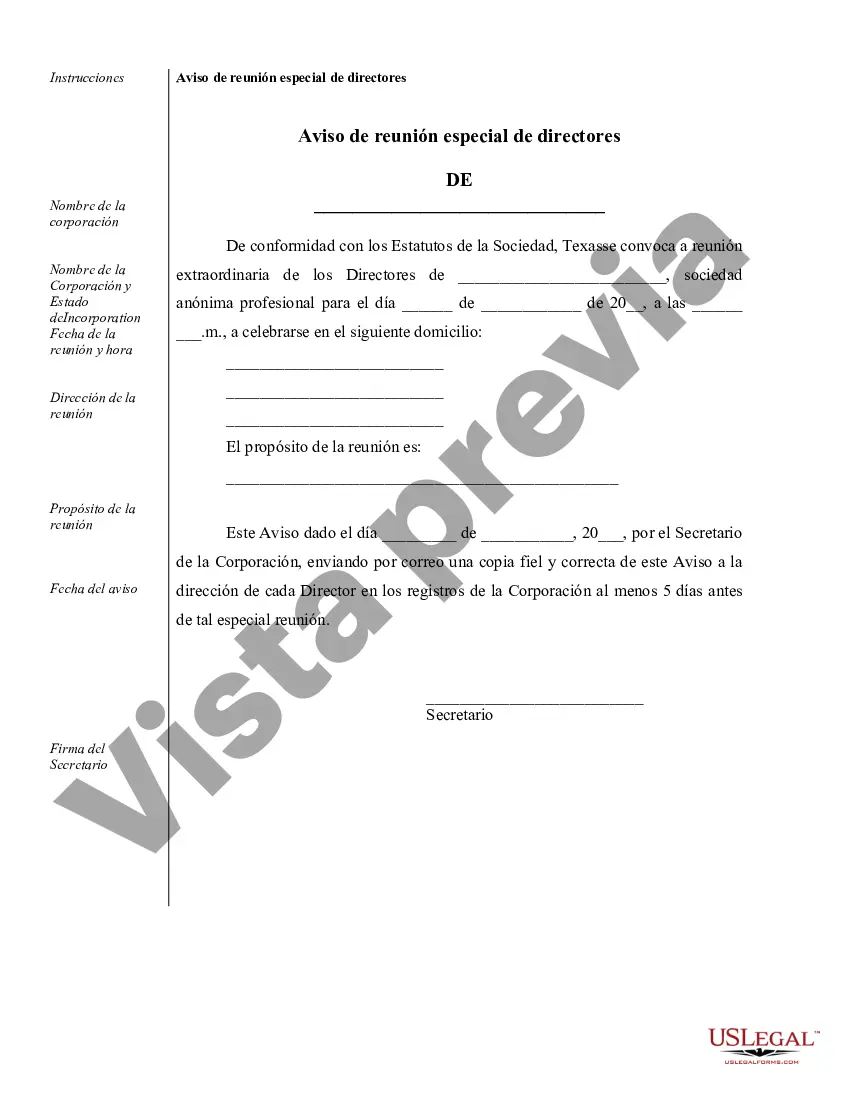

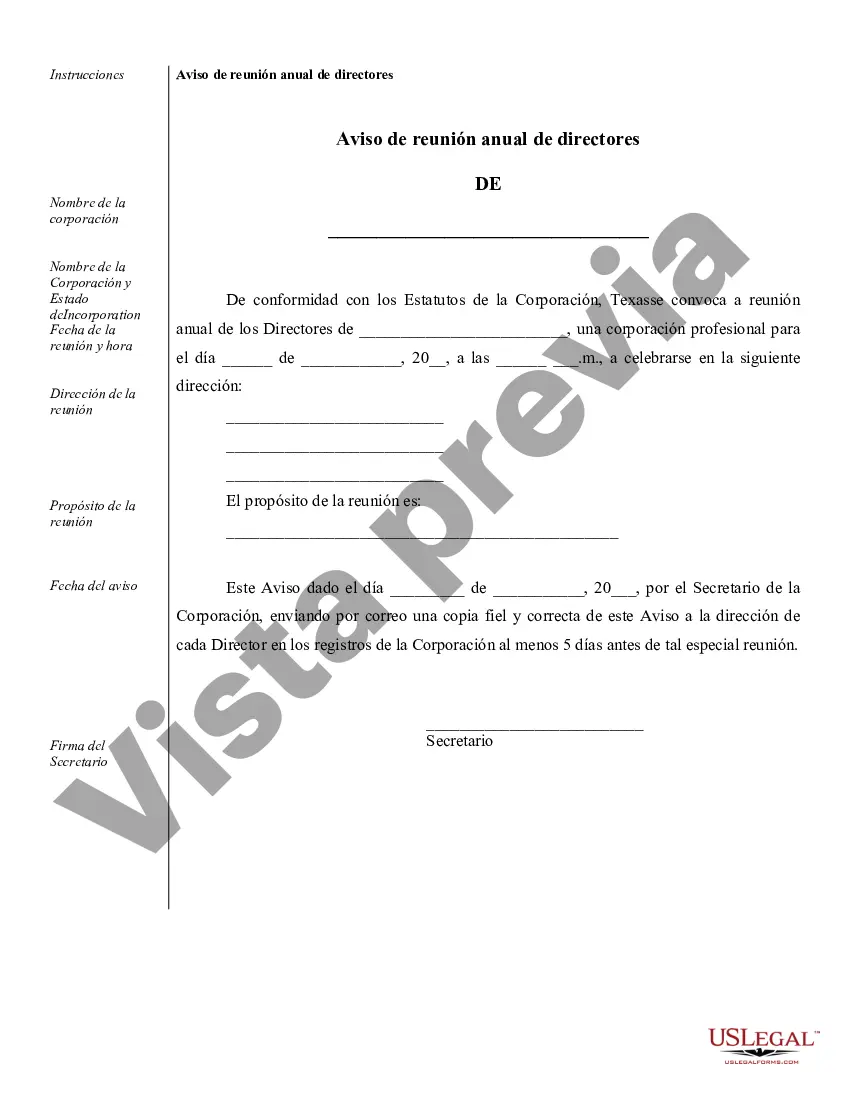

Arlington Sample Corporate Records for a Texas Professional Corporation refers to a comprehensive collection of documents and records that every professional corporation in Texas should maintain to ensure compliance with state regulations. These records are crucial for the smooth functioning and legal protection of the corporation. Here, we will discuss the different types of Arlington Sample Corporate Records for a Texas Professional Corporation: 1. Certificate of Formation: This is the foundational document that establishes the existence of a professional corporation in Texas. It includes details such as the corporation's name, purpose, registered agent, and capital structure. 2. Articles of Incorporation: Similar to the certificate of formation, the articles of incorporation provide more detailed information about the corporation and its governance. It includes information about the corporation's directors, officers, shareholders, and any specific restrictions or guidelines governing the corporation. 3. Bylaws: These are the internal rules and regulations that govern the corporation's operations. Bylaws typically cover matters such as shareholder meetings, director duties, officer roles, stock issuance, and voting procedures. 4. Board of Directors Meeting Minutes: These minutes document the discussions, decisions, and actions taken during board meetings. They provide a record of important corporate matters, such as the election of officers, approval of financial statements, and significant corporate transactions. 5. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes document discussions, voting outcomes, and other actions taken during shareholder meetings. These minutes are essential for recording key decisions that may affect the rights and interests of shareholders. 