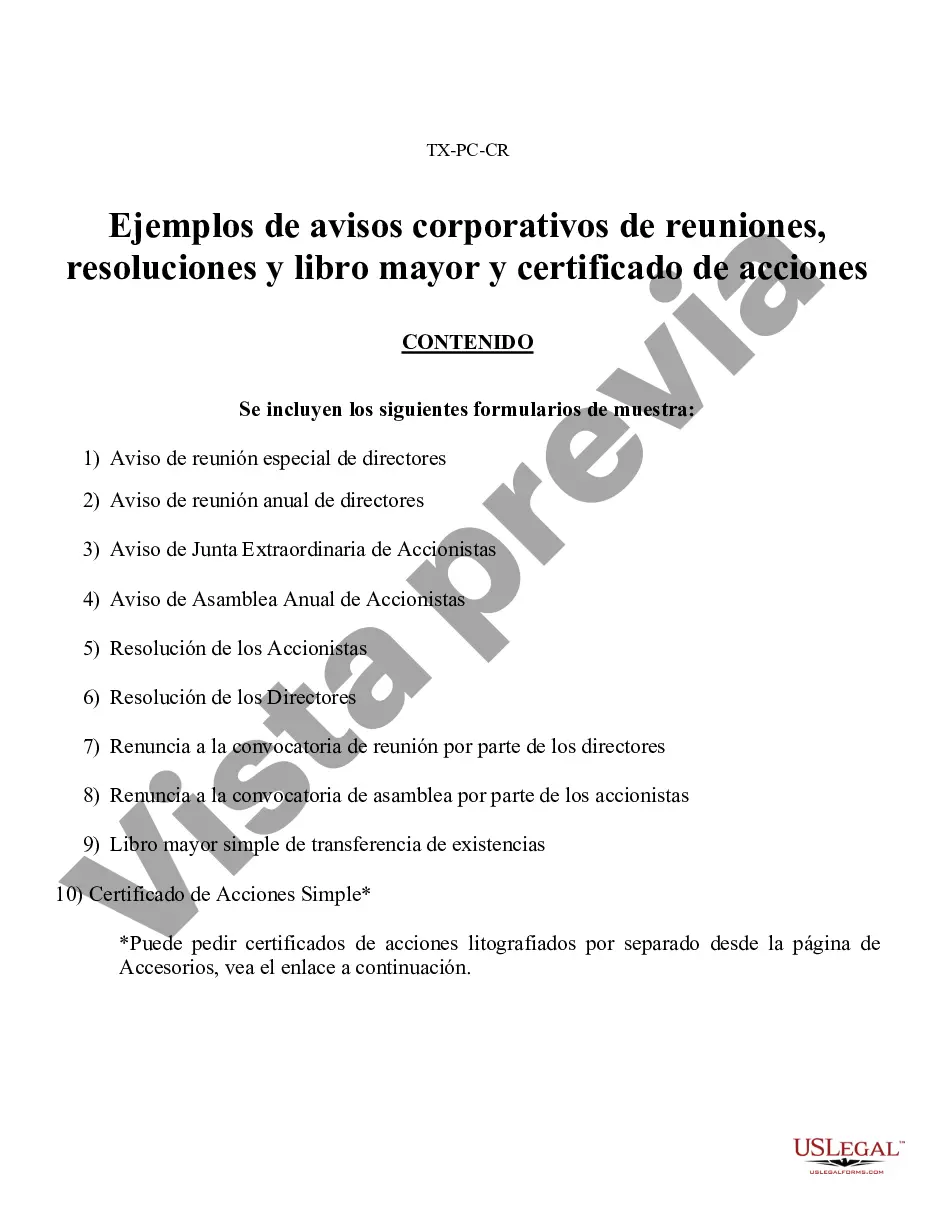

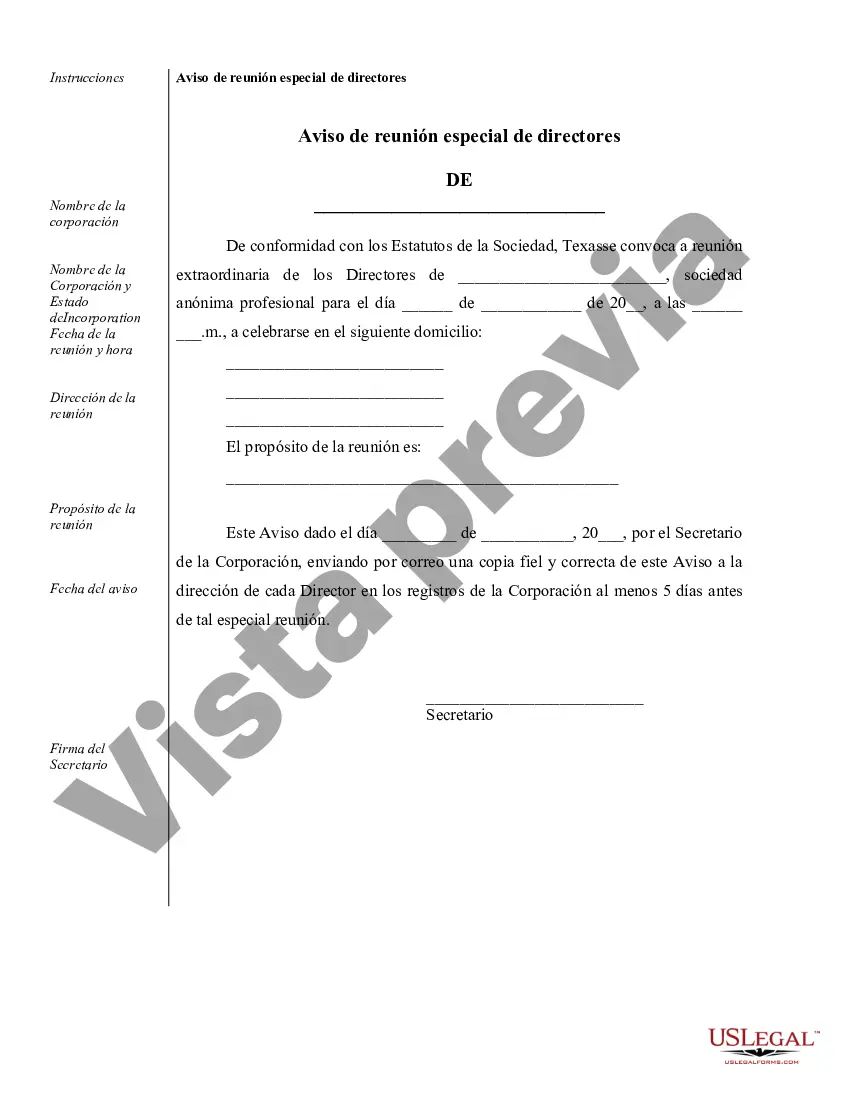

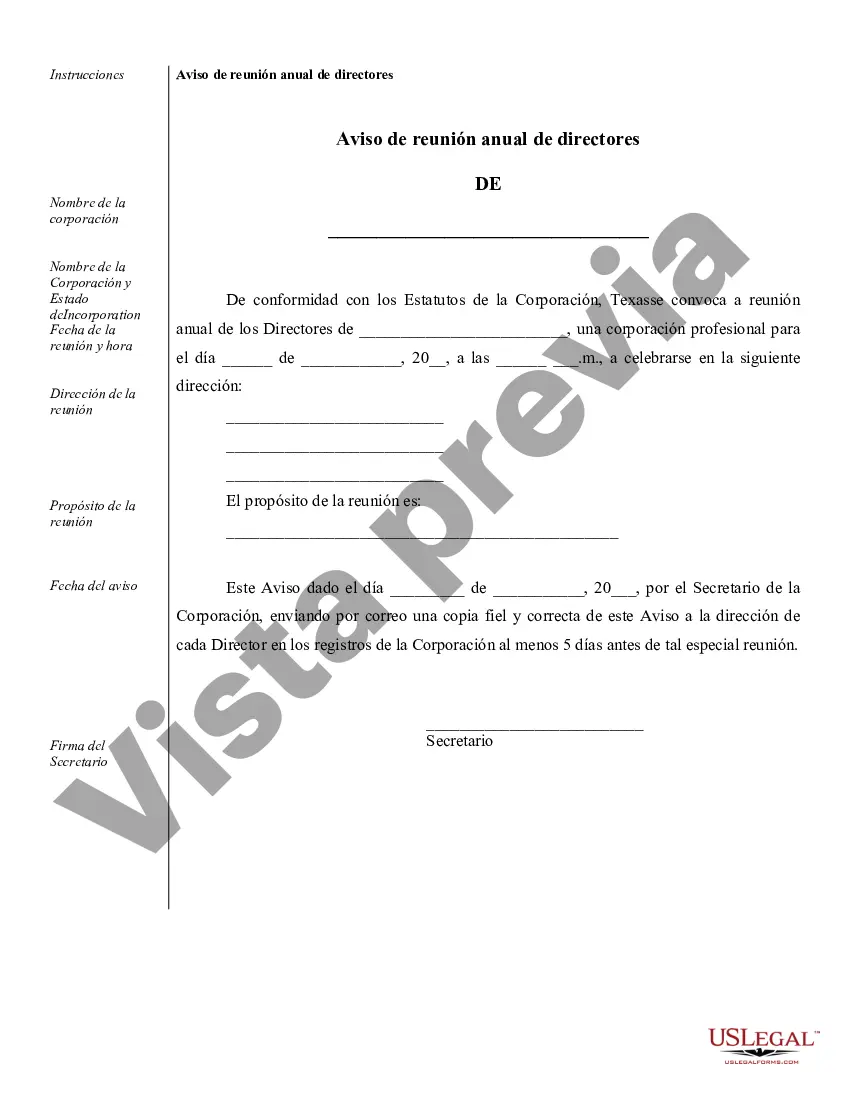

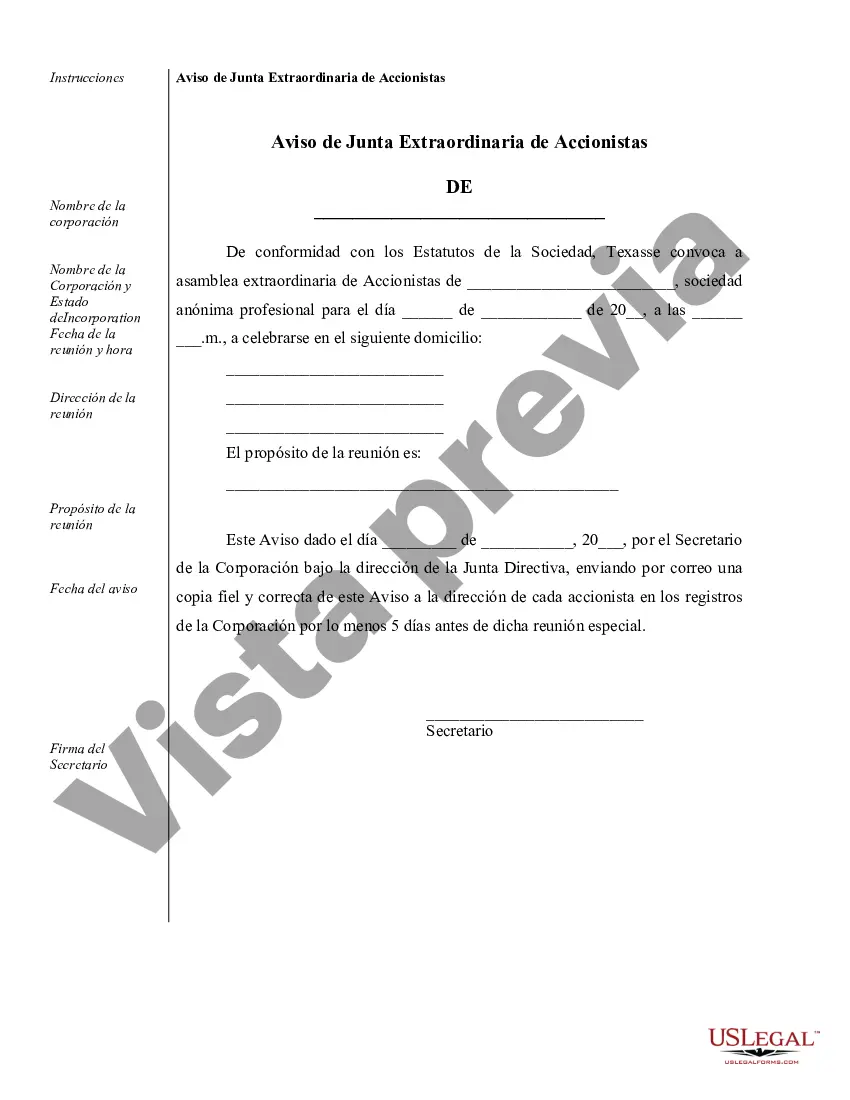

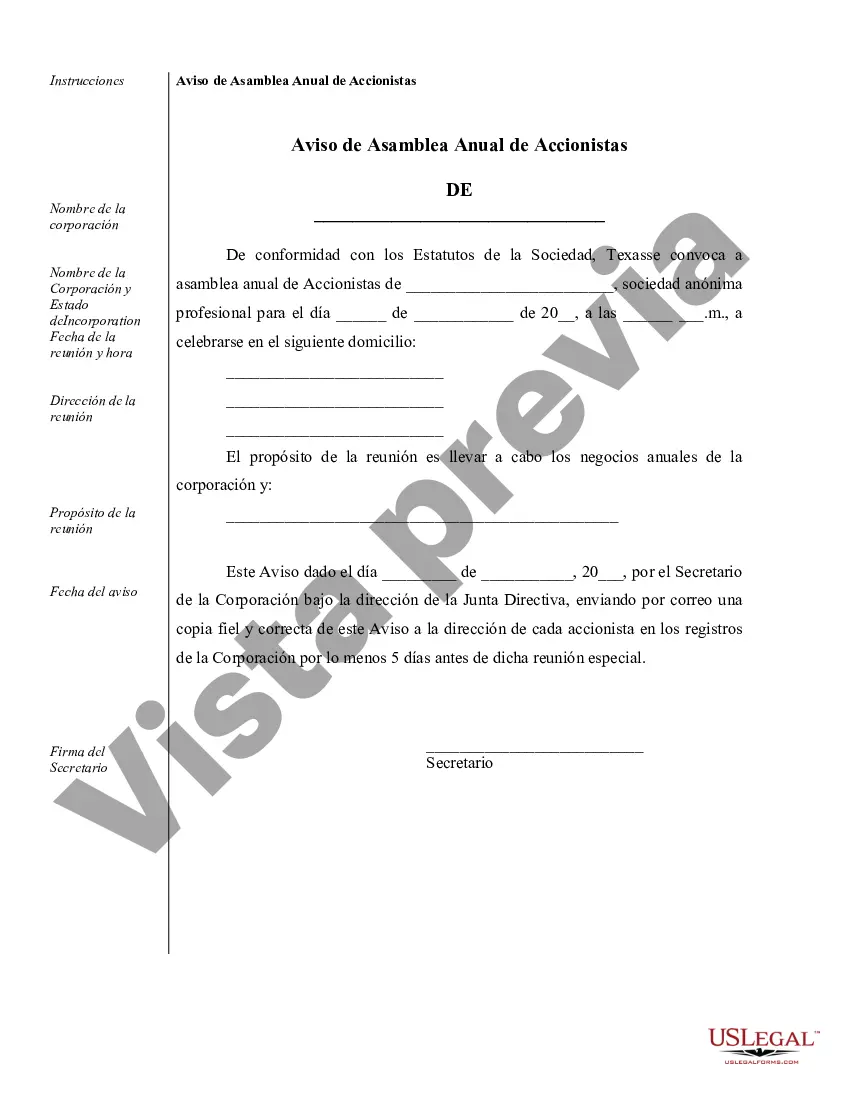

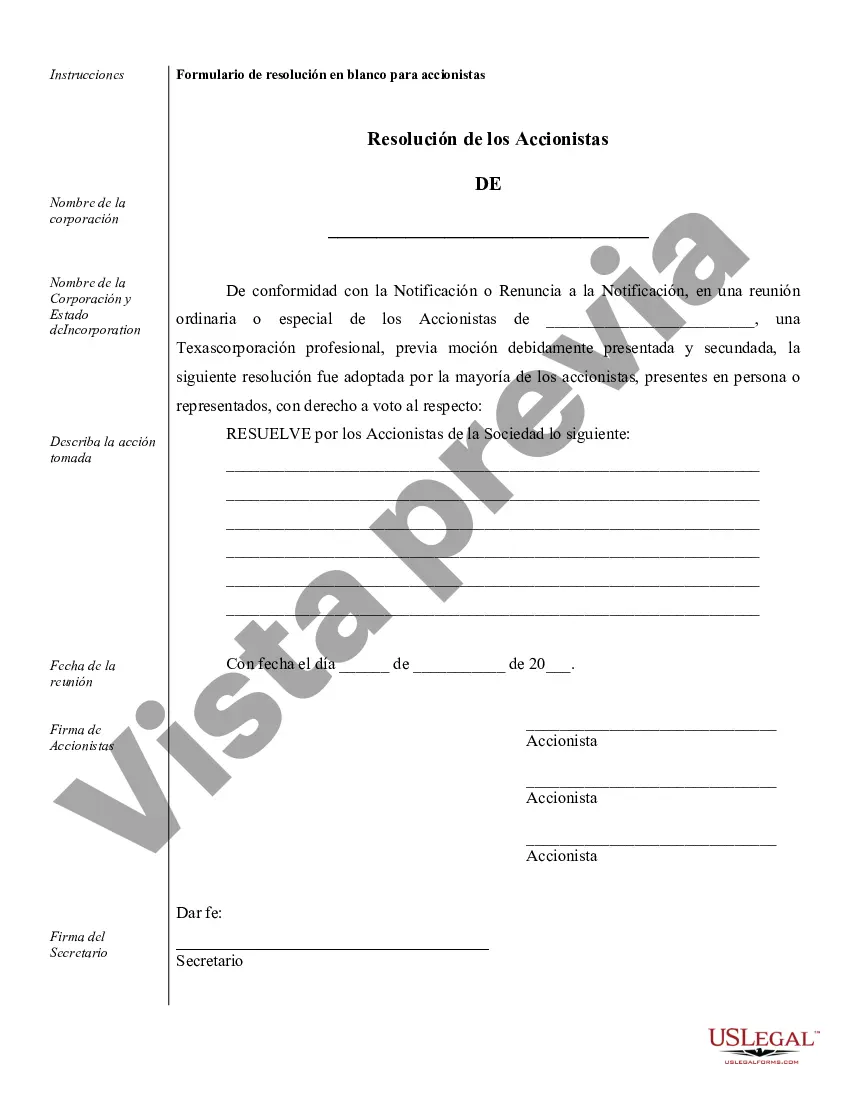

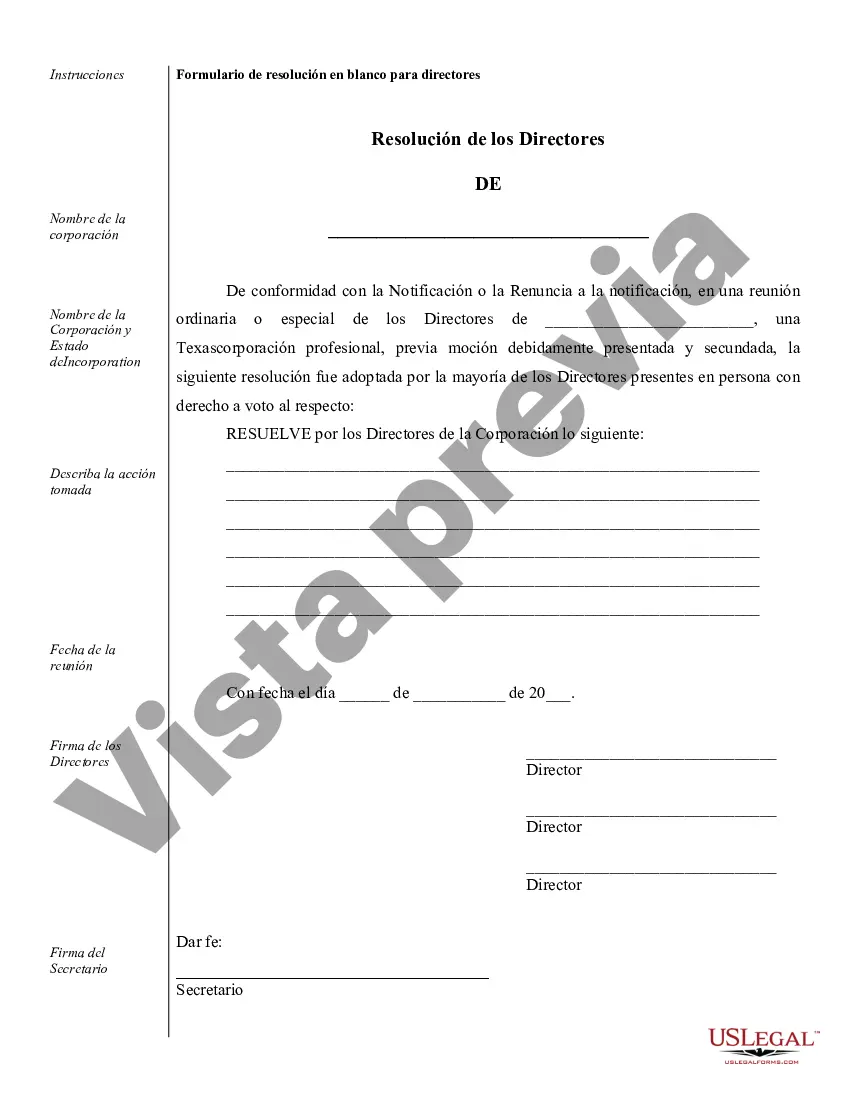

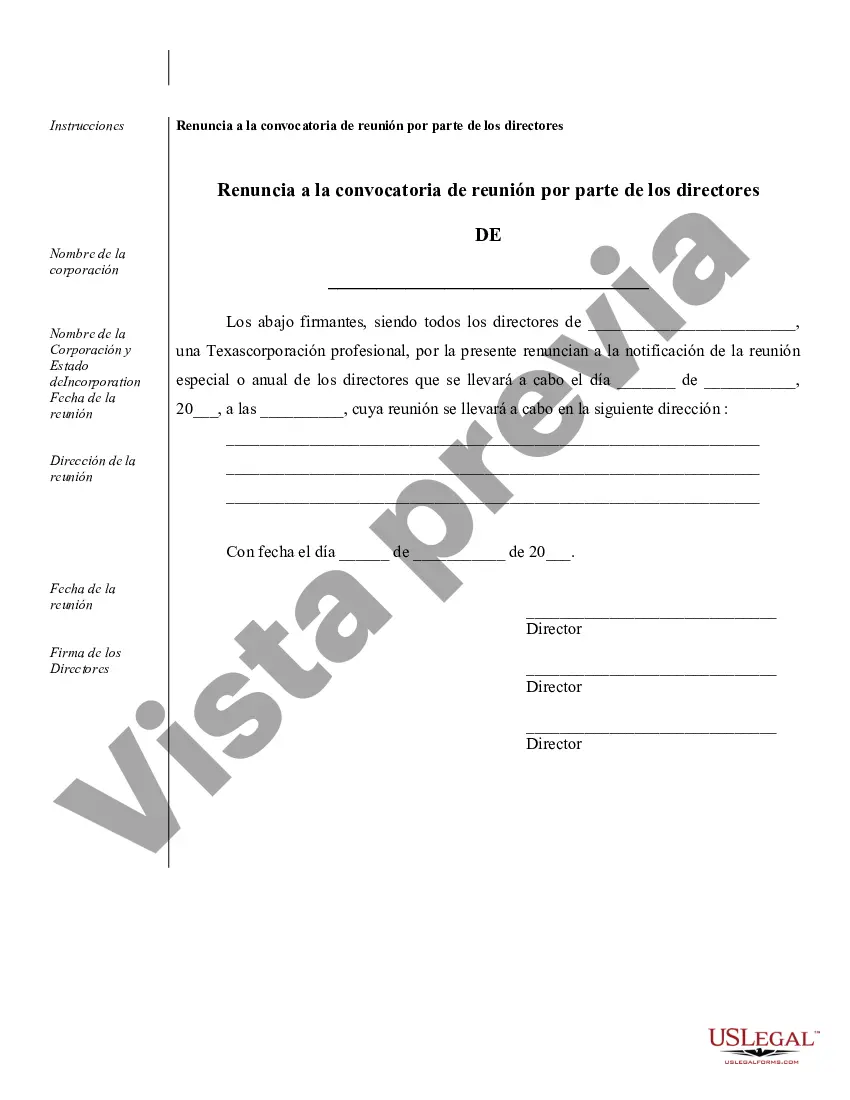

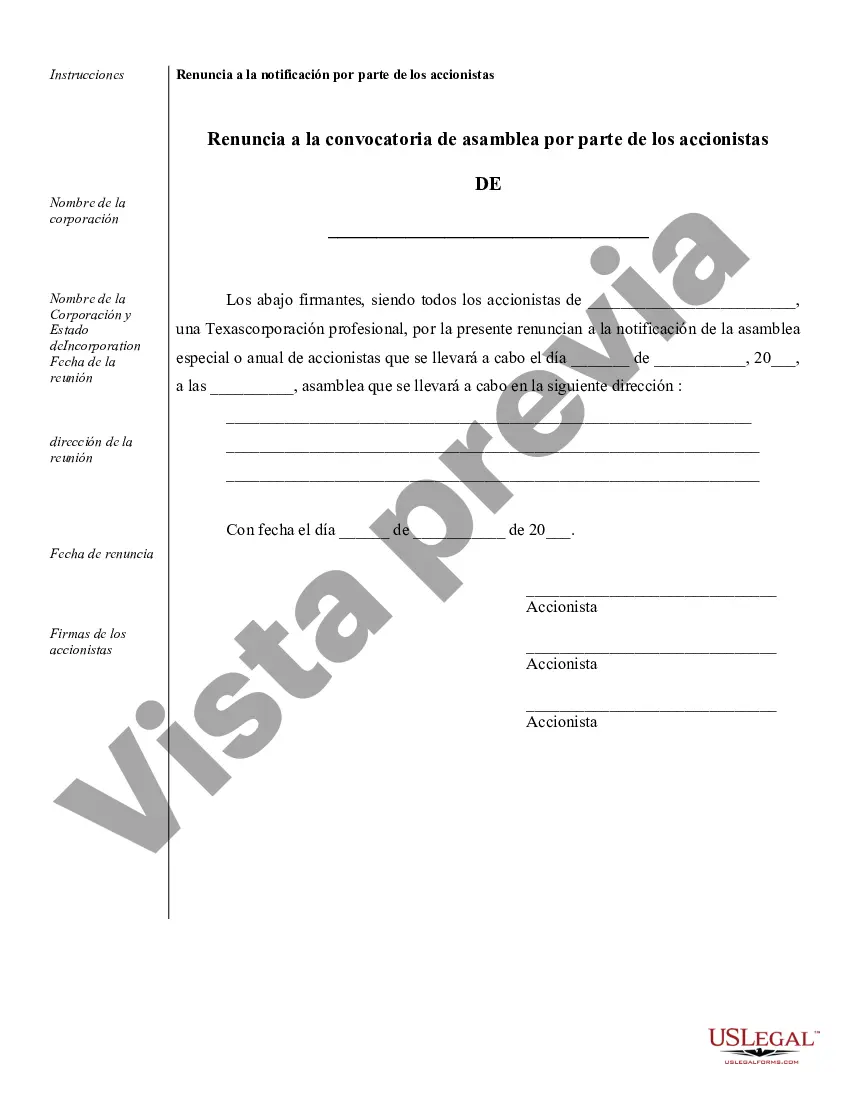

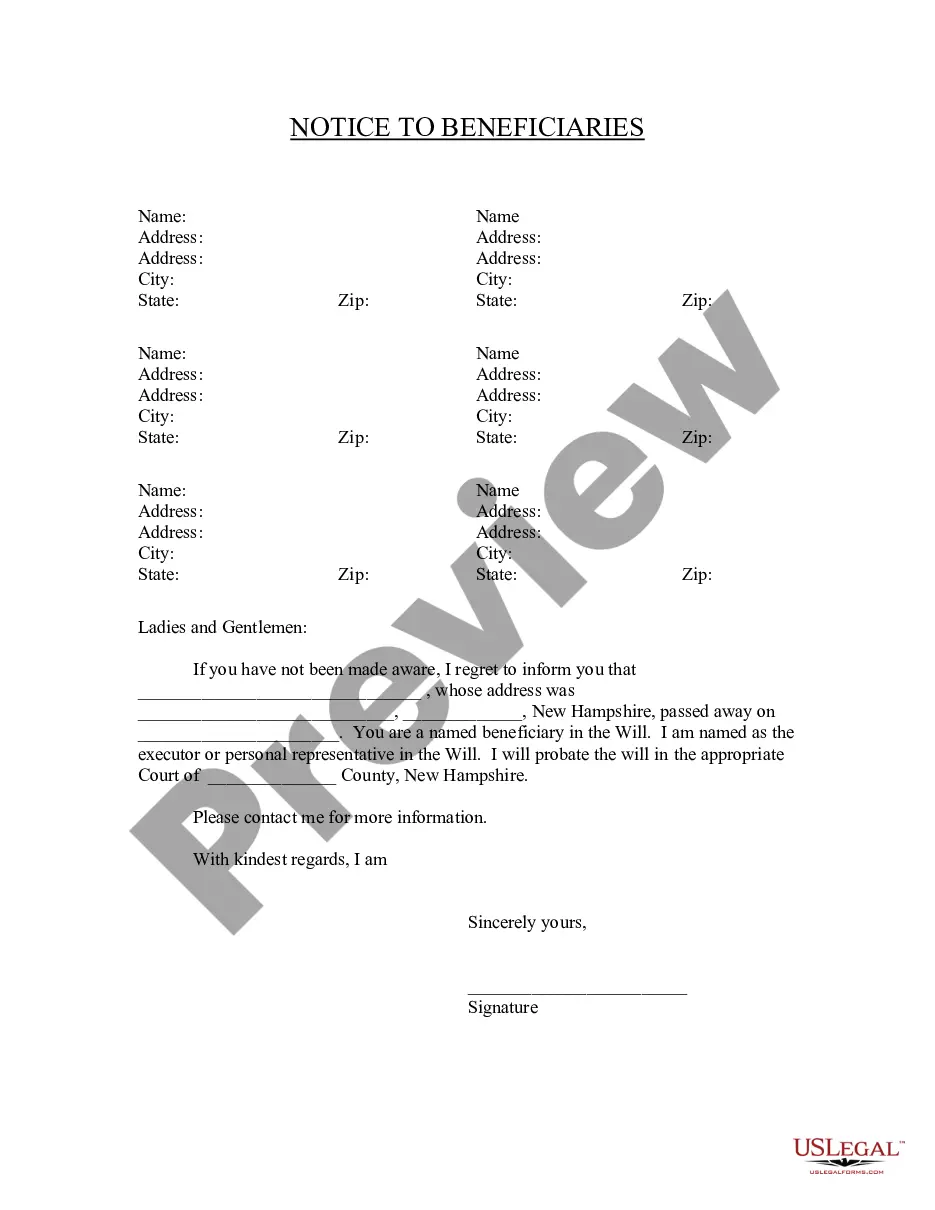

Corpus Christi Sample Corporate Records for a Texas Professional Corporation serve as essential documentation to keep the company compliant with state regulations and maintain transparency in all business operations. These records provide a detailed account of the corporation's activities, financial transactions, and corporate governance. Here are some of the different types of Corpus Christi Sample Corporate Records that should be maintained: 1. Articles of Incorporation: These are the official documents submitted to the Texas Secretary of State to establish the professional corporation. They contain essential information such as the corporation's name, purpose, registered agent details, and authorized shares. 