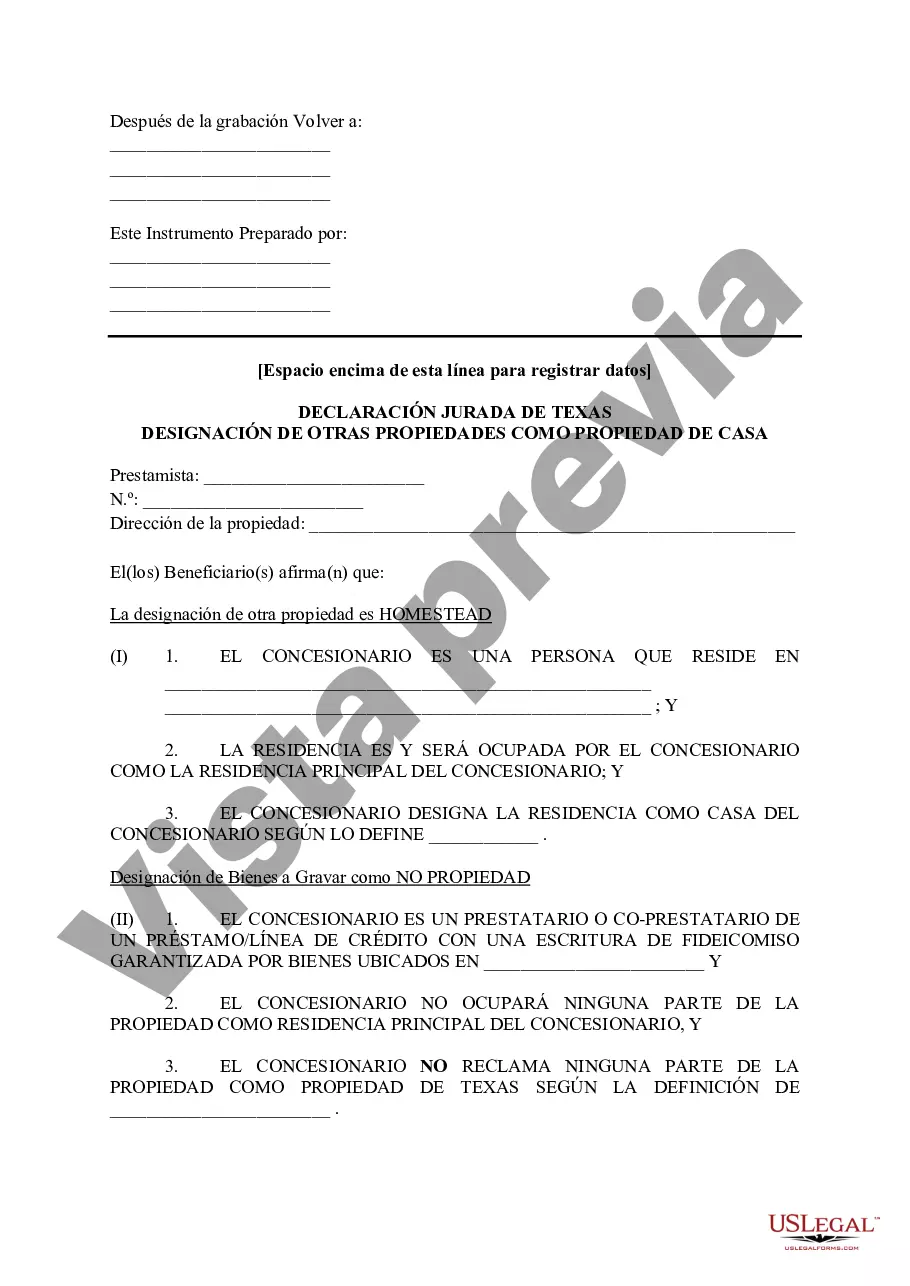

Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property: A Comprehensive Guide In Tarrant County, Texas, homeowners can take advantage of a valuable benefit known as the Tax Affidavit Designation, specifically for properties designated as homesteads. This designation provides various significant advantages, including exemption from certain property taxes and potential protection against creditors. However, it's important to understand the different types of Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property in order to make the most informed decisions regarding property ownership and taxation. 1. Primary Residence Homestead: The most common type of homestead property in Tarrant County, the Primary Residence Homestead refers to a property where the homeowner primarily resides. This type of designation offers the broadest range of benefits, such as a general residential exemption of a specific dollar amount from the property's assessed value. By designating their primary residence as a homestead, homeowners ensure access to these advantages and potentially lower their property tax payments. 2. Secondary Residence Homestead: In some cases, a homeowner may own multiple properties in Tarrant County. If one of these properties serves as their secondary residence or vacation home, they may still be eligible for a certain level of homestead benefits. By designating the secondary residence as a homestead property, homeowners can secure exemptions for a portion of the property's assessed value and possibly reduce their overall tax burden. 3. Disabled Veteran Homestead: Tarrant County recognizes the immense sacrifices made by disabled veterans who have sustained injuries during their service. As a result, special provisions have been established to assist these veterans through the Disabled Veteran Homestead designation. By qualifying for this designation, disabled veterans can receive substantial tax exemptions based on their level of disability. It's recommended that eligible veterans explore this option as it can significantly reduce property tax obligations. 4. Elderly and Disabled Homestead: Tarrant County extends additional assistance to elderly and disabled residents who may require financial relief in managing homeownership costs. Homeowners who are over a certain age or have a disability can apply for the Elderly and Disabled Homestead designation. This designation offers an enhanced level of property tax exemption, helping these individuals maintain stable housing without the undue financial burden. By understanding the various types of Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property, homeowners can assess their eligibility for certain exemptions and benefits. It's essential for homeowners to consult with the Tarrant County Appraisal District or seek professional advice to determine the specific criteria and application process to optimize their property tax savings. Remember, taking advantage of these designations can significantly impact your property tax liability and ensure a more secure financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Tarrant Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you are searching for a valid form, it’s extremely hard to find a better place than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can get thousands of form samples for company and individual purposes by types and regions, or keywords. With the high-quality search option, getting the most recent Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property is as elementary as 1-2-3. Additionally, the relevance of every file is confirmed by a group of skilled attorneys that regularly check the templates on our website and update them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the sample you want. Read its description and utilize the Preview function to check its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to get the proper record.

- Affirm your selection. Click the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Get the template. Select the format and save it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property.

Every template you add to your profile does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra copy for enhancing or printing, feel free to come back and export it once more anytime.

Take advantage of the US Legal Forms professional catalogue to get access to the Tarrant Texas Tax Affidavit Designation Other Property as Homestead Property you were seeking and thousands of other professional and state-specific samples on one platform!