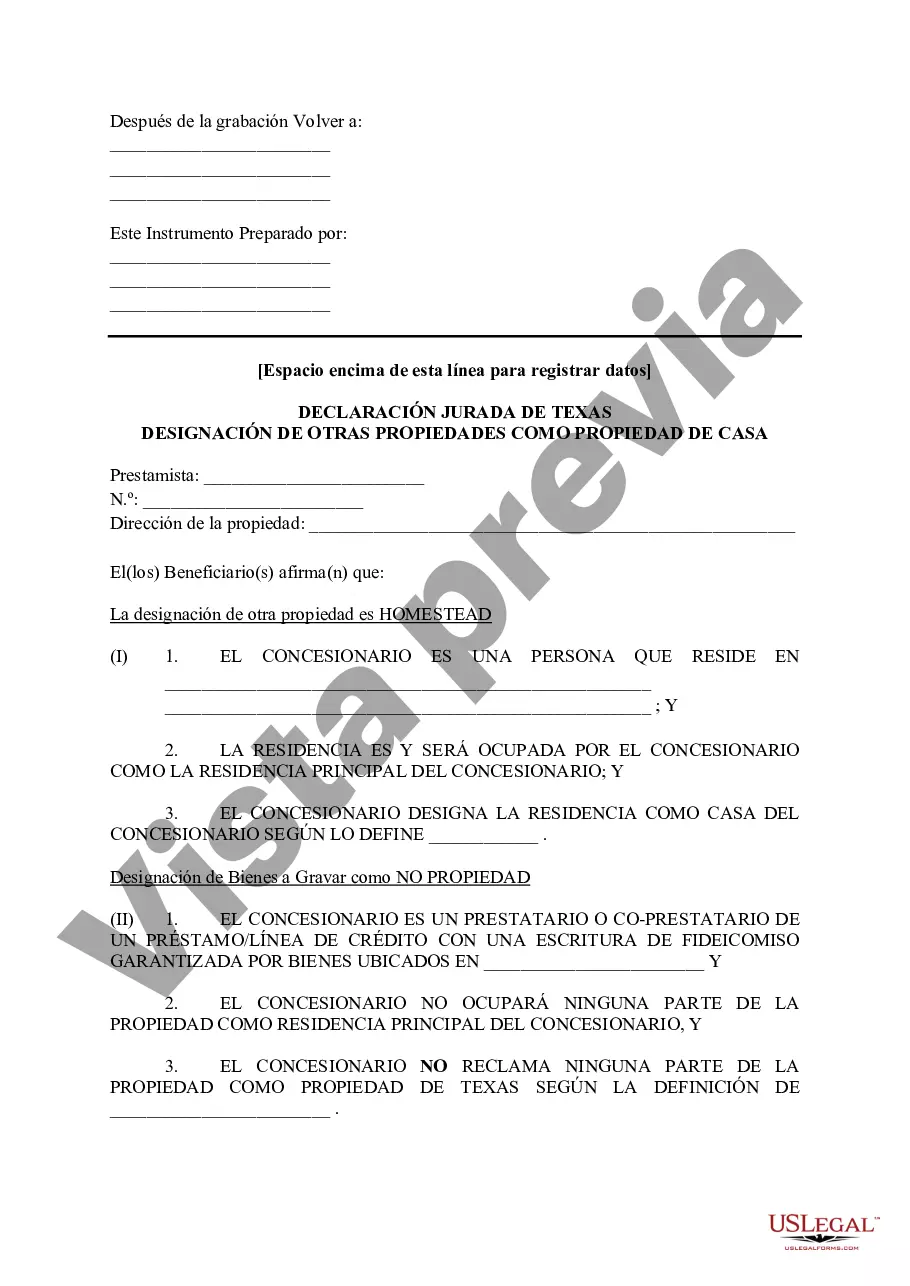

Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property refers to a legal document that homeowners in Mesquite, Texas, can use to designate a secondary property as their homestead for tax purposes. This designation allows property owners to benefit from certain tax exemptions and deductions applicable to the homestead property. When homeowners own more than one property, they must choose which one to designate as their primary homestead. However, they also have the option to designate a different property, apart from their primary residence, as a homestead property through the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property. By designating a property as a homestead, homeowners enjoy tax benefits such as a reduction in property taxes and protection from certain creditor claims. This designation can be especially beneficial if the secondary property has a higher assessed value or faces higher property tax rates. There are no specific different types of Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property. Rather, it refers to a general process of designating a non-primary property as a homestead for tax purposes. Homeowners must follow the proper procedures outlined by the Mesquite Tax Assessor's Office to complete the tax affidavit designation. To designate a property as a homestead, homeowners need to meet specific criteria set by the State of Texas, such as using the property as their primary residence and occupying it on January 1st of the tax year. Additionally, they must file the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property form with the Mesquite Tax Assessor's Office. In conclusion, the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property allows homeowners in Mesquite, Texas, to designate a secondary property as their homestead for tax purposes. This designation offers tax benefits to property owners and entails following specific criteria and procedures set by the State of Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mesquite Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Mesquite Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Utilize the US Legal Forms to gain instant access to any form template you need.

Our user-friendly website featuring a vast array of documents simplifies the process of locating and obtaining nearly any document sample you require.

You can save, complete, and sign the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property in merely a few minutes instead of spending countless hours searching the Internet for a suitable template.

Leveraging our collection is an excellent method to enhance the security of your document submissions.

If you haven’t set up a profile yet, follow the instructions outlined below.

Access the page with the form you need. Ensure that it is the form you intended to find: check its title and description, and utilize the Preview option when available. Otherwise, you can use the Search field to seek out the required one.

- Our expert attorneys routinely review all records to ensure that the forms are suitable for a specific state and comply with new laws and regulations.

- How do you acquire the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property.

- If you possess a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- Furthermore, you can discover all previously saved files in the My documents menu.

Form popularity

FAQ

Yes, a homestead can be exempt under Texas property law. The Texas Property Code offers exemptions that protect a portion of the value of a homestead from property taxes and creditors. If you are considering a Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property, utilizing these exemptions can significantly benefit your financial situation. Therefore, it is essential to understand how the homestead designation works in combination with state laws.

