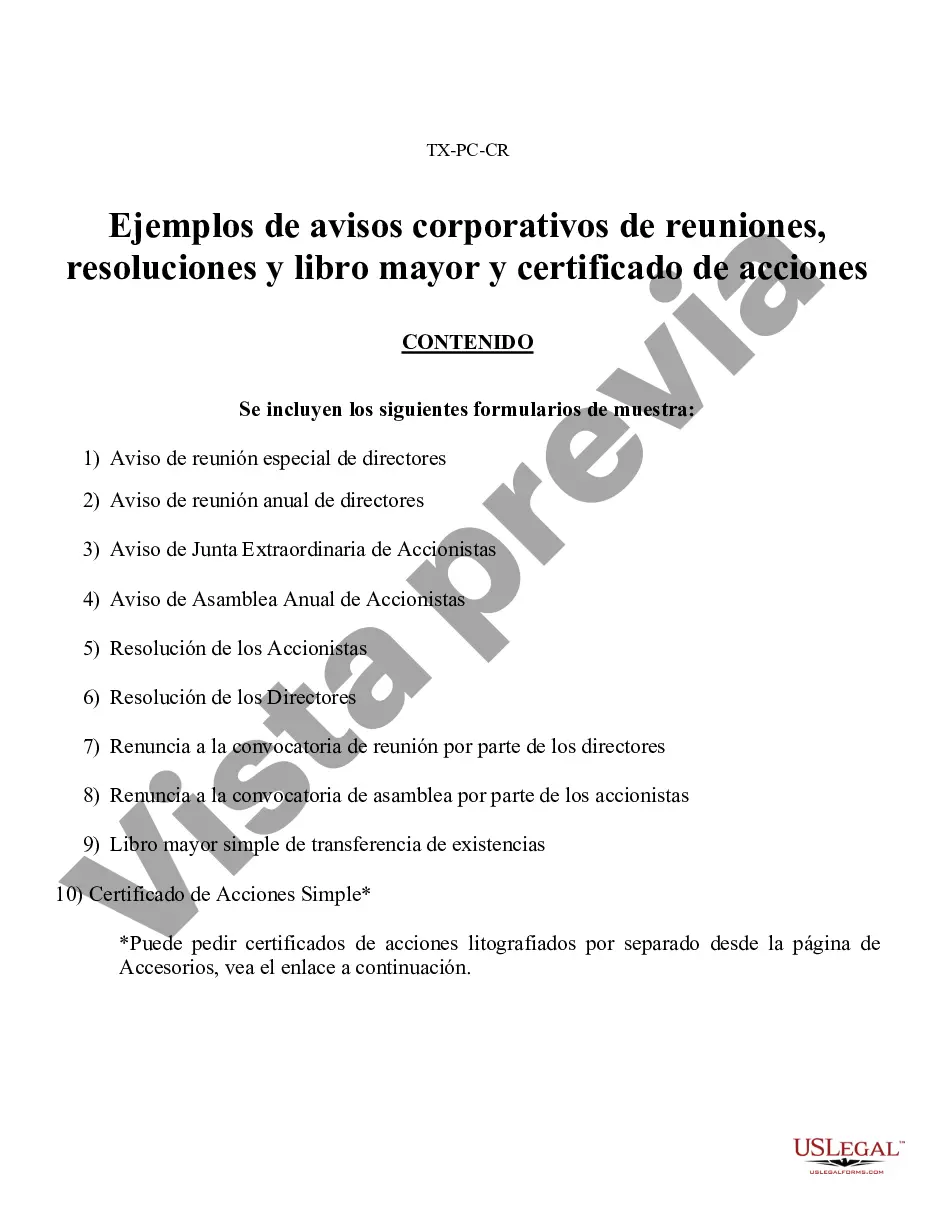

Plano Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

Description

How to fill out Plano Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

Regardless of social or professional standing, completing legal documents is an unfortunate requirement in today’s work environment.

Frequently, it’s nearly impossible for someone without any legal background to create such documents from the beginning, largely due to the complex terminology and legal nuances they contain.

This is where US Legal Forms can be a lifesaver.

Ensure the document you have found is appropriate for your region as the regulations of one state or county do not apply to another state or county.

Review the form and read a brief overview (if available) of situations where the document can be utilized.

