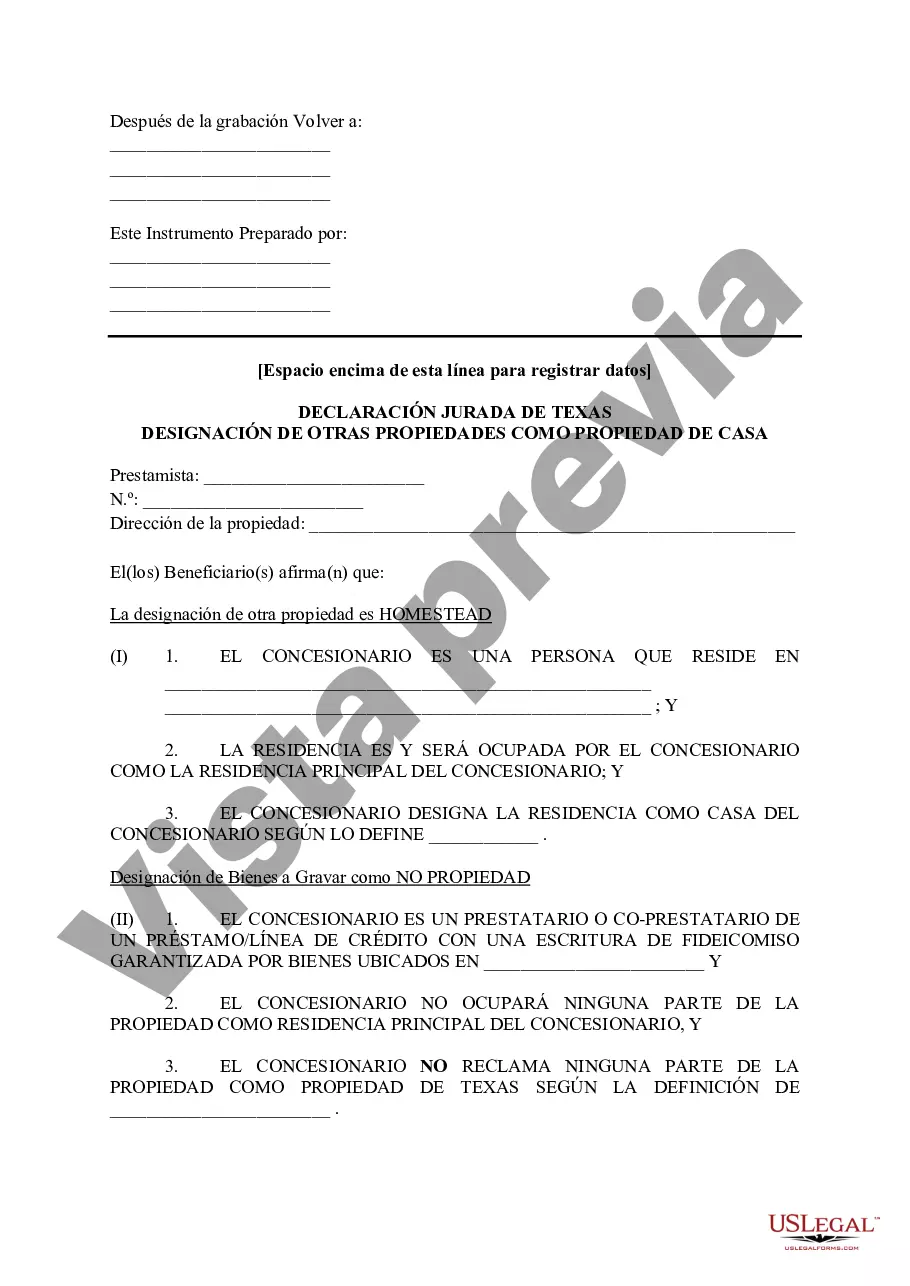

The Bexar Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows individuals to designate a property other than their primary residence as a homestead for tax purposes. This designation is important as it provides certain tax benefits and exemptions to the property owner. In Bexar County, Texas, there are a few different types of properties that can be designated as homestead property using the tax affidavit. These include: 1. Second Homes: Individuals who own a second home in Bexar County can designate it as a homestead property if they meet certain criteria. This allows them to enjoy the benefits and exemptions available to primary residences. 2. Rental Properties: Property owners who own rental properties in Bexar County can use the tax affidavit to designate one of their rental properties as a homestead. However, this designation comes with certain limitations and conditions. 3. Vacant Land: Even vacant land can be designated as a homestead property using the tax affidavit. However, there may be additional requirements and restrictions for this type of designation. It is important to note that the Bexar Texas Tax Affidavit Designation Other Property as Homestead Property is subject to specific guidelines and requirements set by the county. Property owners must meet certain eligibility criteria, such as residing in the state, owning the property, and using it as a primary residence or another qualified purpose. By designating a property as a homestead, individuals can benefit from exemptions such as a reduction in property taxes, protection from certain creditors, and various other tax-related advantages. However, it is crucial to consult with a qualified legal professional or tax advisor to ensure compliance with all applicable laws and regulations. In summary, the Bexar Texas Tax Affidavit Designation Other Property as Homestead Property is a valuable tool for property owners in Bexar County seeking to designate a property other than their main residence as a homestead. Whether it is a second home, rental property, or vacant land, this option provides tax benefits and exemptions when certain eligibility criteria are met. It is always recommended seeking professional guidance to ensure adherence to all legal requirements and to make the most of the available advantages.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Bexar Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Are you looking for a reliable and affordable legal forms supplier to buy the Bexar Texas Tax Affidavit Designation Other Property as Homestead Property? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Bexar Texas Tax Affidavit Designation Other Property as Homestead Property conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Bexar Texas Tax Affidavit Designation Other Property as Homestead Property in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online for good.

Form popularity

FAQ

La declaracion de herederos es el proceso que se realiza para determinar quienes son los llamados a heredar los bienes, derechos y obligaciones de un difunto. Es un procedimiento diferente al del reparto de bienes. Mediante el procedimiento de la declaracion de herederos se determina quienes son los llamados a heredar.

Es el impuesto que se aplica a la transferencia del patrimonio sucesoral por causa de muerte (herencia y/o legado). ¿Cuando se paga este impuesto? Este impuesto se paga al momento de recibir la herencia de bienes muebles e inmuebles por fallecimiento.

