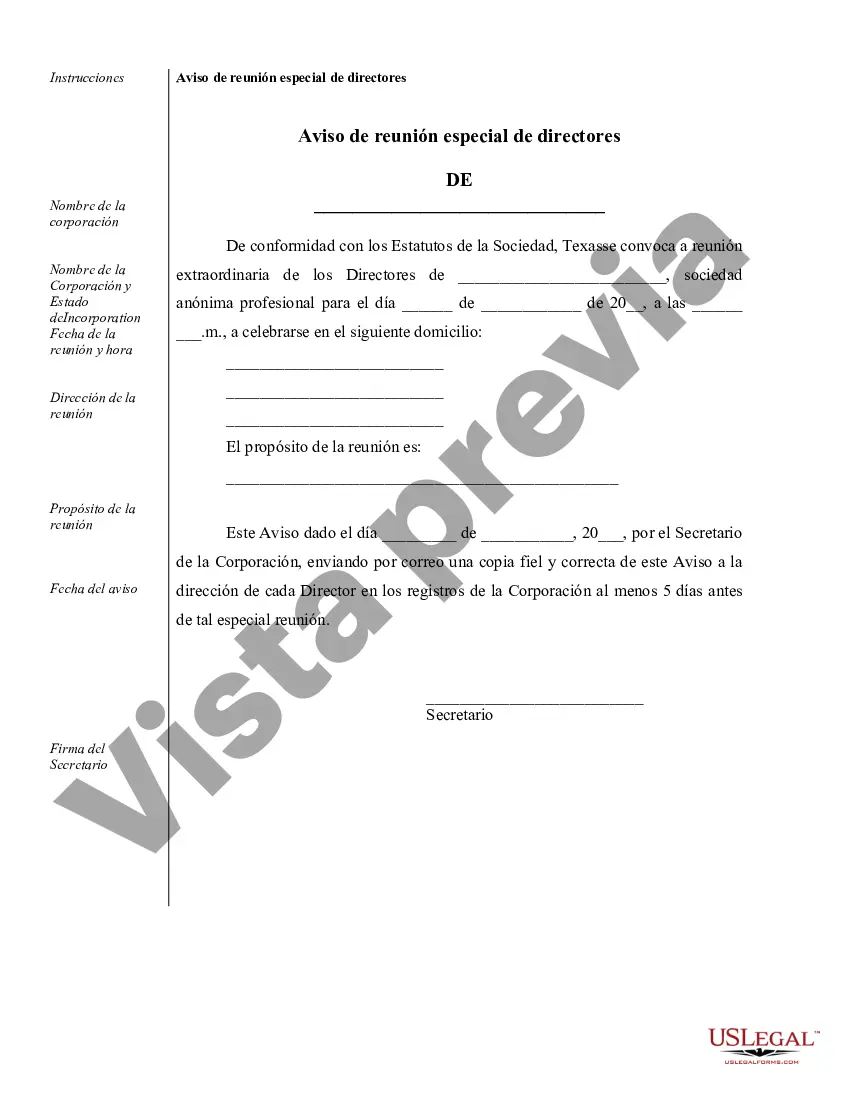

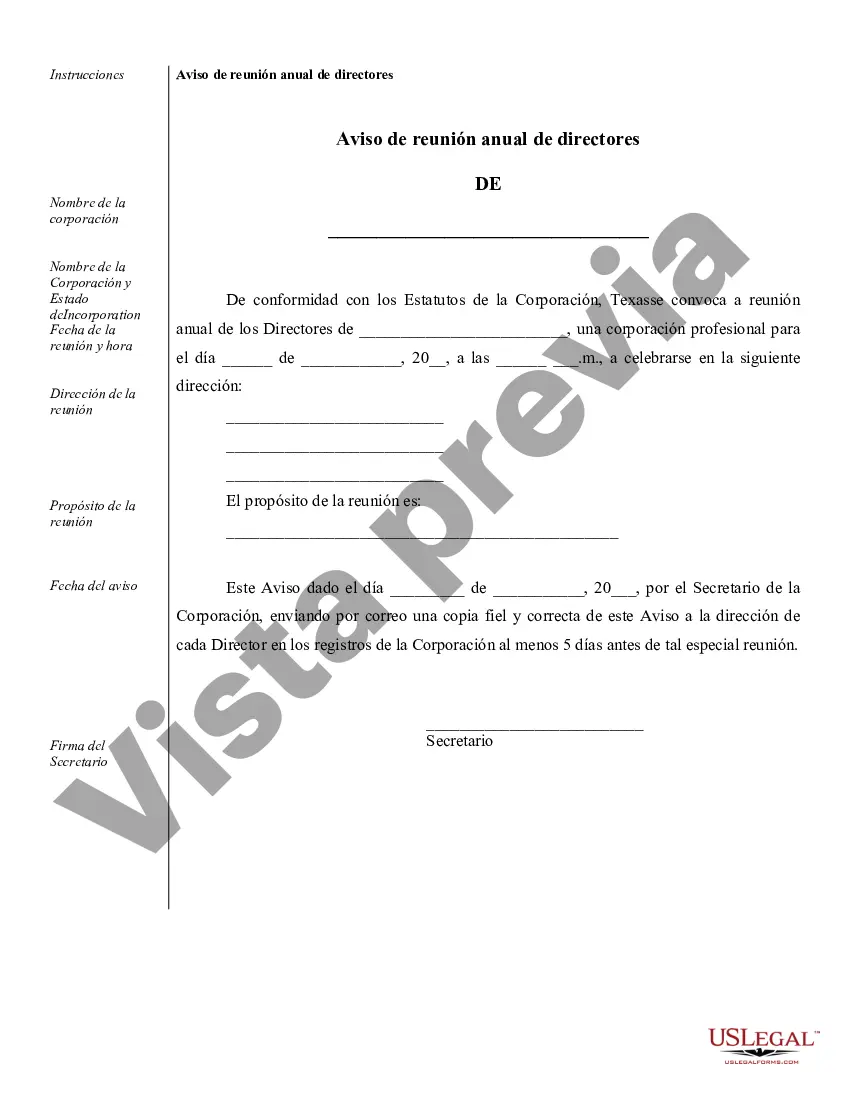

Sugar Land Sample Corporate Records for a Texas Professional Corporation are essential documents that provide an organized overview of the company's operations, financial activities, and legal compliance. These records help corporations in Sugar Land, Texas, maintain transparency, accountability, and ensure proper fulfillment of legal requirements. Here is a detailed description of the various types of Sugar Land Sample Corporate Records for a Texas Professional Corporation: 1. Certificate of Formation: The Certificate of Formation is the foundational document that establishes a professional corporation in Texas. It includes key information such as the corporation's name, purpose, duration, registered agent, directors, and shareholder details. 2. Bylaws: Bylaws outline the rules and regulations that govern the company's internal operations. They cover provisions regarding shareholder meetings, board of directors' responsibilities, voting procedures, and corporate decision-making processes. 3. Shareholder Agreements: Shareholder agreements define the rights, responsibilities, and obligations of the corporation's shareholders. These agreements often address issues such as shareholder voting rights, stock transfers, dividend distributions, and procedures for resolving disputes. 4. Board Resolutions: Board resolutions are official records of decisions made by the board of directors. These resolutions cover a wide range of matters, including approving annual budgets, appointing officers, issuing dividends, acquiring or disposing of assets, and hiring key personnel. 5. Meeting Minutes: Meeting minutes are detailed records of discussions, actions, and decisions made during corporate meetings, such as board of directors meetings or shareholder meetings. These minutes typically include attendance, the meeting agenda, reports from officers or committees, voting outcomes, and any other significant details. 6. Financial Statements: Financial statements provide a comprehensive overview of the corporation's financial position, including balance sheets, income statements, and cash flow statements. These statements should adhere to Generally Accepted Accounting Principles (GAAP) for accurate and transparent reporting. 7. Shareholder Capitalization Records: Shareholder capitalization records document the capital contributed by shareholders, including stock issuance, transfers, ownership percentages, and any restrictions or agreements regarding equity. 8. Annual Reports: Annual reports summarize the corporation's activities and financial performance over the course of a year. These reports usually include a message from the CEO or president, financial highlights, achievements, challenges, and future goals or initiatives. 9. Intellectual Property Records: If the corporation owns or uses intellectual property, records related to patents, trademarks, copyrights, or trade secrets should be documented to protect the company's intellectual assets. 10. Legal and Compliance Records: These records encompass legal documents, licenses, permits, contracts, regulatory filings, and any correspondence related to the corporation's compliance with federal, state, and local laws and regulations. In conclusion, Sugar Land Sample Corporate Records for a Texas Professional Corporation consist of a range of documents that govern the corporation's operations, financial well-being, and legal compliance. By maintaining these records accurately and comprehensively, professional corporations in Sugar Land can ensure smooth operations, transparency, and legal compliance throughout their existence.

