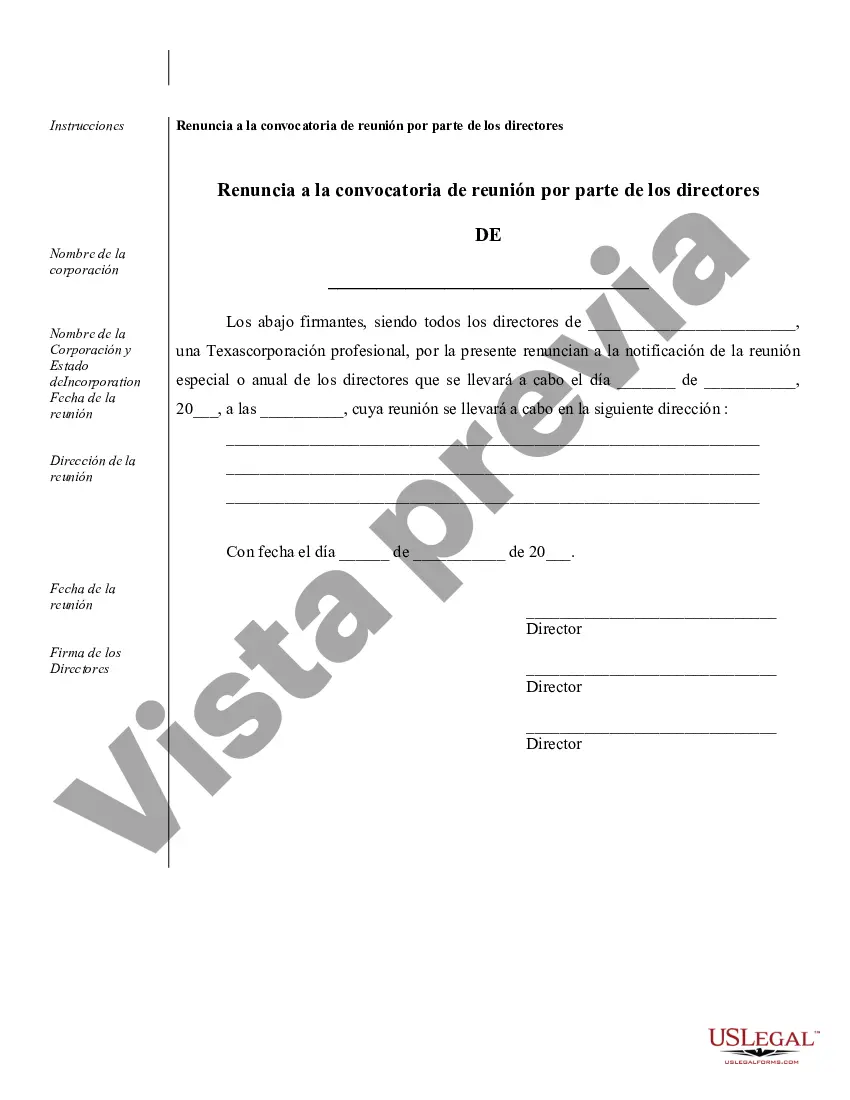

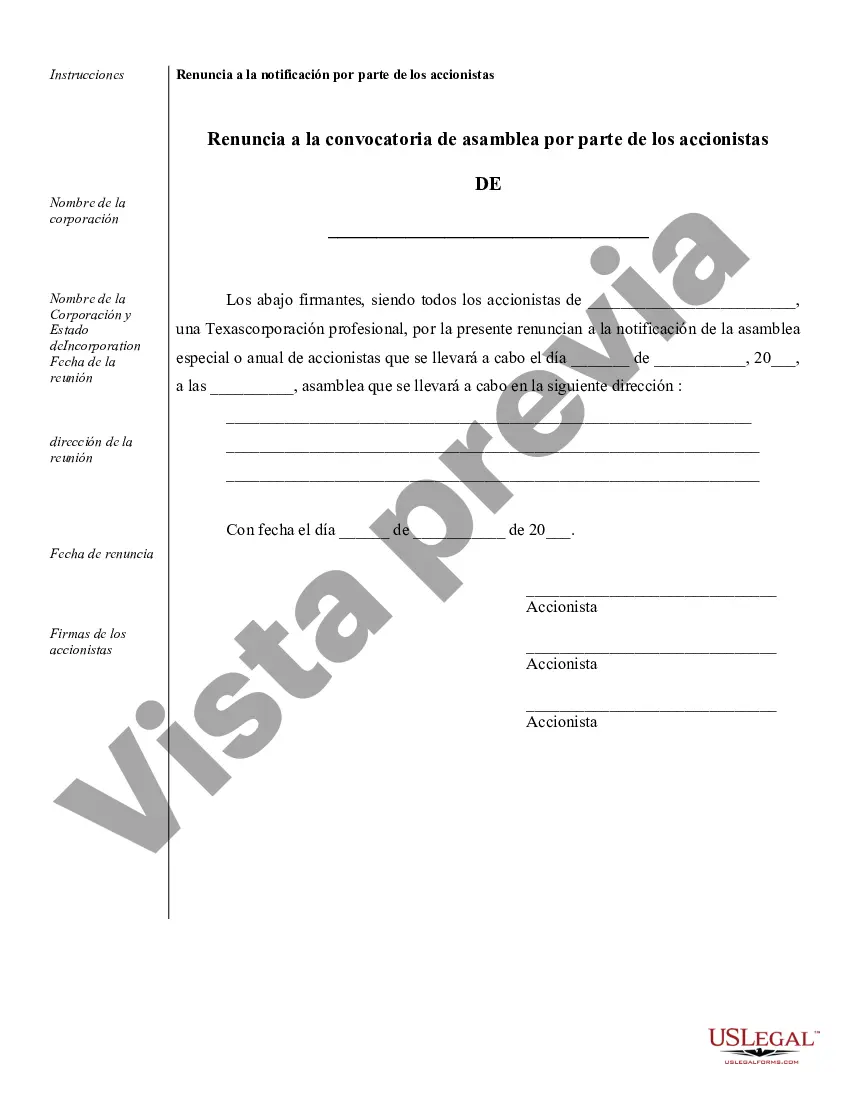

Harris Sample Corporate Records for a Texas Professional Corporation are essential documents that provide comprehensive and accurate information about the company's operations, structure, and legal obligations. These records serve as a crucial reference for internal management, external audits, legal compliance, and transactions involving the corporation. They are legally required and play an important role in maintaining transparency and good corporate governance. The various types of Harris Sample Corporate Records for a Texas Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and contains essential details such as the corporation's name, stated purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder meetings, director appointments, and voting processes. 3. Shareholder Records: This set of records includes information about the individuals or entities who hold shares in the corporation. It outlines the number and class of shares held, their ownership percentages, and any transfer or voting restrictions. 4. Director and Officer Records: These records document the identities, positions, and duties of the corporation's directors and officers. They may also include information about their compensation, employment contracts, and any conflicts of interest. 5. Meeting Minutes: Detailed minutes of meetings, including those of the board of directors and shareholders, are documented and preserved. These minutes record the decisions made, discussions held, and voting results for future reference and legal compliance. 6. Financial Records: These records include financial statements, accounting documents, and budgets that provide an overview of the corporation's financial health and performance. They also encompass tax filings, invoices, receipts, and other financial transactions. 7. Stock Transfer Ledger: This ledger maintains a record of all stock transfers and issuance, including dates, details of the parties involved, and any restrictions or conditions associated with the transfers. 8. Annual Reports: Harris Sample Corporate Records may also contain annual reports that summarize the corporation's activity and financial status over the past year. These reports provide a comprehensive overview of the corporation's performance to shareholders and regulatory bodies. These various types of Harris Sample Corporate Records for a Texas Professional Corporation are crucial in ensuring the company's compliance with legal and regulatory requirements, facilitating transparency among shareholders, and preserving accurate records of its operations. It is essential to maintain these records consistently and keep them updated to support the corporation's smooth functioning and growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

State:

Texas

County:

Harris

Control #:

TX-PC-CR

Format:

