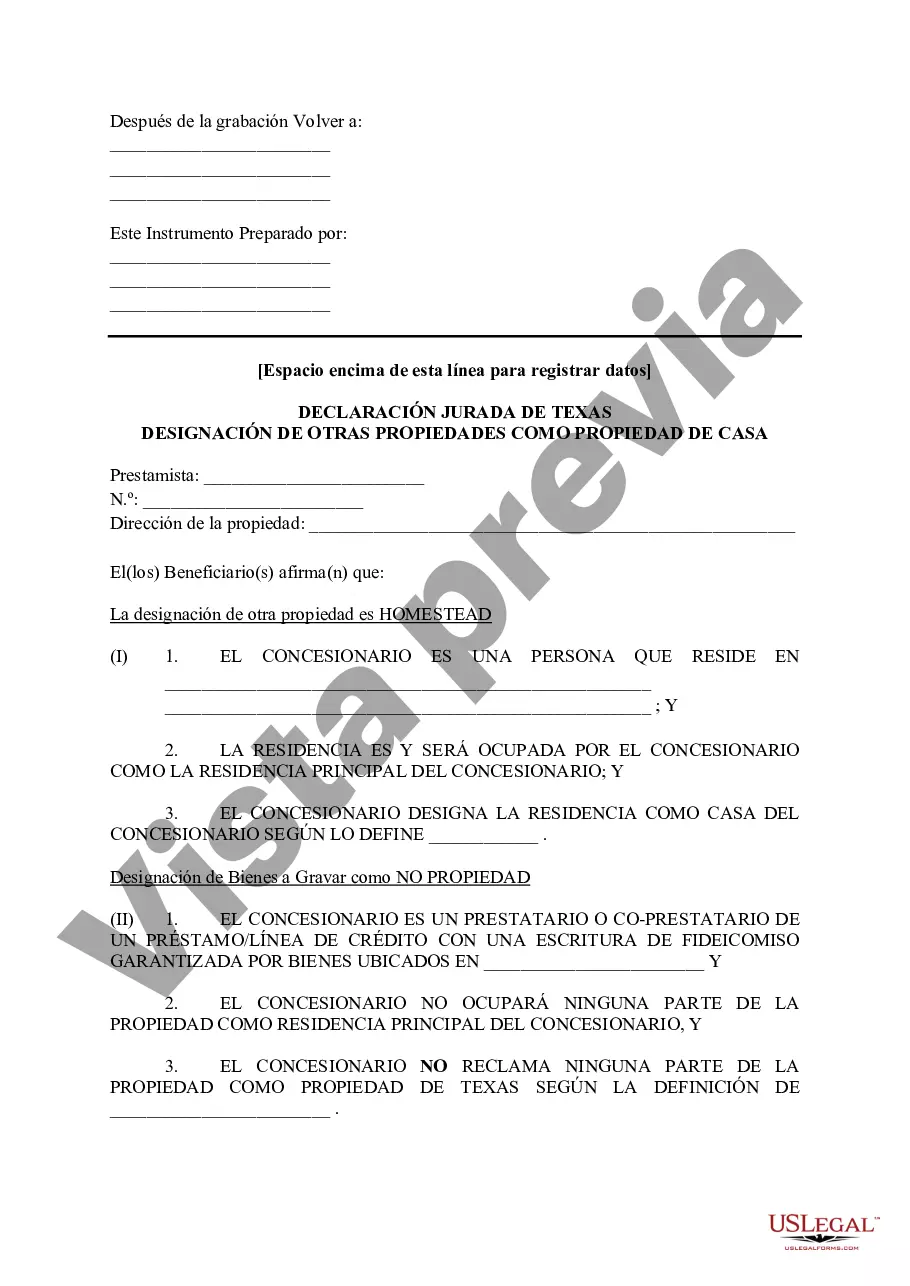

Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document used to classify a property as a homestead for tax purposes. This designation provides homeowners with numerous benefits, such as property tax exemptions, lower appraisal values, and protection against certain types of creditor claims. The Tax Affidavit Designation Other Property as Homestead Property is specifically used in Edinburg, Texas, and is designed for property owners who possess an additional property that they wish to classify as their homestead. This allows them to enjoy the same tax advantages as their primary residence. There are several types of properties that can be designated as homestead in Edinburg, Texas. These include vacant land, secondary or vacation homes, rental properties, and multiple properties owned by the same homeowner. By filing the Tax Affidavit Designation Other Property as Homestead Property, homeowners can essentially convert any eligible property into their homestead for tax purposes. This designation is particularly advantageous for those who maintain a primary residence elsewhere but own additional properties in Edinburg. By designating these properties as homestead, owners can benefit from reduced property taxes and potentially save a significant amount of money. To qualify for the Tax Affidavit Designation Other Property as Homestead Property, homeowners must meet certain criteria. These include proving that the designated property is not their primary residence, maintaining a homestead exemption for their main residence, and being able to demonstrate residency at the primary home. By following the necessary procedures and submitting the Tax Affidavit Designation Other Property as Homestead Property, homeowners in Edinburg, Texas, can enjoy a range of financial benefits. This includes reduced property taxes, lower appraisal values, and protection against creditor claims, among others. In conclusion, the Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property is a crucial legal document that allows property owners to classify an additional property as their homestead for tax purposes. By filing this affidavit, homeowners can benefit from various advantages, including property tax exemptions and protection against creditor claims. Whether it's vacant land, secondary homes, or rental properties, homeowners can leverage this designation to save money and enhance their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Edinburg Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Edinburg Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you are looking for a valid form, it’s difficult to choose a more convenient platform than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can get a large number of form samples for business and individual purposes by categories and regions, or keywords. Using our high-quality search feature, discovering the newest Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property is as easy as 1-2-3. In addition, the relevance of every file is proved by a group of skilled attorneys that on a regular basis review the templates on our platform and update them in accordance with the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the form you want. Look at its description and utilize the Preview feature (if available) to check its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the needed file.

- Affirm your decision. Select the Buy now button. Following that, pick the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Choose the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property.

Each template you save in your user profile does not have an expiry date and is yours forever. You always have the ability to access them via the My Forms menu, so if you want to get an additional copy for modifying or creating a hard copy, you can come back and export it again anytime.

Make use of the US Legal Forms professional collection to gain access to the Edinburg Texas Tax Affidavit Designation Other Property as Homestead Property you were seeking and a large number of other professional and state-specific templates on a single website!