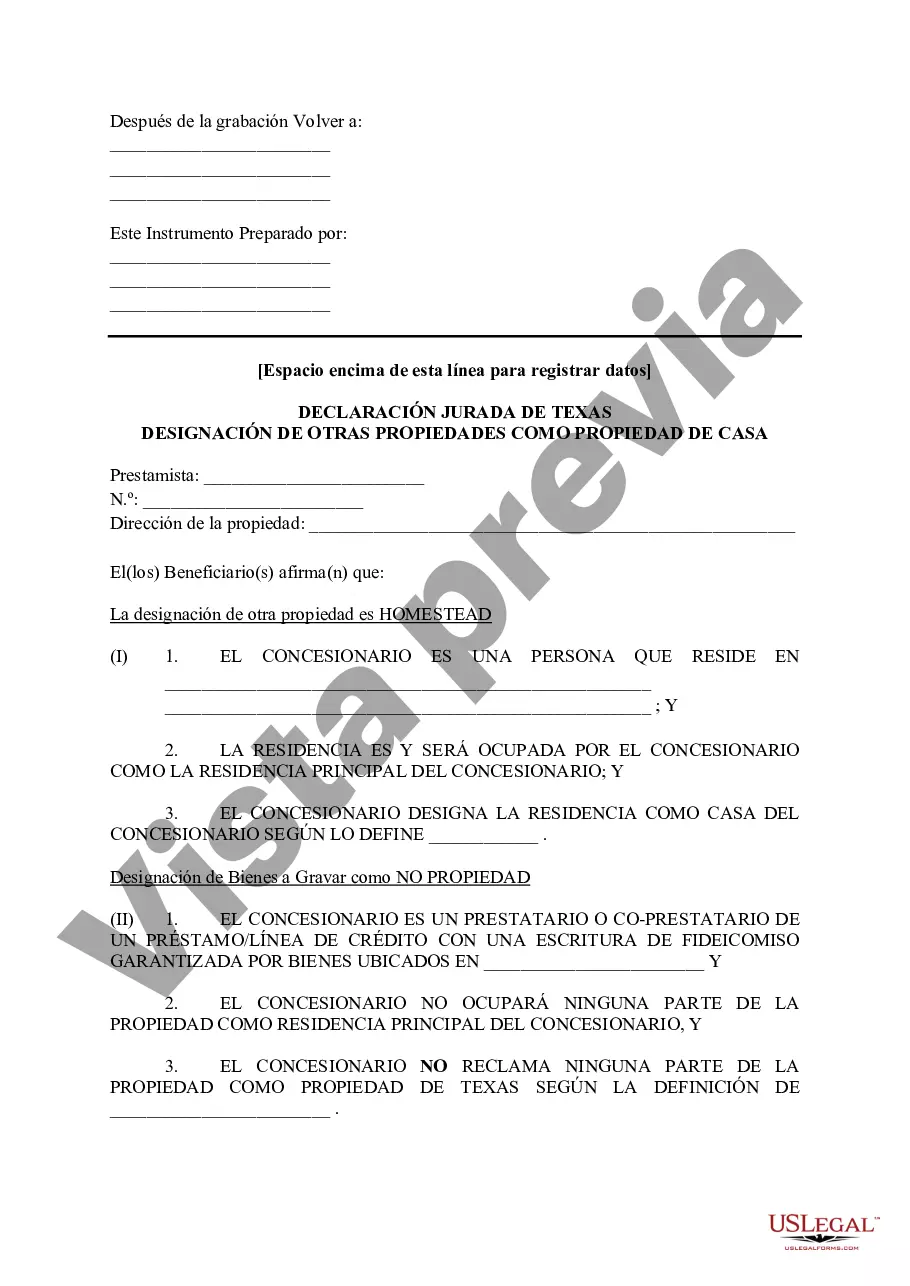

Irving Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners in Irving, Texas, to designate a property other than their primary residence as a homestead property for tax purposes. This designation can have various implications and benefits for property owners. When filing the Irving Texas Tax Affidavit Designation Other Property as Homestead Property, individuals must provide detailed information about the property in question, including its location, size, and ownership details. This filing helps establish that the property owner intends to use the designated property as their homestead, even though it may not be their primary residence. The purpose of this designation is to provide property owners with certain exemptions and benefits that are typically associated with a homestead property. These exemptions and benefits may include a reduction in property taxes, protection from certain liens and judgments, and eligibility for certain government programs. Aside from the general Irving Texas Tax Affidavit Designation Other Property as Homestead Property, there are two specific types of designations that property owners can consider: 1. Adjacent Property Designation: This type of designation applies to properties that are located adjacent to the primary residence, such as an additional lot or adjoining land. By designating these adjacent properties as homestead, property owners can enjoy the same tax benefits as their primary residence. 2. Rental Property Designation: Property owners who rent out certain portions or units of their property can also file for the Irving Texas Tax Affidavit Designation Other Property as Homestead Property. This designation allows them to claim a portion of their rental property as a homestead for tax purposes. It is essential to note that property owners must meet specific criteria and comply with certain regulations to qualify for the Irving Texas Tax Affidavit Designation Other Property as Homestead Property. These criteria may include using the designated property as their primary residence or providing substantial evidence of intent to live on the property in the future. By filing the Irving Texas Tax Affidavit Designation Other Property as Homestead Property, property owners in Irving, Texas can potentially enjoy tax benefits and exemptions on properties other than their primary residence. However, it is crucial to consult with a legal or tax professional to understand the specific requirements and implications of this designation to ensure compliance with all relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Irving Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

