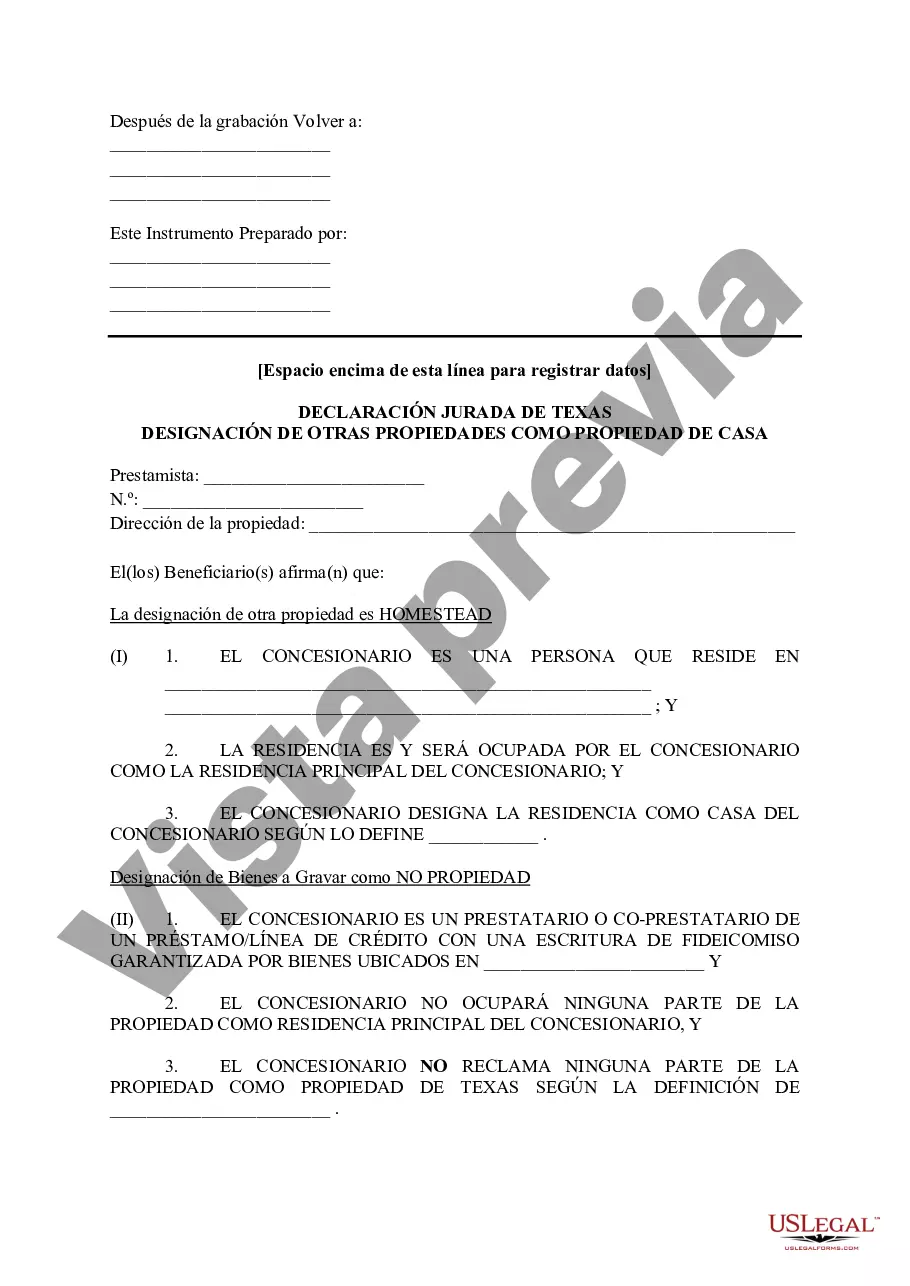

Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property provides homeowners in Carrollton, Texas, with a legal means to designate their property as a homestead for tax purposes. This designation offers various benefits to eligible individuals, including property tax exemptions and protection from certain creditors. By filing this tax affidavit, homeowners can ensure that their property is classified correctly and enjoy the associated advantages. To begin the process, homeowners must first understand the requirements and qualifications for filing a Tax Affidavit Designation Other Property as Homestead Property in Carrollton, Texas. These requirements may include residency criteria, property ownership, and specific guidelines determined by the Carrollton Tax Appraisal District. Once homeowners determine their eligibility, they can proceed with the application process, which typically involves completing the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property form. This form requires homeowners to provide detailed information about themselves, the property, and any co-owners, if applicable. It is crucial to ensure accuracy and completeness when filling out this form to avoid any potential issues or delays in the homestead designation process. It is important to note that Carrollton, Texas, offers different types of tax affidavits related to homestead property designation. These may include: 1. General Residential Homestead Exemption: This type of tax affidavit is generally applicable to single-family homes or primary residences in Carrollton. It offers homeowners a significant reduction in property taxes by exempting a portion of the property's value from taxation. 2. Senior Citizen Homestead Exemption: Specifically designed for senior citizens aged 65 or older, this tax affidavit provides additional property tax exemptions to eligible individuals. It aims to alleviate the financial burden on older homeowners and promote housing stability for this demographic. 3. Disabled Persons Homestead Exemption: This particular tax affidavit caters to individuals with disabilities, providing additional property tax relief. To qualify, homeowners must meet specific disability criteria as defined by the Carrollton Tax Appraisal District. By selecting the appropriate tax affidavit designation for their specific circumstances, homeowners can maximize the benefits offered by the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property program. This program strives to protect homeowners from excessive property tax burdens and ensure the affordability of homeownership within the community. In conclusion, Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property is a valuable resource for homeowners in Carrollton, Texas. By successfully filing the tax affidavit and meeting the eligibility criteria, individuals can secure property tax exemptions and other significant benefits. It is crucial for homeowners to understand the various types of tax affidavits available and select the one that aligns with their specific situation to maximize the advantages provided by the program.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carrollton Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Carrollton Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any law background to create this sort of paperwork from scratch, mostly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property quickly using our reliable platform. In case you are already a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our platform, ensure that you follow these steps prior to obtaining the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property:

- Be sure the template you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the document and read a brief description (if provided) of scenarios the document can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Carrollton Texas Tax Affidavit Designation Other Property as Homestead Property once the payment is through.

You’re good to go! Now you can go ahead and print out the document or fill it out online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.