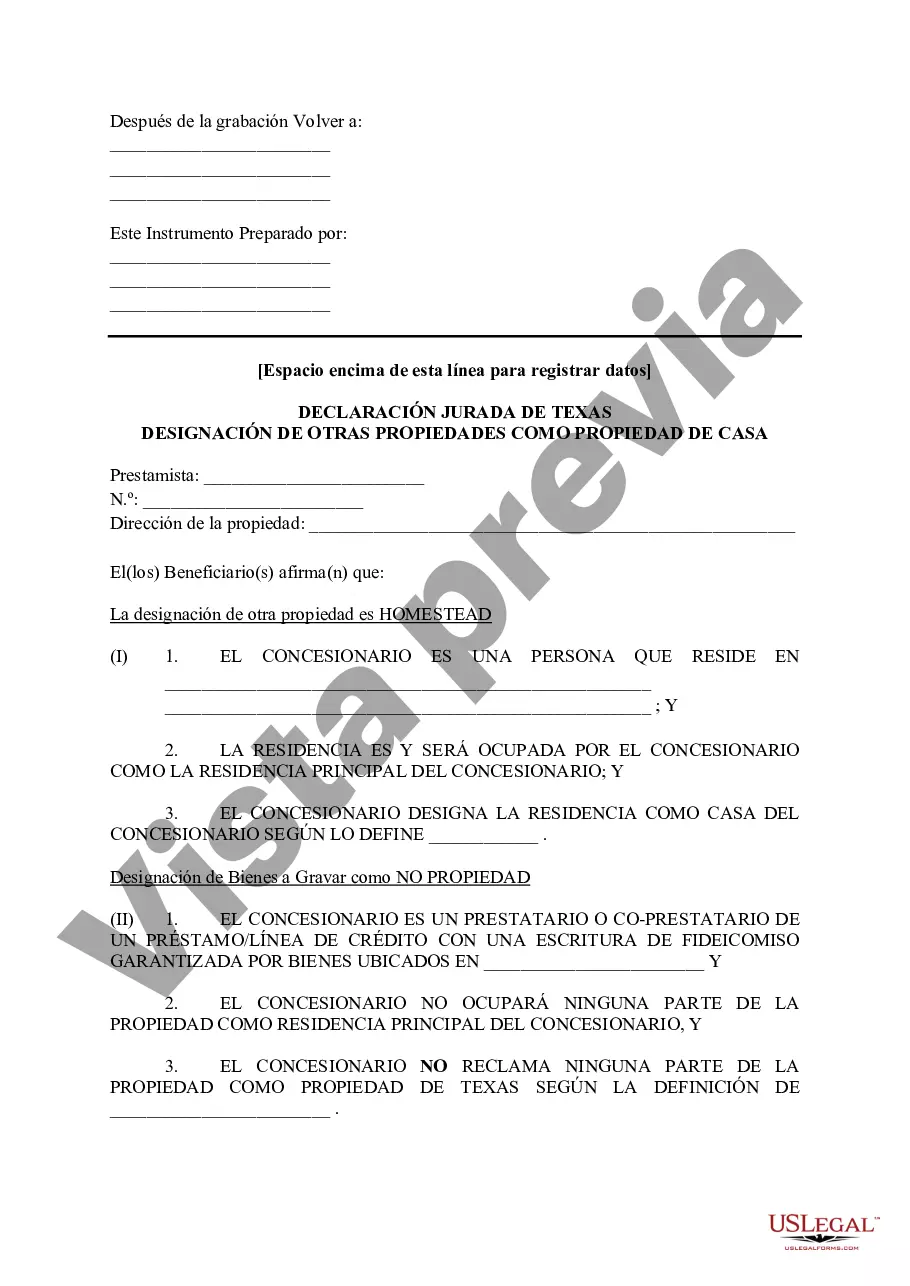

The Austin Texas Tax Affidavit Designation Other Property as Homestead Property refers to a document that allows property owners in Austin to designate a property, other than their primary residence, as a homestead property for tax purposes. This designation grants certain benefits and exemptions to the property owner, such as reduced property taxes. The Affidavit is used when the property owner wants to claim homestead status and associated tax benefits on a property that is not their primary residence. This could include properties such as vacation homes, rental properties, or investment properties. By designating such a property as a homestead, the property owner may be eligible for tax exemptions, reductions in property taxes, and protection against certain legal actions such as forced sale to satisfy debts. The purpose of the Austin Texas Tax Affidavit Designation Other Property as Homestead Property is to provide property owners with the opportunity to optimize their tax savings and minimize their property tax liabilities. It allows individuals to legally designate certain properties as homesteads, even if they are not their primary residences, thereby making them eligible for the homestead-related benefits. Different types of Austin Texas Tax Affidavit Designation Other Property as Homestead Property may include: 1. Vacation Home Designation: This type of designation is applicable when the property owner wants to designate a second home or vacation property as a homestead for taxation purposes. By designating a vacation home as a homestead, the owner may enjoy tax benefits typically associated with primary residences. 2. Rental Property Designation: Rental property owners may use this designation to claim homestead status on a property they are renting out. This can provide tax advantages and exemptions that are typically available only to primary residences. 3. Investment Property Designation: Owners of investment properties, such as commercial or residential buildings, may utilize this designation to enjoy homestead-related tax benefits and exemptions. This can be particularly beneficial for property owners with multiple investment properties. In conclusion, the Austin Texas Tax Affidavit Designation Other Property as Homestead Property is a process by which property owners in Austin can designate a property, other than their primary residence, as a homestead for tax purposes. By using this designation, individuals may be eligible for tax exemptions and reductions on properties such as vacation homes, rental properties, and investment properties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Austin Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Category:

