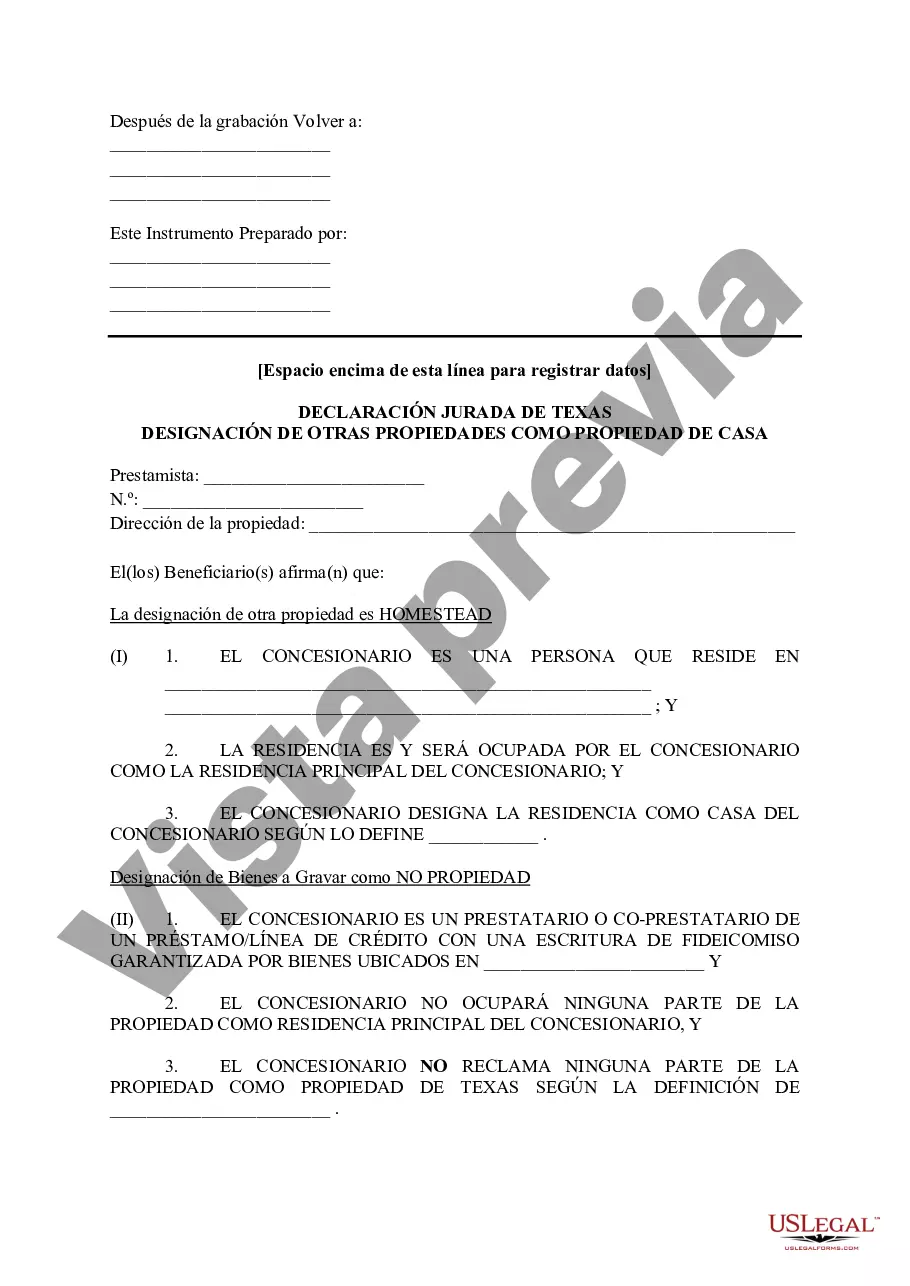

Collin Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document in Collin County, Texas, that allows homeowners to designate a property other than their primary residence as their homestead property for taxation purposes. This designation provides several benefits, including property tax exemptions and protection of the property's value. When it comes to different types of Collin Texas Tax Affidavit Designation Other Property as Homestead Property, there are two primary categories: 1. Temporary Absence: Homeowners who are temporarily residing outside their primary residence due to specific circumstances can designate another property as their homestead. This could include homeowners who are temporarily living in a nursing home, on military duty, or are away for work-related purposes. The Collin Texas Tax Affidavit Designation Other Property as Homestead Property allows them to continue receiving the homestead exemption on their primary residence while ensuring the designated property remains protected. 2. Second Home: Individuals who own multiple properties and consider one of them as their second home can benefit from the Collin Texas Tax Affidavit Designation Other Property as Homestead Property. This allows homeowners to designate a secondary property as their homestead and enjoy the taxation advantages that come with it. For example, if someone owns a primary residence in Collin County but also owns a lake house or vacation home within the county, they may choose to designate the secondary property as their homestead for tax purposes. It is important to note that homeowners must meet certain criteria to qualify for the Collin Texas Tax Affidavit Designation Other Property as Homestead Property. These criteria usually include proof of residency and evidence of the designated property's use. Homeowners are advised to consult with the Collin County Appraisal District or a qualified professional to ensure they meet all the requirements and understand the potential benefits and obligations associated with the designation. Understandably, the Collin Texas Tax Affidavit Designation Other Property as Homestead Property aims to provide flexibility and benefits to homeowners without compromising their primary residence's homestead status. By allowing the designation of a secondary property, residents can make the most of their investments and enjoy various tax exemptions and protections for both their primary and designated homestead properties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tabla De Impuestos Irs 2024 - Texas Tax Affidavit Designation Other Property as Homestead Property

Description tabla de affidavit

How to fill out Collin Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Take advantage of the US Legal Forms and obtain instant access to any form you require. Our helpful website with thousands of templates makes it easy to find and get virtually any document sample you require. You are able to download, fill, and certify the Collin Texas Tax Affidavit Designation Other Property as Homestead Property in just a matter of minutes instead of browsing the web for several hours attempting to find the right template.

Using our collection is a great strategy to improve the safety of your document submissions. Our professional attorneys regularly check all the documents to ensure that the forms are relevant for a particular state and compliant with new laws and polices.

How can you get the Collin Texas Tax Affidavit Designation Other Property as Homestead Property? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Find the form you need. Ensure that it is the form you were looking for: check its name and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the document. Select the format to obtain the Collin Texas Tax Affidavit Designation Other Property as Homestead Property and change and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy template libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Collin Texas Tax Affidavit Designation Other Property as Homestead Property.

Feel free to make the most of our platform and make your document experience as straightforward as possible!