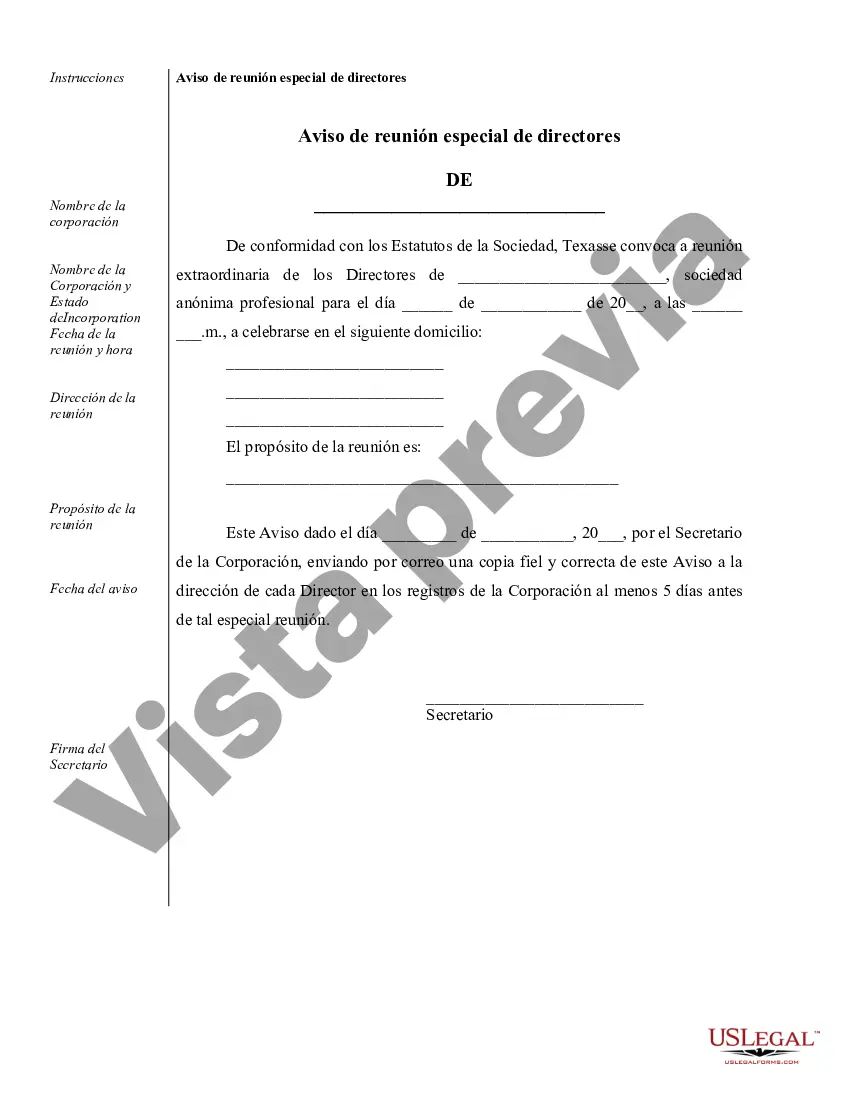

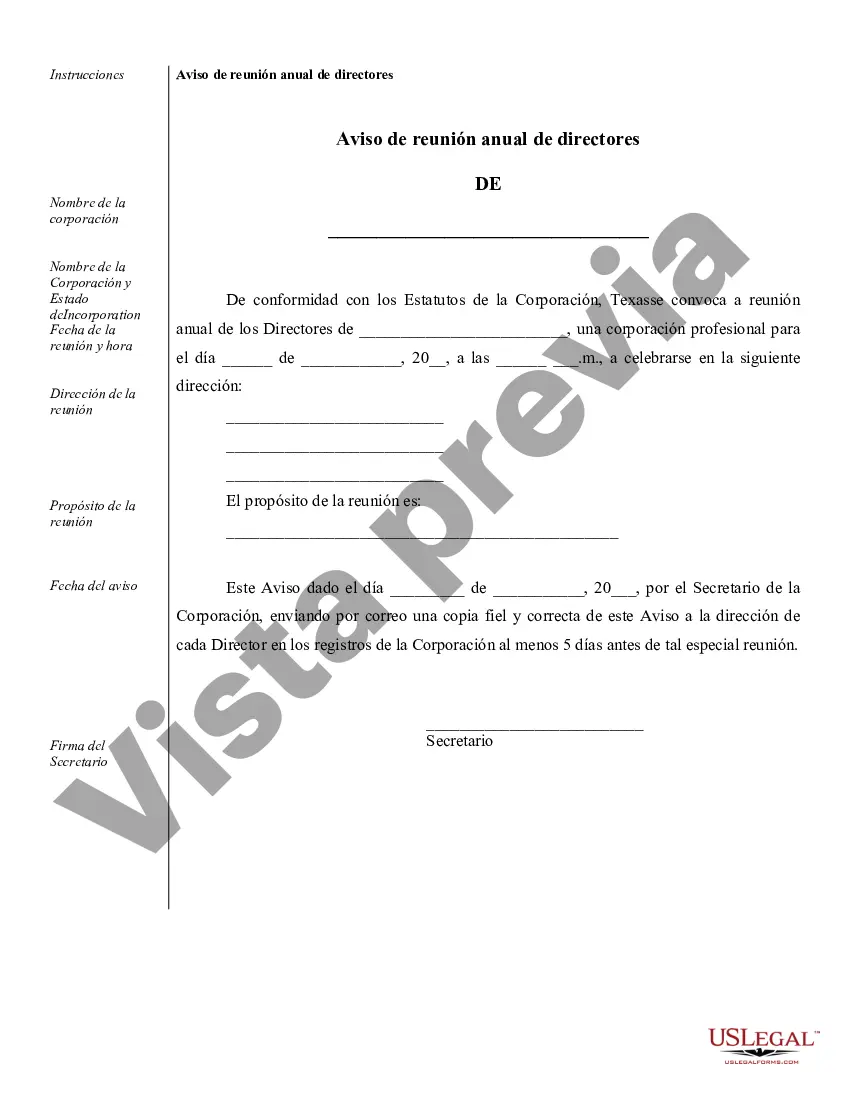

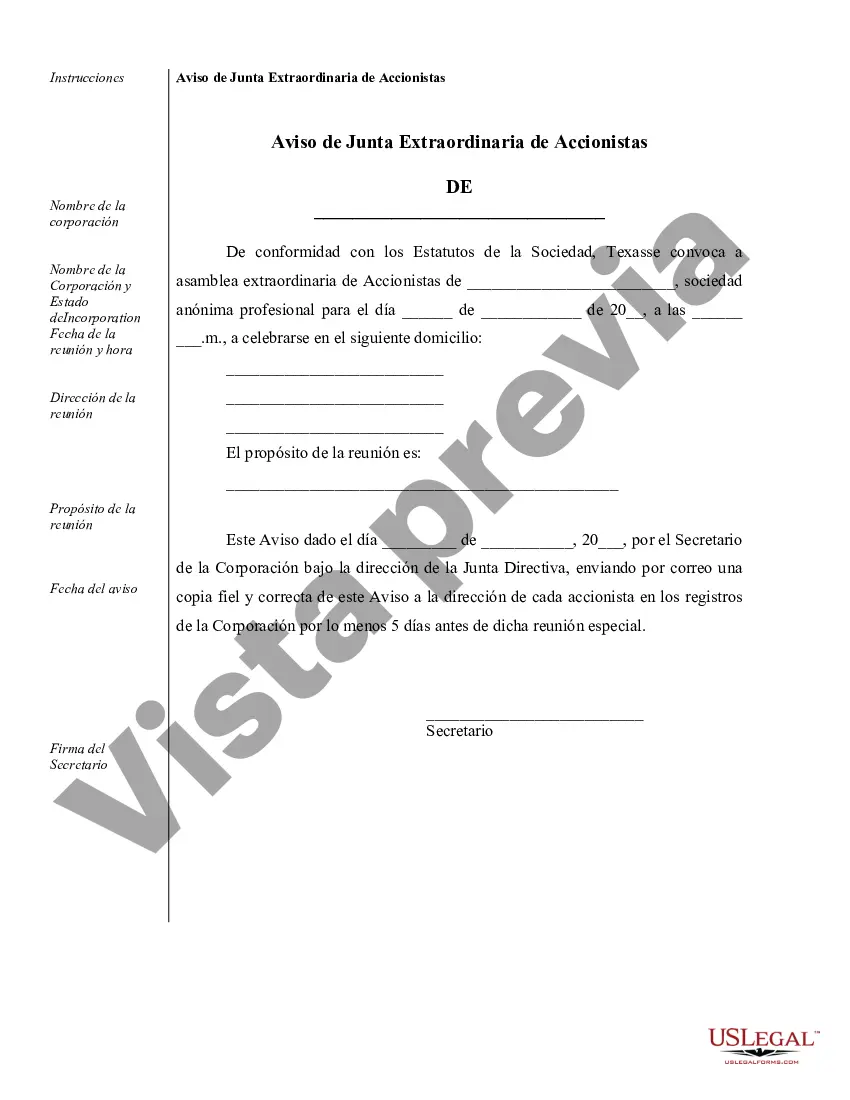

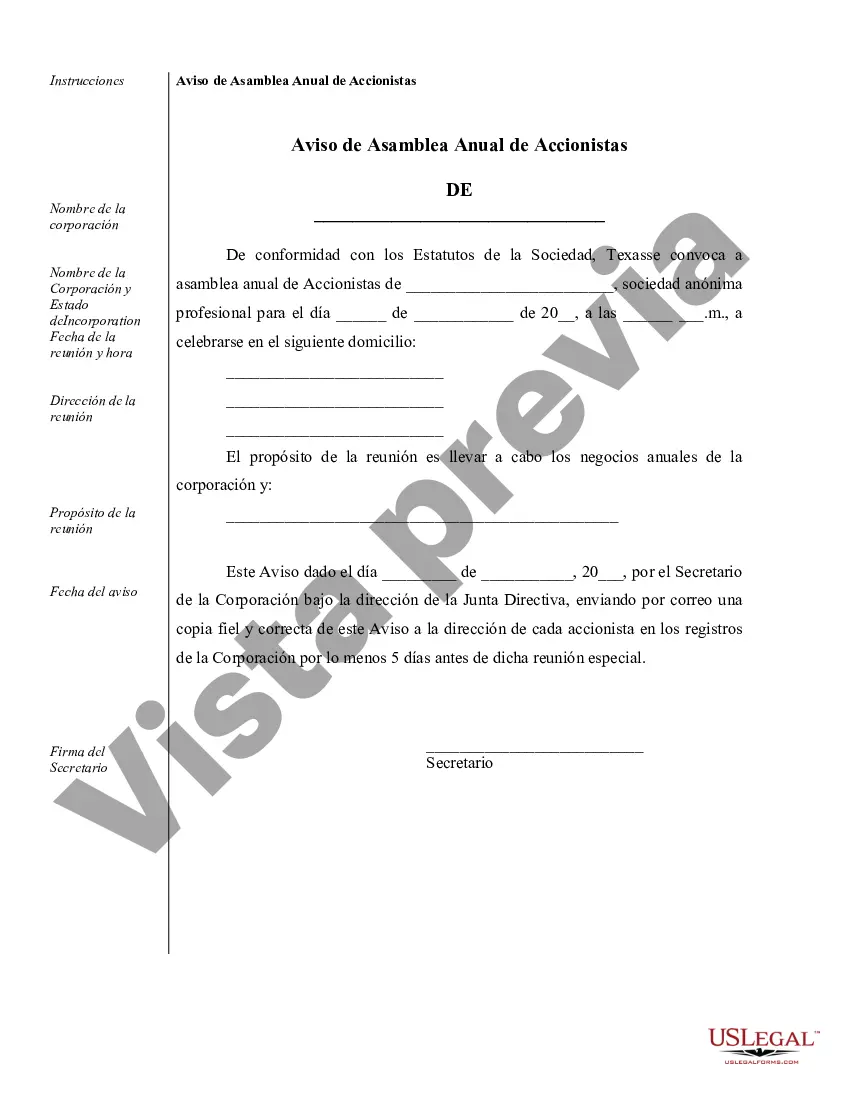

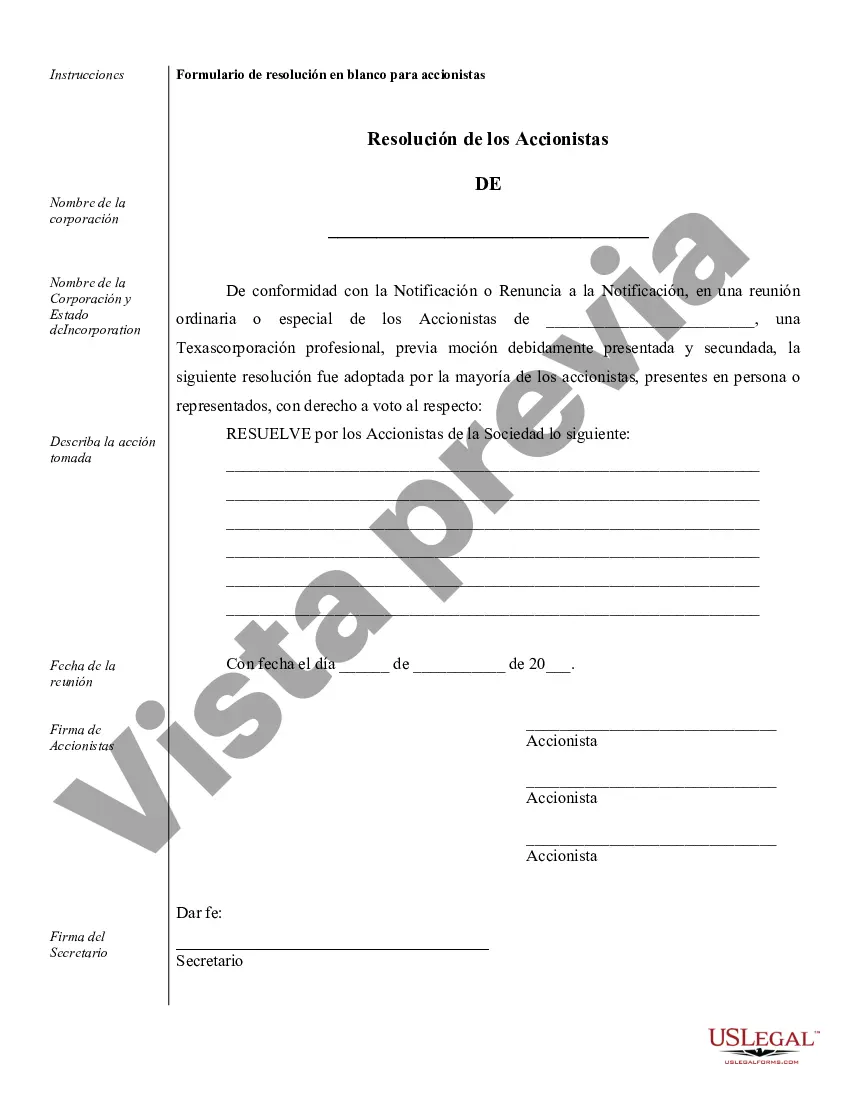

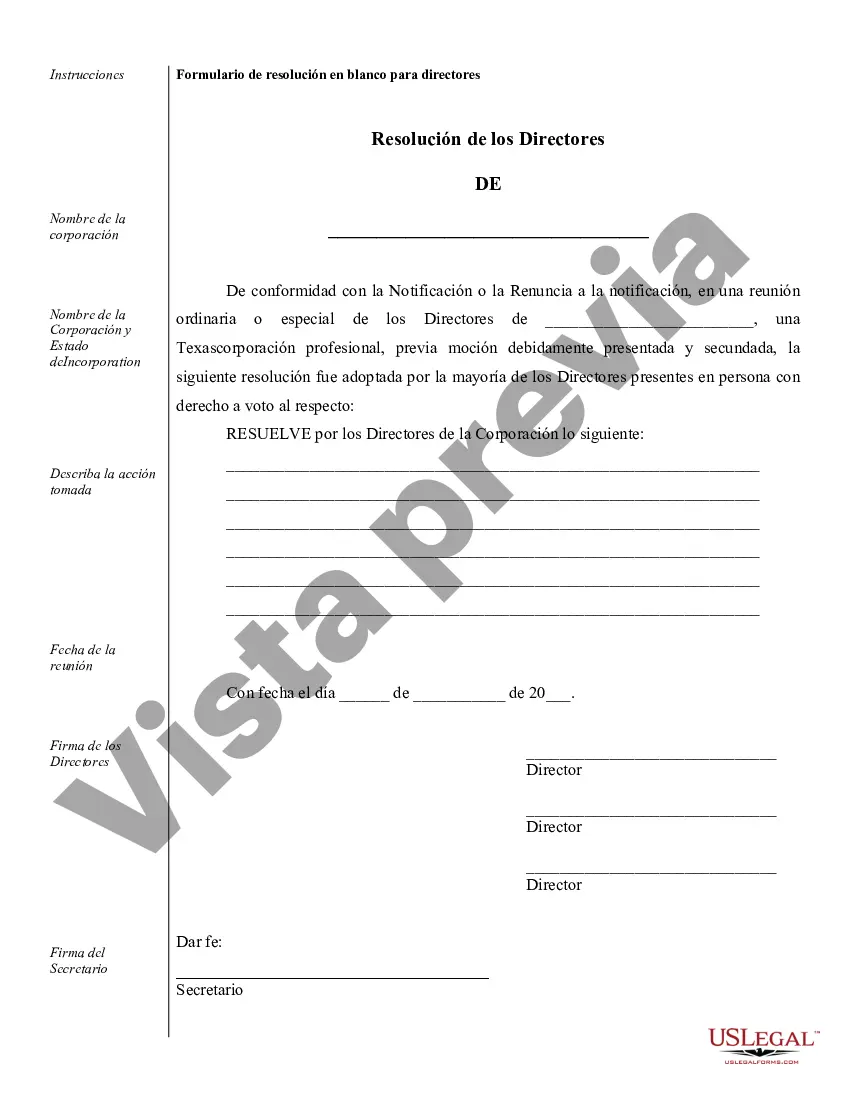

Tarrant Sample Corporate Records for a Texas Professional Corporation refer to the essential documentation that must be maintained by a professional corporation based in Tarrant County, Texas. These records are necessary to demonstrate the corporation's compliance with legal requirements and maintain its corporate status. Here are the different types of Tarrant Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This record outlines the corporation's legal structure, including its name, purpose, registered agent, and shareholders' names and addresses. It is filed with the Texas Secretary of State. 