The property code for the affidavit of heirship in Texas is stated in Chapter 203 of the Texas Property Code. This code provides guidance on how to create an affidavit that establishes the inherited property rights of heirs. If you are looking to file a Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property, understanding this code can be crucial for your legal proceedings.

In Texas, seniors typically qualify for property tax exemptions starting at age 65. This exemption can significantly reduce the amount of property taxes owed. Additionally, the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property allows seniors to designate properties as homestead, potentially alleviating further tax burdens. Utilizing forms from a platform like US Legal Forms can help you navigate these exemptions easily.

The voluntary designation of homestead in Texas allows homeowners to proactively claim their property as a homestead, granting them specific legal protections and exemptions. This designation can help mitigate property taxes and increase security against creditors. Homeowners who take this step in Mesquite, Texas, can benefit significantly from the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property, ensuring a stable home environment.

The property code for homestead in Texas outlines the laws and regulations surrounding homestead designations and exemptions. This code is essential for homeowners seeking to understand their rights and responsibilities regarding property use. It's crucial to reference this code when navigating the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property, as it governs the entire process.

The property ID for homestead exemption is a unique identification number assigned to your property by your local appraisal district. This ID is crucial when applying for tax exemptions related to your homestead designation. In Mesquite, Texas, accurately using your property ID ensures that you receive all applicable benefits under the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property.

A Texas homestead designation is a formal recognition at the local level that identifies a property as a homestead. This designation is important because it can exempt you from certain taxes and offers protections against creditors. Homeowners in Mesquite, Texas, should understand that this designation ensures their residence continues to benefit from the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property.

The designation of homestead under the Texas Property Code allows homeowners to claim a portion of their property as their principal residence. This designation provides certain legal protections and tax benefits, which can be especially valuable in Mesquite, Texas. By legally designating your home under this code, you can ensure your property receives the necessary consideration for homestead exemption, ultimately supporting your financial stability.

To designate a homestead in Texas, you must fill out and submit a homestead exemption application to your county’s appraisal office. This application will require basic information about you and your property. Ensure you leverage the tools provided by US Legal Forms to streamline the process of submitting the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property for optimal results.

To declare your home a homestead in Texas, you need to file an application for a homestead exemption with your local appraisal district. This process involves completing the required forms and submitting necessary documents, like proof of ownership. For ease and clarity, consider using platforms like US Legal Forms to navigate the Mesquite Texas Tax Affidavit Designation Other Property as Homestead Property effectively.