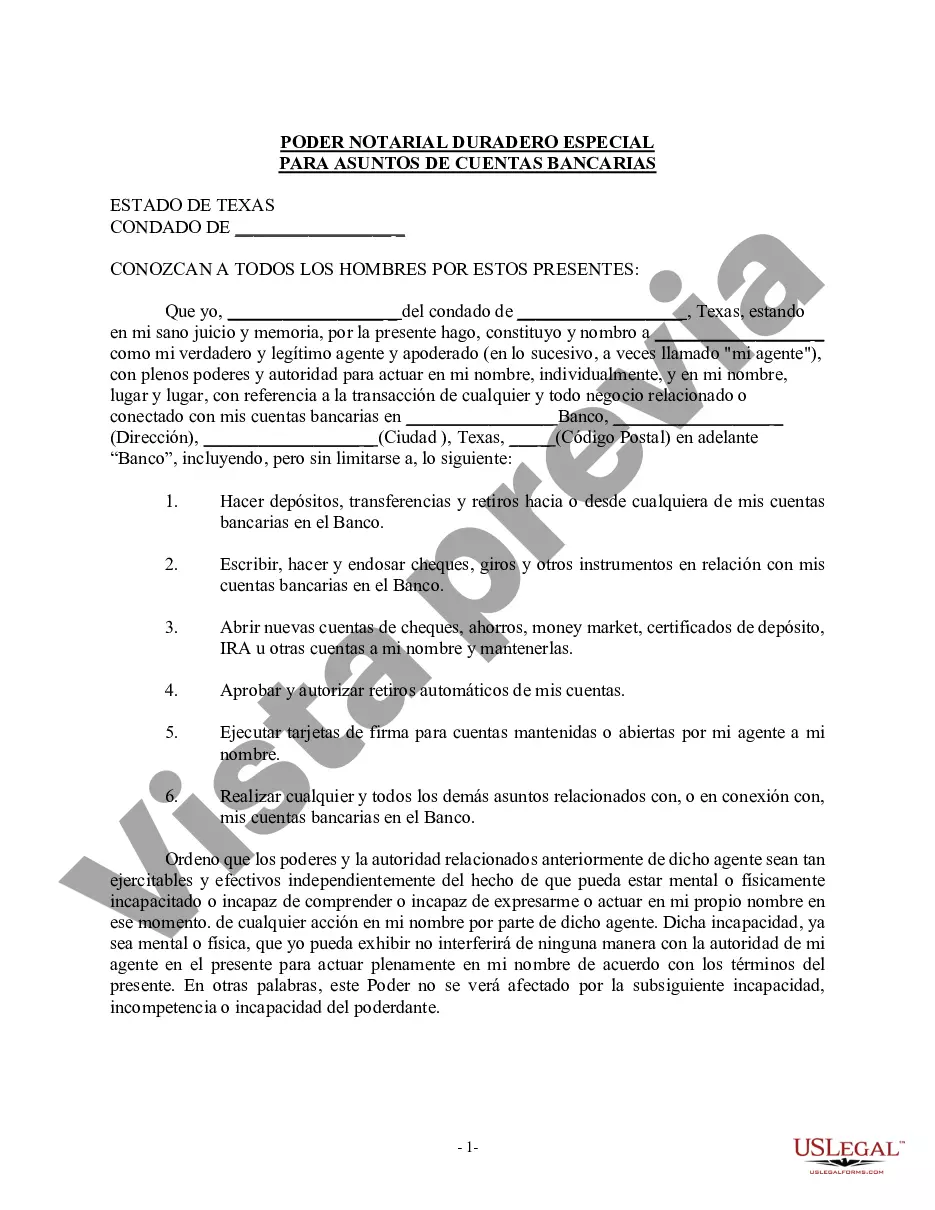

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

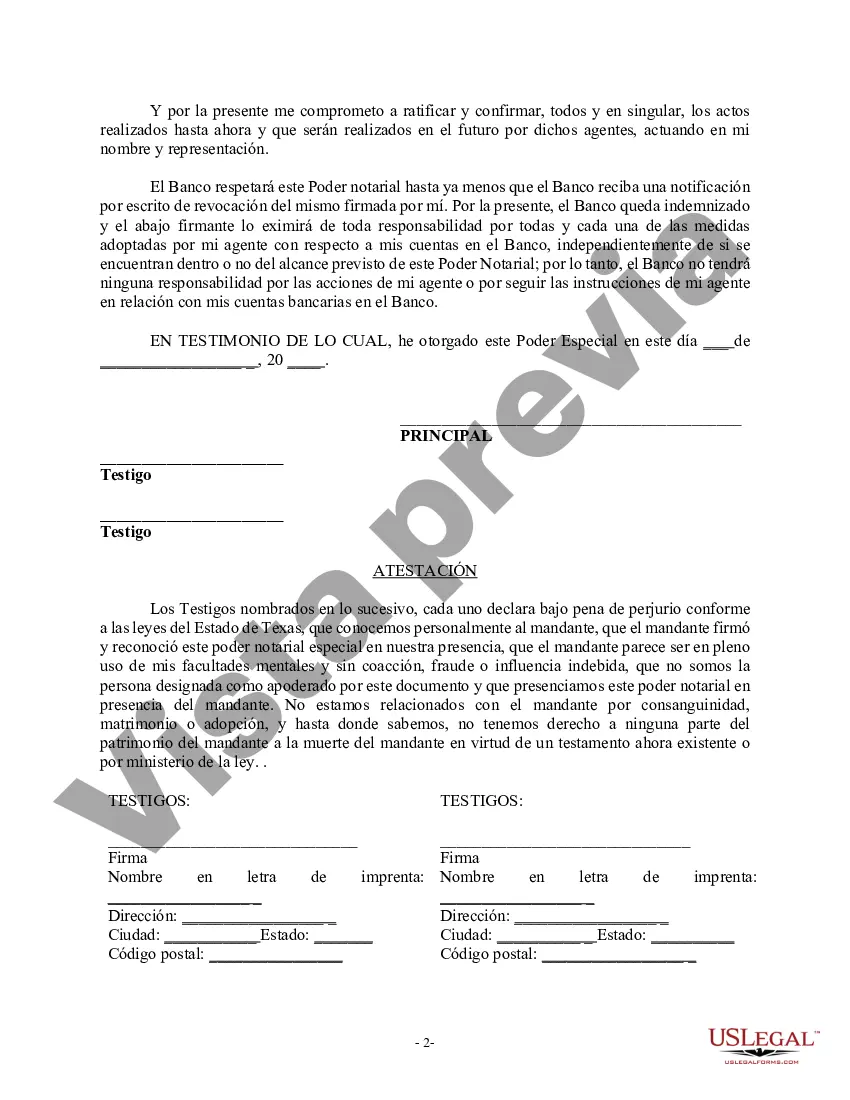

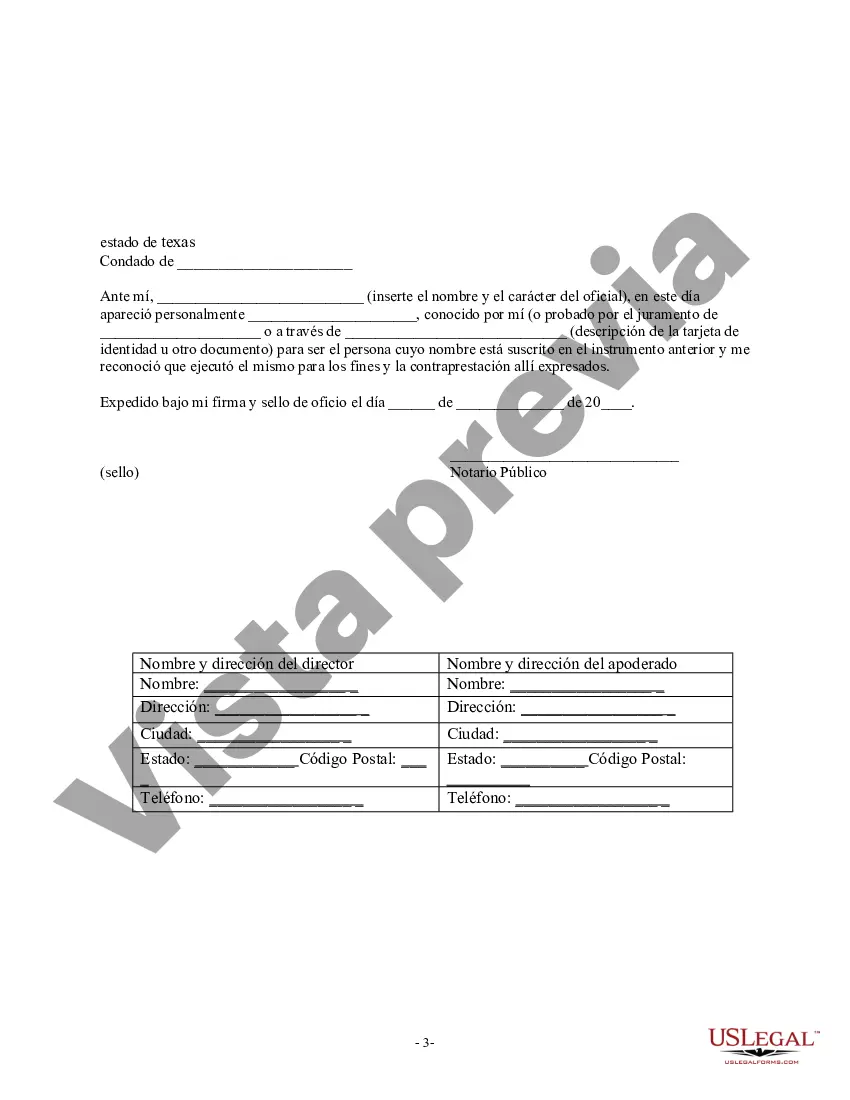

A Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas is a legal document that grants a designated individual or agent the authority to act on behalf of the principal in managing their bank accounts. This type of power of attorney is specifically focused on handling matters related to bank accounts and provides the agent with the legal power to make decisions, perform transactions, and manage financial affairs related to the principal's bank accounts. The Special Durable Power of Attorney for Bank Account Matters gives the agent the ability to handle various banking activities, such as depositing or withdrawing funds, writing checks, initiating wire transfers, opening or closing accounts, managing investments, and accessing online banking services. The agent appointed in this special power of attorney document should possess a thorough understanding of financial matters and be trustworthy to handle the principal's banking affairs responsibly. There might be different types of Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas, depending on the specific needs of the principal. For example, some individuals may require a limited power of attorney that grants the agent authority for a specific duration or restricts their actions to specific bank accounts or transactions. On the other hand, others may opt for a general power of attorney, which provides the agent with broader powers and control over the principal's entire financial portfolio. It is important to note that a durable power of attorney