2. Bylaws: The bylaws of a professional corporation outline its internal organization and governance structure. They establish guidelines for shareholder meetings, director qualifications, voting procedures, and other corporate matters. 3. Shareholder Agreement: This agreement governs the relationship between shareholders and outlines their rights, responsibilities, and restrictions. It may include provisions related to share transfers, dividend distributions, preemptive rights, and dispute resolution mechanisms. 4. Meeting Minutes: Detailed records of all shareholder and board of directors' meetings, including annual meetings and special sessions, should be maintained. These minutes should document attendees, decisions made, voting outcomes, and other significant discussions. 5. Shareholder and Director Register: A register containing relevant information about each shareholder and director, such as their name, contact details, and shareholdings, should be updated regularly. This helps track ownership changes and contact persons for corporate communication. 6. Financial Statements: Comprehensive financial records, including balance sheets, income statements, and cash flow statements, should be prepared periodically. These statements provide an overview of the corporation's financial health, performance, and trends over time. 7. Stock Ledger: The stock ledger serves as a record of all stock issuance, transfers, cancellations, and ownership changes. It should include details like the shareholder's name, number of shares held, certificate numbers, and dates of transactions. 8. Tax Records: Documentation related to tax filings, including federal, state, and local tax returns, supporting schedules, and payment records should be maintained. This ensures compliance with tax laws and facilitates audits or inquiries, if necessary. 