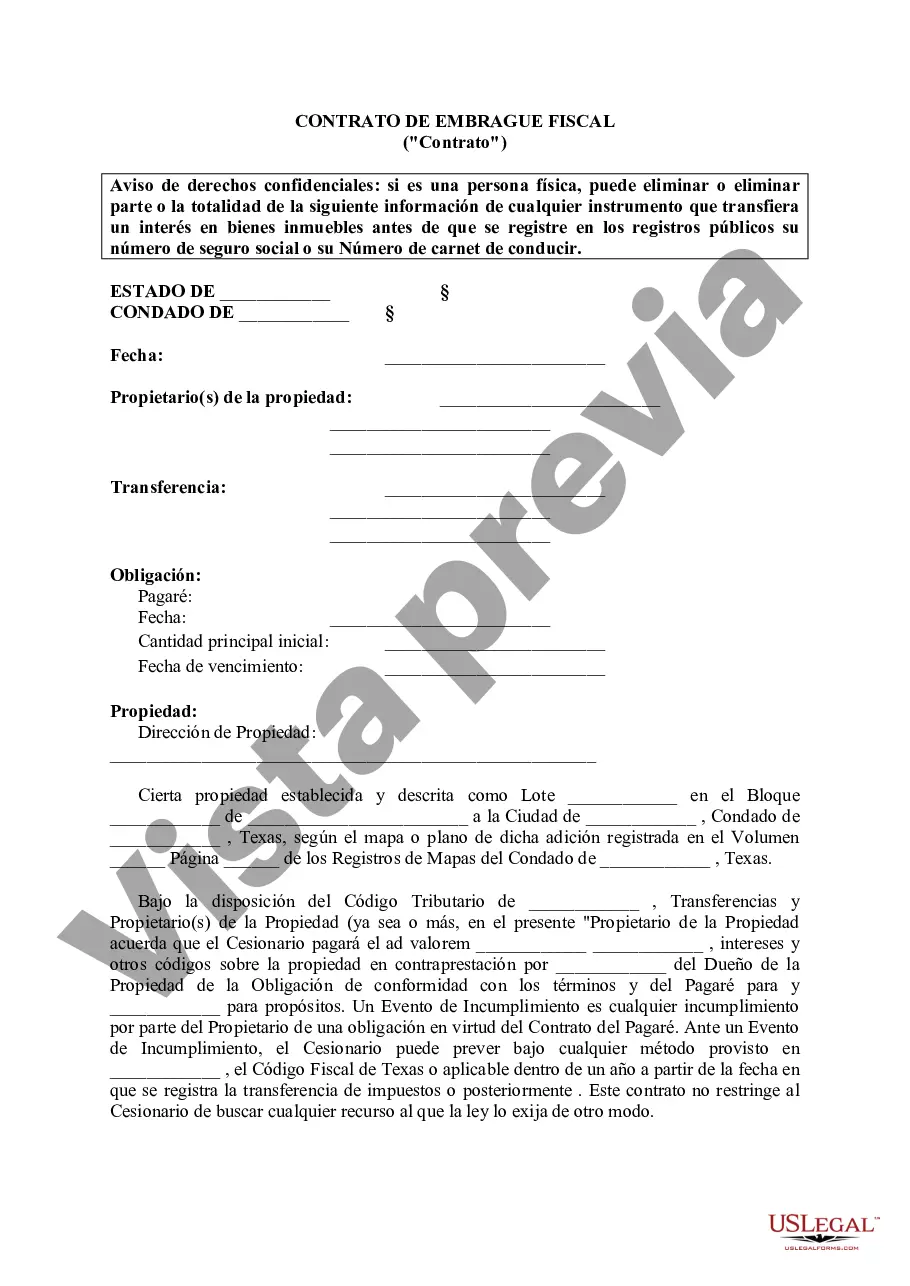

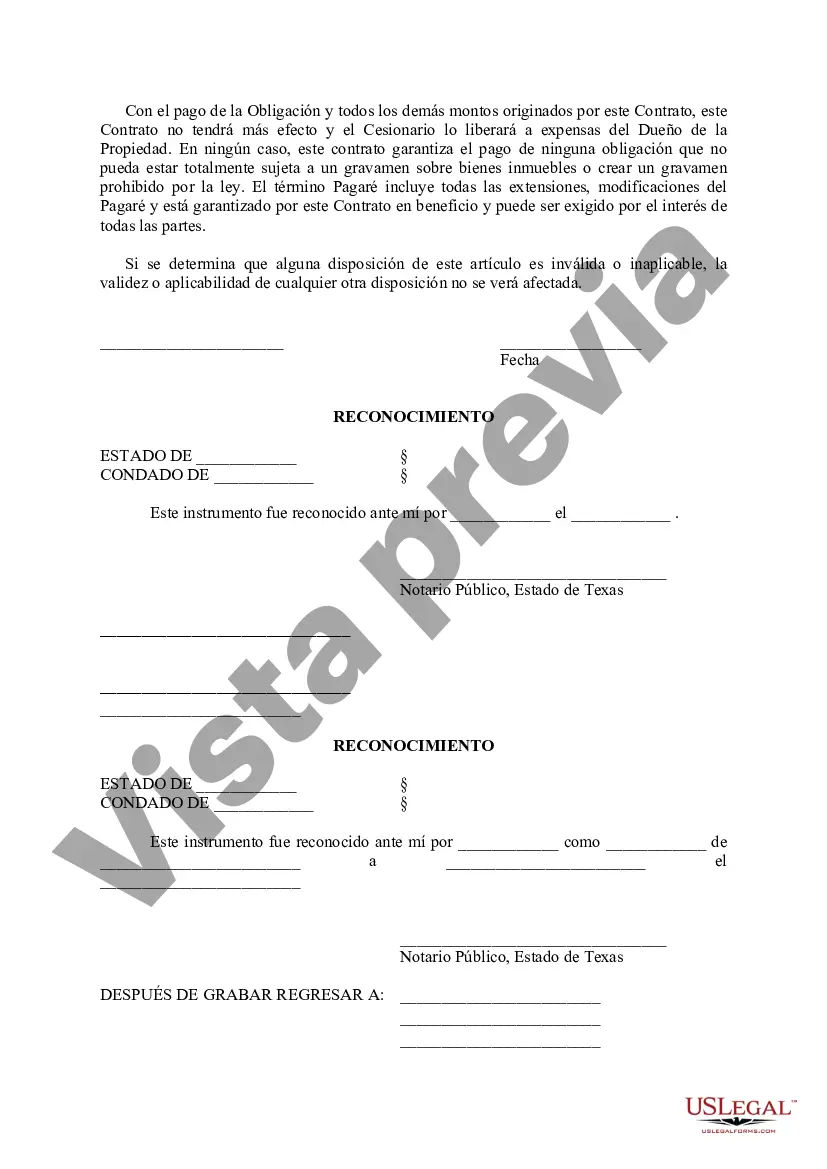

A tax lien contract in Wichita Falls, Texas refers to an agreement between the city and a taxpayer who owes delinquent property taxes. When property owners fail to pay their property taxes on time, the local government can place a tax lien on the property. To recover the unpaid taxes, the city may offer tax lien contracts to investors or individuals interested in purchasing the tax lien. This type of contract allows the city to transfer the debt owed by the delinquent taxpayer to the buyer of the tax lien contract. In return, the buyer pays the outstanding tax amount to the city and gains the right to collect the debt directly from the property owner. It serves as a means for the city to swiftly receive the unpaid funds while offering an opportunity for investors to potentially profit by collecting interest or penalties on the unpaid taxes. Wichita Falls, Texas may have different types of tax lien contracts available, which cater to various investor preferences or the city's specific needs. Here are a few potential variations: 1. Traditional Tax Lien Contracts: These contracts involve the purchase of tax liens directly from the city. Investors pay the delinquent tax amount and become responsible for collecting the debt from the property owner. They earn interest or penalties charged on the unpaid taxes. 2. Tax Lien Certificates: In some cases, Wichita Falls, Texas may issue tax lien certificates instead of offering direct contracts. These certificates represent the city's claim against the property owner for unpaid taxes and may be available for purchase by interested investors. 3. Redeemable Tax Lien Contracts: This type of tax lien contract provides the property owner with a redemption period during which they can repay the investor or city to reclaim their property. If the owner fails to redeem, the investor may acquire the property through foreclosure. 4. Assignment Tax Lien Contracts: These contracts involve the assignment of tax liens by the city to interested investors. The investor takes over the lien, hence becoming the new party responsible for collecting the unpaid taxes. 