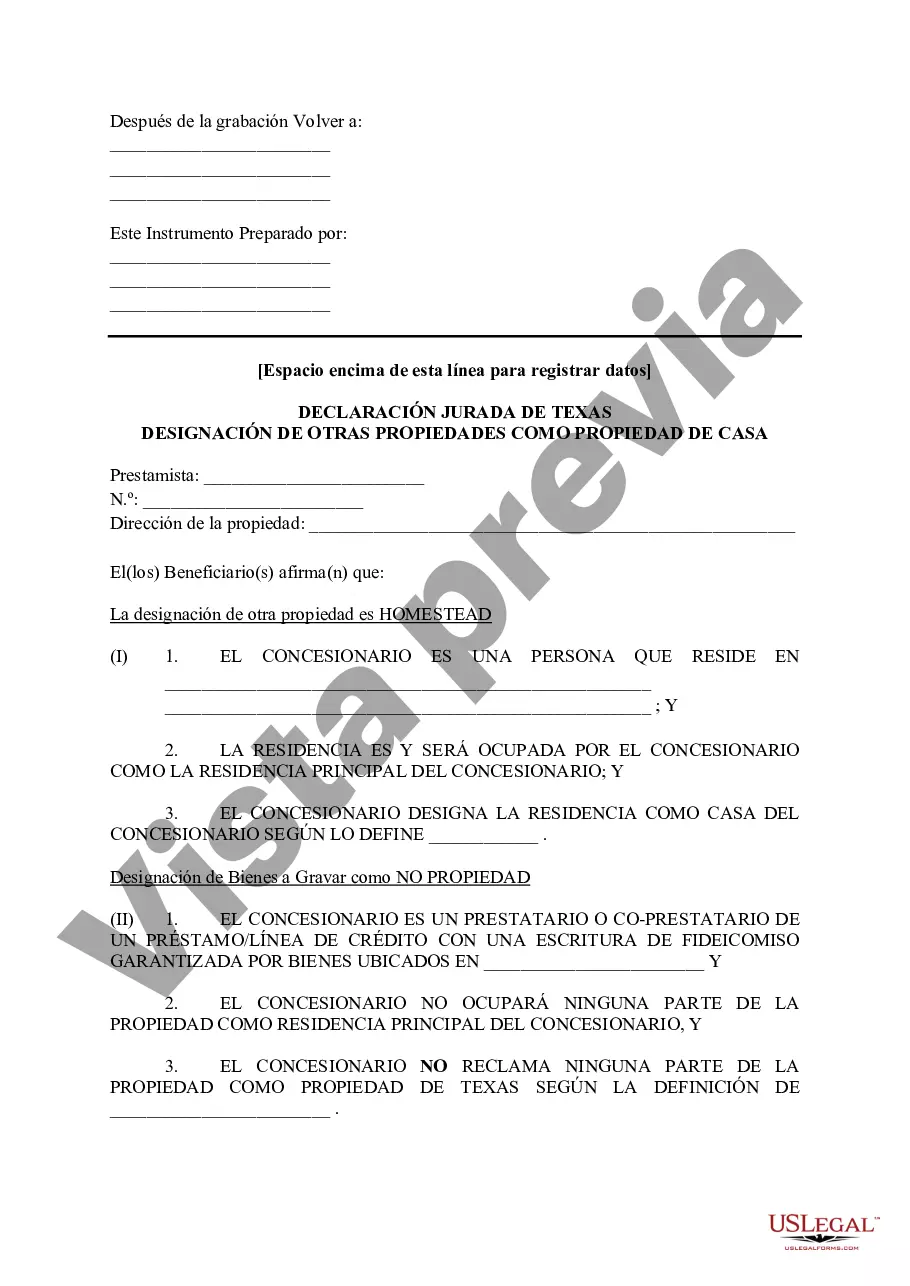

Travis Texas Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners in Travis County, Texas, to designate a property other than their primary residence as a homestead property for property tax purposes. This designation enables the property owner to receive certain tax benefits and exemptions. The Travis Texas Tax Affidavit Designation Other Property as Homestead Property is typically used when a property owner owns multiple properties and wishes to designate one of them as their homestead for tax purposes. By designating a property as a homestead, the owner can benefit from various tax exemptions, such as a reduction in property tax rates and exemptions for a portion of the property's assessed value. The Travis Texas Tax Affidavit Designation Other Property as Homestead Property is important for property owners who have a primary residence but also own additional properties, such as vacation homes, rental properties, or commercial properties. By designating one of these properties as a homestead, they can enjoy tax savings while still maintaining their primary residence as their main homestead. There are various types of properties that can be designated as homestead properties using the Travis Texas Tax Affidavit Designation Other Property as Homestead Property. These may include: 1. Vacation Homes: Property owners who own a second home in Travis County, Texas, can designate it as a homestead property if they meet the necessary requirements. This allows them to benefit from tax exemptions applicable to homestead properties. 2. Rental Properties: Property owners who own rental properties within Travis County can also designate one of them as their homestead property. This designation provides tax advantages, even if the property generates rental income. 3. Investment Properties: Investors who own properties in Travis County, Texas, such as commercial buildings or land, can choose to designate one of these properties as their homestead property. The tax benefits associated with homestead designation can result in significant savings for investors. 4. Second Residences: Property owners who own a second residence within Travis County, Texas, that is not their primary residence can designate it as a homestead property. This includes properties used as a vacation residence, family home, or secondary living space. To complete the Travis Texas Tax Affidavit Designation Other Property as Homestead Property, property owners must provide necessary information such as their name, property address, and the reason for the designation. It's crucial to follow the guidelines provided by Travis County and consult with a tax professional to ensure compliance and maximize tax benefits. By utilizing the Travis Texas Tax Affidavit Designation Other Property as Homestead Property, property owners in Travis County can take advantage of tax benefits and exemptions that can lead to substantial savings on their property taxes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Travis Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Travis Texas Tax Affidavit Designation Other Property as Homestead Property gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Travis Texas Tax Affidavit Designation Other Property as Homestead Property takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Travis Texas Tax Affidavit Designation Other Property as Homestead Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!