The McKinney Texas Tax Affidavit Designation Other Property as Homestead Property is an essential legal document that allows property owners in McKinney, Texas, to designate a property as their homestead for tax purposes. This designation offers certain benefits and protections under Texas law, such as property tax exemptions and limitations on property value increases. The process of designating Other Property as Homestead Property in McKinney requires completing an official tax affidavit. This affidavit must be filed with the Collin County Appraisal District, the local governing body responsible for assessing property values and collecting property taxes. By completing the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property, property owners can enjoy the various benefits associated with homestead exemptions. Examples of the different types of property that can be designated as homestead property include: 1. Primary Residence: The primary residence or main dwelling where the property owner resides for the majority of the year can be designated as homestead property. This is typically the home where the property owner and their family live. 2. Second Home: In some cases, property owners may own multiple properties within McKinney, Texas. If they consider one of these additional properties as their second home, they can designate it as homestead property by filing the designated tax affidavit. 3. Rental Property Conversion: Property owners who have converted a non-homestead property like a rental property into their primary residence can designate it as homestead property. This allows them to enjoy the benefits of a homestead exemption on a property that was previously used for rental income. 4. Aging-in-Place Designation: McKinney provides an aging-in-place designation for individuals who are 65 years of age or older. This designation allows them to freeze property values at a certain level, preventing excessive property tax increases as they age. It is important to note that each property type may have specific eligibility requirements, deadlines, and limitations associated with the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property. Property owners are advised to consult local tax authorities or professionals to understand the specific rules and regulations applicable to their situation. In conclusion, the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property is a crucial document for property owners in McKinney, Texas, seeking to designate their property as a homestead for tax benefits and protections. Understanding the different types of designated homestead properties and following the necessary procedures can help property owners optimize their tax liabilities and enjoy the advantages provided under Texas law.

