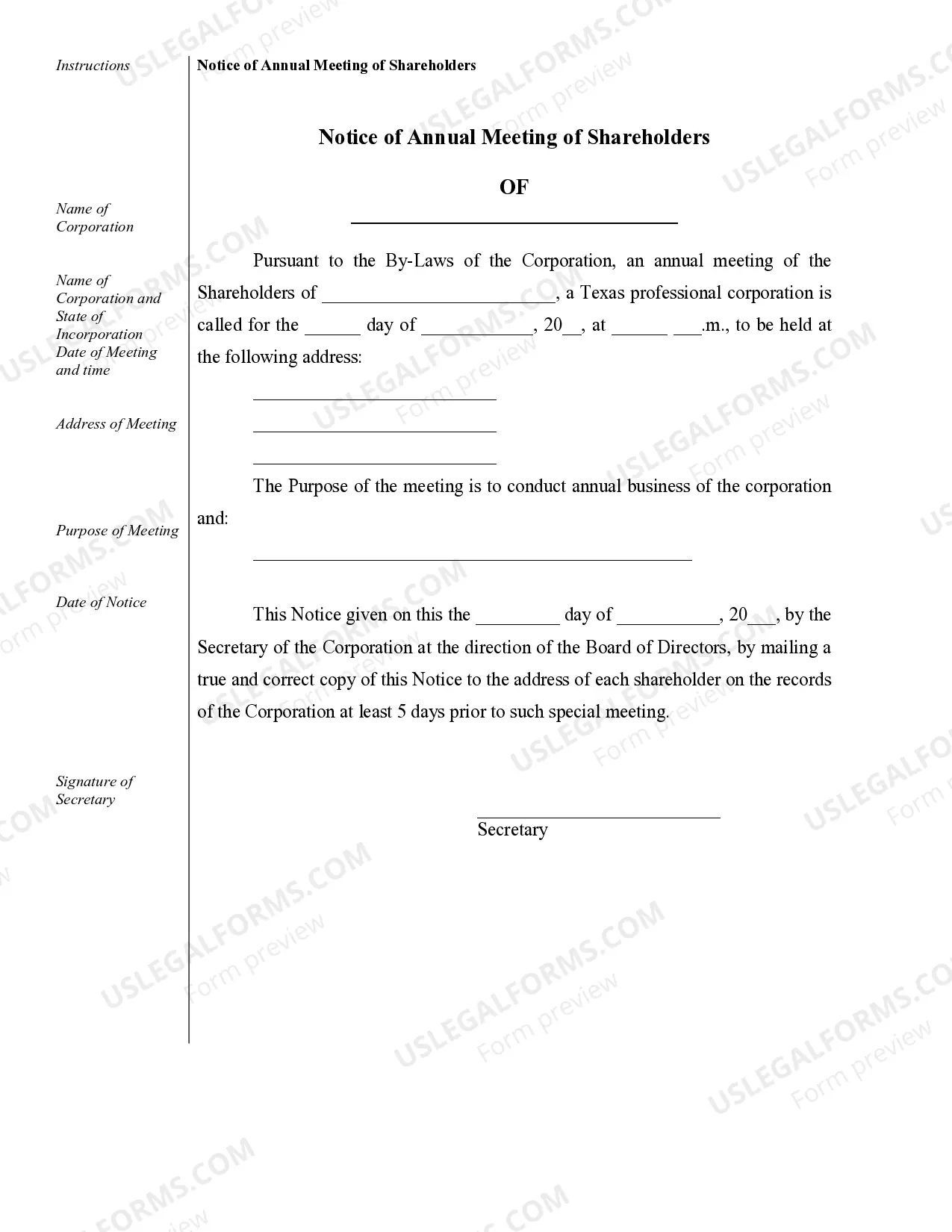

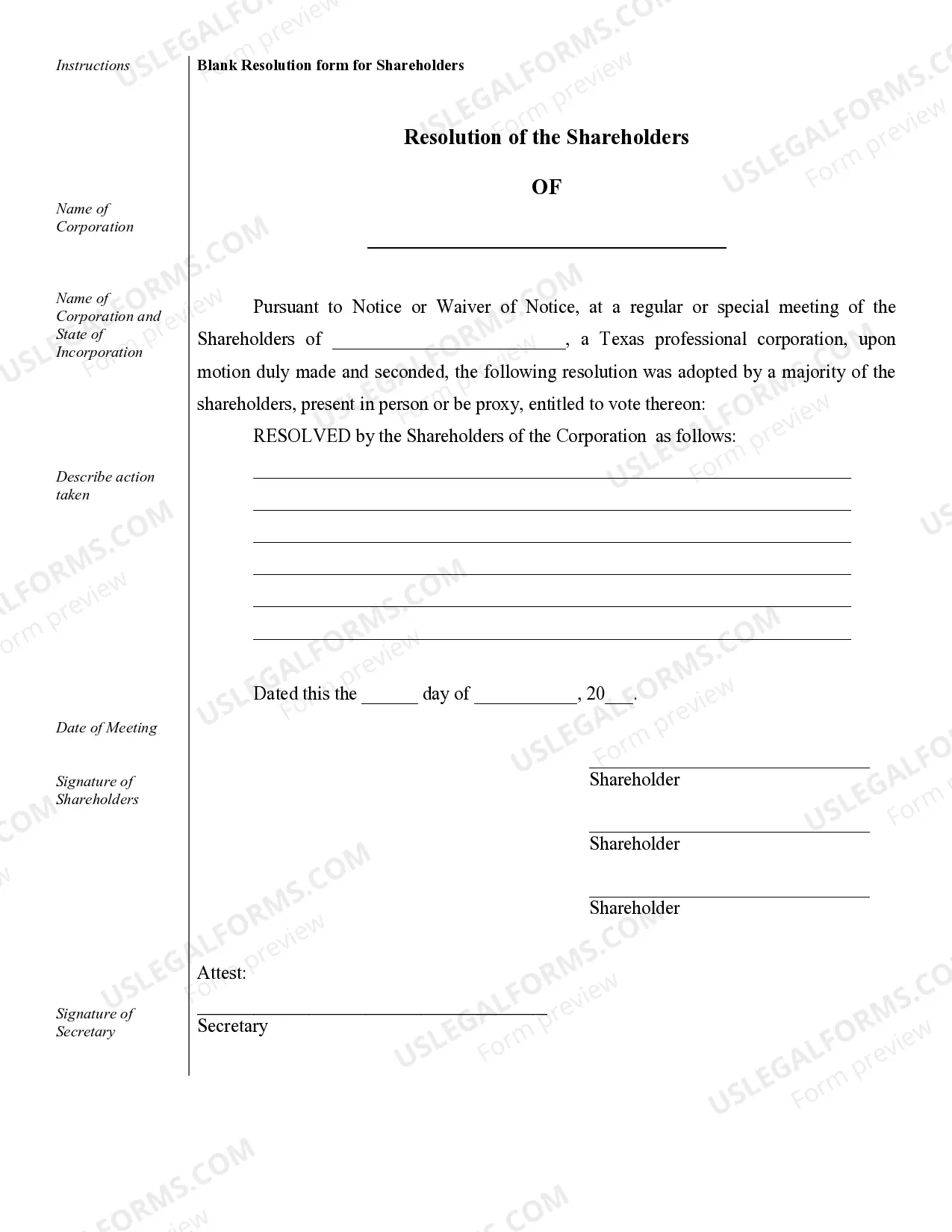

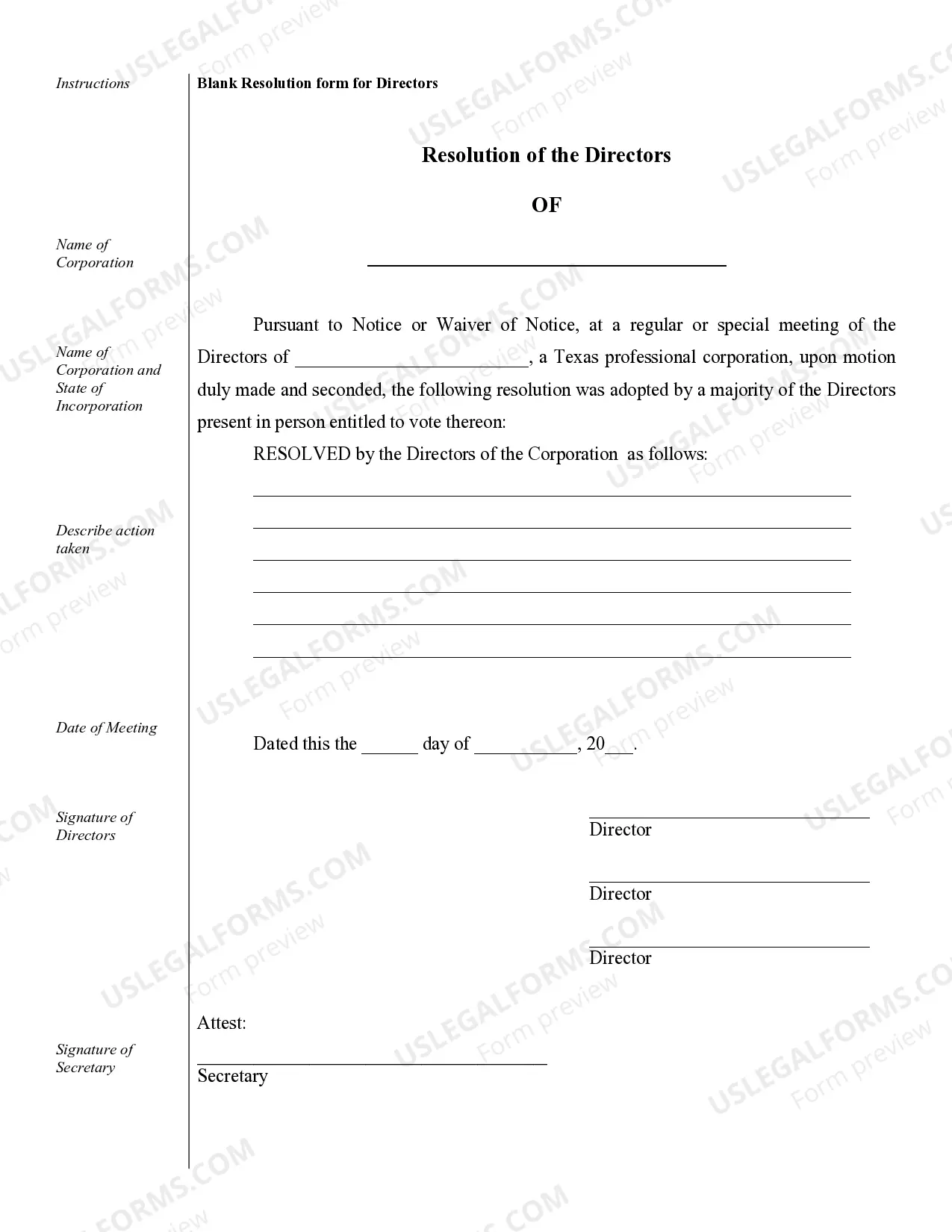

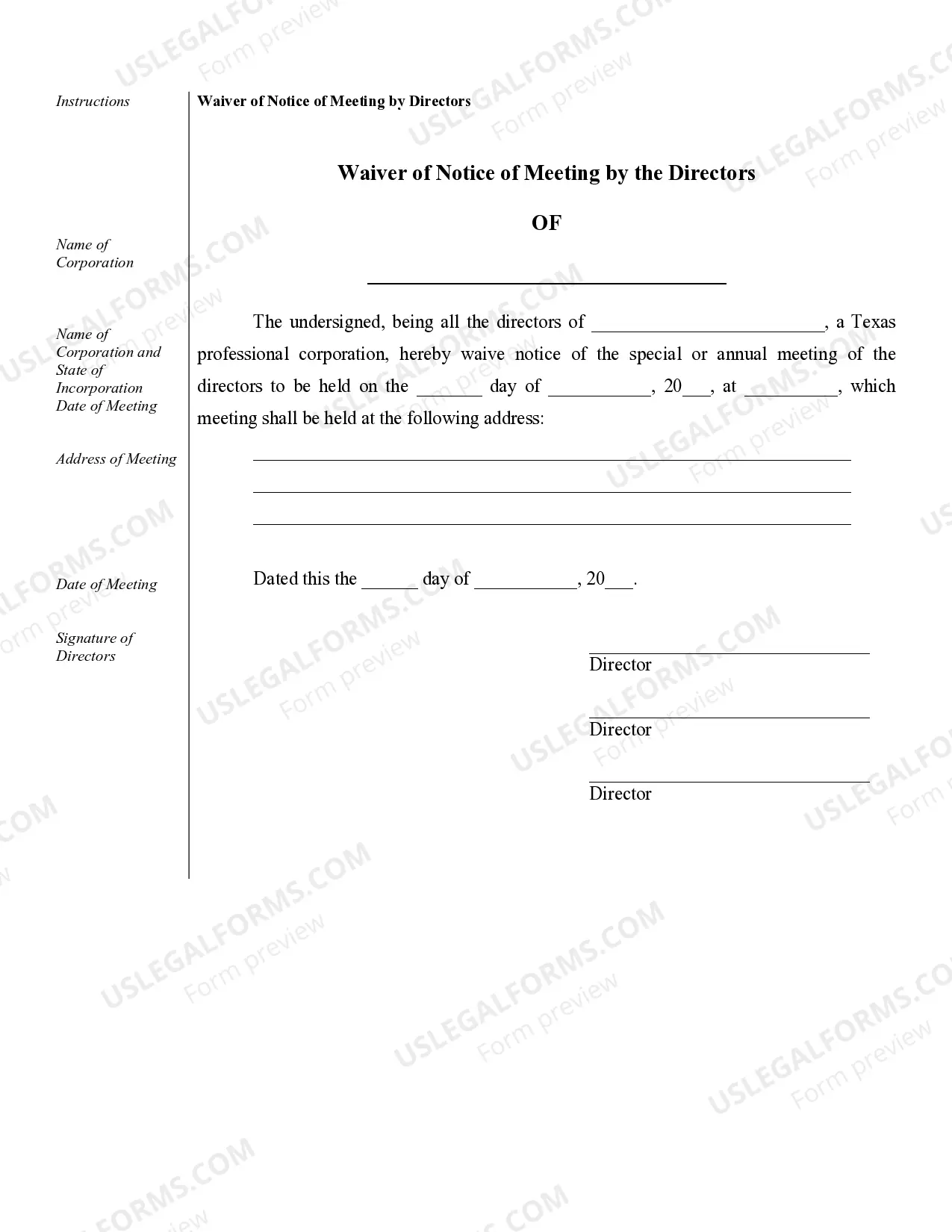

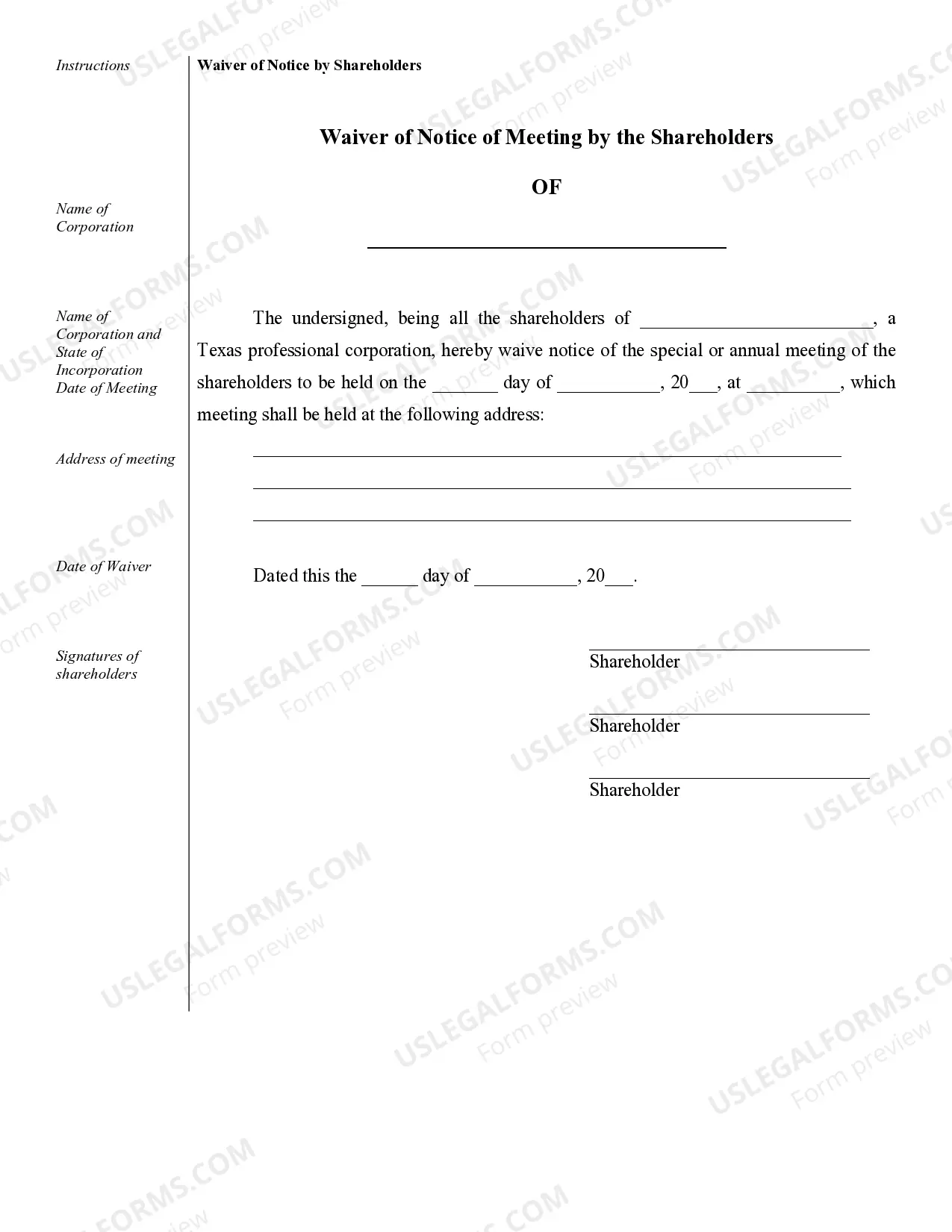

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Austin Sample Corporate Records for a Texas Professional Corporation

Description

How to fill out Sample Corporate Records For A Texas Professional Corporation?

Finding authenticated templates that adhere to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

Each document is appropriately sorted by usage area and jurisdiction, making it as fast and simple as one-two-three to find the Austin Sample Corporate Records for a Texas Professional Corporation.