- Our platform provides a vast assortment with over 85,000 ready-to-use state-specific documents suitable for virtually any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who wish to enhance their efficiency by using our DIY forms.

- Irrespective of whether you require the Plano Sample Corporate Records for a Texas Professional Corporation or any other documents that will be applicable in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly obtain the Plano Sample Corporate Records for a Texas Professional Corporation using our trustworthy platform.

- If you are currently an existing user, you can proceed to Log In to your account to access the suitable form.

- However, if you are not familiar with our library, make sure to follow these steps before acquiring the Plano Sample Corporate Records for a Texas Professional Corporation.

Form popularity

FAQ

Search for a business entity (Corporation, LLC, Limited Partnership) in Texas by going to the Secretary of State's Website. Preform a lookup by Name, Tax ID Number, or File Number.

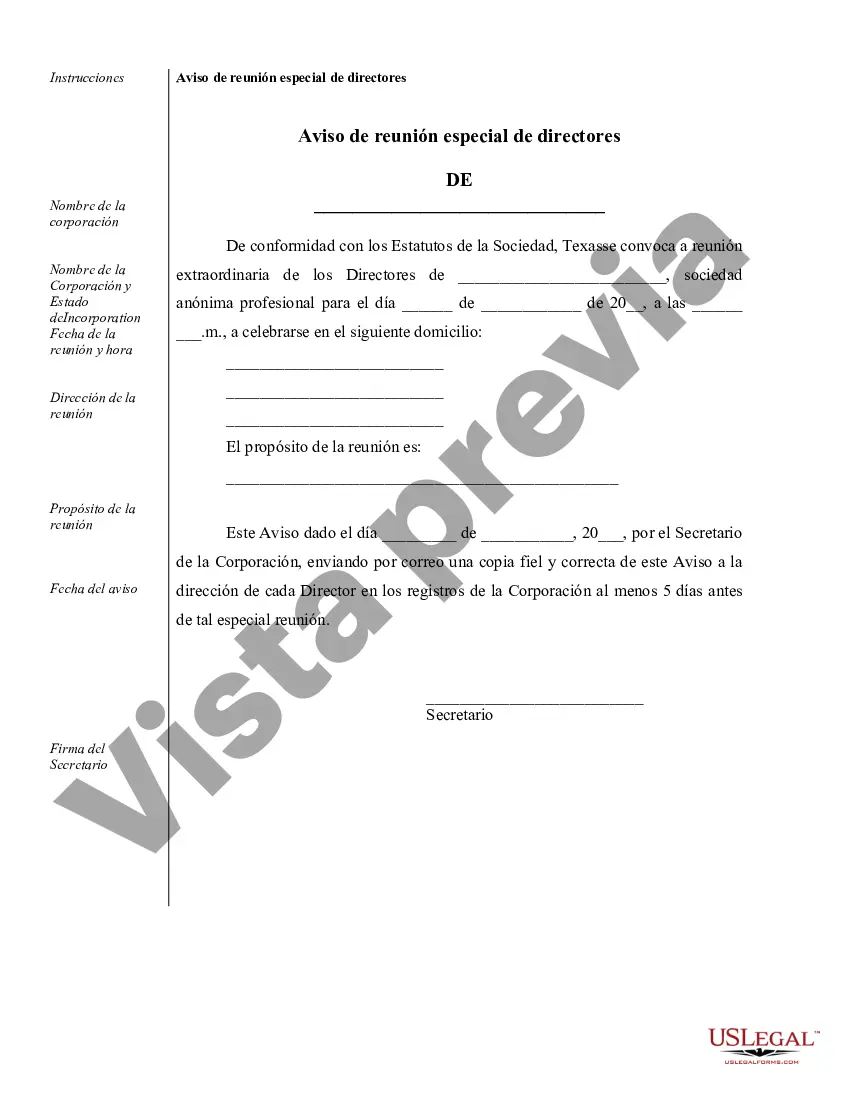

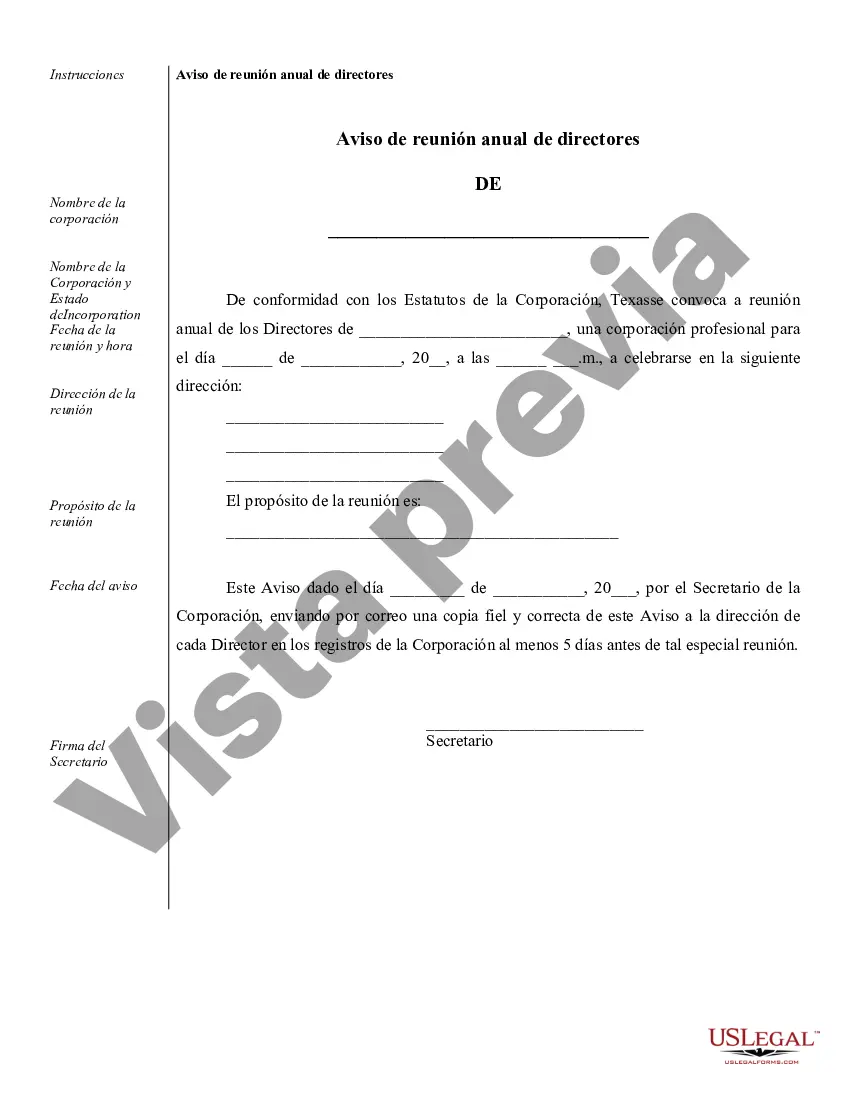

Professional corporations (PCs), or professional service corporations, are a unique corporate structure which is comprised of a specific group of professionals. An S corporation or a C corporation may be formed by certain professionals including physicians, attorneys, engineers, or accountants.

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.

You can call State Business Information at 512-463-5555. They are available Monday through Friday from 8 a.m. to 5 p.m. Central Time.

A professional corporation is a corporation that is formed for the purpose of providing a professional service that by law a for-profit or nonprofit corporation is prohibited from rendering.

Search for a business entity (Corporation, LLC, Limited Partnership) in Texas by going to the Secretary of State's Website. Preform a lookup by Name, Tax ID Number, or File Number.

You can either file this document online through the secretary of state's SOSDirect website or submit it by postal mail, along with a filing fee of $300. The main purpose of the articles of organization is to give the state a written document to keep on file.

If your business meets the qualifications, S corporation status allows you to avoid double taxation, thus increasing your net profits. In many states, licensed professionals are not permitted to operate as regular corporations. However, a professional corporation is an alternative that provides limited liability.

A Texas partnership registered as a Texas limited liability partnership (LLP) is required to file an annual report with the secretary of state no later than June 1 of each year following the calendar year in which the application for registration takes effect.

In Texas, professional corporations are comprised of groups such as architects, attorneys, certified public accountants, dentists, and veterinarians. All professionals within a professional corporation must be properly certified or licensed by the state in which they incorporate.