remains valid even if the principal becomes incapacitated or mentally incompetent. This ensures that the agent can continue to manage the principal's bank accounts and financial matters in case the principal is unable to do so themselves. To create a Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas, the principal should consult with an attorney experienced in estate planning or elder law. The document should clearly state the powers and limitations of the agent, provide explicit instructions and guidelines, and be signed in the presence of witnesses or a notary public to make it legally binding. By having a Special Durable Power of Attorney for Bank Account Matters, individuals in Fort Worth, Texas can have peace of mind knowing that their financial affairs will be managed by a trusted agent in accordance with their wishes, even in situations where they are unable to do so themselves.A Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas is a legal document that grants a designated individual or agent the authority to act on behalf of the principal in managing their bank accounts. This type of power of attorney is specifically focused on handling matters related to bank accounts and provides the agent with the legal power to make decisions, perform transactions, and manage financial affairs related to the principal's bank accounts. The Special Durable Power of Attorney for Bank Account Matters gives the agent the ability to handle various banking activities, such as depositing or withdrawing funds, writing checks, initiating wire transfers, opening or closing accounts, managing investments, and accessing online banking services. The agent appointed in this special power of attorney document should possess a thorough understanding of financial matters and be trustworthy to handle the principal's banking affairs responsibly. There might be different types of Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas, depending on the specific needs of the principal. For example, some individuals may require a limited power of attorney that grants the agent authority for a specific duration or restricts their actions to specific bank accounts or transactions. On the other hand, others may opt for a general power of attorney, which provides the agent with broader powers and control over the principal's entire financial portfolio. It is important to note that a durable power of attorney remains valid even if the principal becomes incapacitated or mentally incompetent. This ensures that the agent can continue to manage the principal's bank accounts and financial matters in case the principal is unable to do so themselves. To create a Special Durable Power of Attorney for Bank Account Matters in Fort Worth, Texas, the principal should consult with an attorney experienced in estate planning or elder law. The document should clearly state the powers and limitations of the agent, provide explicit instructions and guidelines, and be signed in the presence of witnesses or a notary public to make it legally binding. By having a Special Durable Power of Attorney for Bank Account Matters, individuals in Fort Worth, Texas can have peace of mind knowing that their financial affairs will be managed by a trusted agent in accordance with their wishes, even in situations where they are unable to do so themselves.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.