State:

Texas

City:

Irving

Control #:

TX-LR052T

Format:

Word

Instant download

Description

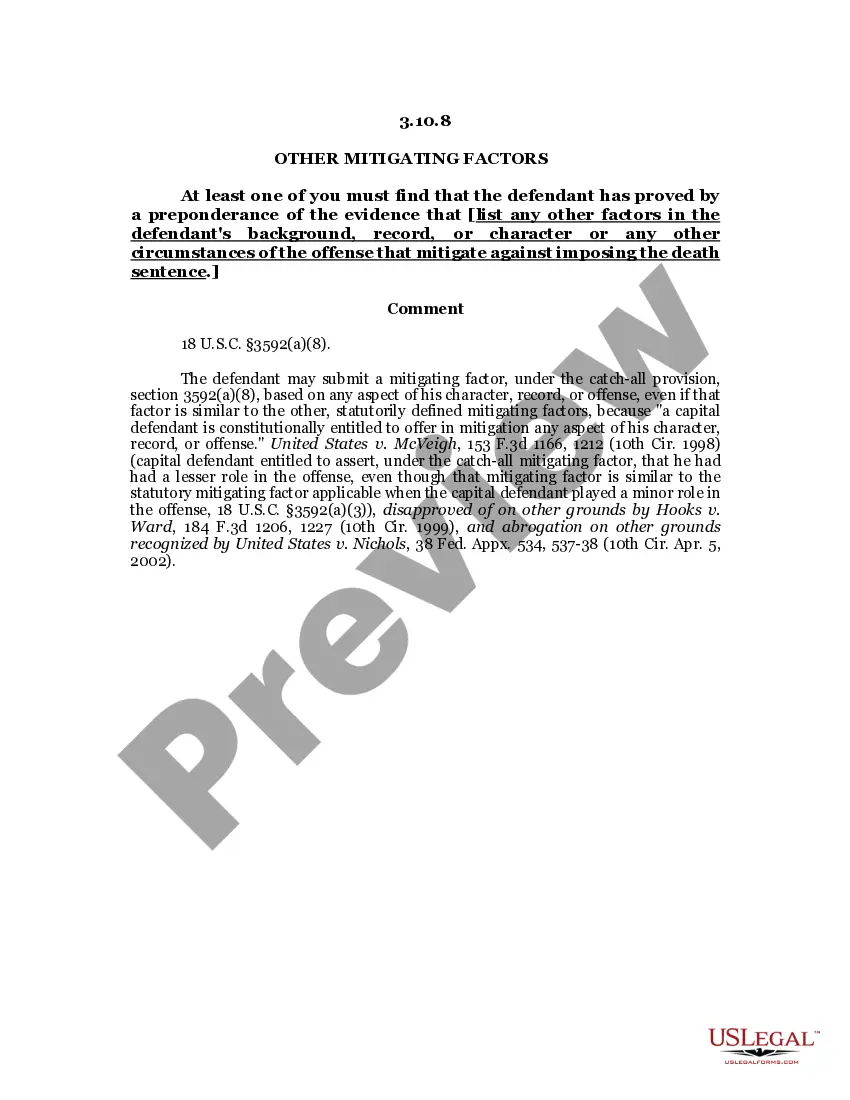

This affidavit is used to designate another property as legal Homestead Property as defined by Texas Law and list the location of non-homestead property.

Irving Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners in Irving, Texas, to designate a property other than their primary residence as a homestead property for tax purposes. This designation can have various implications and benefits for property owners. When filing the Irving Texas Tax Affidavit Designation Other Property as Homestead Property, individuals must provide detailed information about the property in question, including its location, size, and ownership details. This filing helps establish that the property owner intends to use the designated property as their homestead, even though it may not be their primary residence. The purpose of this designation is to provide property owners with certain exemptions and benefits that are typically associated with a homestead property. These exemptions and benefits may include a reduction in property taxes, protection from certain liens and judgments, and eligibility for certain government programs. Aside from the general Irving Texas Tax Affidavit Designation Other Property as Homestead Property, there are two specific types of designations that property owners can consider: 1. Adjacent Property Designation: This type of designation applies to properties that are located adjacent to the primary residence, such as an additional lot or adjoining land. By designating these adjacent properties as homestead, property owners can enjoy the same tax benefits as their primary residence. 2. Rental Property Designation: Property owners who rent out certain portions or units of their property can also file for the Irving Texas Tax Affidavit Designation Other Property as Homestead Property. This designation allows them to claim a portion of their rental property as a homestead for tax purposes. It is essential to note that property owners must meet specific criteria and comply with certain regulations to qualify for the Irving Texas Tax Affidavit Designation Other Property as Homestead Property. These criteria may include using the designated property as their primary residence or providing substantial evidence of intent to live on the property in the future. By filing the Irving Texas Tax Affidavit Designation Other Property as Homestead Property, property owners in Irving, Texas can potentially enjoy tax benefits and exemptions on properties other than their primary residence. However, it is crucial to consult with a legal or tax professional to understand the specific requirements and implications of this designation to ensure compliance with all relevant laws and regulations.

Free preview

How to fill out Irving Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you’ve already used our service before, log in to your account and save the Irving Texas Tax Affidavit Designation Other Property as Homestead Property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Irving Texas Tax Affidavit Designation Other Property as Homestead Property. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!