Word

Instant download

Description

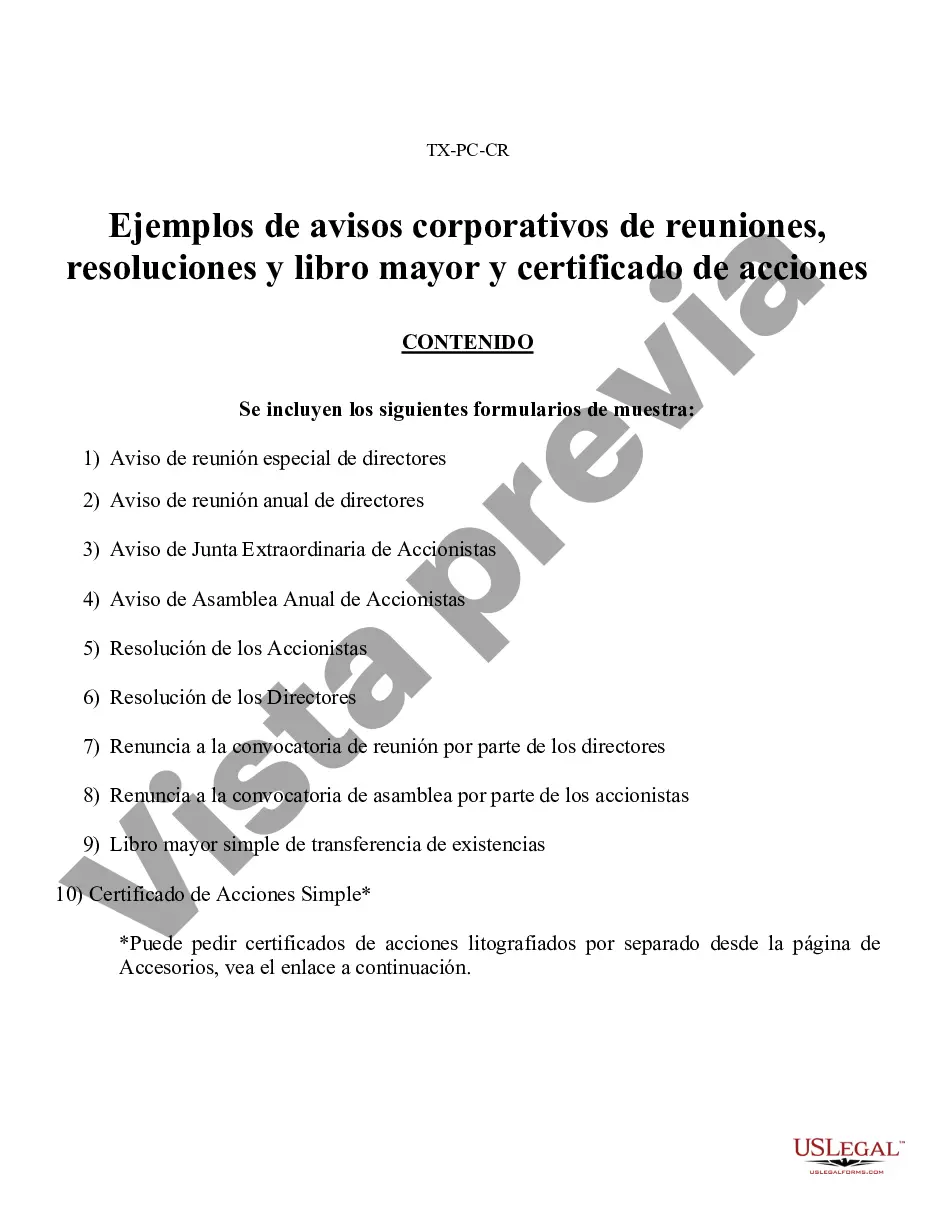

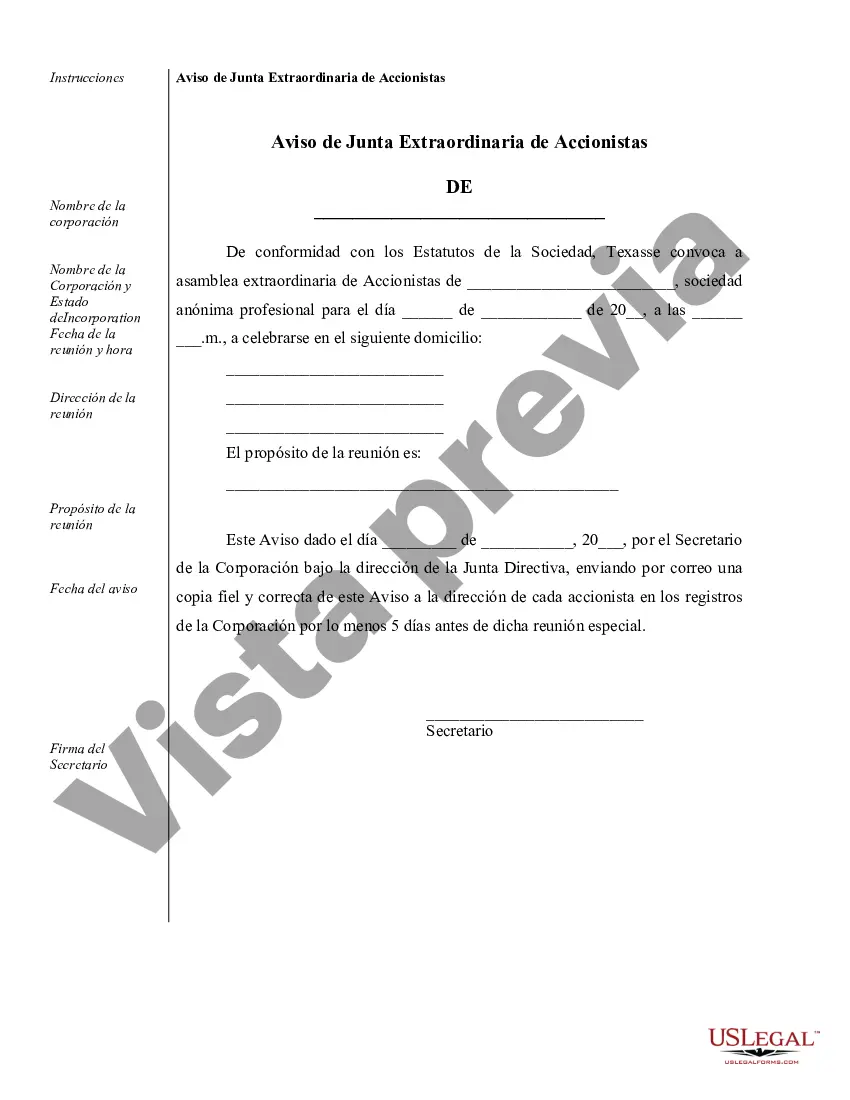

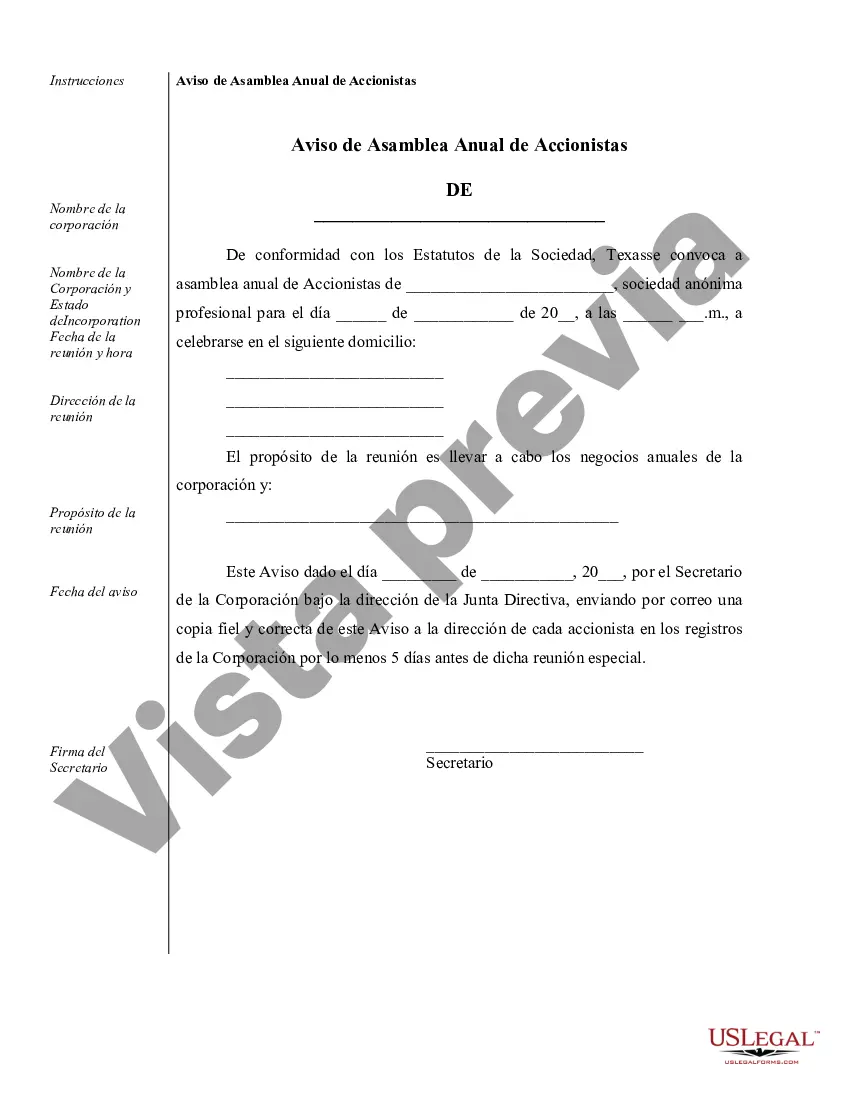

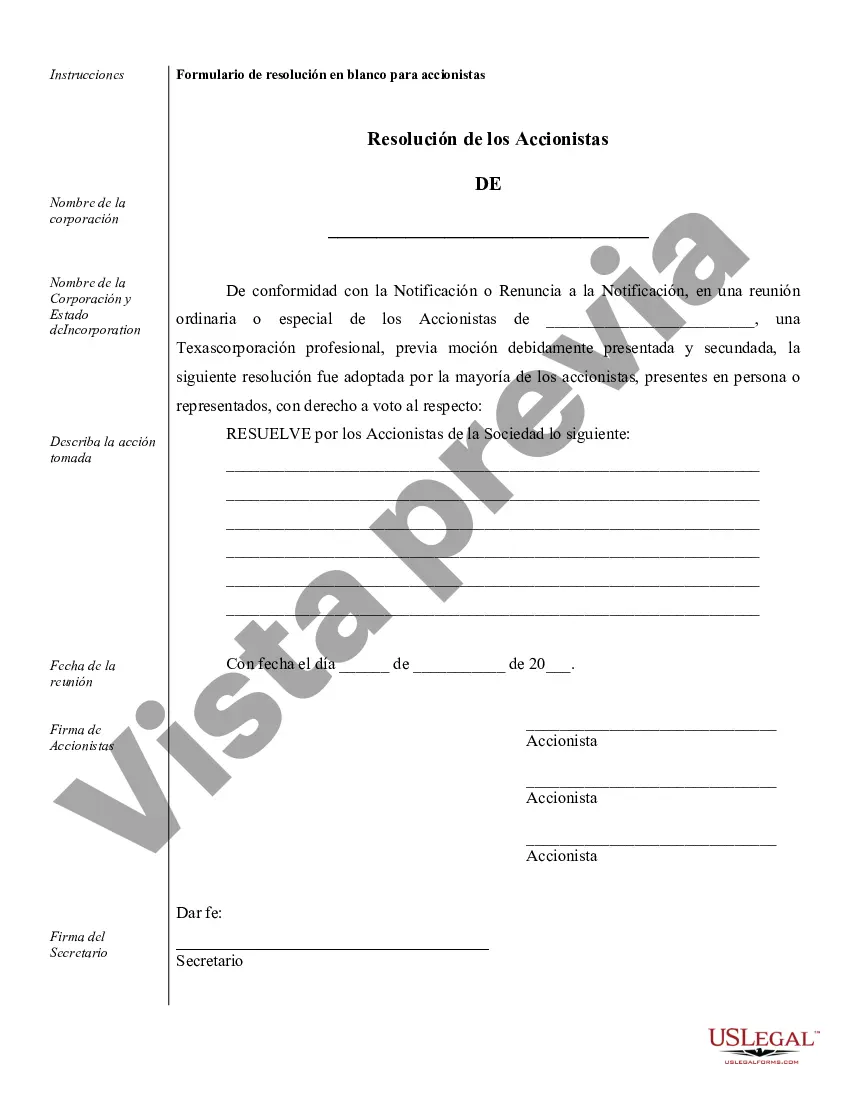

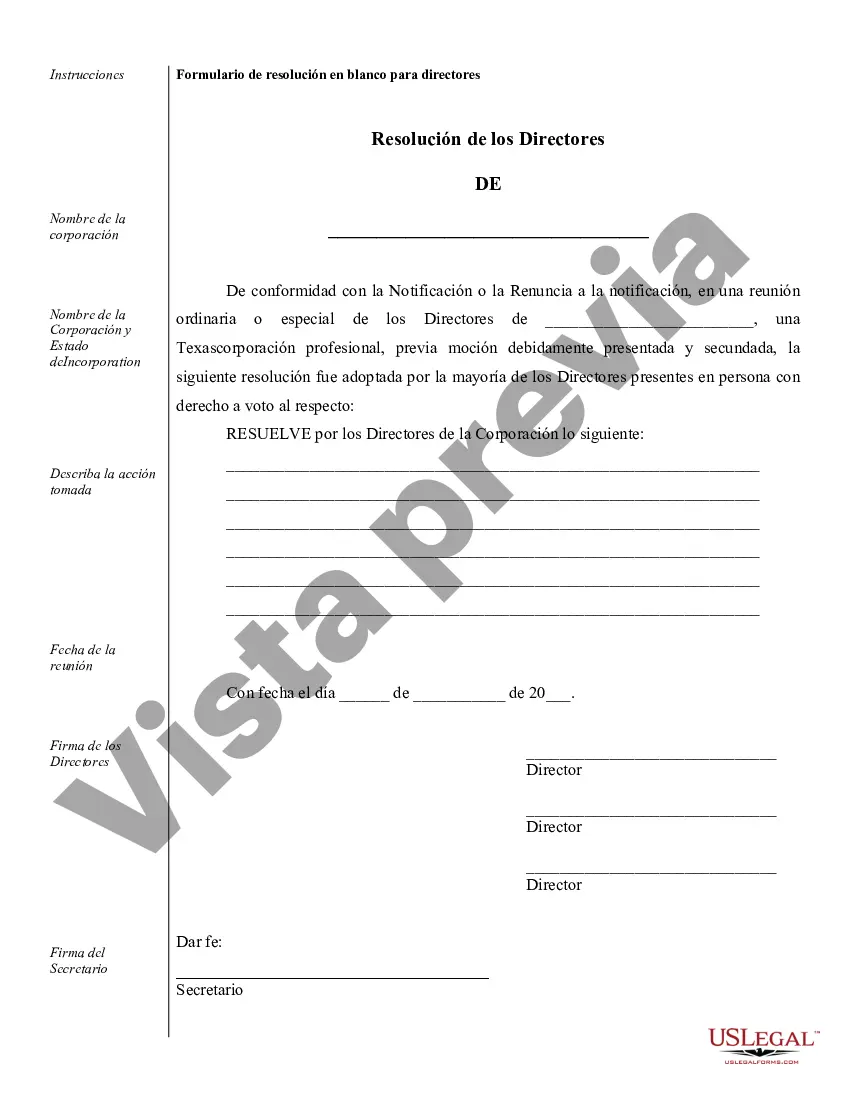

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

Harris Sample Corporate Records for a Texas Professional Corporation are essential documents that provide comprehensive and accurate information about the company's operations, structure, and legal obligations. These records serve as a crucial reference for internal management, external audits, legal compliance, and transactions involving the corporation. They are legally required and play an important role in maintaining transparency and good