Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners in Round Rock, Texas to designate a property, other than their primary residence, as a homestead property for tax purposes. This designation provides certain tax benefits and exemptions to eligible property owners. To qualify for Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property, the property must meet specific criteria set by the local tax authorities. These criteria may include the property being owned and occupied by the property owner as their principal residence, and the property being used primarily for residential purposes. The Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property offers several benefits to property owners. It helps reduce the property owner's tax burden by providing exemptions and deductions on property taxes. This designation can also offer protection against certain creditors and help preserve the property in case of financial difficulties. There are different types of Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property, depending on the specific circumstances of the property owner. These may include: 1. Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property — Secondary/Investment Property: This type of homestead designation allows property owners to designate a secondary or investment property as their homestead for tax benefits. It is often used by property owners who have multiple properties and want to take advantage of the homestead tax exemptions on a property other than their primary residence. 2. Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property — Agricultural Property: This type of homestead designation is specifically for properties that are used for agricultural purposes. Owners of agricultural properties can designate their land and structures as a homestead to benefit from agricultural-related tax exemptions and deductions. 3. Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property — Rental Property: Property owners who rent out a portion of their property or own rental properties may be eligible to designate their rental property as a homestead for tax purposes. This allows them to enjoy certain exemptions and deductions on property taxes related to their rental properties. 4. Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property — Vacation Home: Property owners who have a vacation home in Round Rock, Texas, can designate it as a homestead property. This homestead designation offers tax benefits for the property owner, even if the vacation home is not their primary residence. It is important for property owners in Round Rock, Texas to consult with a tax professional or review the specific guidelines provided by the local tax authorities to determine their eligibility for Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property. This will ensure they understand the requirements and benefits associated with the designation and can take full advantage of the tax exemptions and deductions available to them.

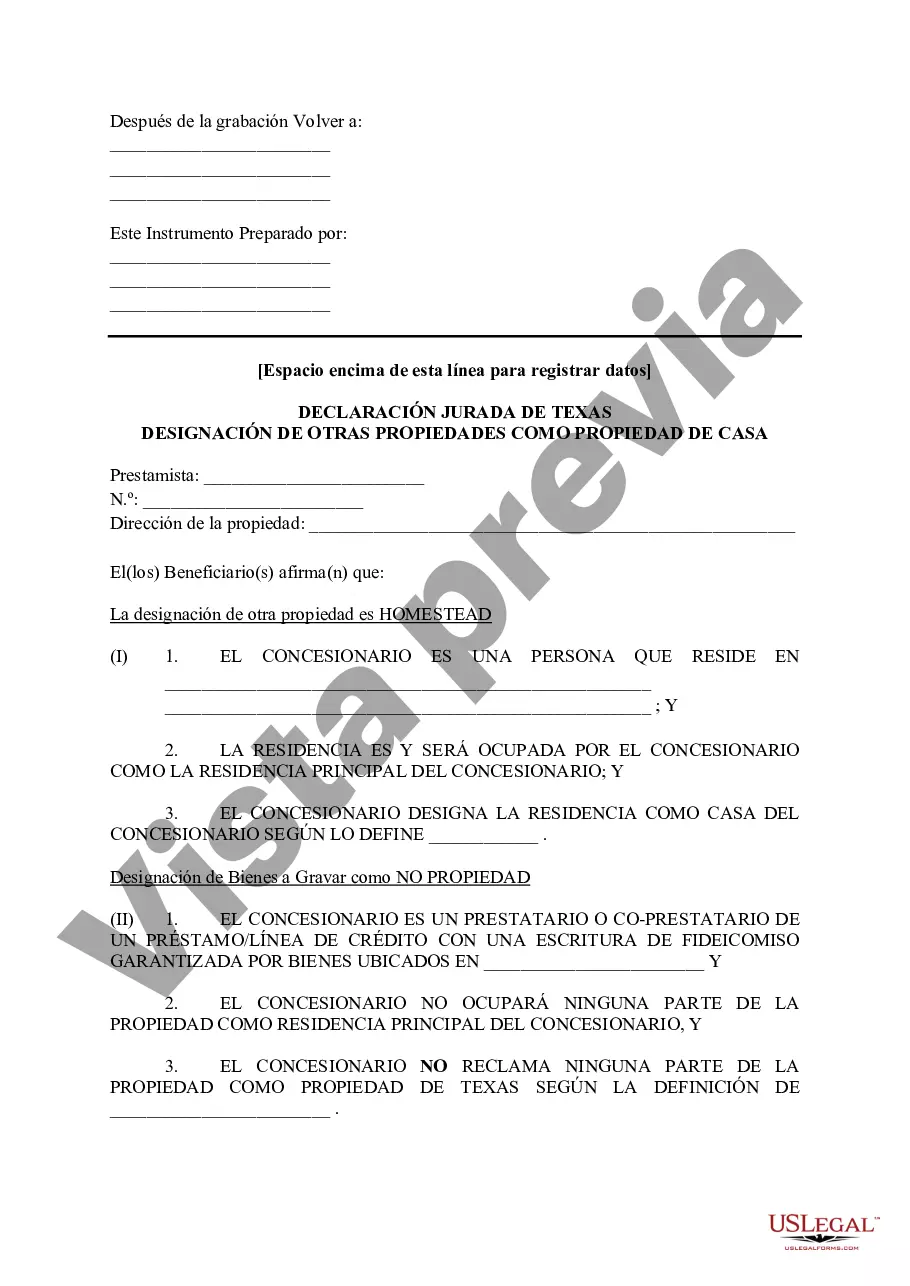

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Round Rock Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Round Rock Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Round Rock Texas Tax Affidavit Designation Other Property as Homestead Property is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!