Keep your documentation organized and compliant with legal standards. Take advantage of the US Legal Forms library to consistently have essential document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure you have selected the correct one that fulfills your needs and aligns perfectly with your local jurisdiction regulations.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the proper one. If it fits your criteria, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

If your business meets the qualifications, S corporation status allows you to avoid double taxation, thus increasing your net profits. In many states, licensed professionals are not permitted to operate as regular corporations. However, a professional corporation is an alternative that provides limited liability.

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.

In Texas, professional corporations are comprised of groups such as architects, attorneys, certified public accountants, dentists, and veterinarians. All professionals within a professional corporation must be properly certified or licensed by the state in which they incorporate.

You can find information on any corporation or business entity in Texas or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

A professional corporation is a corporation that is formed for the purpose of providing a professional service that by law a for-profit or nonprofit corporation is prohibited from rendering.

Professional corporations (PCs), or professional service corporations, are a unique corporate structure which is comprised of a specific group of professionals. An S corporation or a C corporation may be formed by certain professionals including physicians, attorneys, engineers, or accountants.

Texas law does not require a business to have a seal; therefore the secretary of state does not have information or regulations on how to design a seal or where to obtain one. Seals, stock certificates, and minute books can be purchased from book stores, office supply stores, or corporate service companies.

State Seal Laws In states such as New York and California, you do not need corporate seals. For instance, California statutes give corporations the authority to use and adopt corporate seals, but having a seal has no effect on the validity of any documents or instruments.

Yes. Tex. Gov Ann. 406.013 requires a Texas notary to use a seal of office to authenticate all his or her acts.