corporate governance. The various types of Harris Sample Corporate Records for a Texas Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and contains essential details such as the corporation's name, stated purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder meetings, director appointments, and voting processes. 3. Shareholder Records: This set of records includes information about the individuals or entities who hold shares in the corporation. It outlines the number and class of shares held, their ownership percentages, and any transfer or voting restrictions. 4. Director and Officer Records: These records document the identities, positions, and duties of the corporation's directors and officers. They may also include information about their compensation, employment contracts, and any conflicts of interest. 5. Meeting Minutes: Detailed minutes of meetings, including those of the board of directors and shareholders, are documented and preserved. These minutes record the decisions made, discussions held, and voting results for future reference and legal compliance. 6. Financial Records: These records include financial statements, accounting documents, and budgets that provide an overview of the corporation's financial health and performance. They also encompass tax filings, invoices, receipts, and other financial transactions. 7. Stock Transfer Ledger: This ledger maintains a record of all stock transfers and issuance, including dates, details of the parties involved, and any restrictions or conditions associated with the transfers. 8. Annual Reports: Harris Sample Corporate Records may also contain annual reports that summarize the corporation's activity and financial status over the past year. These reports provide a comprehensive overview of the corporation's performance to shareholders and regulatory bodies. These various types of Harris Sample Corporate Records for a Texas Professional Corporation are crucial in ensuring the company's compliance with legal and regulatory requirements, facilitating transparency among shareholders, and preserving accurate records of its operations. It is essential to maintain these records consistently and keep them updated to support the corporation's smooth functioning and growth.