La Declaracion Jurada de Bienes, es una declaracion hecha por una persona de manera unilateral, donde se dispone todos los bienes patrimoniales que tiene un individuo, estableciendo cuales son sus activos y cuales sus pasivos.

Bajo el Codigo Testamentario de Texas, para que un testamento escrito a mano sea valido debe ser totalmente escrito a mano por el testador y firmado por el o ella. No tiene que ser atestiguado y puede ser escrito en cualquier tipo de papel. Palabras escritas en maquina no pueden ser incorporadas al testa- mento.

La tramitacion de herencias en EEUU debe someterse a un proceso sucesorio antes los tribunales competentes, con el fin de, determinar la validez del testamento y/o determinar quienes son los herederos y las cuotas que se distribuiran entre cada uno.

La tasa a pagar es de un 3% sobre la masa sucesoral (herencia) luego de realizadas las deducciones correspondientes. Para fines de poder calcular el impuesto a pagar, a la masa sucesoral se les restan los siguientes conceptos: Las deudas a cargo del fallecido que consten en escrituras publicas o privadas.

Este impuesto debe ser liquidado por todos los herederos y se trata de un impuesto de caracter personal, esto quiere decir, es el heredero quien debe pagar la cuota tributaria y ee ocurrir el caso que el heredero renuncie a la herencia en documento publico, no deberia liquidar ese impuesto, ya que no recibe bienes.

Si no hay ni hijos, ni viudo, ni padres, se reparte a partes iguales entre los hermanos, teniendo los mismos derechos los hermanastros que los hermanos de padre y madre. A falta de hijos, viudo, padres y hermanos, la herencia va, en orden, a tios, sobrinos y primos.

Cuando alguien muere, dejan un patrimonio que debe ser liquidado (manejado). Eso significa colectar la propiedad de la persona, pagar sus deudas, y distribuir lo que sobre. La distribucion puede hacerse de acuerdo a un testamento valido, o, si no existe un testamento, a traves de la ley de herencias de Illinois.

El acta de notoriedad o determinacion de herederos, es el instrumento publico que determina, a falta de un testamentos a quienes se llamaran herederos del fallecido. Es un acto autentico, levantado por ante notario donde se hacen constar quienes son los presuntos o reales herederos de una persona fallecida.

More info

The homestead tax exemption remains in place. You also have the option to transfer the property taxes exemption from your spouse or children. ○ Other exempt property: buildings built before March 31, 1987, and the cost of maintaining a certain portion of the property or building. ○ Tax-exempt property in which a tax exemption was purchased. A homestead is exempt from property taxes if it: ● Is for a specific person or persons; or ● Is to a specific person or persons; ● Is acquired for use in the performance or to produce for sale or lease the profits derived from the use or enjoyment; or ● Is transferred or assigned by the decedent prior to January 1, 1986, and prior to becoming a homestead; or ● Is transferred from you to your minor children; or ● Is taxable property under a homestead exemption plan. The exemption cannot be extended by the owner on this property if you're the beneficiary. You may need to pay the tax or get it waived by the City or County.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.