9. Licenses and Permits: Copies of any licenses or permits obtained by the professional corporation, such as professional licenses, should be included as part of the corporate records to demonstrate legal compliance. 10. Contracts and Agreements: Any legally binding contracts or agreements entered into by the corporation should be filed and kept as part of the corporate records. Examples may include client contracts, vendor agreements, lease agreements, and employment contracts. It is crucial for a professional corporation in Corpus Christi, Texas, to maintain accurate and up-to-date corporate records as failure to do so may result in legal and operational consequences. These records enable transparent decision-making, protect shareholders' interests, and ensure compliance with corporate and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Corpus Christi Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

Description

How to fill out Corpus Christi Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

Are you in search of a reliable and cost-effective provider of legal forms to acquire the Corpus Christi Sample Corporate Records for a Texas Professional Corporation? US Legal Forms is your primary choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of forms to advance your divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for individual and corporate use. All templates we provide are not universal; they are tailored in accordance with the requirements of specific states and regions.

To obtain the form, you must Log Into your account, find the necessary form, and click the Download button adjacent to it. Please remember that you can re-download your previously purchased document templates at any time from the My documents section.

Is it your first time visiting our platform? No problem. You can set up an account within minutes, but before doing so, ensure to follow these steps.

Now you can create your account. Then select the subscription plan and proceed with the payment. After the payment is finalized, download the Corpus Christi Sample Corporate Records for a Texas Professional Corporation in any available format. You can revisit the website whenever you wish and re-download the form at no additional cost.

Obtaining contemporary legal forms has never been simpler. Try US Legal Forms today, and eliminate the need to spend hours understanding legal documentation online once and for all.

- Verify if the Corpus Christi Sample Corporate Records for a Texas Professional Corporation meets the laws of your state and locality.

- Review the description of the form (if provided) to understand who and what the form is aimed at.

- Start over the search if the form does not suit your legal situation.

Form popularity

FAQ

In a handful of states, such as Texas, a professional association is an entirely separate type of business entity. Although their legal framework is based in Texas corporate law, they're not technically ?true corporations?, rendering them separate from PCs and other types of professional entities.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