Free preview

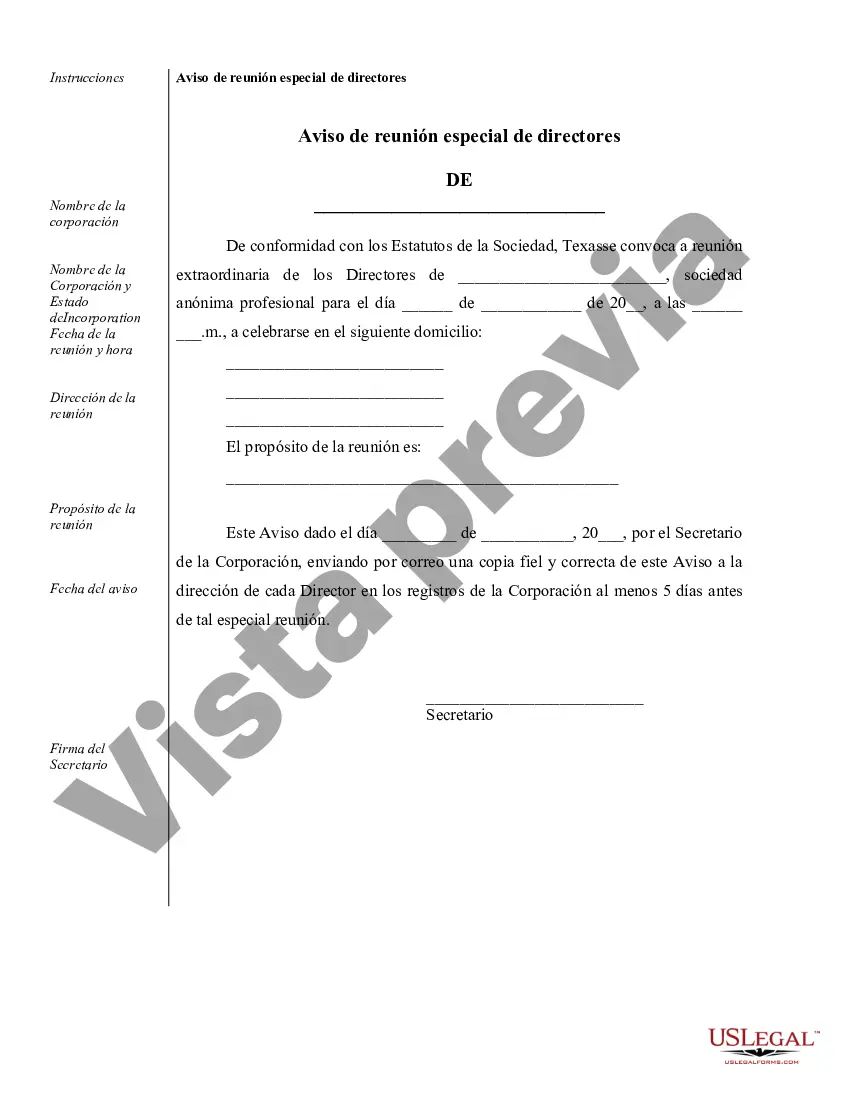

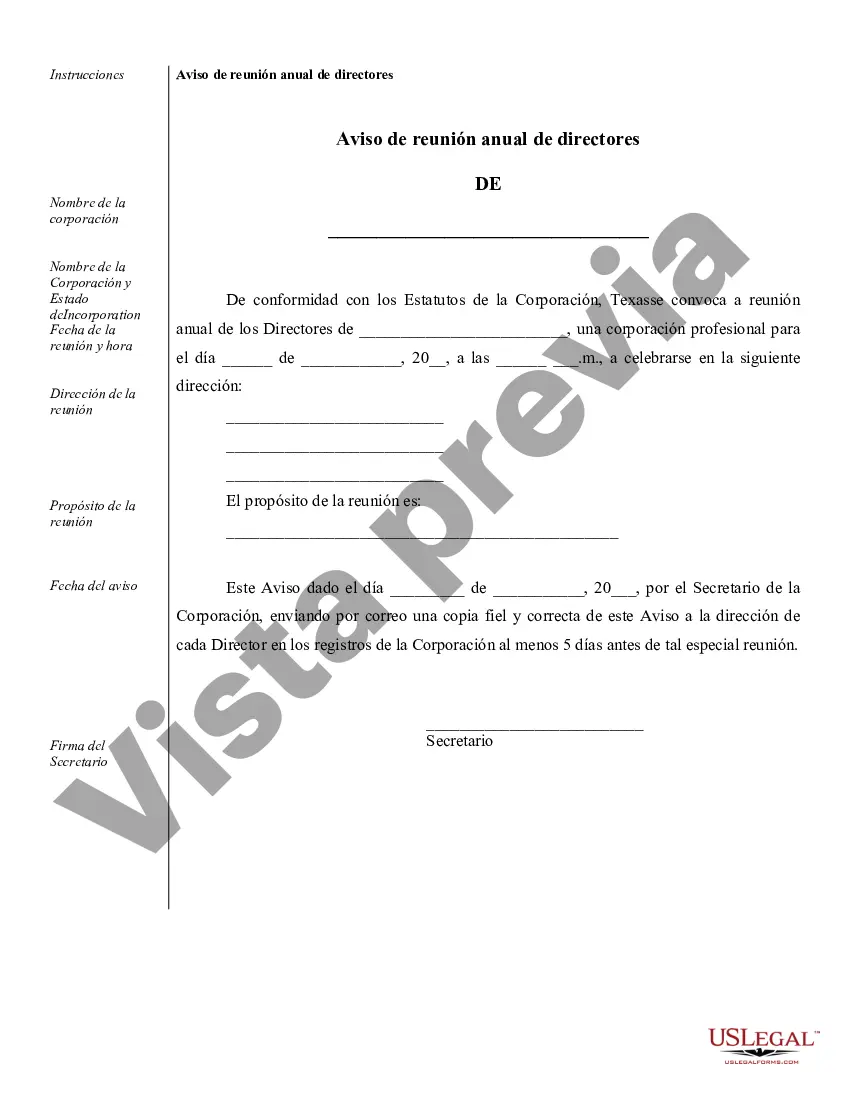

How to fill out Harris Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

If you’ve already utilized our service before, log in to your account and save the Harris Sample Corporate Records for a Texas Professional Corporation on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Harris Sample Corporate Records for a Texas Professional Corporation. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!