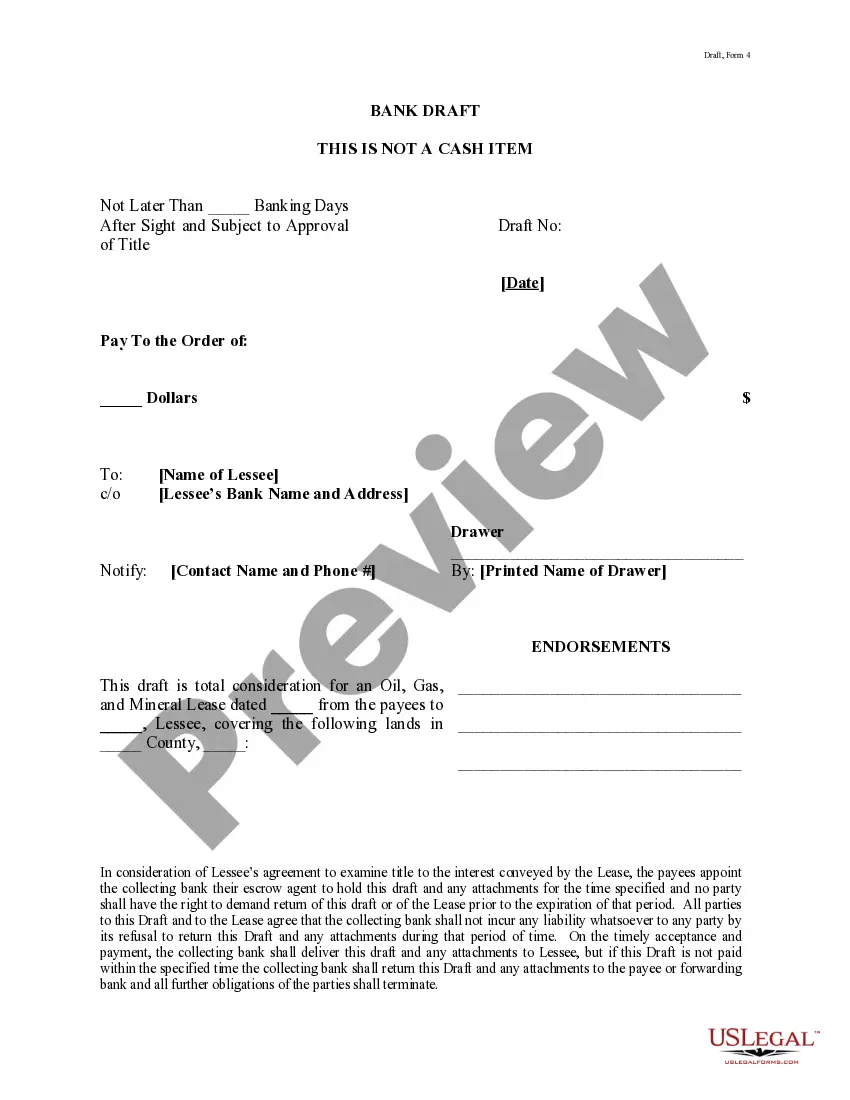

Arlington Texas Bank Draft is a widely used financial instrument offered by several banks in Arlington, Texas. It enables individuals or businesses to make payments by authorizing the bank to withdraw funds directly from their account and transfer them to a designated recipient or payee. Bank drafts serve as a secure and convenient alternative to using cash or personal checks, ensuring that payments are made promptly and reliably. One type of Arlington Texas Bank Draft is the personal bank draft, which allows individuals to make financial transactions such as sending money to a friend or family member, paying bills, or making purchases. These drafts are linked to the individual's personal checking or savings account, requiring them to provide the necessary details to initiate the draft, such as the recipient's name, account number, and the amount of money to be transferred. Another type of Arlington Texas Bank Draft is the business bank draft. This type of draft is commonly used by businesses for various purposes, including supplier payments, employee salaries, rental deposits, and other business-related transactions. Business bank drafts provide a convenient and traceable way to transfer financial resources securely, ensuring that payments are settled efficiently and accurately. Some key features and benefits of Arlington Texas Bank Drafts include: 1. Security: Bank drafts provide a safe and secure method of payment, minimizing the risk of loss or theft associated with carrying cash or using personal checks. 2. Prompt Payments: Bank drafts offer fast and timely transactions. Once authorized, the funds are typically withdrawn from the payer's account and transferred to the recipient's account without delay, ensuring swift payment settlement. 3. Traceability: Bank drafts provide a built-in transaction record, making it easy to trace and verify payments, which can be particularly useful for businesses managing their financial records or for individuals who need proof of payment. 4. Wide Acceptance: Arlington Texas Bank Drafts are widely accepted as a form of payment by various individuals, businesses, and organizations, including utility companies, government agencies, and merchants, both locally and often nationwide. 5. Convenience: With bank drafts, individuals can conveniently make payments without the need to carry cash, write checks, or visit the bank. This flexibility allows for hassle-free transactions and greater control over finances. It is worth noting that while Arlington Texas Bank Drafts are a popular payment method, it is always advisable to check with individual banks for their specific terms, conditions, and any associated fees before initiating a bank draft transaction. Different banks may have variations in their procedures or offer added features/benefits specific to their services.

Arlington Texas Bank Draft

Description

How to fill out Arlington Texas Bank Draft?

If you are looking for a valid form, it’s extremely hard to choose a better place than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can get a huge number of form samples for company and individual purposes by categories and regions, or key phrases. With our high-quality search feature, getting the newest Arlington Texas Bank Draft is as easy as 1-2-3. Furthermore, the relevance of each and every record is verified by a group of expert lawyers that regularly review the templates on our platform and update them according to the most recent state and county demands.

If you already know about our platform and have an account, all you should do to get the Arlington Texas Bank Draft is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the sample you require. Read its description and utilize the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to get the proper file.

- Confirm your selection. Click the Buy now option. Following that, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Indicate the format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Arlington Texas Bank Draft.

Every form you add to your profile does not have an expiry date and is yours forever. It is possible to access them using the My Forms menu, so if you want to get an extra version for enhancing or creating a hard copy, feel free to come back and save it once again whenever you want.

Make use of the US Legal Forms extensive library to gain access to the Arlington Texas Bank Draft you were seeking and a huge number of other professional and state-specific templates on a single platform!