This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

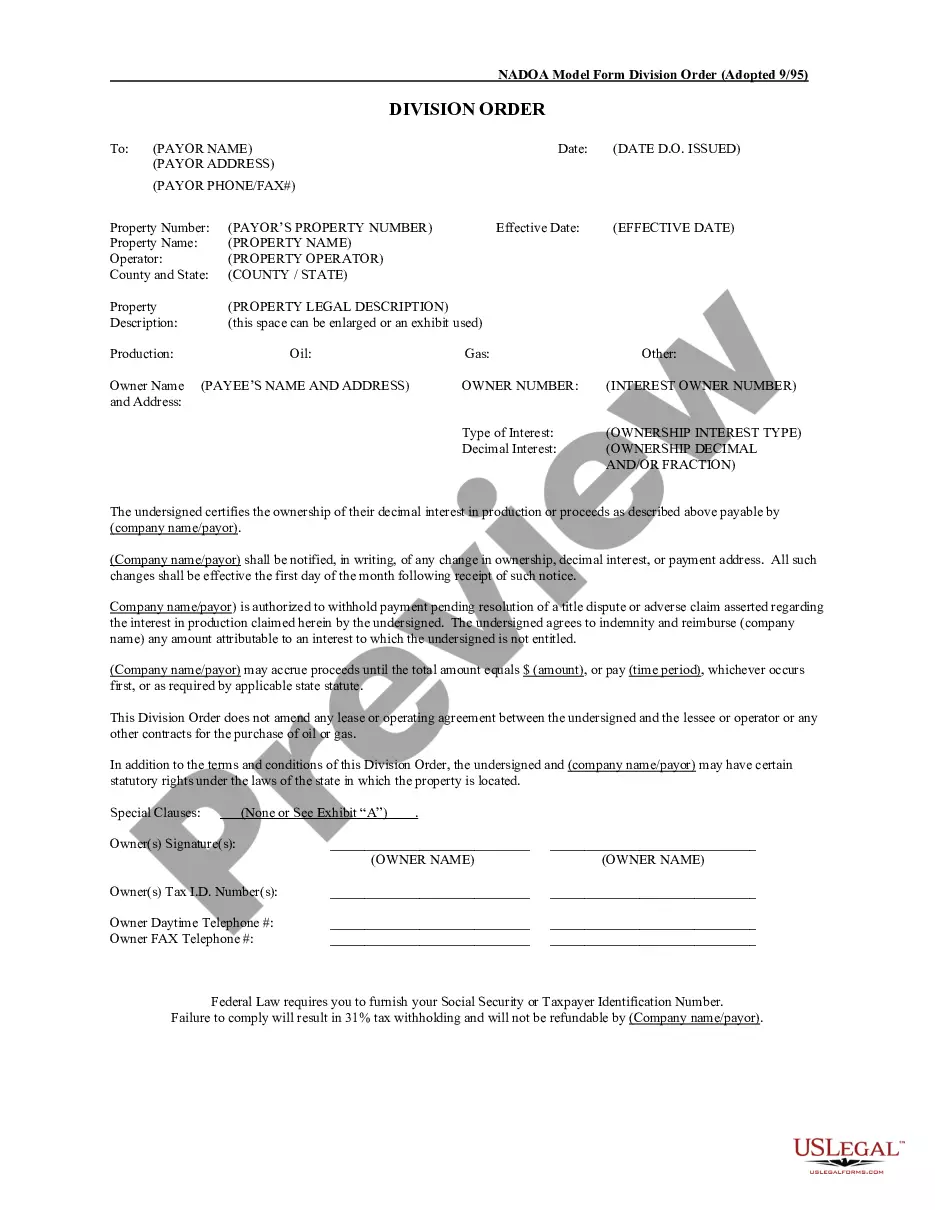

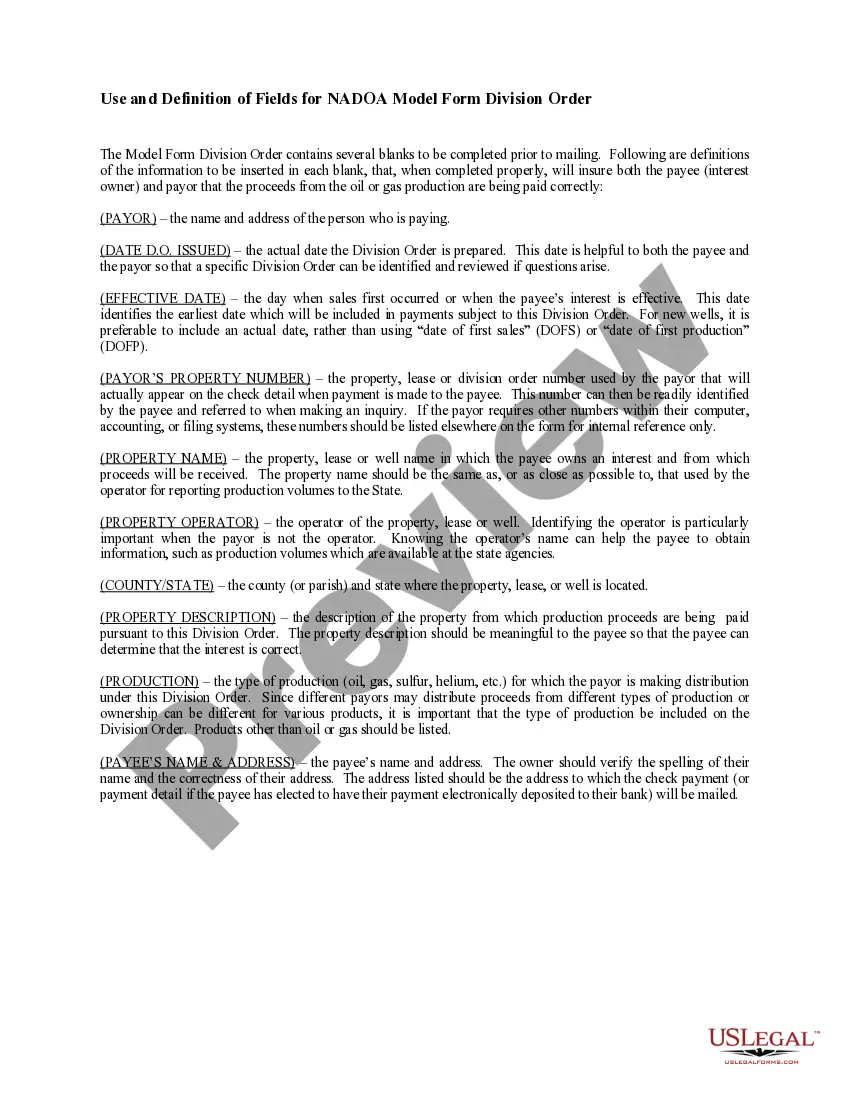

Sugar Land, Texas Division Orders: A Comprehensive Guide Introduction: Division orders play a crucial role in the oil and gas industry, including in Sugar Land, Texas. They are legal documents that outline the distribution of revenue from oil and gas production to various individuals or entities. In this article, we will provide a detailed description of what Sugar Land, Texas division orders are, how they function, and highlight potential types of division orders specific to this locality. Key Keywords: Sugar Land, Texas; division orders; oil and gas production; revenue distribution; legal documents. What are Division Orders? Division orders are contractual agreements between the operators of oil and gas wells and the individuals or entities entitled to receive income from the production. These documents establish the terms, conditions, and method of payment for royalty interests, overriding royalty interests, and other revenue streams generated by pumping oil or gas from the ground. Sugar Land, Texas Division Orders: In Sugar Land, Texas, division orders are created to facilitate the fair distribution of revenue among various stakeholders, including mineral rights owners, working interest owners, and royalty interest owners. The division orders specify the proportion of interest each party holds in the production, ensuring accurate payments. Types of Sugar Land, Texas Division Orders: 1. Mineral Rights Division Orders: These division orders are designed for individuals or entities that own the underlying mineral rights to the land where oil and gas production is taking place. Mineral rights owners typically receive a percentage of the revenue generated from extraction activities. 2. Working Interest Division Orders: Working interest division orders pertain to individuals or entities that have invested capital and resources in operating and maintaining the oil and gas wells in Sugar Land, Texas. These parties bear a proportionate share of the costs and risks associated with the project but also receive a corresponding percentage of the revenues generated. 