State:

Texas

City:

Austin

Control #:

TX-LR052T

Format:

Word

Instant download

Description

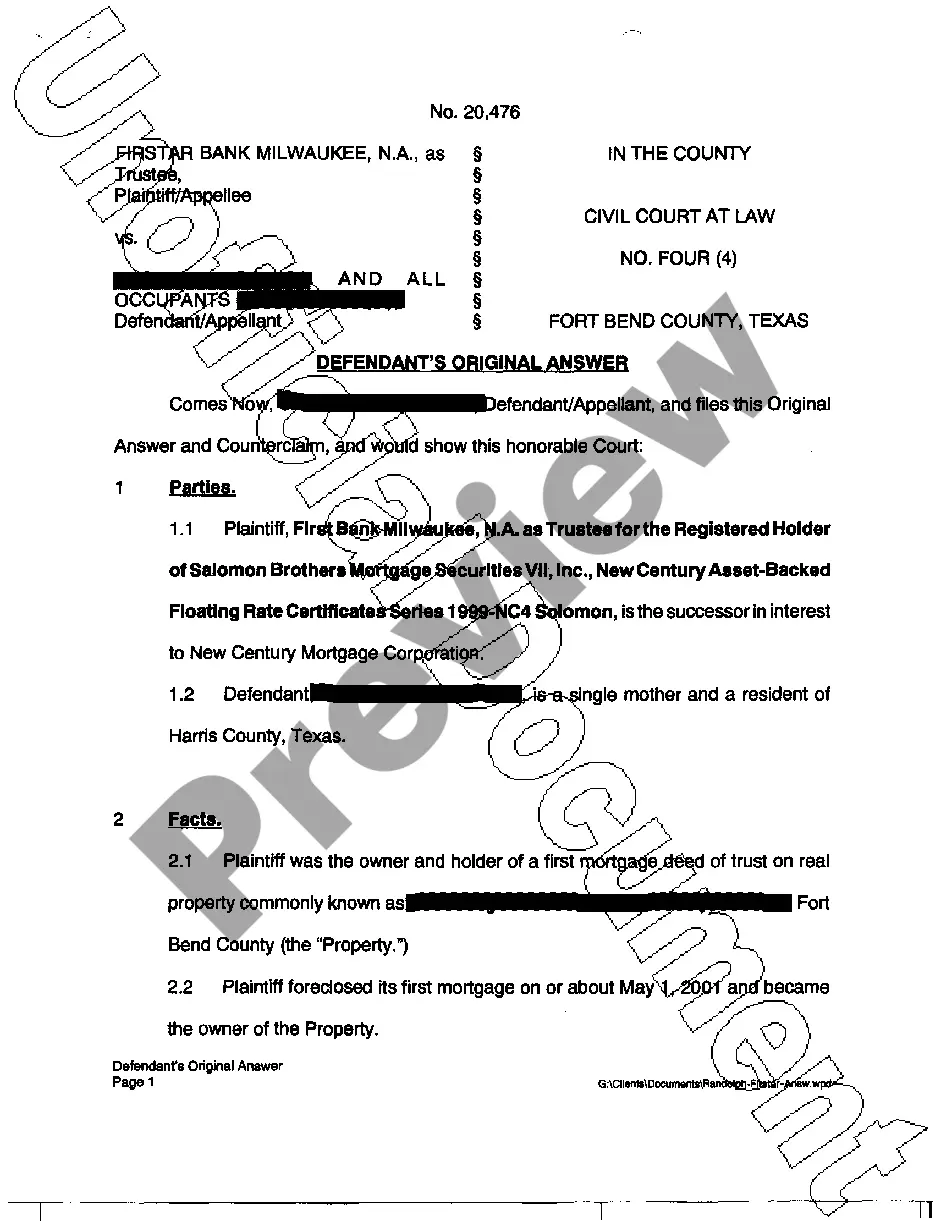

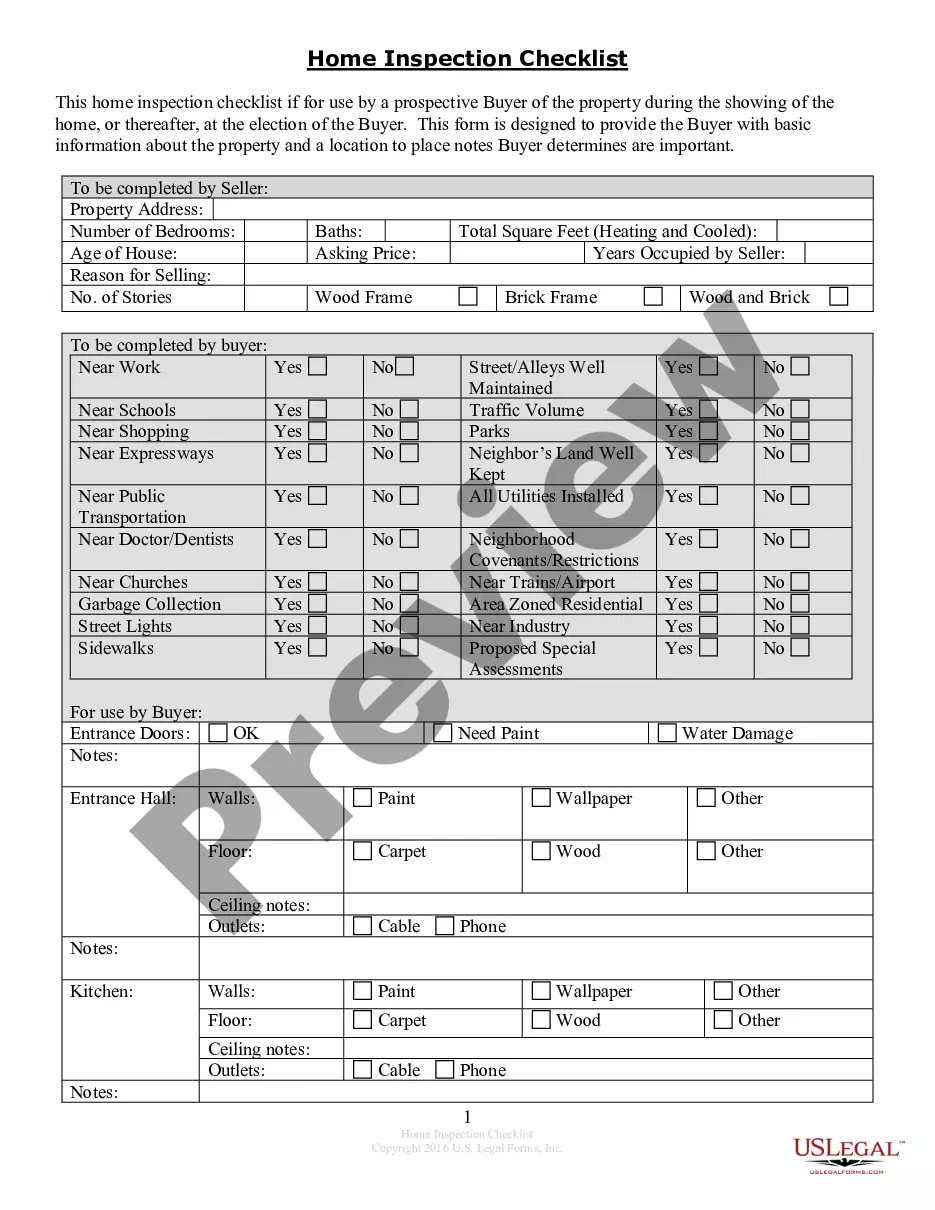

This affidavit is used to designate another property as legal Homestead Property as defined by Texas Law and list the location of non-homestead property.

Free preview

How to fill out Austin Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

No matter your social or professional rank, completing legal documents is an unfortunate requirement in today’s society.

Often, it’s nearly impossible for someone without legal knowledge to create such paperwork from scratch, primarily because of the complicated terminology and legal intricacies they entail.

This is where US Legal Forms comes to the aid.

Confirm the form you found is applicable for your location, as regulations of one state do not apply to another.

Preview the document and review a brief description (if available) of situations the document may be used for.

- Our service provides a vast collection with over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors who aim to be more time-efficient using our DIY documents.

- Whether you need the Austin Texas Tax Affidavit Designation Other Property as Homestead Property or any other documentation valid in your state or region, with US Legal Forms, everything is within reach.

- Here’s how you can obtain the Austin Texas Tax Affidavit Designation Other Property as Homestead Property swiftly using our reliable service.

- If you are already a customer, you can Log In to your account to download the necessary form.

- However, if you are new to our library, make sure to follow these steps before acquiring the Austin Texas Tax Affidavit Designation Other Property as Homestead Property.

Form popularity

More info

Designation of Homestead. The ceiling freezes your school taxes at the amount you pay in the year that you qualify for the exemption.In order to obtain an ITIN number for FIRPTA purposes you must complete Form W7 or W7SP. Unofficial Texas Homestead Designation Document to look out for. An owelty of partition against the entire property. Refinance of a federal tax lien. 111(b) to execute and complete the designation form. Once filed, a Texas homestead exemption is valid as long as the homeowner lives on the property and is using it as the primary residence. How to Apply For a Homestead Exemption. How to Apply For a Homestead Exemption.