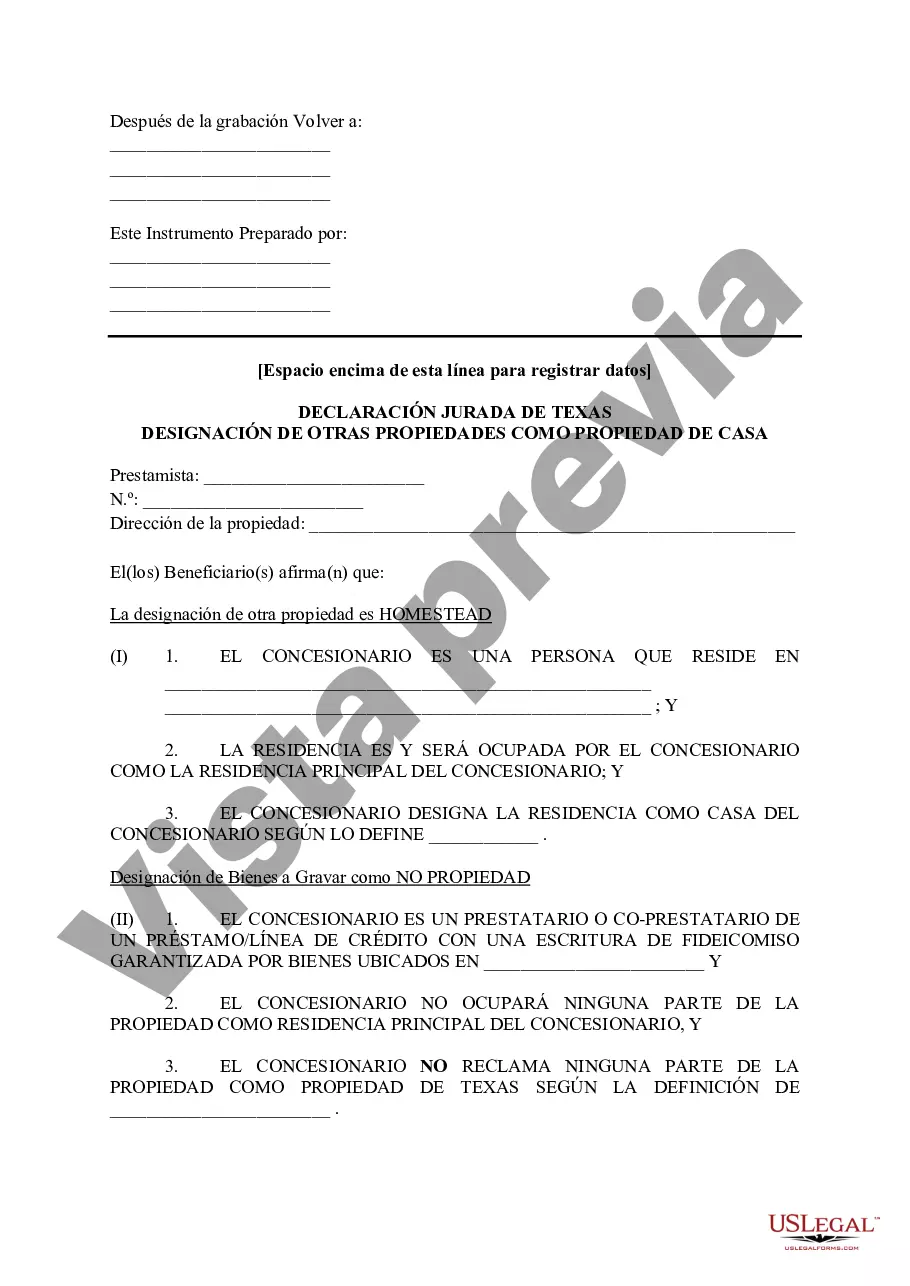

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McKinney Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

State:

Texas

City:

McKinney

Control #:

TX-LR052T

Format:

Word

Instant download

Description

This affidavit is used to designate another property as legal Homestead Property as defined by Texas Law and list the location of non-homestead property.

The McKinney Texas Tax Affidavit Designation Other Property as Homestead Property is an essential legal document that allows property owners in McKinney, Texas, to designate a property as their homestead for tax purposes. This designation offers certain benefits and protections under Texas law, such as property tax exemptions and limitations on property value increases. The process of designating Other Property as Homestead Property in McKinney requires completing an official tax affidavit. This affidavit must be filed with the Collin County Appraisal District, the local governing body responsible for assessing property values and collecting property taxes. By completing the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property, property owners can enjoy the various benefits associated with homestead exemptions. Examples of the different types of property that can be designated as homestead property include: 1. Primary Residence: The primary residence or main dwelling where the property owner resides for the majority of the year can be designated as homestead property. This is typically the home where the property owner and their family live. 2. Second Home: In some cases, property owners may own multiple properties within McKinney, Texas. If they consider one of these additional properties as their second home, they can designate it as homestead property by filing the designated tax affidavit. 3. Rental Property Conversion: Property owners who have converted a non-homestead property like a rental property into their primary residence can designate it as homestead property. This allows them to enjoy the benefits of a homestead exemption on a property that was previously used for rental income. 4. Aging-in-Place Designation: McKinney provides an aging-in-place designation for individuals who are 65 years of age or older. This designation allows them to freeze property values at a certain level, preventing excessive property tax increases as they age. It is important to note that each property type may have specific eligibility requirements, deadlines, and limitations associated with the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property. Property owners are advised to consult local tax authorities or professionals to understand the specific rules and regulations applicable to their situation. In conclusion, the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property is a crucial document for property owners in McKinney, Texas, seeking to designate their property as a homestead for tax benefits and protections. Understanding the different types of designated homestead properties and following the necessary procedures can help property owners optimize their tax liabilities and enjoy the advantages provided under Texas law.

Free preview

How to fill out McKinney Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you’ve already utilized our service before, log in to your account and save the McKinney Texas Tax Affidavit Designation Other Property as Homestead Property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your McKinney Texas Tax Affidavit Designation Other Property as Homestead Property. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!