Laredo Texas Change of Depository is a crucial process that refers to the switch of a financial institution where funds and assets are stored by the City of Laredo, Texas. This change typically occurs when the City decides to transfer its deposits from one bank or credit union to another for various reasons, such as better interest rates, improved services, or a more secure financial institution. One type of Laredo Texas Change of Depository is the switch from a local community bank to a larger national bank. This change may be driven by the desire to have access to a broader range of financial services, greater resources, or an extensive network of branches and ATMs. It enables the City to work with a bank that aligns better with its financial goals and objectives. Another type of Laredo Texas Change of Depository could involve moving deposits from a traditional bank setting to a credit union. Credit unions are member-owned financial cooperatives that often offer competitive interest rates, lower fees, and a more personalized banking experience. This transition might be preferred by the City if they desire a closer relationship with its financial institution and want to support the local community. Regardless of the specific type of change, the Laredo Texas Change of Depository process typically involves careful evaluation and selection of a new financial institution. The City will perform a comprehensive review of potential candidates, assessing their financial stability, quality of services, accessibility, and reputation. It is essential to ensure that the chosen depository institution is insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCAA) to safeguard public funds. Once a suitable depository is selected, the City of Laredo will execute legal agreements and documentation to start the transition process properly. This may include notifying the existing depository institution and establishing new account setups and fund transfers. City officials and representatives from the new depository will collaborate to ensure a seamless transition, minimizing disruptions to financial operations. During the Laredo Texas Change of Depository, the City will provide public announcements and initiate widespread communication to inform the community, stakeholders, and relevant agencies about the change. Transparency and clear communication channels are vital to maintaining public trust and ensuring that individuals and businesses relying on city services are aware of the new banking arrangements. In conclusion, the Laredo Texas Change of Depository involves the relocation of the City's funds and assets from one financial institution to another. Whether transitioning to a larger national bank or a local credit union, this process aims to optimize financial operations and better serve the needs of the City and its constituents.

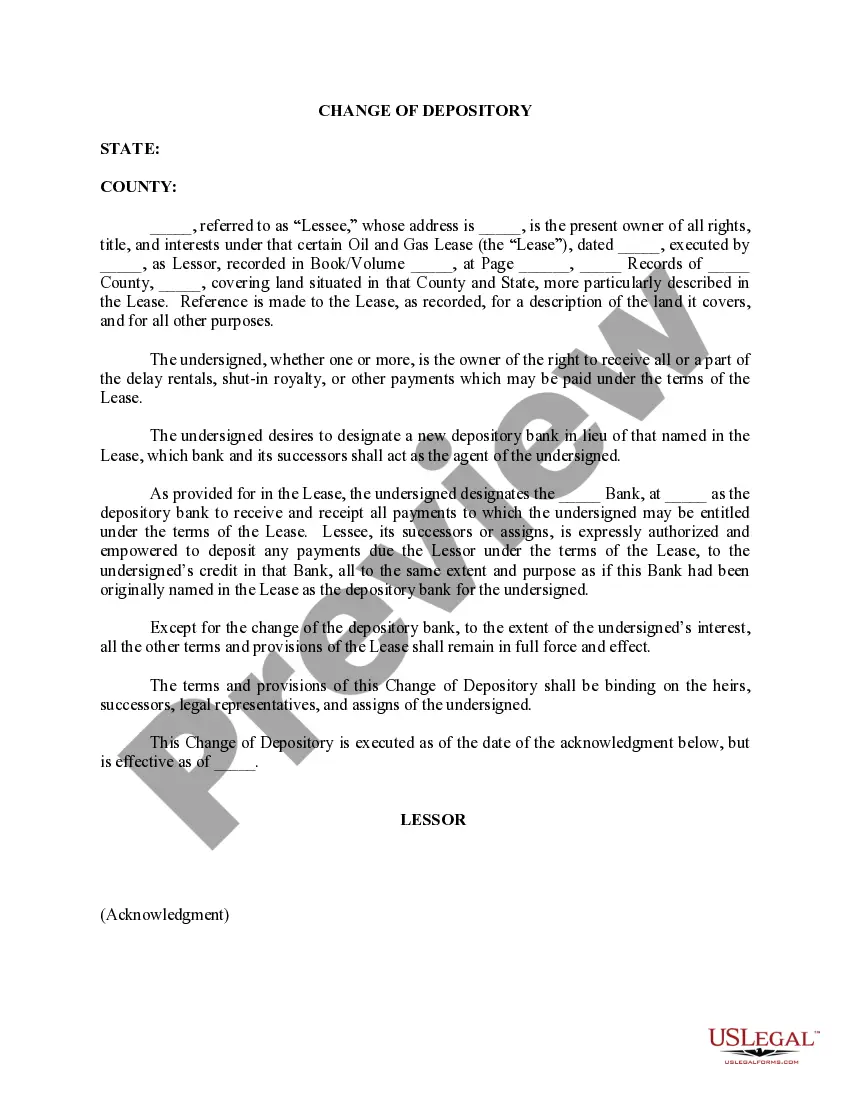

Laredo Texas Change of Depository

Description

How to fill out Laredo Texas Change Of Depository?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Laredo Texas Change of Depository becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Laredo Texas Change of Depository takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Laredo Texas Change of Depository. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!