3. Royalty Interest Division Orders: Royalty interest division orders apply to individuals or entities who may not own the mineral rights or have direct involvement in the oil and gas operations but are entitled to a percentage of the revenue generated. Royalty interest owners typically enter into agreements with mineral rights owners, receiving payments based on a predetermined percentage of the production. Conclusion: Sugar Land, Texas division orders are crucial legal documents that ensure fair distribution of revenue among stakeholders involved in oil and gas production. Mineral rights, working interest, and royalty interest division orders are some key types of division orders relevant to Sugar Land, Texas. These documents provide clarity and transparency in revenue sharing, establishing efficient relationships between operators and various interest owners. Keywords: Sugar Land, Texas division orders; oil and gas production; mineral rights; working interest; royalty interest; revenue distribution; legal documents; stakeholders; transparency.Sugar Land, Texas Division Orders: A Comprehensive Guide Introduction: Division orders play a crucial role in the oil and gas industry, including in Sugar Land, Texas. They are legal documents that outline the distribution of revenue from oil and gas production to various individuals or entities. In this article, we will provide a detailed description of what Sugar Land, Texas division orders are, how they function, and highlight potential types of division orders specific to this locality. Key Keywords: Sugar Land, Texas; division orders; oil and gas production; revenue distribution; legal documents. What are Division Orders? Division orders are contractual agreements between the operators of oil and gas wells and the individuals or entities entitled to receive income from the production. These documents establish the terms, conditions, and method of payment for royalty interests, overriding royalty interests, and other revenue streams generated by pumping oil or gas from the ground. Sugar