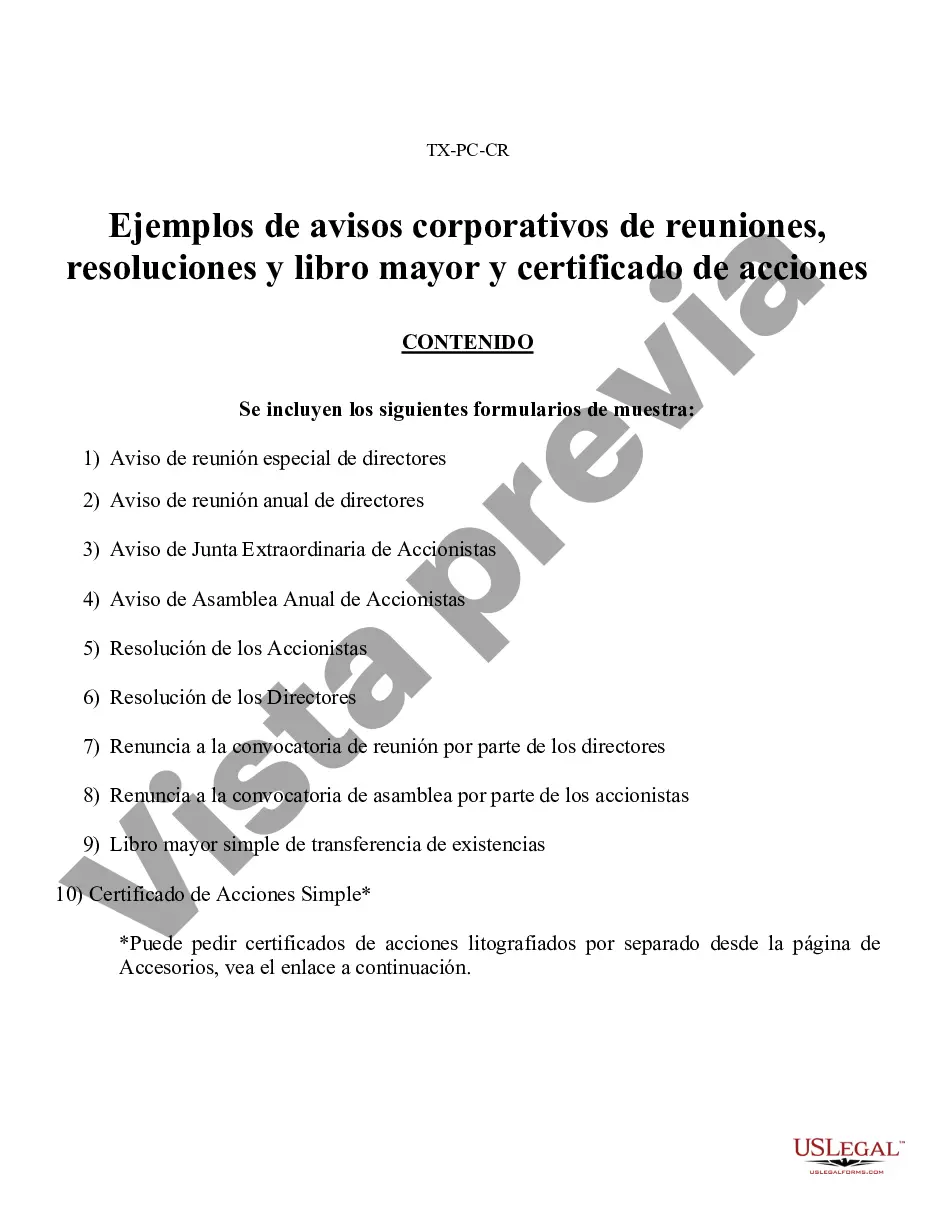

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sugar Land Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

State:

Texas

City:

Sugar Land

Control #:

TX-PC-CR

Format:

Word

Instant download

Description

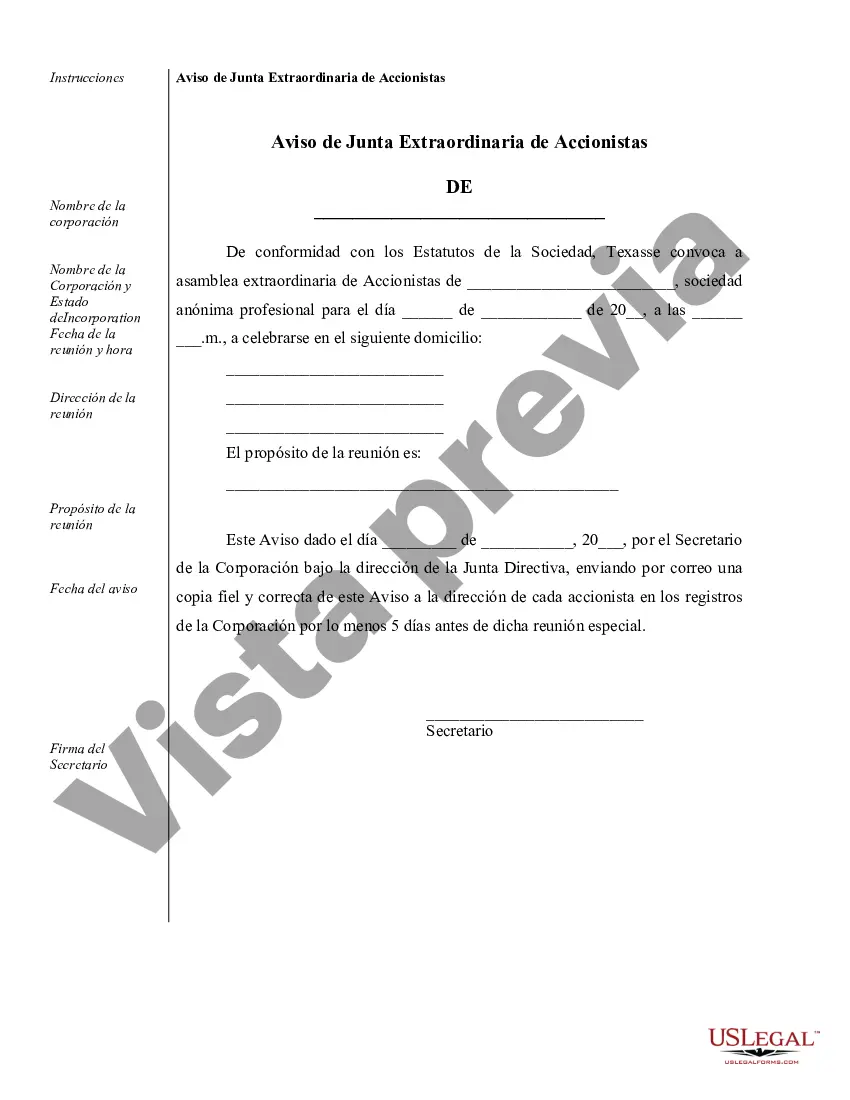

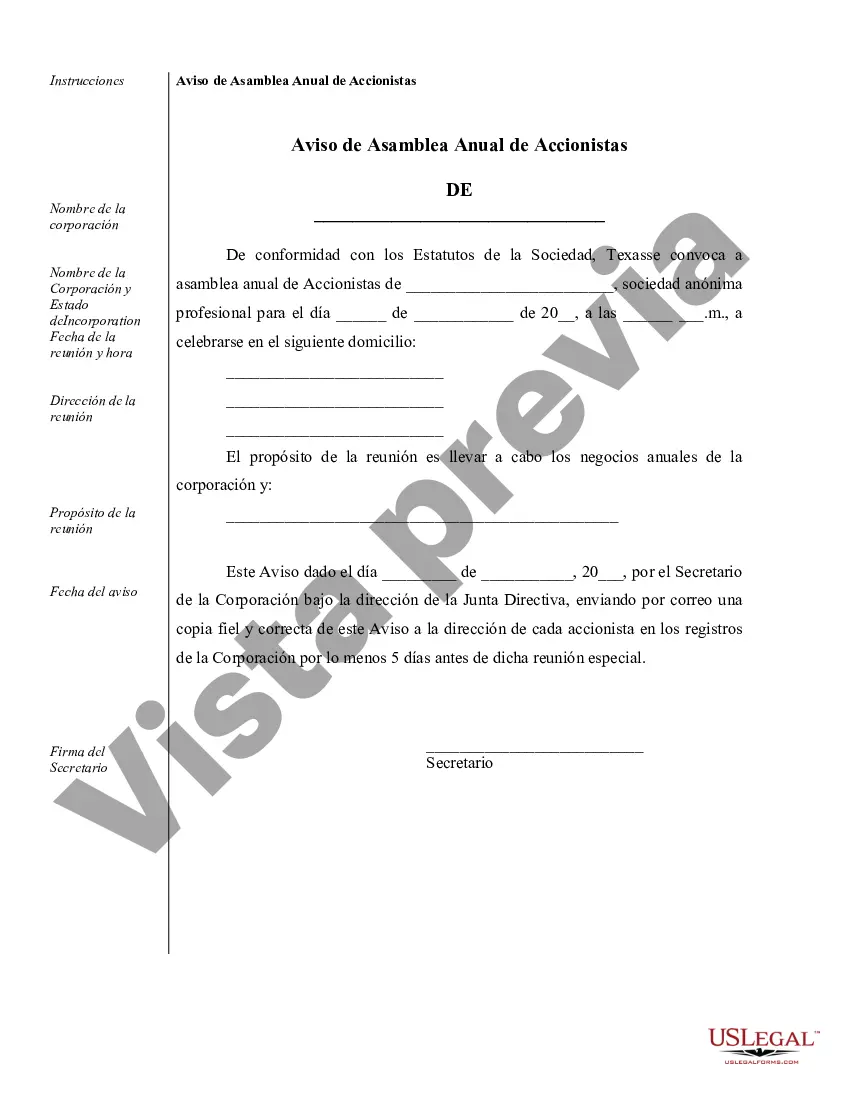

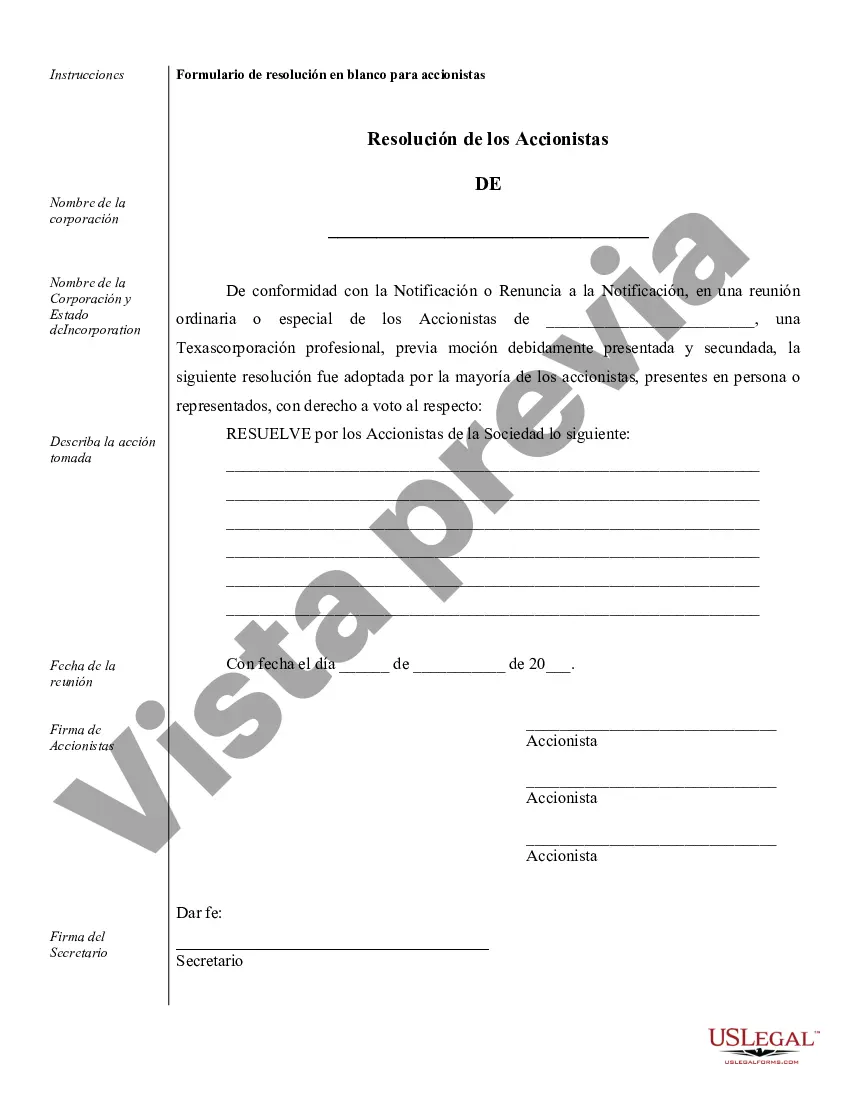

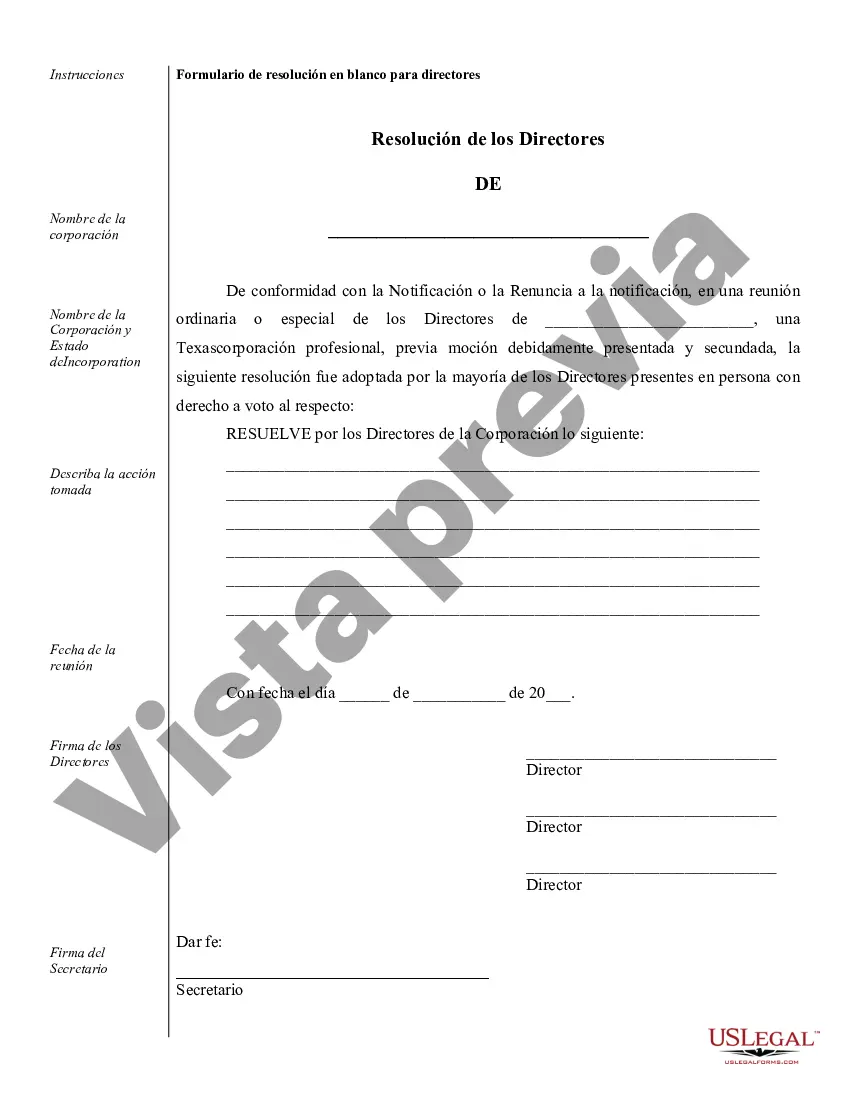

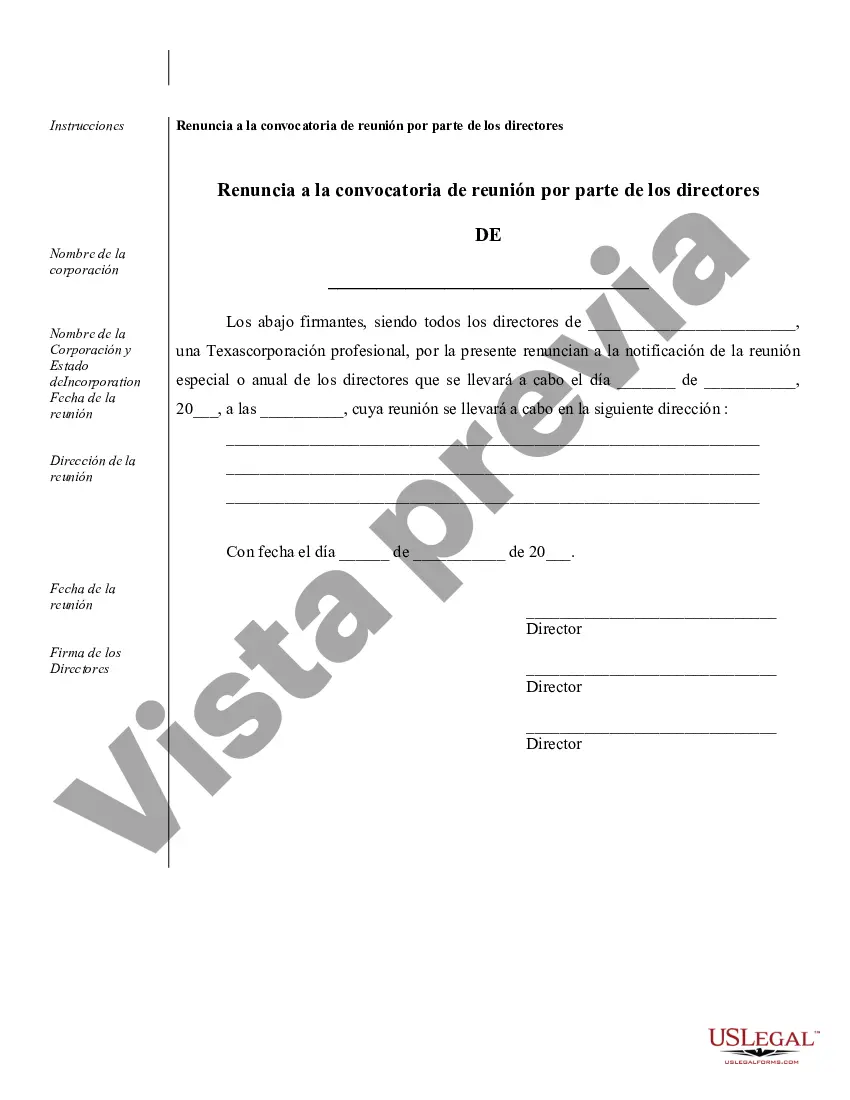