In Texas, professional corporations are comprised of groups such as architects, attorneys, certified public accountants, dentists, and veterinarians. All professionals within a professional corporation must be properly certified or licensed by the state in which they incorporate.

A professional association is a professional entity formed for the purpose of providing the professional service rendered by a doctor of medicine, doctor of osteopathy, doctor of podiatry, dentist, chiropractor, optometrist, therapeutic optometrist, veterinarian, or licensed mental health professional.

Yes. Tex. Gov Ann. 406.013 requires a Texas notary to use a seal of office to authenticate all his or her acts.

Texas law does not require a business to have a seal; therefore the secretary of state does not have information or regulations on how to design a seal or where to obtain one. Seals, stock certificates, and minute books can be purchased from book stores, office supply stores, or corporate service companies.

State Seal Laws In states such as New York and California, you do not need corporate seals. For instance, California statutes give corporations the authority to use and adopt corporate seals, but having a seal has no effect on the validity of any documents or instruments.

A corporate seal is no longer required by LLCs or Corporations and any state in the United States. Although both a corporate seal and official stock certificates were once required for corporations, like spurs on a boot, these remnants of the past are no longer functional or relevant.

You can find information on any corporation or business entity in Texas or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

A professional corporation is a corporation that is formed for the purpose of providing a professional service that by law a for-profit or nonprofit corporation is prohibited from rendering.