Land, Texas Division Orders: In Sugar Land, Texas, division orders are created to facilitate the fair distribution of revenue among various stakeholders, including mineral rights owners, working interest owners, and royalty interest owners. The division orders specify the proportion of interest each party holds in the production, ensuring accurate payments. Types of Sugar Land, Texas Division Orders: 1. Mineral Rights Division Orders: These division orders are designed for individuals or entities that own the underlying mineral rights to the land where oil and gas production is taking place. Mineral rights owners typically receive a percentage of the revenue generated from extraction activities. 2. Working Interest Division Orders: Working interest division orders pertain to individuals or entities that have invested capital and resources in operating and maintaining the oil and gas wells in Sugar Land, Texas. These parties bear a proportionate share of the costs and risks associated with the project but also receive a corresponding percentage of the revenues generated. 3. Royalty Interest Division Orders: Royalty interest division orders apply to individuals or entities who may not own the mineral rights or have direct involvement in the oil and gas operations but are entitled to a percentage of the revenue generated. Royalty interest owners typically enter into agreements with mineral rights owners, receiving payments based on a predetermined percentage of the production. Conclusion: Sugar Land, Texas division orders are crucial legal documents that ensure fair distribution of revenue among stakeholders involved in oil and gas production. Mineral rights, working interest, and royalty interest division orders are some key types of division orders relevant to Sugar Land, Texas. These documents provide clarity and transparency in revenue sharing, establishing efficient relationships between operators and various interest owners. Keywords: Sugar Land, Texas division orders; oil and gas production; mineral rights; working interest; royalty interest; revenue distribution; legal documents; stakeholders; transparency.