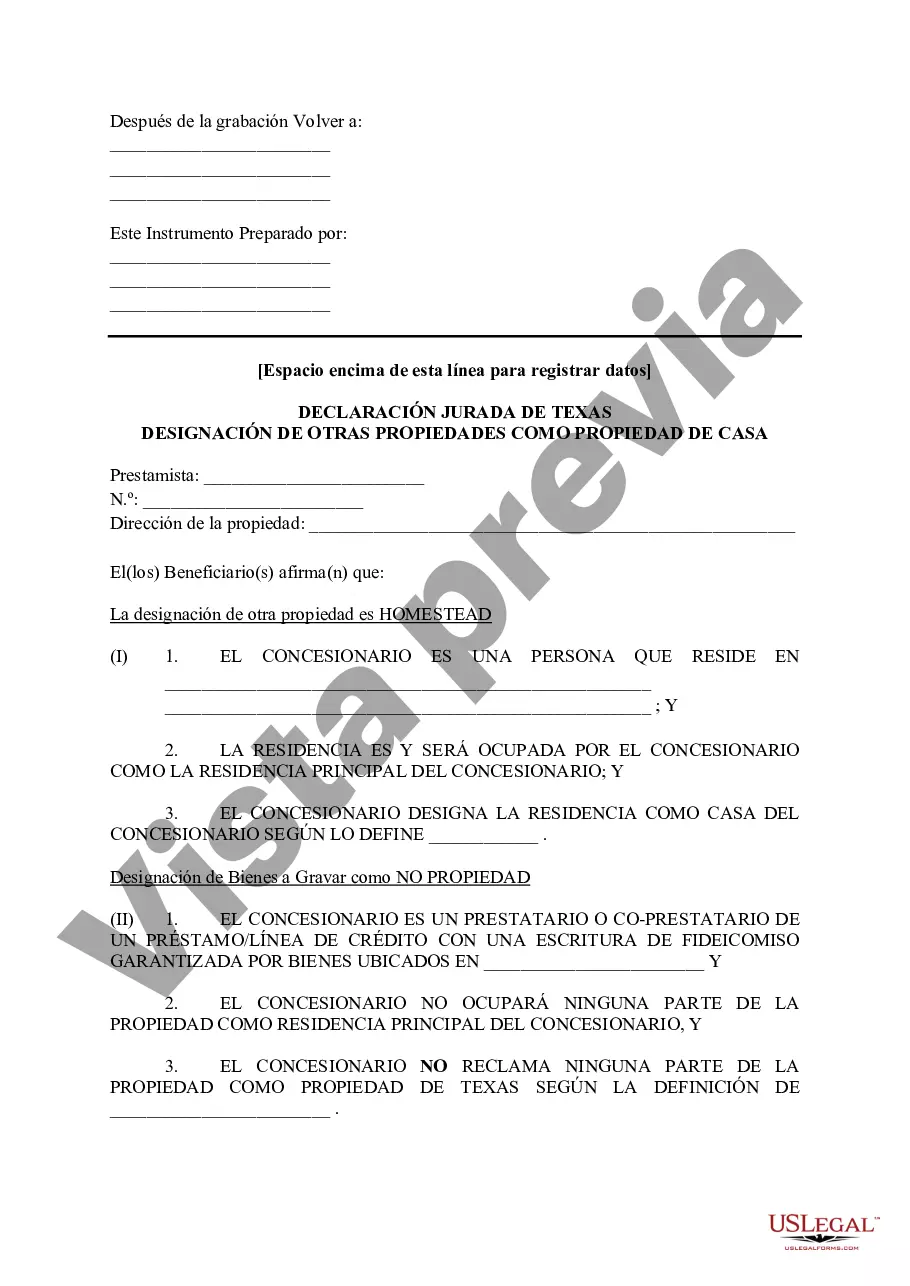

Laredo, Texas Tax Affidavit Designation Other Property as Homestead Property refers to a legal document that allows property owners to declare a property as their homestead for tax purposes. This designation provides homeowners with certain tax benefits and protections. In Laredo, Texas, there are two types of Tax Affidavit Designation Other Property as Homestead Property: 1. Residential Homestead Property: This category includes residential properties that are considered the primary residence of the homeowner. To be eligible for this designation, the property must be owned and occupied by the homeowner as their primary residence on January 1st of the tax year. This type of property can benefit from various tax exemptions and deductions, including a reduction in the property's assessed value. 2. Special Homestead Property: This designation is for properties that are not eligible for the Residential Homestead Property designation but still meet certain criteria. Special Homestead Property includes properties such as vacant land or properties used for commercial purposes. To qualify, the property must be owned by the homeowner and meet specific requirements outlined by the Texas Property Tax Code. The Laredo, Texas Tax Affidavit Designation Other Property as Homestead Property is an important mechanism for property owners to ensure fair taxation and protect their property rights. By designating a property as a homestead, homeowners can take advantage of tax exemptions and deductions that can result in significant savings. It is essential for property owners to understand the eligibility criteria and file the necessary paperwork to claim these benefits. If you own a property in Laredo, Texas, it is advisable to consult with a tax professional or the local tax assessor's office to determine if your property qualifies for the Tax Affidavit Designation Other Property as Homestead Property and to ensure you comply with all requirements and deadlines.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Laredo Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

