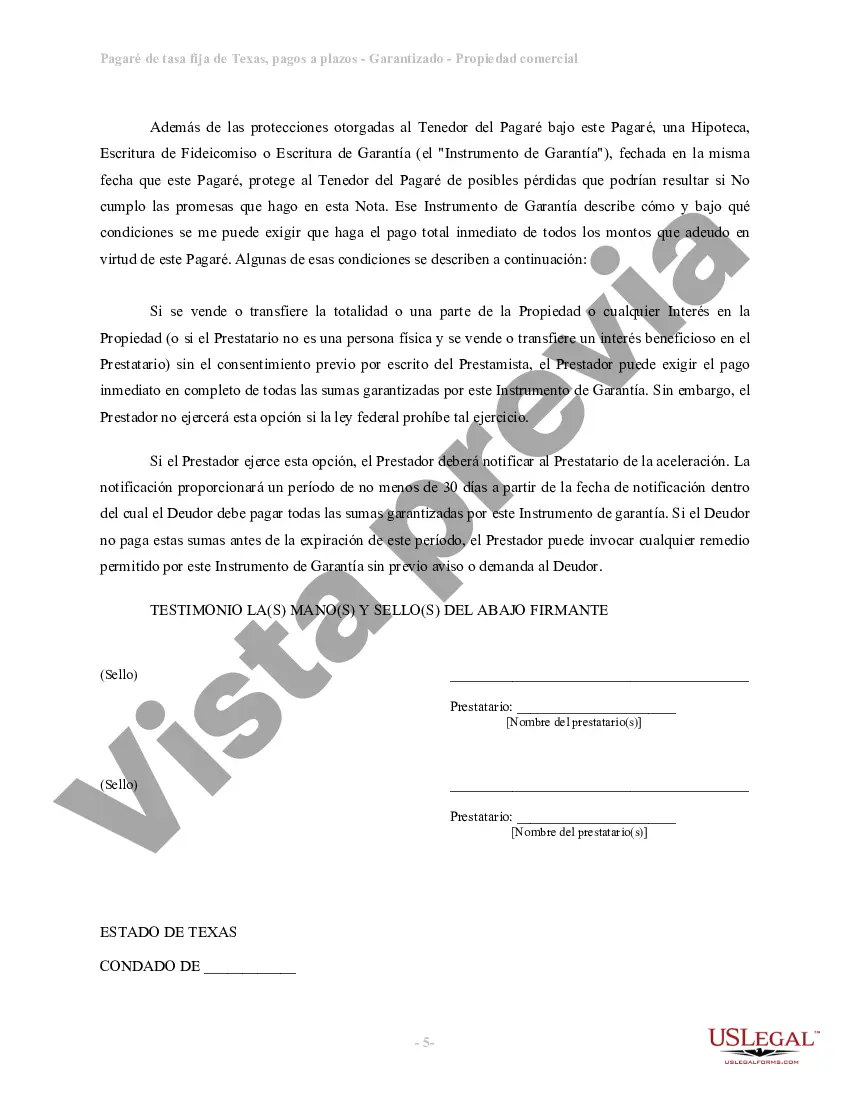

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

A Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal agreement that outlines the terms and conditions of a loan, specifically in the Harris County area of Texas. This type of promissory note is secured by commercial real estate, providing lenders with the assurance of collateral in case of default. This content will detail the key aspects of this financial instrument and discuss its variations, if any. When entering into a Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, both the borrower and the lender must agree to the terms stipulated within the document. The note specifies the principal amount of the loan, the interest rate charged, the length of the loan, and the frequency and amount of installment payments. Unlike an adjustable rate promissory note, a fixed rate note ensures that the interest rate remains constant throughout the loan term, providing borrowers with predictable payment amounts. This type of promissory note holds commercial real estate as collateral. The commercial property must be owned by the borrower and is offered as security to the lender. In the case of default, the lender has the legal right to seize and sell the property to recover their investment. The inclusion of collateral lowers the risk for the lender, which often results in more favorable loan terms, such as lower interest rates and longer repayment periods. Different variations of the Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can arise based on specific terms agreed upon by the parties involved. Variations may include adjustments to interest rates, repayment options, prepayment penalties, or additional clauses tailored to suit individual needs. These variations can be negotiated, but it is crucial for both parties to fully understand and agree upon any modifications made to the standard structure. Overall, a Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate offers a transparent and secure lending option for businesses or individuals seeking financing. It provides borrowers with the necessary funds to acquire or develop commercial properties while ensuring lenders are protected through lateralization. Proper legal guidance and thorough understanding of the note's terms are vital for both parties involved to ensure a successful and mutually beneficial agreement.A Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal agreement that outlines the terms and conditions of a loan, specifically in the Harris County area of Texas. This type of promissory note is secured by commercial real estate, providing lenders with the assurance of collateral in case of default. This content will detail the key aspects of this financial instrument and discuss its variations, if any. When entering into a Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, both the borrower and the lender must agree to the terms stipulated within the document. The note specifies the principal amount of the loan, the interest rate charged, the length of the loan, and the frequency and amount of installment payments. Unlike an adjustable rate promissory note, a fixed rate note ensures that the interest rate remains constant throughout the loan term, providing borrowers with predictable payment amounts. This type of promissory note holds commercial real estate as collateral. The commercial property must be owned by the borrower and is offered as security to the lender. In the case of default, the lender has the legal right to seize and sell the property to recover their investment. The inclusion of collateral lowers the risk for the lender, which often results in more favorable loan terms, such as lower interest rates and longer repayment periods. Different variations of the Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can arise based on specific terms agreed upon by the parties involved. Variations may include adjustments to interest rates, repayment options, prepayment penalties, or additional clauses tailored to suit individual needs. These variations can be negotiated, but it is crucial for both parties to fully understand and agree upon any modifications made to the standard structure. Overall, a Harris Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate offers a transparent and secure lending option for businesses or individuals seeking financing. It provides borrowers with the necessary funds to acquire or develop commercial properties while ensuring lenders are protected through lateralization. Proper legal guidance and thorough understanding of the note's terms are vital for both parties involved to ensure a successful and mutually beneficial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.