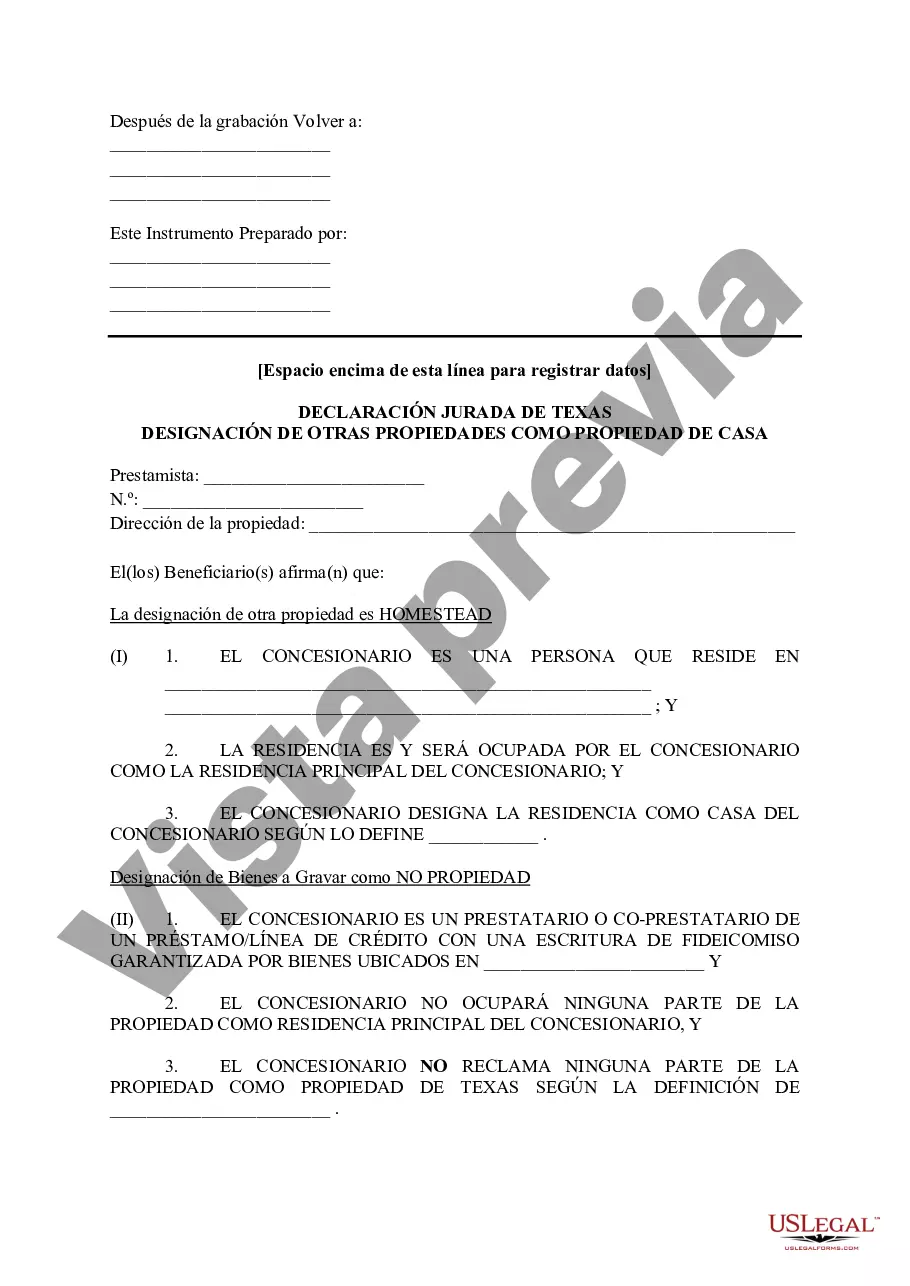

The Fort Worth Texas Tax Affidavit Designation Other Property as Homestead Property is a legal process that allows property owners to designate multiple properties as their homestead for tax purposes. This designation is important as it provides certain tax benefits for property owners. The tax affidavit is a legal document that property owners in Fort Worth, Texas, complete to designate a property as their homestead. The affidavit must be submitted to the local tax assessor's office. It includes the property owner's name, address, and identification information, along with a declaration that the property is their primary residence. The designation of "Other Property as Homestead Property" refers to the fact that an individual can have additional properties designated as their homestead for tax purposes, apart from their primary residence. This allows property owners to benefit from the homestead exemptions on multiple properties. Homestead exemptions typically include reduced property taxes and protection from certain creditors. There are different types of Fort Worth Texas Tax Affidavit Designation Other Property as Homestead Property based on the purpose and type of additional properties. Some examples of these designations may include: 1. Investment Property Homestead: This designation is used when the additional property is an investment property, such as a rental property or vacation home. Property owners can still receive homestead exemptions on investment properties as long as they meet specific criteria, such as not residing in the property for more than a certain number of days per year. 2. Multiple Residence Homestead: This designation applies when the property owner owns and resides in multiple residences within Fort Worth. It allows the property owner to designate each of these residences as a homestead for tax purposes, thus benefiting from the associated exemptions. 3. Agricultural Homestead: If the additional property is used for agricultural purposes, such as farming or ranching, property owners can designate it as an agricultural homestead. This designation brings additional tax benefits specific to agricultural properties. It is important to note that each designation may have specific eligibility requirements and guidelines that property owners must meet to qualify for the homestead exemptions. Property owners should consult with the local tax assessor's office or a qualified attorney to understand the specific requirements and procedures for designating other properties as homestead property in Fort Worth, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Worth Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Fort Worth Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney services that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Fort Worth Texas Tax Affidavit Designation Other Property as Homestead Property or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Fort Worth Texas Tax Affidavit Designation Other Property as Homestead Property adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Fort Worth Texas Tax Affidavit Designation Other Property as Homestead Property is proper for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!