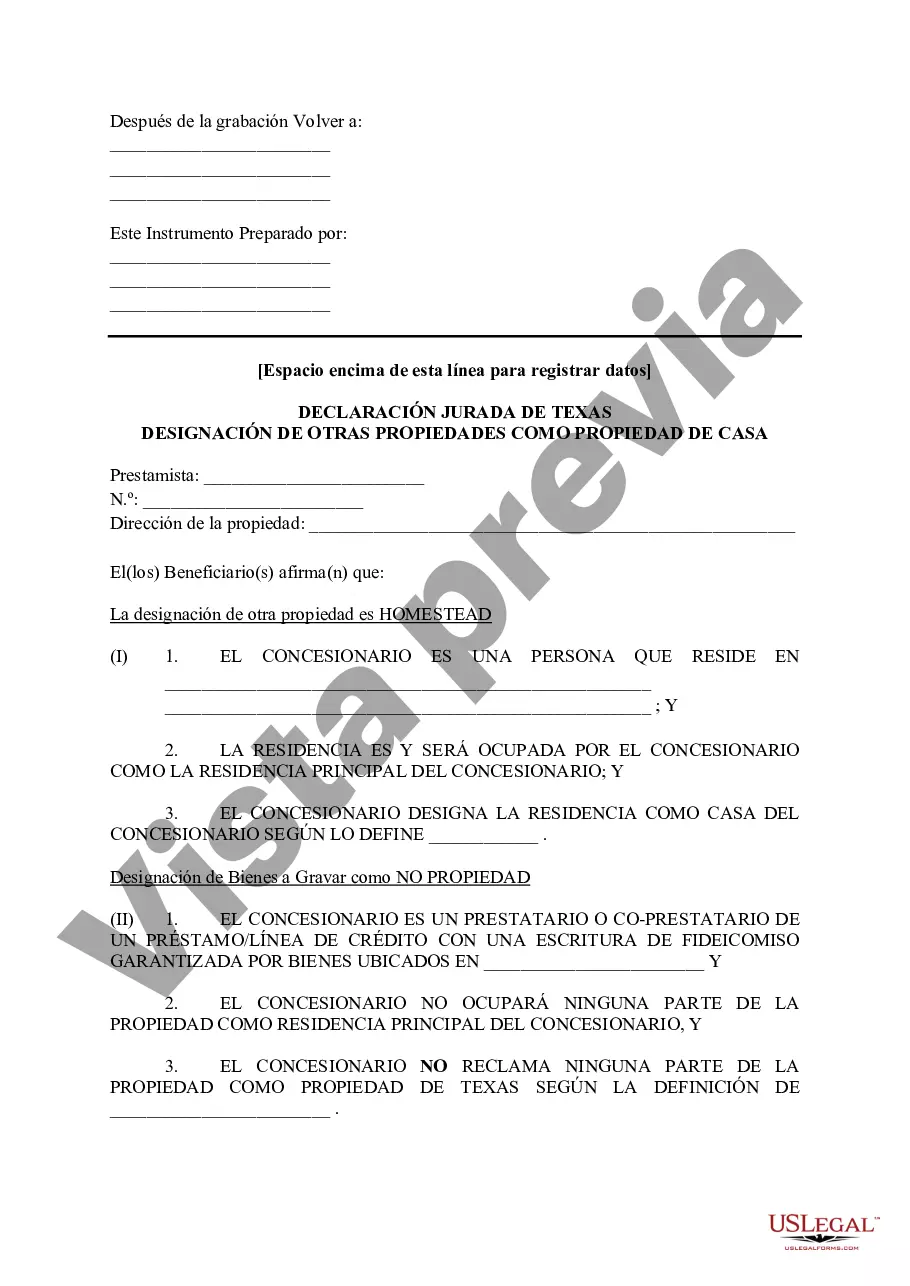

The Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows individuals to designate a property as their homestead for tax purposes in Amarillo, Texas. This designation provides certain tax benefits and protections for homeowners. The affidavit serves as proof of the homeowner's intent to use the property as their primary residence. By designating a property as a homestead, homeowners can benefit from exemptions on property taxes, which can result in significant savings. Additionally, this designation offers certain protections against creditors and allows for the preservation of the property's value. There are several types of Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property available, depending on the homeowner's specific circumstances: 1. Basic Homestead Exemption: This is the most common type of designation for homeowners who use their property as their primary residence. It provides a standard exemption on property taxes, reducing the amount homeowners are required to pay. 2. Over 65 or Disabled Homestead Exemption: Amarillo offers additional exemption options for homeowners who are 65 years or older or those with disabilities. This designation provides a higher exemption amount, reducing the tax burden even further for eligible individuals. 3. Disabled Veteran Homestead Exemption: Veterans with disabilities may qualify for an even higher exemption amount. This special designation recognizes their service and sacrifices and offers additional tax benefits to honor their contribution. 4. Surviving Spouse Homestead Exemption: In the event of a homeowner's death, their surviving spouse may be eligible for a homestead designation. This allows the surviving spouse to maintain the tax benefits and protections associated with the property. It is important to note that homeowners must meet certain criteria and file the Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property with the appropriate county tax office to qualify for these exemptions and protections. The specific requirements and forms may vary, so it is advisable to consult with a tax professional or the local tax office for accurate and up-to-date information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Amarillo Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Amarillo Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you are looking for a relevant form template, it’s extremely hard to find a more convenient service than the US Legal Forms site – probably the most extensive libraries on the web. With this library, you can get a large number of templates for business and individual purposes by categories and regions, or keywords. With our advanced search feature, finding the most recent Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property is as elementary as 1-2-3. Additionally, the relevance of each document is verified by a group of skilled attorneys that regularly review the templates on our platform and revise them according to the latest state and county laws.

If you already know about our system and have an account, all you need to receive the Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the sample you require. Read its description and use the Preview option (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to find the needed document.

- Confirm your decision. Choose the Buy now option. After that, pick the preferred pricing plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and save it to your system.

- Make changes. Fill out, edit, print, and sign the received Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property.

Every single form you save in your profile has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to have an additional duplicate for editing or printing, feel free to return and download it once more whenever you want.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Amarillo Texas Tax Affidavit Designation Other Property as Homestead Property you were looking for and a large number of other professional and state-specific templates on one website!