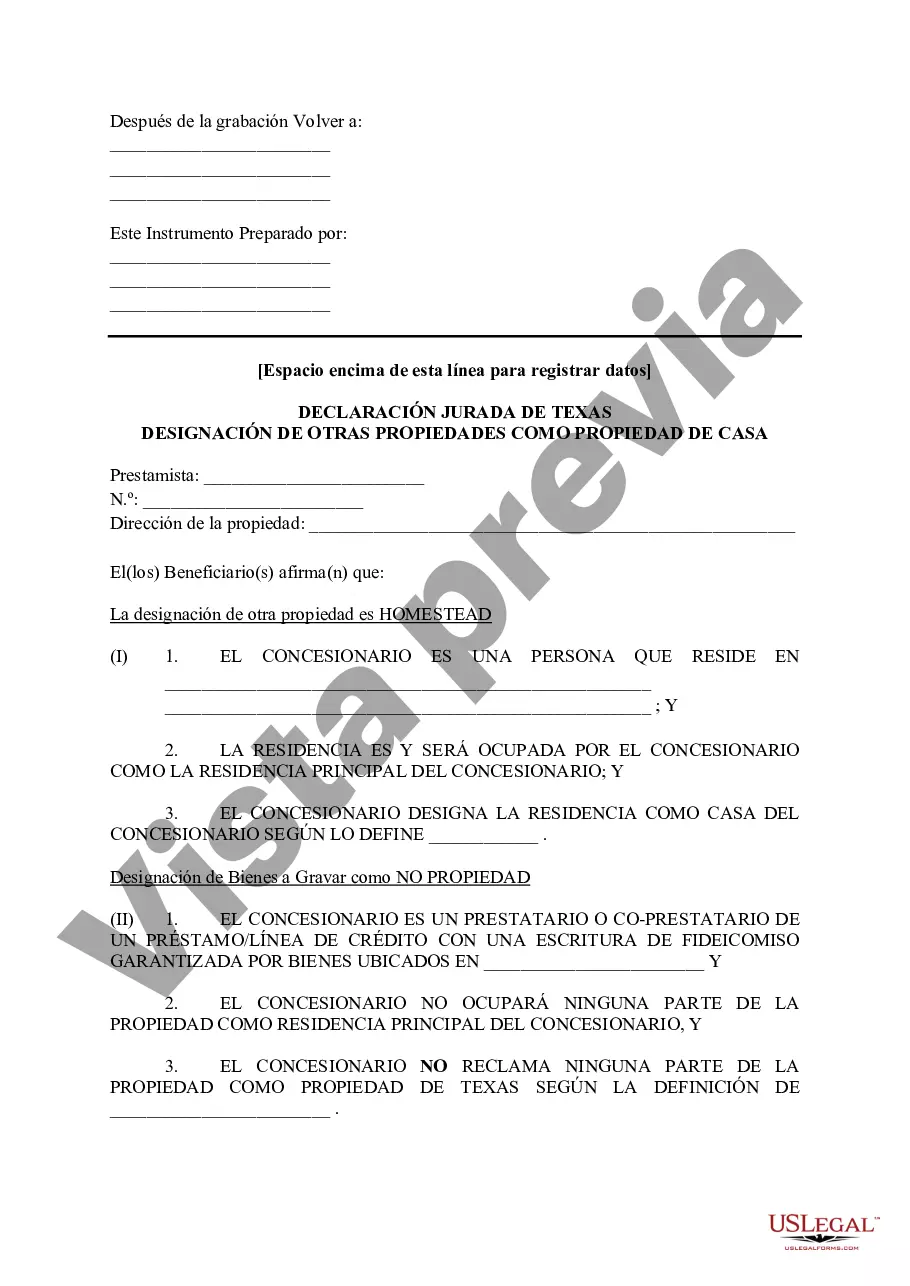

Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that property owners in Brownsville, Texas can use to declare certain properties, other than their primary residence, as homestead properties for tax purposes. This designation allows them to benefit from certain tax advantages and exemptions. The main purpose of the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property is to provide property owners with the opportunity to lower their property tax liability by designating additional properties as homestead properties. By doing so, they can potentially reduce their overall tax burden and benefit from various tax exemptions. There are several types of properties that may qualify for the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property, including vacant land, rental properties, vacation homes, and commercial properties. Each property type may have specific criteria that need to be met in order to qualify for the designation. For example, vacant land may need to have certain improvements, such as utility connections or a permanent structure, to be eligible for the designation. Rental properties may need to have a certain percentage of the property owner's residency or must not exceed a certain number of units. Vacation homes may need to be used for personal use for a minimum number of days per year. Commercial properties may have specific requirements related to their use and ownership. To designate a property as a homestead property, property owners in Brownsville, Texas must submit a completed tax affidavit to the local tax assessor's office. The affidavit requires detailed information about the property, including its location, size, and use. Property owners may also need to provide supporting documentation, such as property deeds or lease agreements, to prove their ownership or residency. Once the tax affidavit is filed and approved by the tax assessor's office, the property will receive the designation of a homestead property. This designation will result in certain tax benefits, such as exemption from a portion of property taxes or a reduced tax rate. It is important to note that the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property is subject to specific rules and regulations set forth by the Brownsville City Council and may be subject to change. Property owners should consult with a tax professional or the local tax assessor's office for the most up-to-date information and guidance regarding the designation process and eligibility criteria for different property types.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Brownsville Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Brownsville Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Do you need a trustworthy and affordable legal forms provider to get the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is intended for.

- Restart the search if the form isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Brownsville Texas Tax Affidavit Designation Other Property as Homestead Property in any available file format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online for good.