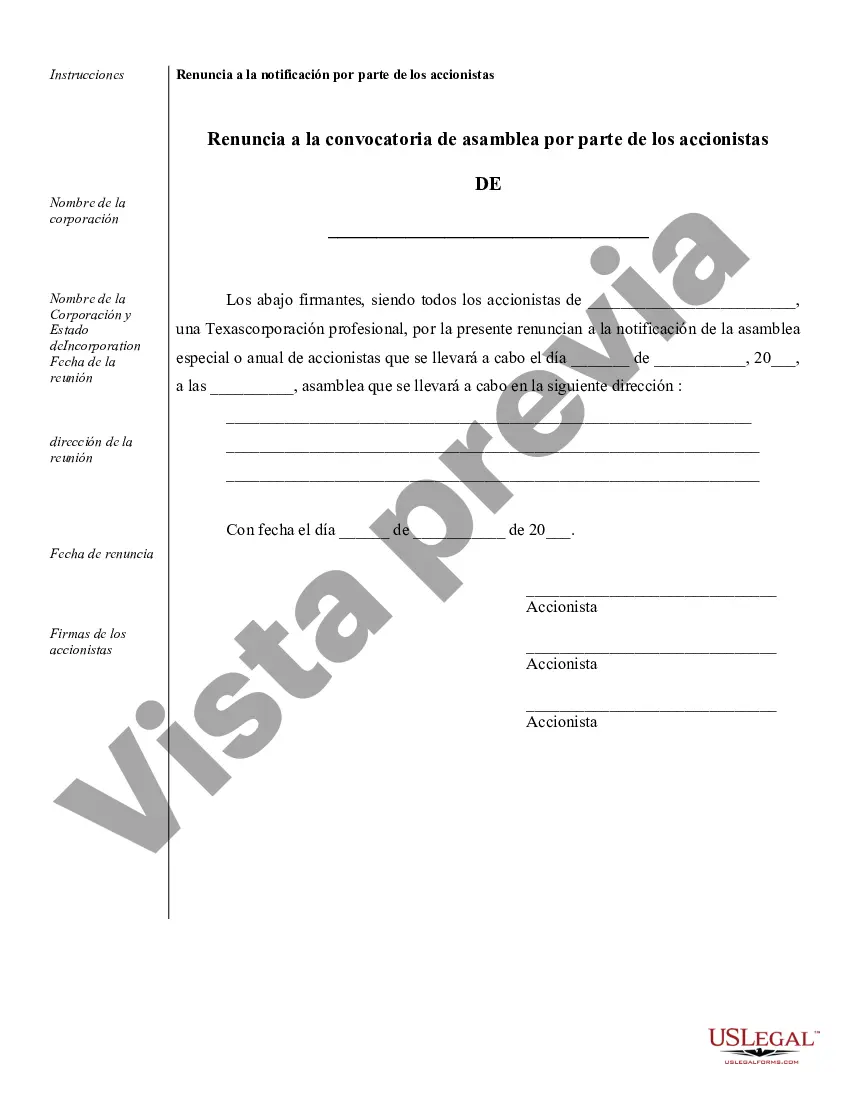

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

Free preview

How to fill out Sugar Land Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is a digital collection encompassing over 85,000 legal forms for personal and professional requirements and various real-world situations.

All the documents are appropriately categorized by usage area and jurisdictional regions, so finding the Sugar Land Sample Corporate Records for a Texas Professional Corporation becomes as swift and simple as 1-2-3.

Maintaining organized paperwork and adhering to legal standards is critically important. Take advantage of the US Legal Forms library to always have essential document templates accessible for any requirements!

- Verify the Preview mode and form details.

- Ensure you’ve chosen the correct one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- Proceed to the next step if it meets your criteria.