2. Bylaws: These documents establish the internal rules and regulations that govern the corporation's operations, such as procedures for shareholder and board meetings, election of officers, and voting rights. 3. Shareholder Meeting Minutes: Detailed minutes of meetings held by the shareholders, including discussions, voting results, and resolutions passed. These minutes should be maintained for every shareholder meeting conducted by the corporation. 4. Board of Directors Meeting Minutes: Minutes of meetings held by the board of directors, including discussions on significant matters, decision-making processes, and voting results. These records should be maintained for every board meeting held. 5. Stock Certificate Ledger: A ledger that records all the issued shares of the corporation, including details such as the shareholder's name, address, the number of shares allocated, and the date of issuance. 6. Stock Transfer Ledger: This record tracks the transfer of shares from one shareholder to another, capturing details such as the transferor's and transferee's information, share certificates' serial numbers, and the date of transfer. 7. Financial Statements: Comprehensive records reflecting the corporation's financial performance, including balance sheets, income statements, cash flow statements, and notes to the financial statements. These statements should be prepared annually by a certified public accountant. 8. Registered Agent Information: Records that provide details of the corporation's registered agent, such as their name, address, and contact information. The registered agent is responsible for receiving legal notices on behalf of the corporation. 9. Tax Filings: Records related to the corporation's tax filings, including federal tax returns (Form 1120) and any relevant Texas franchise tax returns (No Tax Due or Franchise Tax Report). 10. Annual Reports: Yearly reports submitted to the Texas Secretary of State, providing updates on the corporation's basic information, such as the registered agent, principal address, officers, and directors. It is crucial for a Texas Professional Corporation to maintain accurate and up-to-date records of these documents to ensure compliance with state laws and protect the corporation's liability protections and legal standing. Professional guidance from legal experts familiar with Texas corporate laws and regulations is highly recommended ensuring the proper creation, organization, and maintenance of these records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Ejemplos de registros corporativos para una corporación profesional de Texas - Sample Corporate Records for a Texas Professional Corporation

Description

How to fill out Tarrant Ejemplos De Registros Corporativos Para Una Corporación Profesional De Texas?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Tarrant Sample Corporate Records for a Texas Professional Corporation becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Tarrant Sample Corporate Records for a Texas Professional Corporation takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Tarrant Sample Corporate Records for a Texas Professional Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!