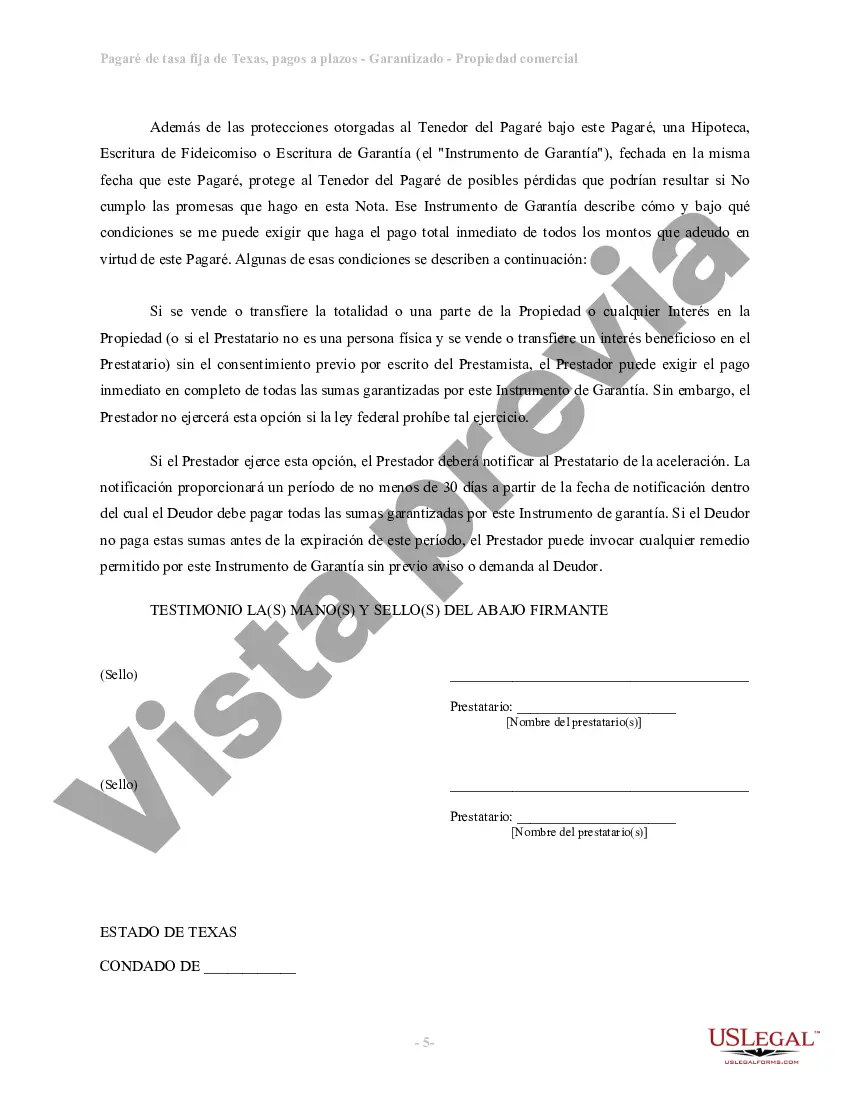

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

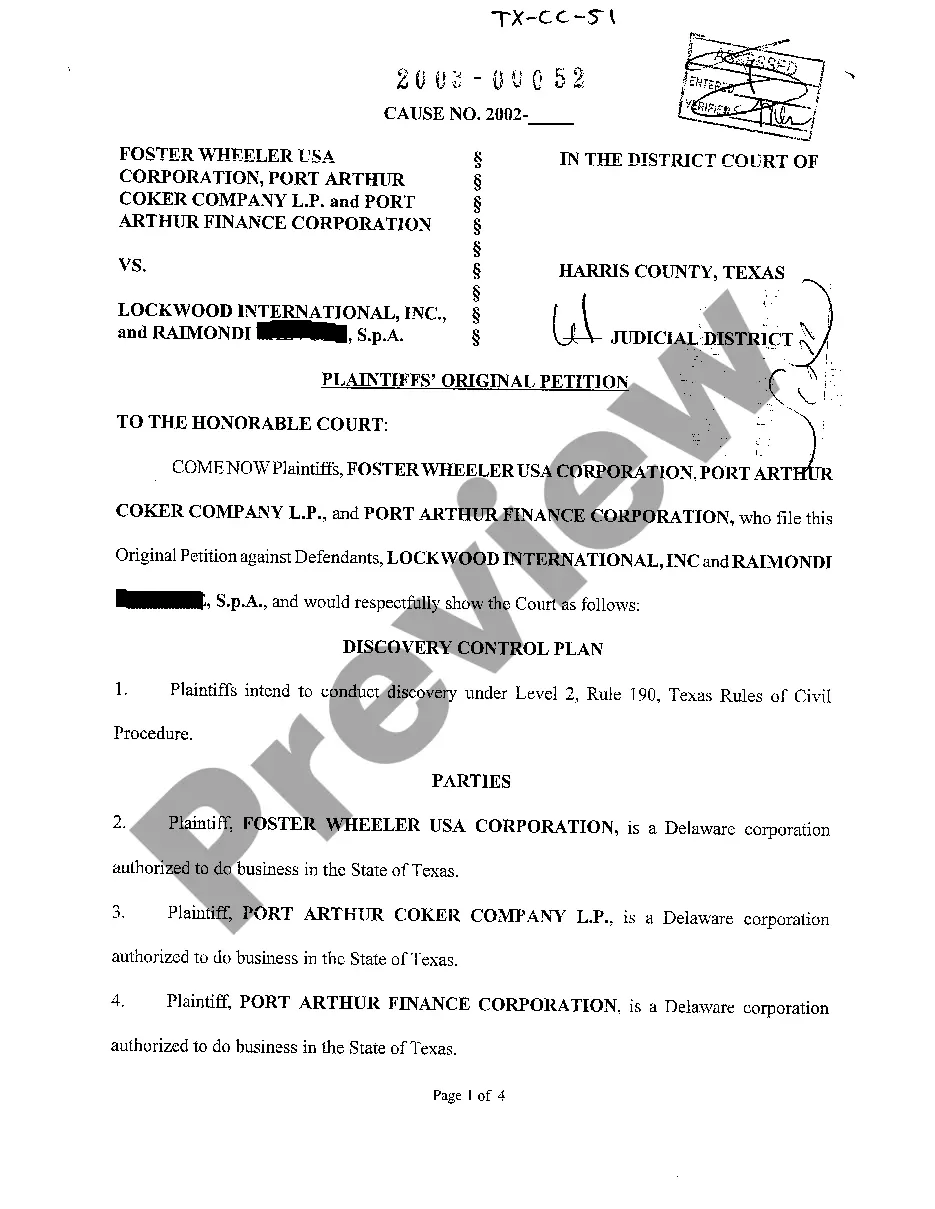

A Travis Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specific to the Travis County area in Texas and is secured by commercial real estate property. The key characteristic of a Travis Texas Installments Fixed Rate Promissory Note is that it has a fixed interest rate throughout the loan term. This means that the interest rate remains constant and does not fluctuate over time, providing stability and predictability for both parties involved. In addition to the fixed rate, this promissory note is structured in installments, meaning that the borrower makes regular payments at scheduled intervals over an agreed-upon period of time. This allows for easier budgeting and repayment planning for the borrower. The commercial real estate property serves as collateral for the loan, offering security to the lender. In the event that the borrower defaults on payments, the lender has the right to take possession of the property as a means of recovering the outstanding debt. There may be variations or subcategories of Travis Texas Installments Fixed Rate Promissory Notes, depending on specific loan terms and conditions. For example, there could be shorter-term or long-term options, each with their own repayment schedules. Additionally, the loan amount, interest rate, and collateral property may vary based on the individual agreement. Overall, a Travis Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate provides a clear framework for both lender and borrower, ensuring transparency and legal protection for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.