6. Stock Ledgers and Transfer Records: These records contain detailed information about the ownership of the corporation's stock, including the names of shareholders, the number of shares held, and any transfers or changes in ownership. Maintaining accurate stock ledgers is crucial for preserving the integrity of stockholder rights. 7. Financial Statements: Properly maintained financial records are a vital part of corporate governance. They include balance sheets, income statements, cash flow statements, and other financial documents that provide transparency and accountability. 8. Contracts and Agreements: Sample corporate records may also include a collection of contracts and agreements entered into by the corporation, such as employment agreements, client contracts, vendor agreements, and lease agreements. These documents demonstrate the legality of the corporation's business activities and protect its interests. 9. Annual Reports and Filings: Texas professional corporations must file annual reports with the Secretary of State to maintain active status and comply with state regulations. Sample corporate records may include copies of these reports, along with any other necessary filings or registrations with regulatory agencies. 10. IRS Filings: In addition to state filings, professional corporations must also maintain records of their federal tax filings, including income tax returns and supporting documentation. By maintaining these Arlington Sample Corporate Records for a Texas Professional Corporation, the corporation ensures compliance with state regulations, facilitates corporate transparency, and protects the corporation and its stakeholders in legal matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arlington Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

State:

Texas

City:

Arlington

Control #:

TX-PC-CR

Format:

Word

Instant download

Description

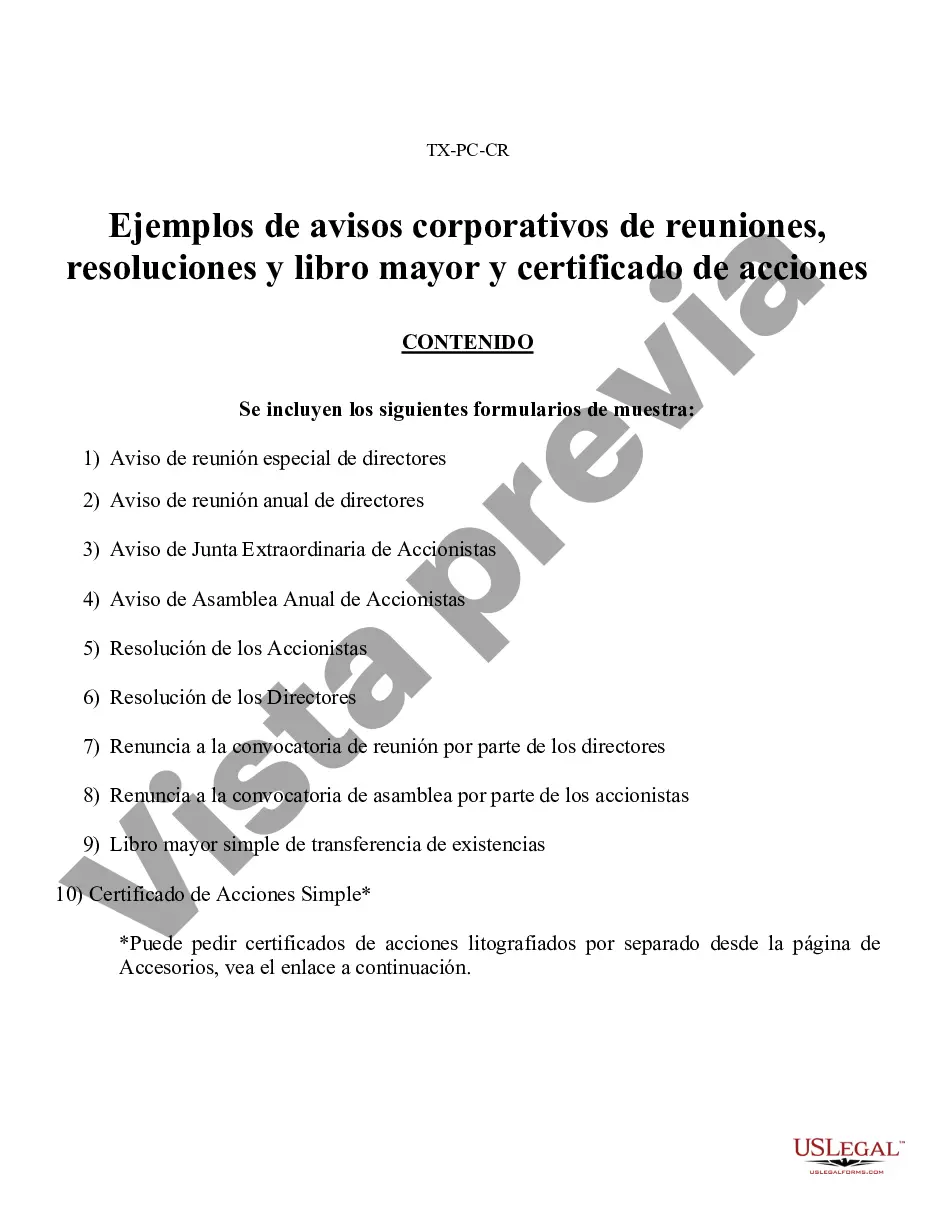

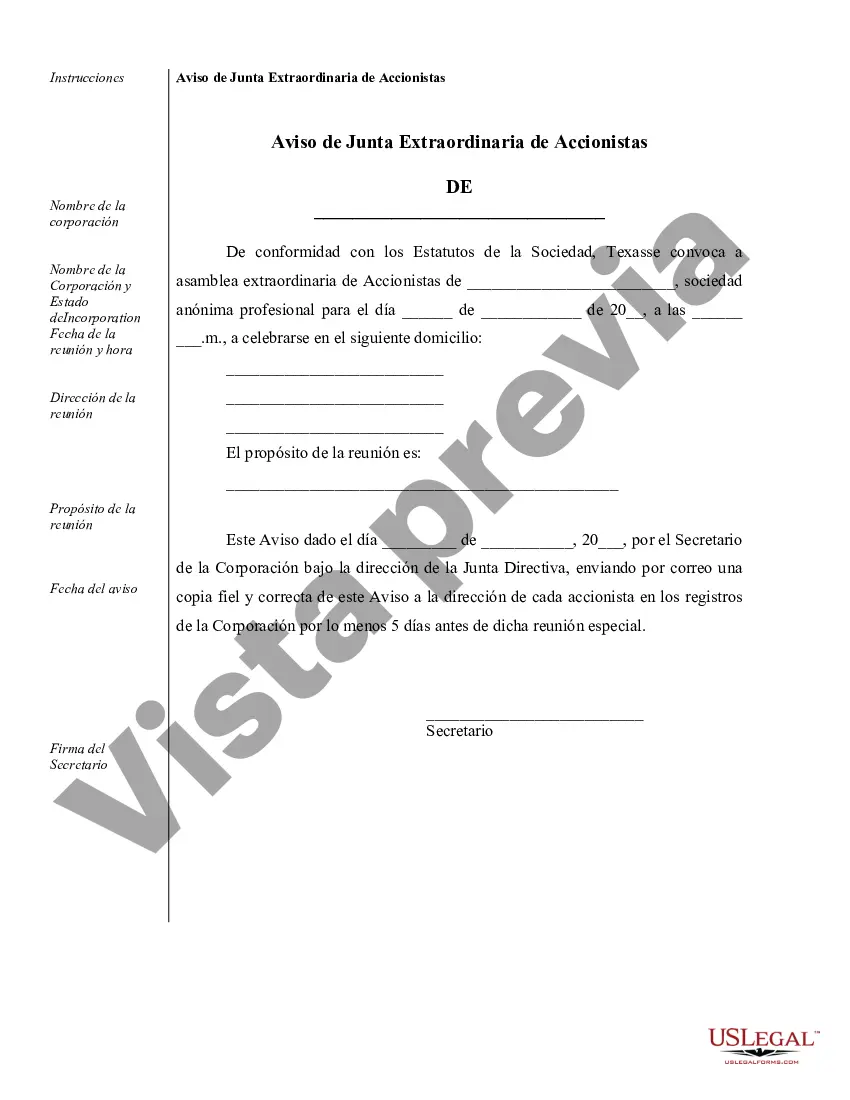

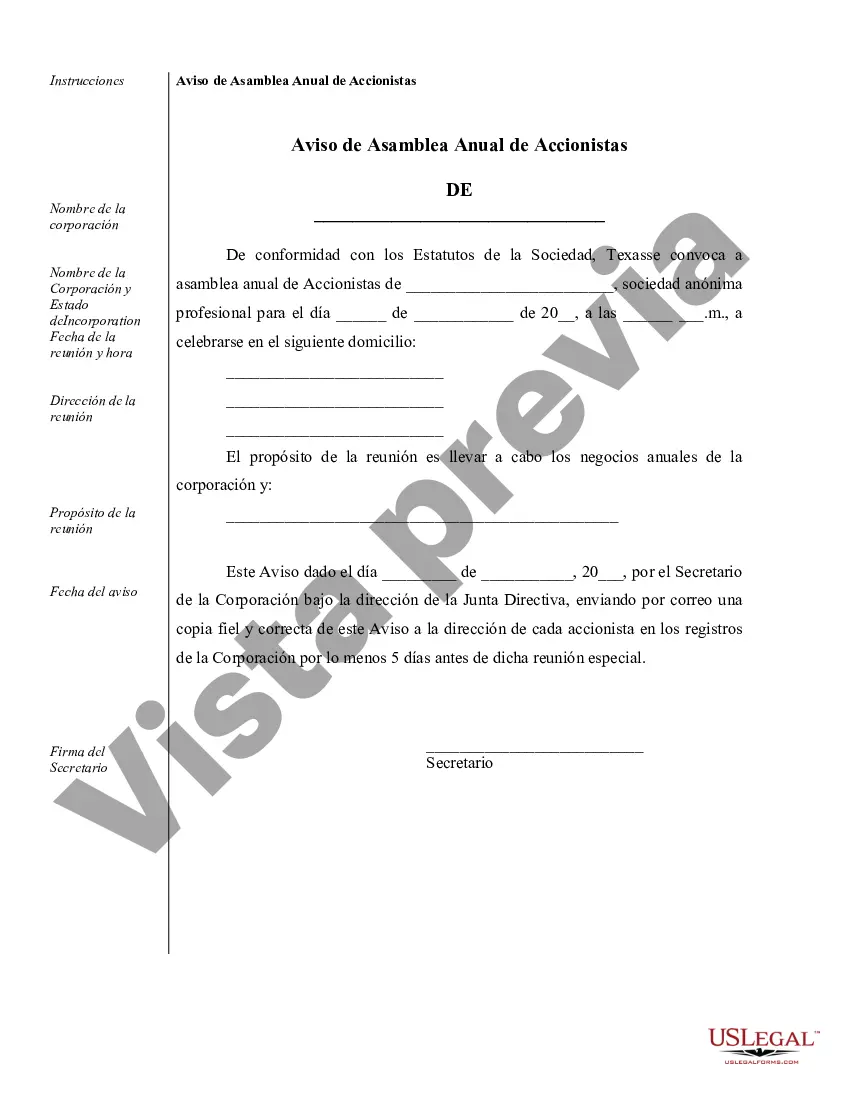

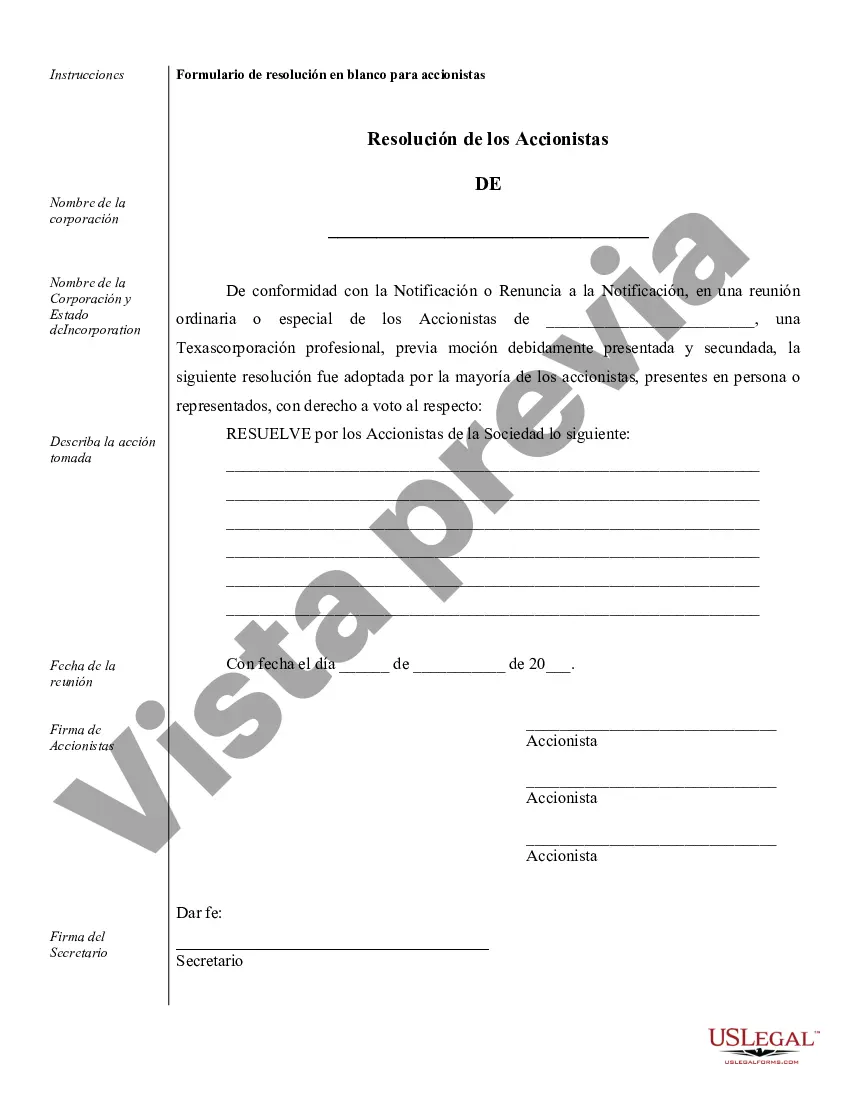

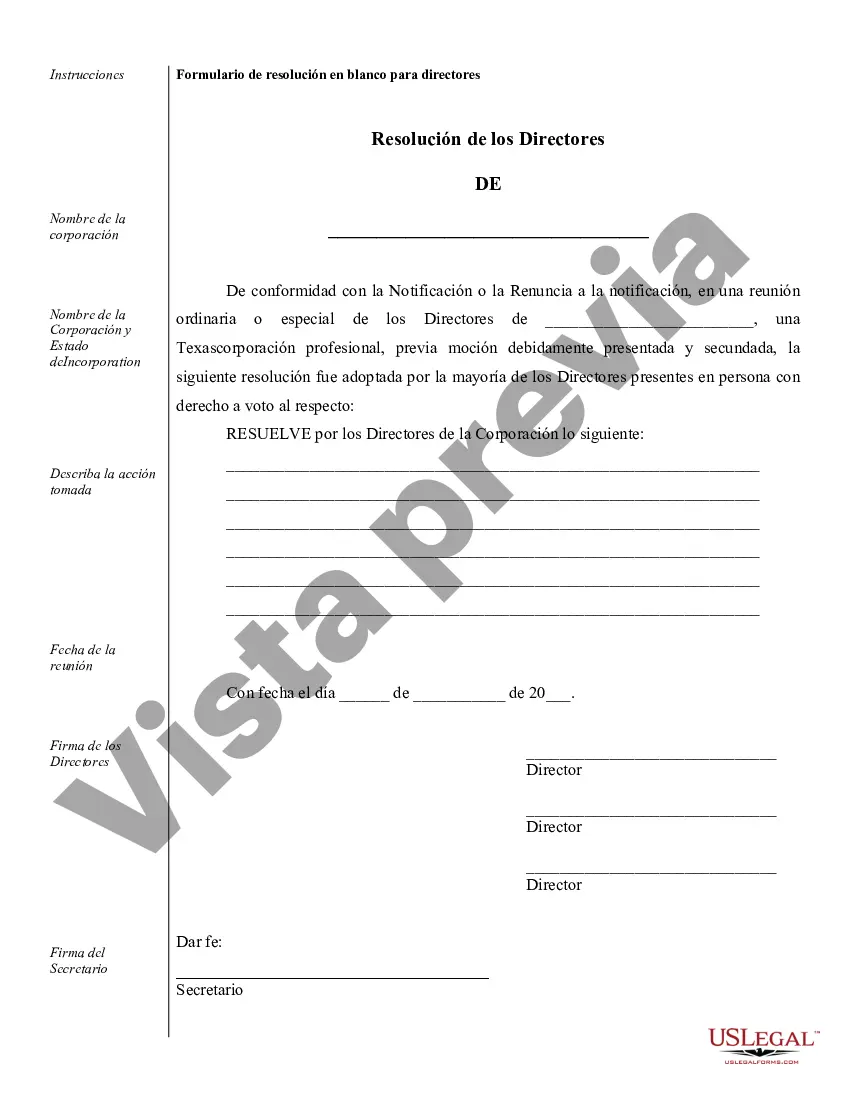

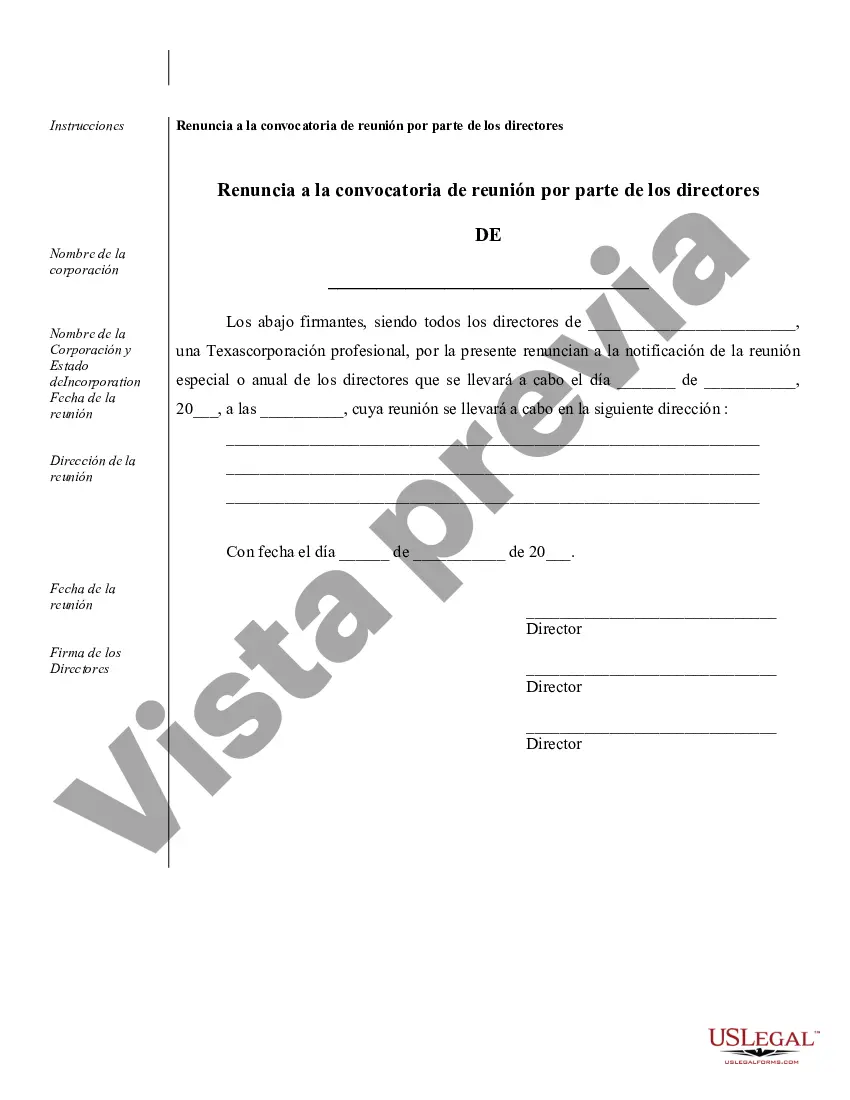

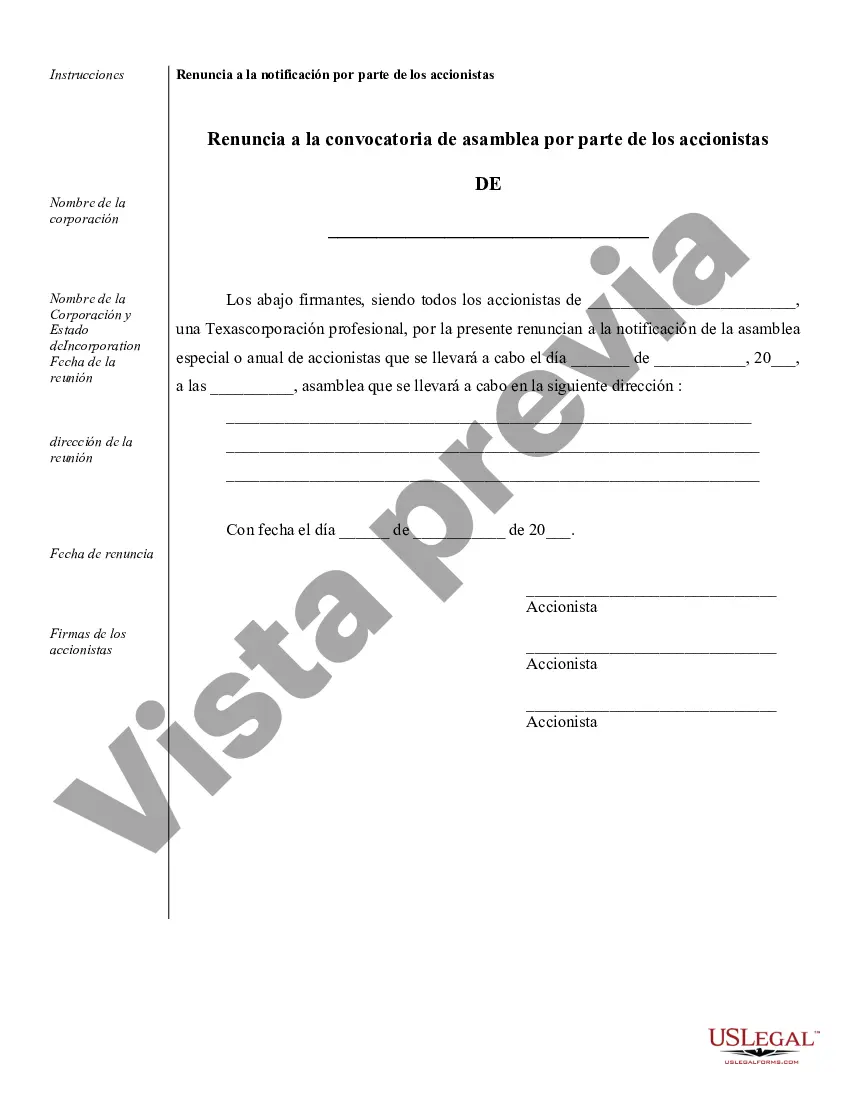

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

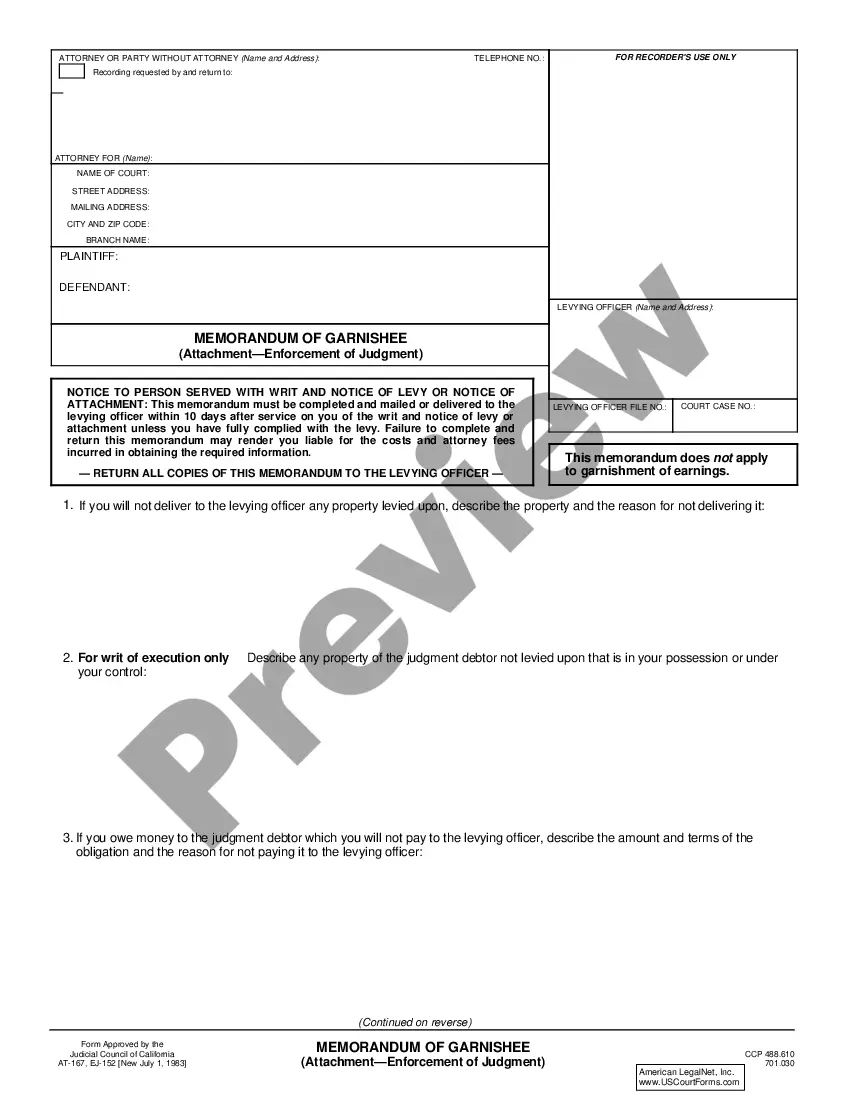

Arlington Sample Corporate Records for a Texas Professional Corporation refers to a comprehensive collection of documents and records that every professional corporation in Texas should maintain to ensure compliance with state regulations. These records are crucial for the smooth functioning and