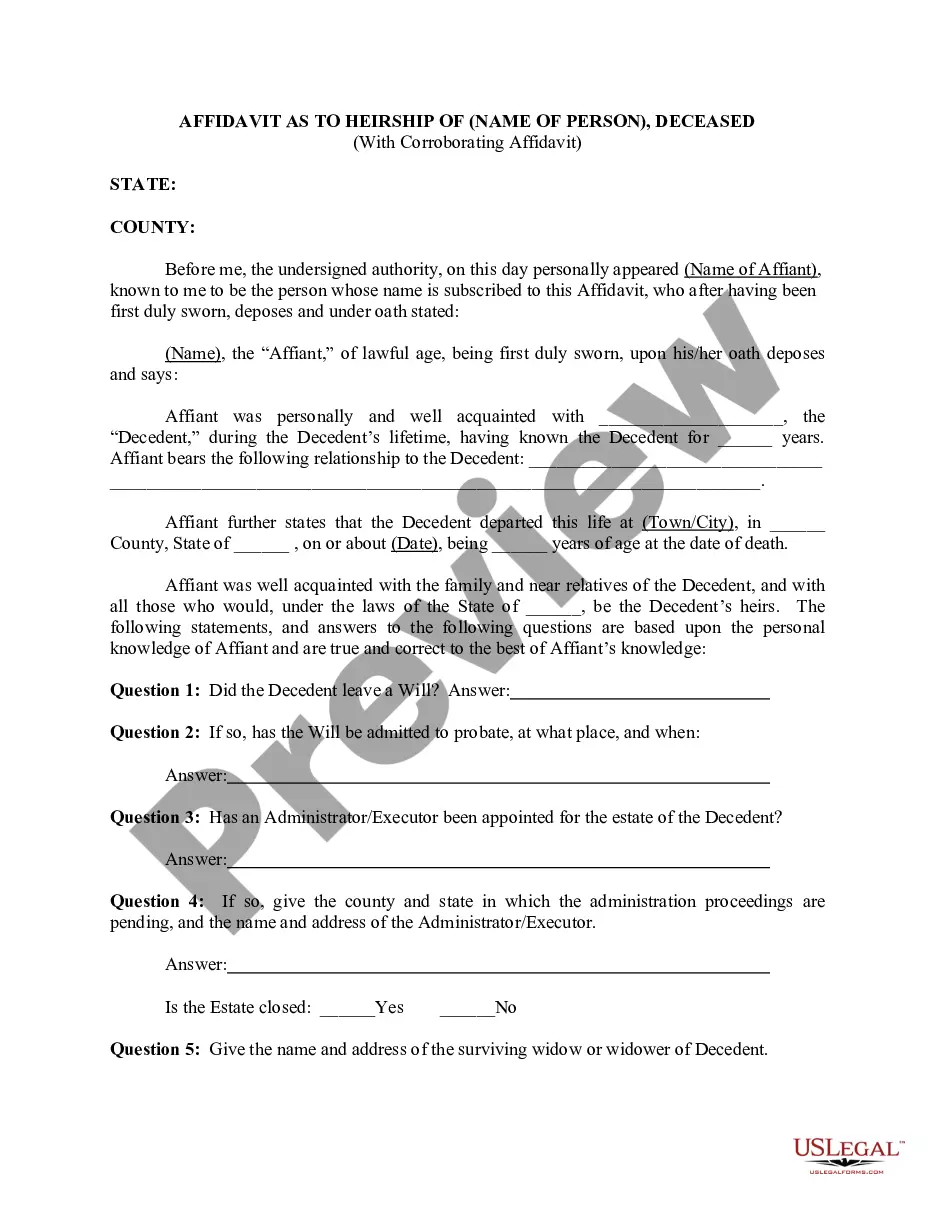

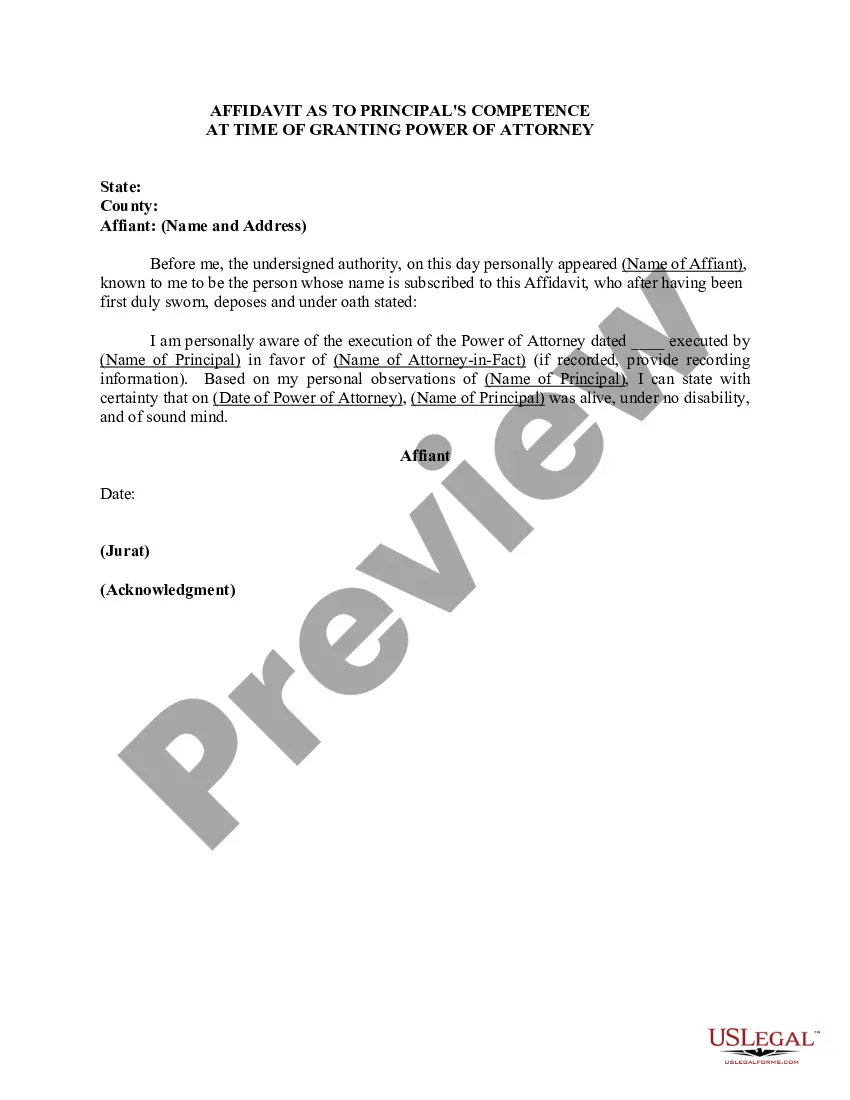

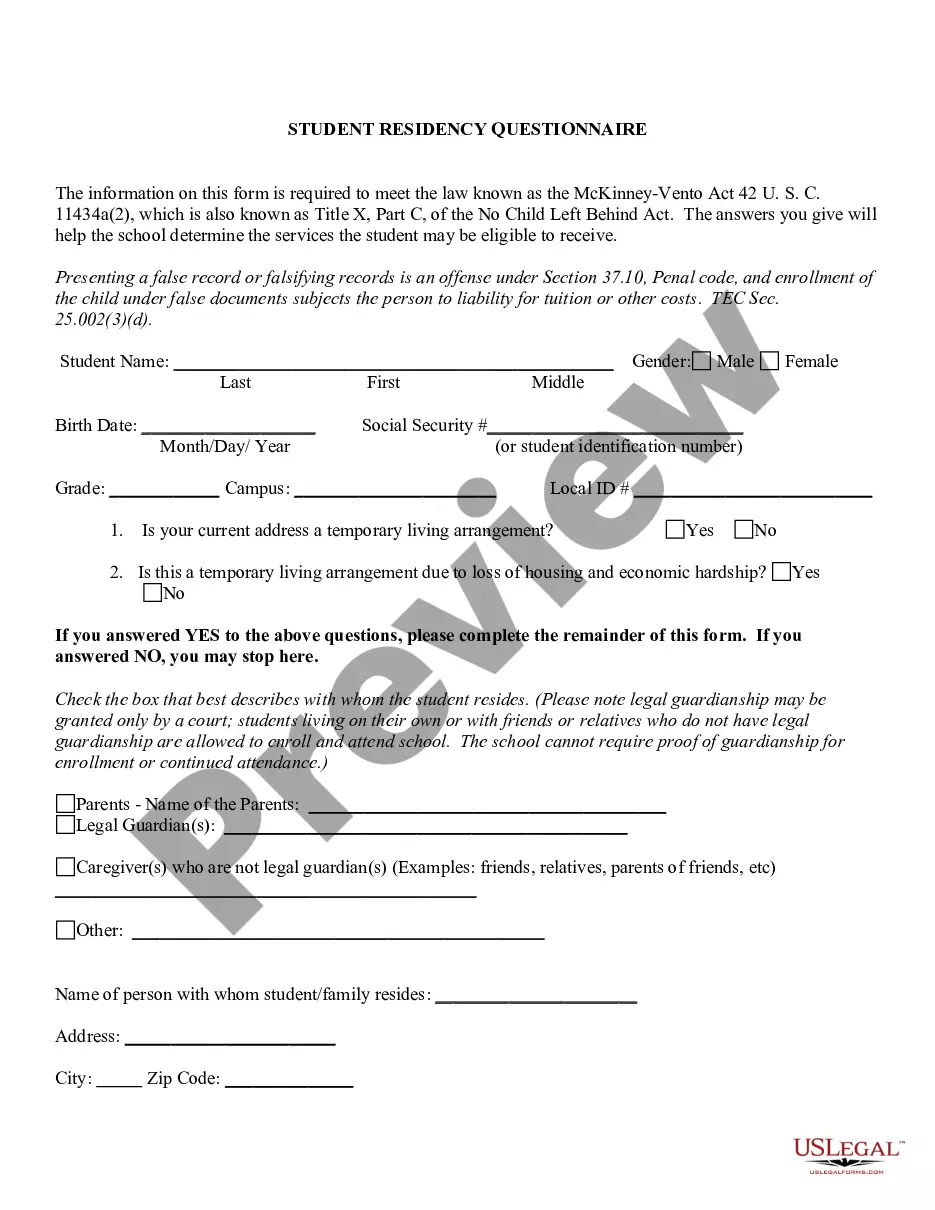

Frisco Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that homeowners in Frisco, Texas can use to claim a property other than their primary residence as a homestead for tax purposes. This designation allows homeowners to receive certain tax benefits and exemptions on the property. To further understand the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property process, it is essential to be familiar with the following keywords and concepts: 1. Frisco, Texas: Frisco is a vibrant city located in Collin and Denton counties in Texas. It is known for its robust economy, excellent schools, and high-quality suburban living. 2. Tax Affidavit: A tax affidavit is a sworn statement provided by taxpayers to confirm specific details regarding their tax liabilities, exemptions, or special designations. 3. Homestead Property: Homestead property refers to the primary residence of a homeowner. It is typically protected from certain creditors and qualifies for various tax exemptions. 4. Designation: The process of designating a property as a homestead involves formally declaring a property's homestead status for tax and legal purposes. 