McAllen Annual Minutes for a Texas Professional Corporation — A Comprehensive Guide In the state of Texas, professional corporations are required to hold annual meetings to ensure the smooth functioning of their operations and maintain compliance with state laws. These meetings are an essential aspect of a corporation's governance, enabling shareholders and directors to discuss vital matters, make strategic decisions, and comply with legal requirements. The official record documenting the proceedings and resolutions of these annual meetings is known as the McAllen Annual Minutes. The McAllen Annual Minutes for a Texas Professional Corporation serve as a valuable record, outlining the discussions, actions, and decisions taken during the meeting. These minutes are crucial for legal and compliance purposes, as they provide evidence of corporate practices and transparency. They also play a significant role in protecting the corporation's interests and fulfilling fiduciary responsibilities towards shareholders. The contents of the McAllen Annual Minutes typically include: 1. Meeting Details: Begin with the official name of the corporation, its address, and the date, time, and location of the annual meeting. 2. Attendees: List the names and titles of all attendees present at the meeting, including shareholders, directors, officers, legal counsel, and any other relevant parties. 3. Quorum: Verify the quorum, ensuring that the minimum number of shareholders or voting power is present as required by the corporation's bylaws. 4. Approval of Previous Minutes: If applicable, record the approval of the minutes from the previous annual meeting or any special meetings held during the year. 5. Financial Statements: Review and discuss the corporation's financial statements, including the balance sheet, income statement, and cash flow statement, ensuring all attendees have access to this crucial information. 6. Reports of Directors and Officers: Provide a summary of the reports presented by directors and officers, focusing on their achievements, challenges, and recommendations for the future. 7. Election of Directors and Officers: Document any elections or re-elections of directors and officers, including their names, positions, and term durations. 8. Resolutions and Voting: Detail each resolution proposed and the corresponding votes, indicating whether they were approved, rejected, or tabled for further discussion. Specify the rationale behind each resolution to document the decision-making process thoroughly. 9. Amendments to Corporate Bylaws: Note any amendments or changes made to the corporation's bylaws during the meeting, including the specific sections modified and the reasons for the amendments. 10. Other Business: Include other important matters discussed during the meeting, such as proposed acquisitions, changes to corporate policies, marketing strategies, or significant legal updates affecting the corporation. By properly documenting these details in the McAllen Annual Minutes, a Texas Professional Corporation can demonstrate its adherence to good corporate governance practices. Furthermore, these minutes provide crucial historical records that may be referenced during future meetings, audits, or legal matters. It is important to note that the content and structure of the McAllen Annual Minutes may vary depending on the specific requirements of the corporation, its industry, and the desired level of detail. However, irrespective of these variations, maintaining accurate, consistent, and well-organized annual minutes is essential for the successful operation and compliance of any Texas Professional Corporation. Different types of McAllen Annual Minutes may also exist based on the specific needs of the corporation. For example, if the professional corporation has subsidiaries, separate minutes may be required for each entity. Additionally, if the corporation holds special meetings or emergency meetings apart from the annual meeting, separate minutes should be prepared for those events to accurately record their proceedings. In conclusion, the McAllen Annual Minutes for a Texas Professional Corporation serve as a critical tool for maintaining corporate compliance, facilitating transparent decision-making, and protecting the interests of shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McAllen Minutos anuales para una corporación profesional de Texas - Annual Minutes for a Texas Professional Corporation