legal protection of the corporation. Here, we will discuss the different types of Arlington Sample Corporate Records for a Texas Professional Corporation: 1. Certificate of Formation: This is the foundational document that establishes the existence of a professional corporation in Texas. It includes details such as the corporation's name, purpose, registered agent, and capital structure. 2. Articles of Incorporation: Similar to the certificate of formation, the articles of incorporation provide more detailed information about the corporation and its governance. It includes information about the corporation's directors, officers, shareholders, and any specific restrictions or guidelines governing the corporation. 3. Bylaws: These are the internal rules and regulations that govern the corporation's operations. Bylaws typically cover matters such as shareholder meetings, director duties, officer roles, stock issuance, and voting procedures. 4. Board of Directors Meeting Minutes: These minutes document the discussions, decisions, and actions taken during board meetings. They provide a record of important corporate matters, such as the election of officers, approval of financial statements, and significant corporate transactions. 5. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes document discussions, voting outcomes, and other actions taken during shareholder meetings. These minutes are essential for recording key decisions that may affect the rights and interests of shareholders. 6. Stock Ledgers and Transfer Records: These records contain detailed information about the ownership of the corporation's stock, including the names of shareholders, the number of shares held, and any transfers or changes in ownership. Maintaining accurate stock ledgers is crucial for preserving the integrity of stockholder rights. 7. Financial Statements: Properly maintained financial records are a vital part of corporate governance. They include balance sheets, income statements, cash flow statements, and other financial documents that provide transparency and accountability. 8. Contracts and Agreements: Sample corporate records may also include a collection of contracts and agreements entered into by the corporation, such as employment agreements, client contracts, vendor agreements, and lease agreements. These documents demonstrate the legality of the corporation's business activities and protect its interests. 9. Annual Reports and Filings: Texas professional corporations must file annual reports with the Secretary of State to maintain active status and comply with state regulations. Sample corporate records may include copies of these reports, along with any other necessary filings or registrations with regulatory agencies. 10. IRS Filings: In addition to state filings, professional corporations must also maintain records of their federal tax filings, including income tax returns and supporting documentation. By maintaining these Arlington Sample Corporate Records for a Texas Professional Corporation, the corporation ensures compliance with state regulations, facilitates corporate transparency, and protects the corporation and its stakeholders in legal matters.

Free preview

How to fill out Arlington Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

If you’ve already utilized our service before, log in to your account and download the Arlington Sample Corporate Records for a Texas Professional Corporation on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Arlington Sample Corporate Records for a Texas Professional Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!