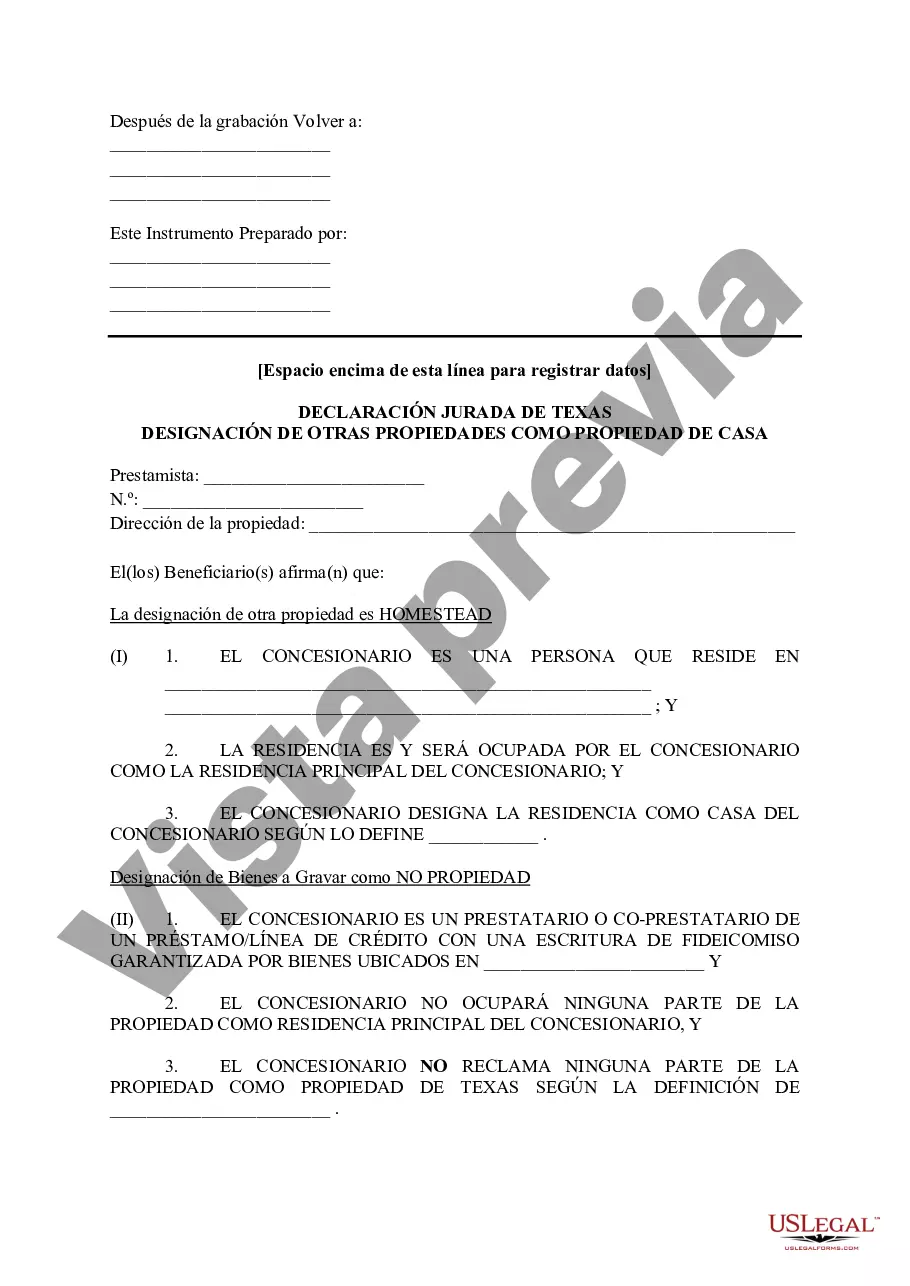

The Waco, Texas Tax Affidavit Designation Other Property as Homestead Property is an important legal document that allows property owners to claim a specific property as their homestead for tax purposes. By designating a property as homestead, the property owner becomes eligible for certain tax benefits and protections. The Homestead Tax Affidavit Designation process in Waco, Texas is applicable to various types of properties. Here are some examples: 1. Residential Homestead Property: This designation is used for single-family homes, townhouses, or condominiums where the property owner resides and considers it as their primary residence. 2. Agricultural Homestead Property: This designation is applicable to properties used for farming or agriculture purposes, such as ranches, farmland, or agricultural land. It allows property owners to avail favorable tax rates and exemptions specific to agricultural activities. 3. Manufactured Homestead Property: This type of designation applies to mobile homes or manufactured housing units located on owned land or in residential communities. Property owners can claim it as their homestead and receive corresponding tax benefits. 4. Elderly or Disabled Homestead Property: Waco, Texas also offers tax benefits for elderly or disabled property owners. The Tax Affidavit Designation allows individuals aged 65 or older or those who are disabled to claim their property as a homestead and benefit from tax exemptions specific to their circumstances. The Waco, Texas Tax Affidavit Designation Other Property as Homestead Property provides property owners with a means to optimize their tax liabilities and protect their property. It is important to accurately complete and file this affidavit within the designated time frame to ensure compliance with applicable tax laws and regulations. Whether you own a residential property, agricultural land, manufactured home, or qualify for elderly or disabled benefits in Waco, Texas, understanding the tax affidavit designation process can help you secure the maximum benefits available under the law. Consulting with a tax professional or the local tax assessor's office is advisable to ensure proper completion of the affidavit and to address any specific questions related to your property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Waco Texas Declaración jurada de impuestos Designación de otra propiedad como propiedad familiar - Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Waco Texas Declaración Jurada De Impuestos Designación De Otra Propiedad Como Propiedad Familiar?

If you are searching for a relevant form, it’s difficult to choose a better place than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can find thousands of form samples for business and individual purposes by types and regions, or keywords. With the high-quality search feature, getting the latest Waco Texas Tax Affidavit Designation Other Property as Homestead Property is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a team of expert attorneys that on a regular basis check the templates on our website and update them in accordance with the most recent state and county regulations.

If you already know about our system and have an account, all you should do to get the Waco Texas Tax Affidavit Designation Other Property as Homestead Property is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you require. Look at its description and use the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the needed record.

- Confirm your selection. Choose the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Select the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Waco Texas Tax Affidavit Designation Other Property as Homestead Property.

Every form you save in your user profile has no expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra copy for editing or printing, you can return and download it once more anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Waco Texas Tax Affidavit Designation Other Property as Homestead Property you were looking for and thousands of other professional and state-specific templates in one place!