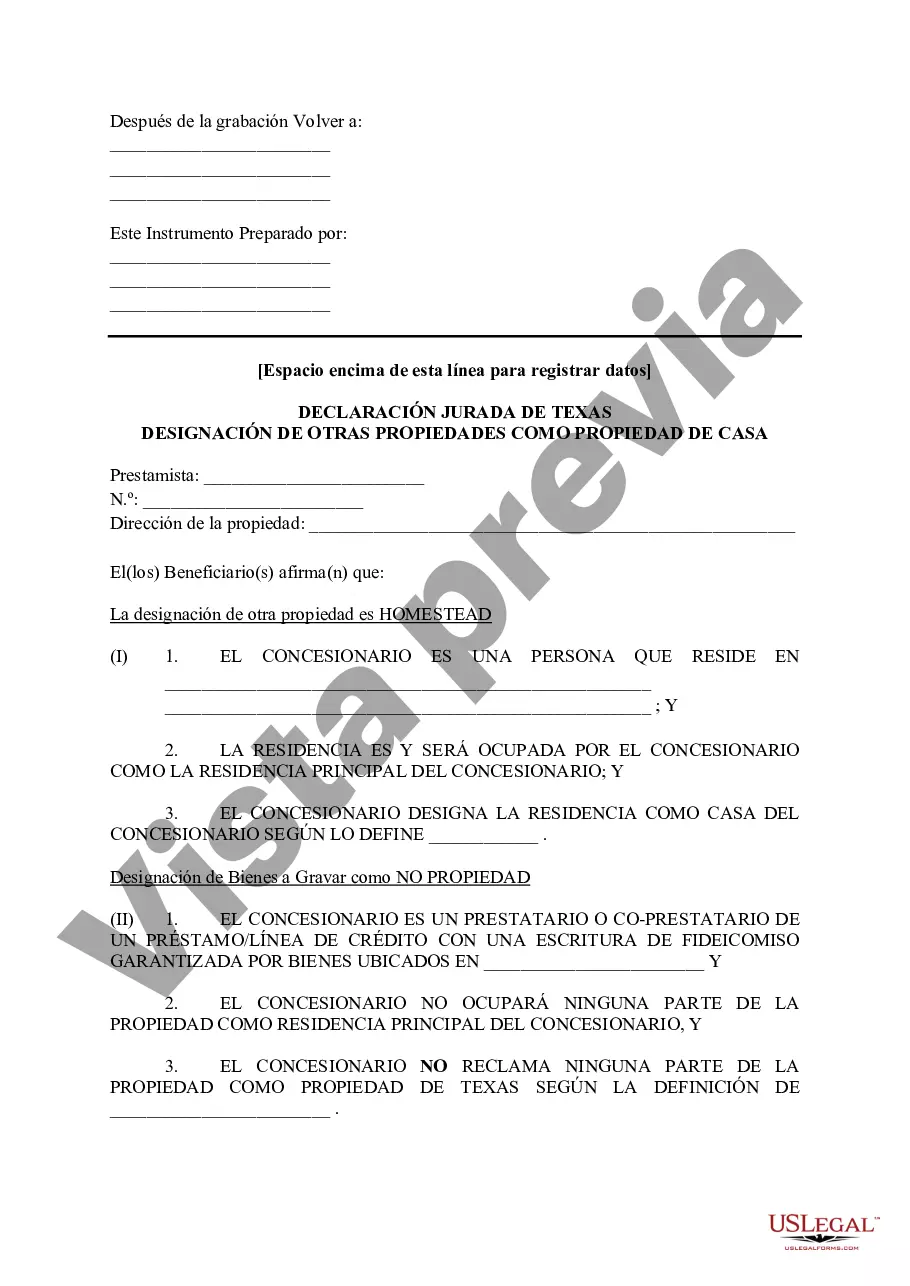

The Arlington Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows homeowners in Arlington, Texas, to designate properties other than their primary residence as qualifying for homestead exemptions. This affidavit provides an opportunity for individuals to benefit from potential property tax savings on their secondary properties. In Arlington, Texas, there are several types of properties that may qualify for the Tax Affidavit Designation Other Property as Homestead Property: 1. Rental Properties: Property owners can designate rental properties as homestead properties if they meet specific requirements. This designation provides an opportunity to reduce property taxes on rental properties. 2. Vacation Homes: Individuals who own vacation homes in Arlington, Texas, can utilize the Tax Affidavit Designation Other Property as Homestead Property to enjoy the financial benefits of homestead exemptions on their secondary residences. 3. Investment Properties: Investors can also take advantage of this affidavit to designate their investment properties as homestead properties. By doing so, they may be eligible for reduced property taxes, depending on certain criteria. 4. Seasonal Residences: Arlington, Texas, is home to several seasonal residents who only reside in the city for a portion of the year. This affidavit allows them to designate their seasonal residences as homestead properties and potentially save on property taxes. 5. Secondary Residences: Homeowners who own more than one property in Arlington can use this affidavit to designate their secondary residences as homestead properties. This includes properties such as vacation homes, second houses, or rental properties. By completing the Arlington Texas Tax Affidavit Designation Other Property as Homestead Property, property owners can potentially decrease their property taxes on these designated properties. It is important to note that specific criteria and guidelines must be met to qualify, and homeowners should consult with the Arlington County Tax Assessor's office for more information regarding eligibility and the application process. Overall, the Tax Affidavit Designation Other Property as Homestead Property in Arlington, Texas, offers property owners the opportunity to save on property taxes for properties other than their primary residence, such as rental properties, vacation homes, investment properties, seasonal residences, and secondary residences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arlington Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Arlington Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Make use of the US Legal Forms and get immediate access to any form template you want. Our helpful website with thousands of templates simplifies the way to find and get virtually any document sample you need. You can save, fill, and sign the Arlington Texas Tax Affidavit Designation Other Property as Homestead Property in a matter of minutes instead of surfing the Net for many hours looking for the right template.

Using our catalog is an excellent strategy to increase the safety of your document filing. Our professional attorneys on a regular basis check all the records to ensure that the forms are relevant for a particular state and compliant with new laws and polices.

How can you obtain the Arlington Texas Tax Affidavit Designation Other Property as Homestead Property? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you look at. Additionally, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Find the form you require. Make sure that it is the form you were hoping to find: check its headline and description, and use the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Choose the format to obtain the Arlington Texas Tax Affidavit Designation Other Property as Homestead Property and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the web. We are always ready to assist you in any legal case, even if it is just downloading the Arlington Texas Tax Affidavit Designation Other Property as Homestead Property.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!