5. Bulk Tax Lien Contracts: At times, Wichita Falls, Texas may sell tax liens in bulk to institutional or large-scale investors. These contracts typically involve significant amounts of outstanding taxes and may offer a higher potential return but may also require a greater investment. It's important to note that the specific types and availability of tax lien contracts may vary over time or based on the policies of the city. Potential buyers should consult the city's tax authorities or legal professionals for the most up-to-date information regarding tax lien contracts in Wichita Falls, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wichita Falls Texas Contrato de gravamen fiscal - Texas Tax Lien Contract

Description

How to fill out Wichita Falls Texas Contrato De Gravamen Fiscal?

If you are looking for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get thousands of document samples for company and personal purposes by types and regions, or key phrases. With the high-quality search feature, getting the latest Wichita Falls Texas Tax Lien Contract is as easy as 1-2-3. Moreover, the relevance of every document is proved by a group of professional attorneys that on a regular basis review the templates on our website and update them according to the latest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Wichita Falls Texas Tax Lien Contract is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you want. Look at its explanation and use the Preview option to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the proper document.

- Confirm your choice. Click the Buy now button. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Process the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Wichita Falls Texas Tax Lien Contract.

Every template you save in your user profile has no expiration date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you need to have an additional duplicate for modifying or creating a hard copy, you can return and download it once more at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Wichita Falls Texas Tax Lien Contract you were looking for and thousands of other professional and state-specific templates on a single website!