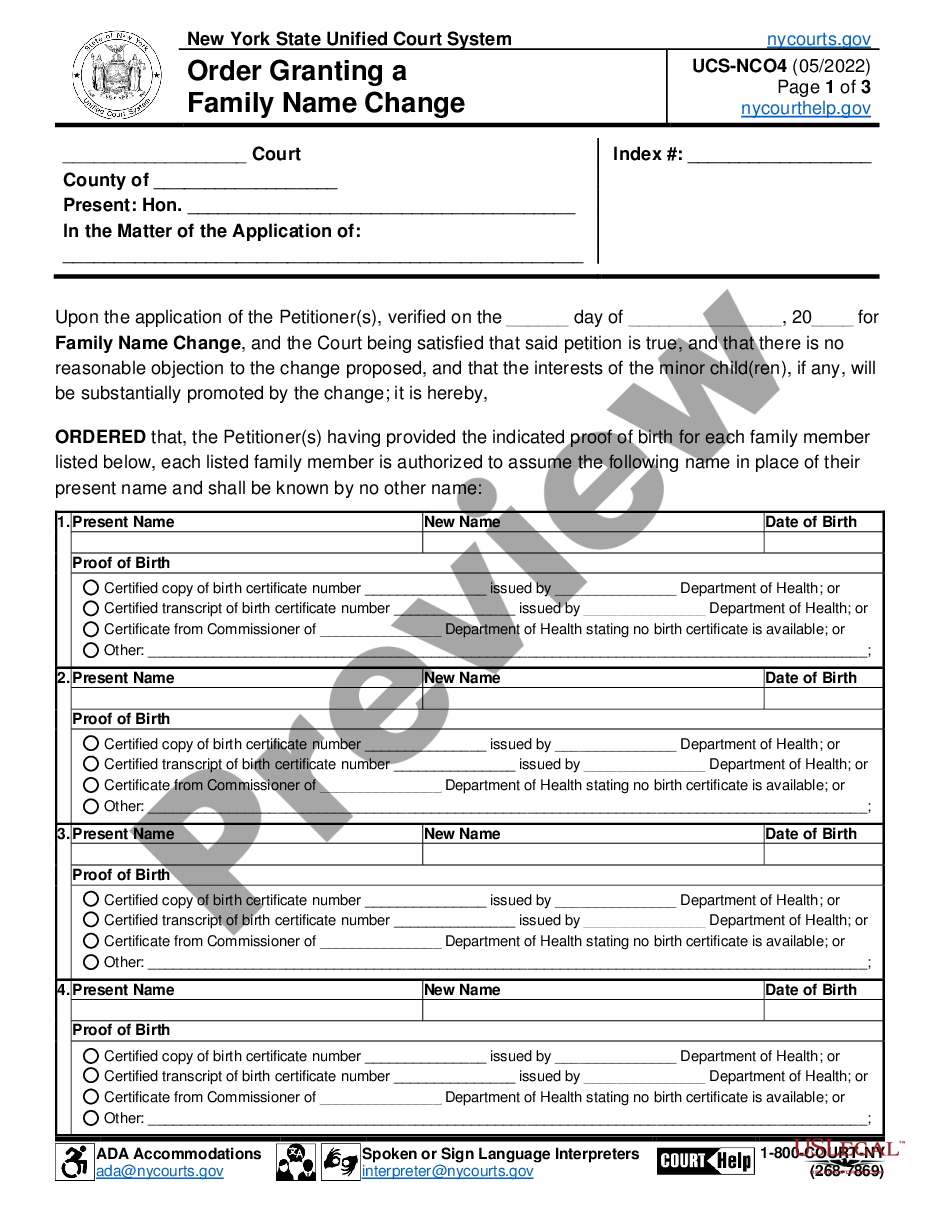

Description

How to fill out Laredo Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Benefit from the US Legal Forms and get immediate access to any form you want. Our useful platform with thousands of document templates makes it simple to find and obtain almost any document sample you want. You are able to download, complete, and certify the Laredo Texas Tax Affidavit Designation Other Property as Homestead Property in just a couple of minutes instead of browsing the web for many hours trying to find an appropriate template.

Utilizing our catalog is a superb strategy to raise the safety of your document filing. Our experienced legal professionals regularly review all the records to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How can you obtain the Laredo Texas Tax Affidavit Designation Other Property as Homestead Property? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the tips listed below:

- Open the page with the template you need. Ensure that it is the form you were looking for: check its headline and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Indicate the format to obtain the Laredo Texas Tax Affidavit Designation Other Property as Homestead Property and edit and complete, or sign it for your needs.

US Legal Forms is among the most significant and reliable form libraries on the web. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Laredo Texas Tax Affidavit Designation Other Property as Homestead Property.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!