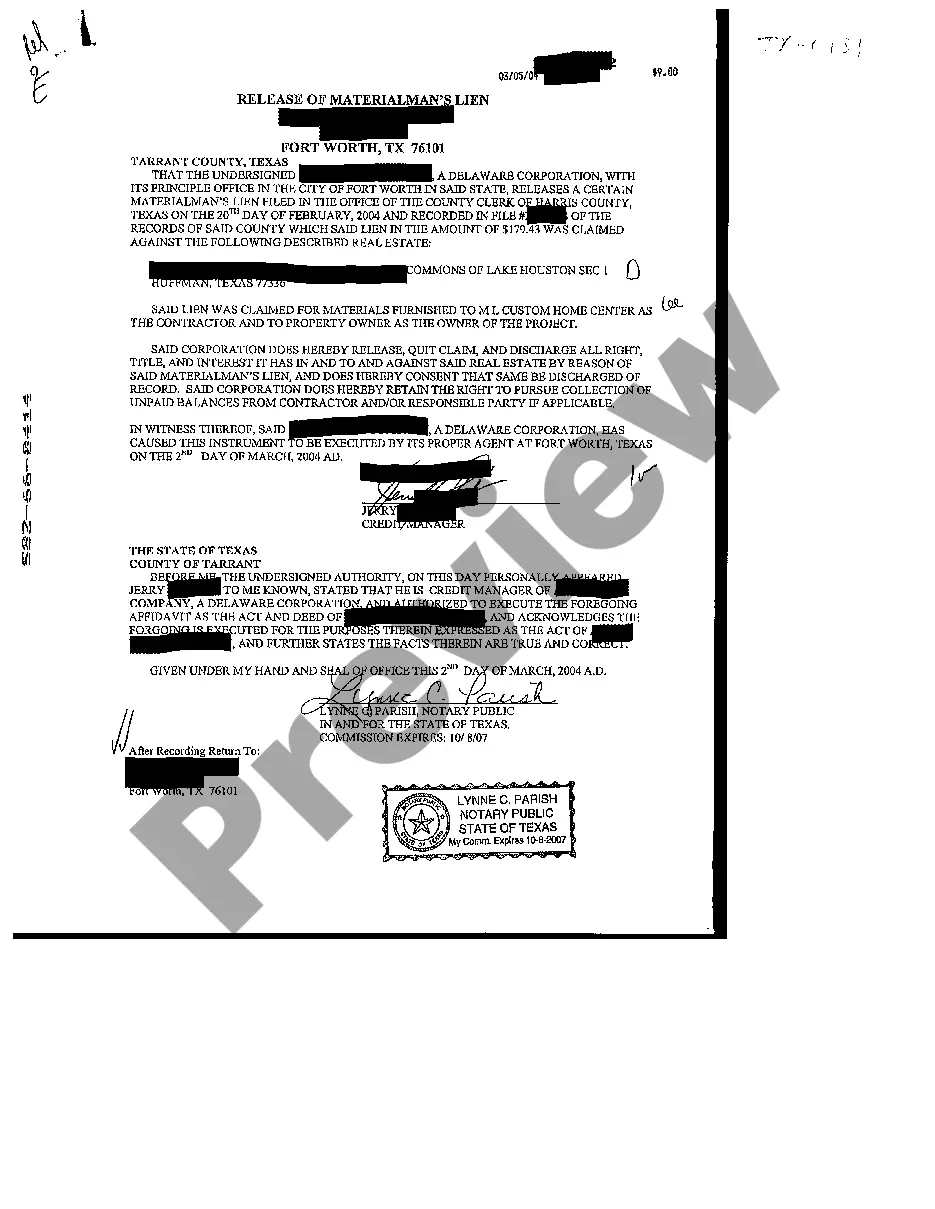

Description

How to fill out McAllen Minutos Anuales Para Una Corporación Profesional De Texas?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the McAllen Annual Minutes for a Texas Professional Corporation or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the McAllen Annual Minutes for a Texas Professional Corporation quickly employing our reliable platform. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the McAllen Annual Minutes for a Texas Professional Corporation:

- Ensure the form you have found is specific to your location since the rules of one state or area do not work for another state or area.

- Preview the document and read a brief outline (if available) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your requirements, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the McAllen Annual Minutes for a Texas Professional Corporation once the payment is completed.

You’re all set! Now you can proceed to print the document or complete it online. Should you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.