5. Other Property: The term "other property" refers to any additional property owned by the homeowner, such as a second home, vacation home, or rental property. When homeowners in Frisco, Texas own multiple properties, they may wish to designate a property other than their primary residence as a homestead. This designation enables them to apply for tax exemptions and benefits for that specific property. However, it is important to note that Frisco Texas Tax Affidavit Designation Other Property as Homestead Property is not applicable to the primary residence, as it already automatically qualifies as a homestead. By utilizing the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property, homeowners can potentially reduce their property taxes on the designated additional property. This can lead to considerable financial savings and increased financial stability. Furthermore, it is crucial to understand that the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property process may vary based on factors such as the type of property being designated, its location, and the zoning regulations in place. Homeowners should consult with a qualified tax advisor or real estate attorney to ensure they meet all the necessary requirements and accurately complete the required forms. In summary, the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property is a valuable opportunity for homeowners in Frisco, Texas, to designate a property other than their primary residence as a homestead for tax purposes. This allows them to potentially receive tax benefits and exemptions on the designated property, reducing their overall property tax burden. It is recommended to seek professional guidance when pursuing this designation to comply with all legal and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Frisco Property Tax - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Frisco Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any legal background to draft this sort of papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our service offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property quickly employing our trusted service. In case you are already an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property:

- Ensure the template you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Preview the document and go through a short outline (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Frisco Texas Tax Affidavit Designation Other Property as Homestead Property as soon as the payment is through.

You’re all set! Now you can go ahead and print out the document or fill it out online. If you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.