Title: Dallas Texas Tax Affidavit Designation Other Property as Homestead Property: A Comprehensive Guide Introduction: In Dallas, Texas, property owners have the option to designate a property as a homestead property through a Tax Affidavit. This designation offers various benefits, such as decreasing property taxes and protecting the property from some creditors. In this article, we will explore the details of the Dallas Texas Tax Affidavit Designation Other Property as Homestead Property, including its types and the benefits associated with this designation. Keywords: — Dallas Texas TaAffidavitvi— - Designation Other Property as Homestead Property — Dallas homesteapropertyrt— - Dallas homestead benefits — Dallas property tareductionio— - Dallas homestead protection Types of Dallas Texas Tax Affidavit Designation Other Property as Homestead Property: 1. Primary Residence: The most common type of homestead property in Dallas is the primary residence. Property owners can designate their primary residence as a homestead property, provided they meet certain criteria. This designation offers the maximum benefits associated with homestead properties. 2. Secondary Residence: Property owners who own a second property in Dallas, such as a vacation home or a rental property, may also be eligible to designate it as a homestead property. However, the benefits and exemptions associated with secondary residences may vary compared to primary residences. 3. Elderly/Disabled Exemption: Dallas offers additional homestead exemptions for the elderly (65 years or older) and disabled individuals. These exemptions aim to provide additional tax relief to those who meet the required criteria. Property owners must submit relevant documentation and meet specific qualifications to qualify for this type of designation. 4. Surviving Spouse of a First Responder Exemption: Dallas recognizes the surviving spouses of first responders who died in the line of duty as eligible for exemptions. This designation provides certain property tax benefits and protects the surviving spouse's homestead property from forced sale to satisfy creditor claims. Benefits of Dallas Texas Tax Affidavit Designation Other Property as Homestead Property: 1. Property Tax Reduction: Designating a property as a homestead can lead to a reduction in property taxes. The Dallas homestead exemption lowers the taxable value of a property, resulting in lower annual tax payments. 2. Protection from Creditors: A homestead property designation in Dallas provides limited protection from creditors. It helps shield the property from seizure or forced sale to satisfy debts or judgments, ensuring the homeowner's place of residence remains secure. 3. Transfer of Benefits: If a homeowner sells their homestead property and purchases a new one, they can transfer their homestead exemption benefits to the new property. This allows homeowners to continue enjoying the reduced property tax payments without interruption. Conclusion: The Dallas Texas Tax Affidavit Designation Other Property as Homestead Property provides property owners with significant financial and legal benefits. Whether it's a primary or secondary residence or if the owner qualifies for additional exemptions, the designation offers property tax reductions and safeguards against certain creditor actions. Understanding the various types of homestead designations and their associated benefits can help Dallas property owners make informed decisions to maximize the advantages of this designation.

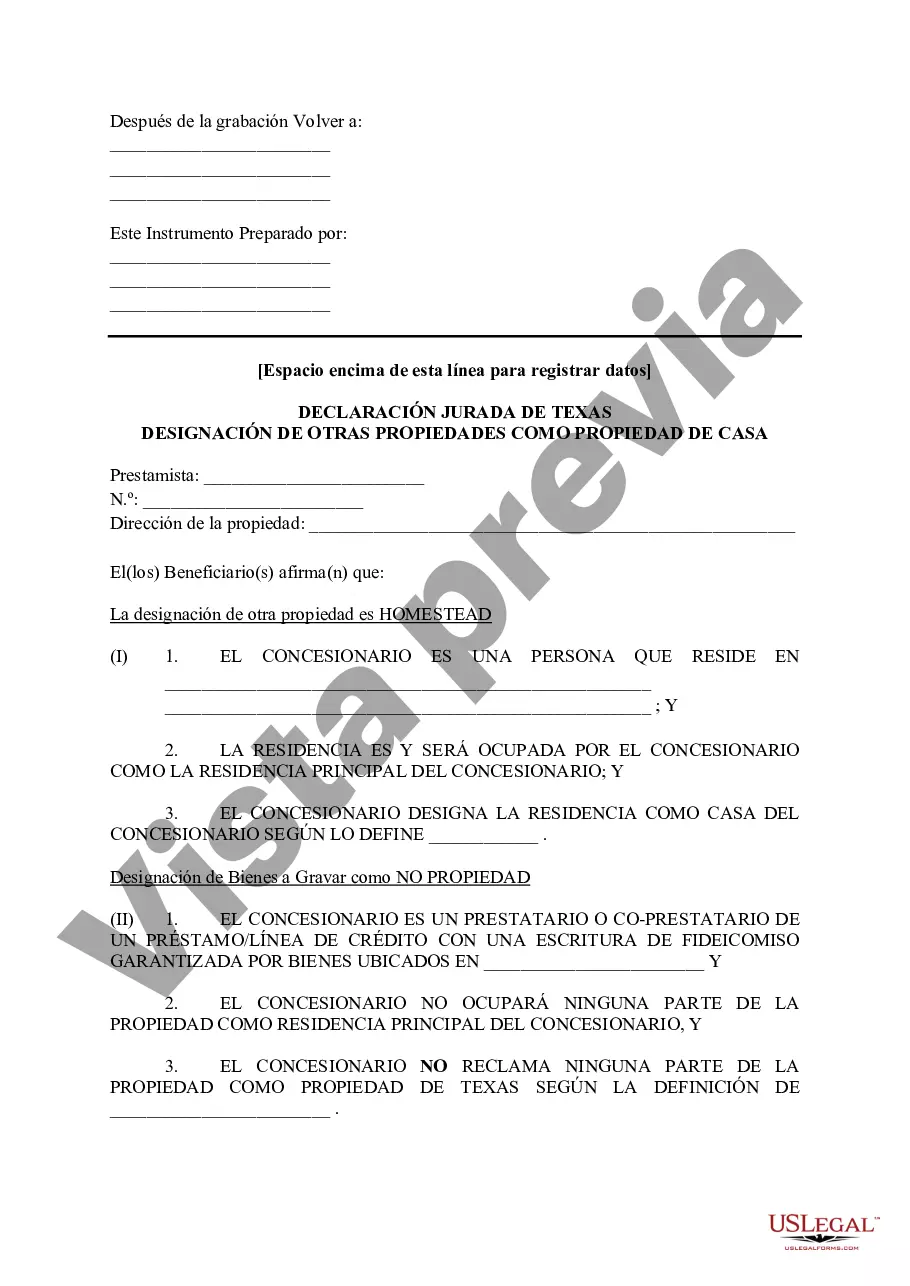

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Dallas Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Make use of the US Legal Forms and get instant access to any form sample you need. Our beneficial website with a huge number of documents simplifies the way to find and obtain virtually any document sample you want. You can save, fill, and certify the Dallas Texas Tax Affidavit Designation Other Property as Homestead Property in just a few minutes instead of browsing the web for several hours looking for a proper template.

Using our catalog is a great strategy to raise the safety of your form submissions. Our experienced legal professionals on a regular basis check all the documents to ensure that the templates are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Dallas Texas Tax Affidavit Designation Other Property as Homestead Property? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Open the page with the template you require. Make certain that it is the form you were hoping to find: verify its headline and description, and utilize the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to obtain the Dallas Texas Tax Affidavit Designation Other Property as Homestead Property and modify and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy template libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the Dallas Texas Tax Affidavit Designation Other Property as Homestead Property.

Feel free to make the most of our platform and make your document experience as efficient as possible!