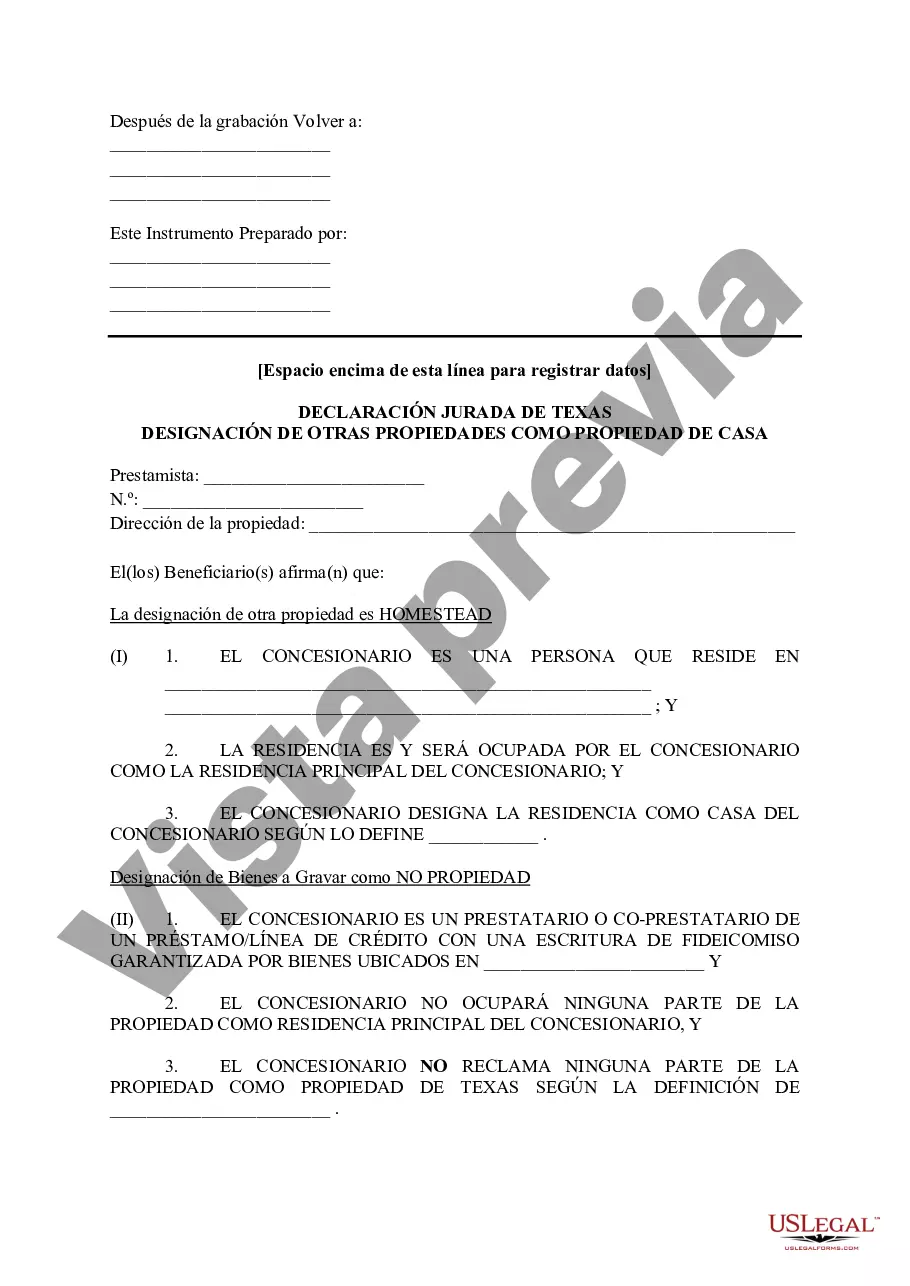

Description: The Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners in Pasadena, Texas, to designate an additional property as their homestead for tax purposes. This designation provides homeowners with certain benefits and protections under Texas law. When an individual owns multiple properties, the primary residence is typically designated as the homestead property. However, if a property owner wishes to claim another property as their homestead, they must complete the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property. This affidavit is filed with the Harris County Appraisal District, the governing entity responsible for property assessments and tax collection. By designating a property as a homestead, homeowners can benefit from various tax exemptions and deductions. These include the homestead exemption, which reduces the assessed value of the property for taxation purposes, resulting in lower property taxes. Additionally, the designation provides protection against certain creditors and limits any increases in the property's taxable value. There are different types of Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property, including: 1. Primary Residence Affidavit: This type of affidavit allows property owners to designate their primary residence as their homestead property. It is the most common and straightforward designation. 2. Secondary Property Affidavit: In some cases, homeowners may choose to designate a secondary property as their homestead, such as a vacation home or rental property. 3. Investment Property Affidavit: Property owners who own investment properties in Pasadena, Texas, can utilize this affidavit to designate one of their investment properties as their homestead. It is important to note that the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property must meet certain criteria to be valid. The property must be the owner's principal place of residence, and the owner must have legal title to the property. Additionally, the property owner must file the affidavit during the designated filing period, which is typically between January 1st and April 30th of each year. Overall, the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property is a valuable tool for property owners in Pasadena, Texas, who wish to claim additional properties as their homesteads. By properly completing and filing this affidavit, homeowners can enjoy various tax benefits and protections while ensuring compliance with Texas tax laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pasadena Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Pasadena Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal background to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property in minutes employing our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our library, ensure that you follow these steps before obtaining the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property:

- Be sure the form you have chosen is good for your location because the rules of one state or county do not work for another state or county.

- Review the document and go through a quick outline (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment method and proceed to download the Pasadena Texas Tax Affidavit Designation Other Property as Homestead Property as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the document or fill it out online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.