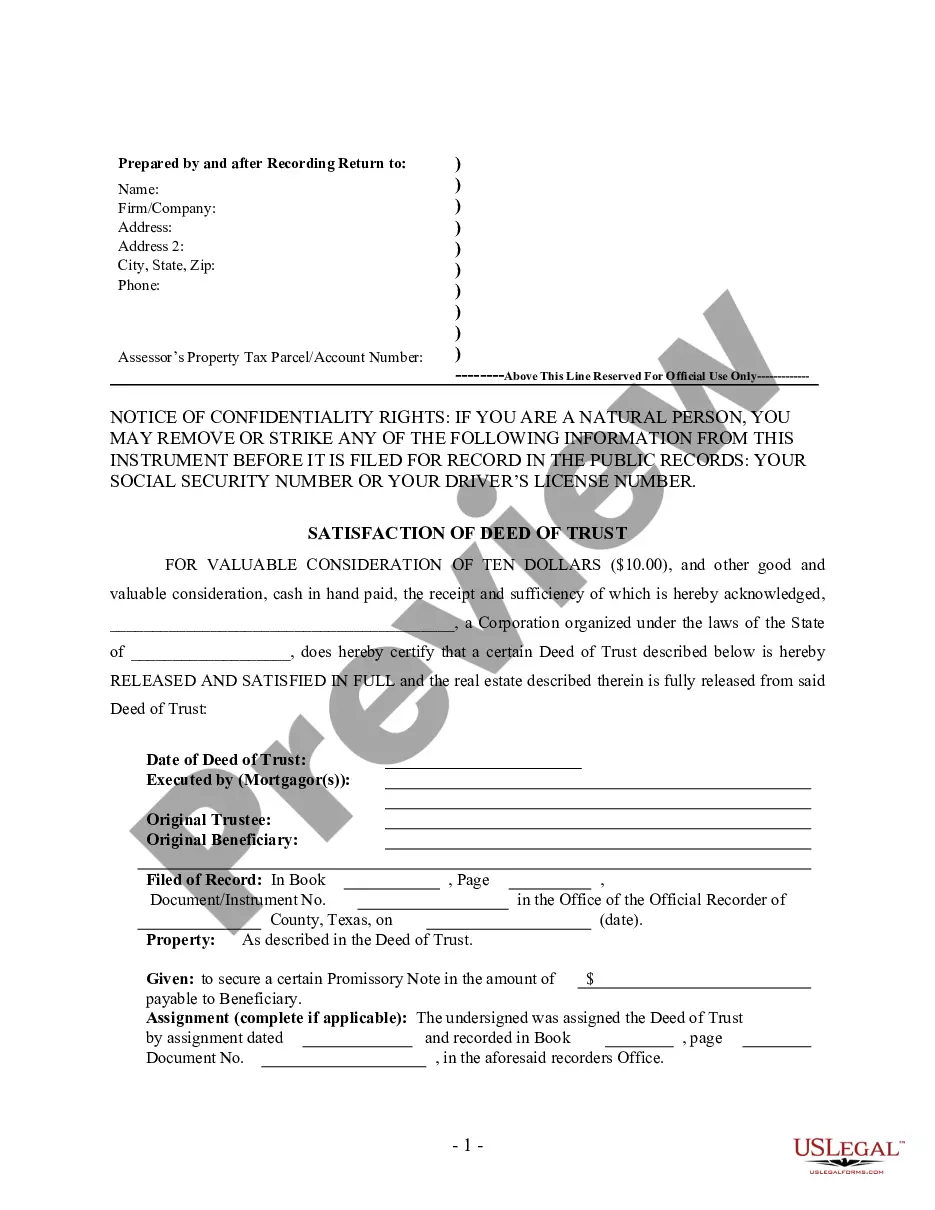

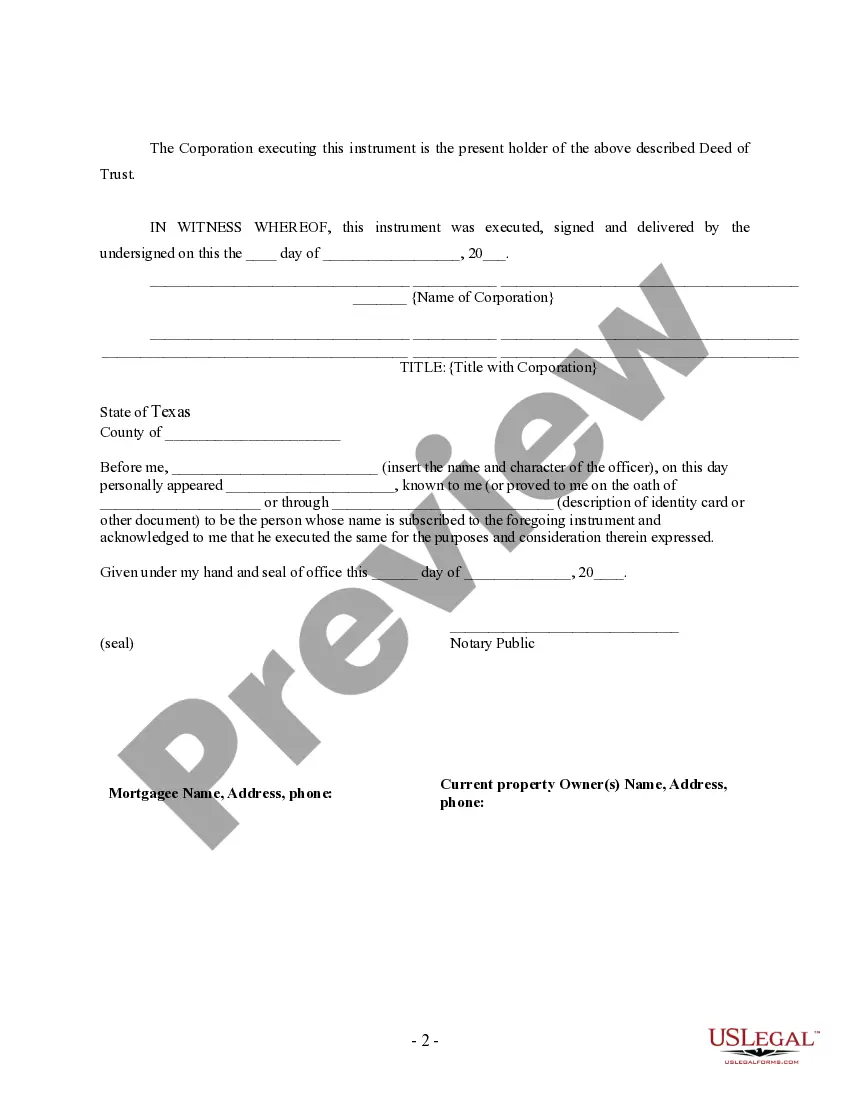

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

A Satisfaction of Deed of Trust, or Mortgage, signifies the release and satisfaction of a loan secured by a property in Sugar Land, Texas. This legal document is typically executed by a corporate lender, signifying that the borrower has successfully repaid their mortgage, and the debt obligation has been fully satisfied. Here is a detailed description of what a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender entails, along with some variations or types that may exist within this context: 1. Overview of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: The Satisfaction of Deed of Trust, also referred to as a Release of Mortgage, is a legal instrument used by corporate lenders in Sugar Land, Texas, to officially acknowledge the full repayment and satisfaction of a mortgage by a borrower. This document serves as evidence that the debt associated with the property has been discharged, allowing the borrower to clear any potential lien or encumbrance on their real estate title. Once executed, the Satisfaction of Deed of Trust is typically recorded with the appropriate county clerk's office, ensuring the public record correctly reflects the release of the mortgage. 2. Key Elements and Contents of a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a. Identification: The document starts with the identification of the parties involved, including the lender, borrower, and property details (address, legal description). b. Recitals: This section provides a summary of the original mortgage, disclosing loan amount, interest rate, date of execution, and any specific conditions or covenants agreed upon. c. Satisfaction Statement: Here, the corporate lender explicitly states that the loan has been fully repaid, releasing the borrower and the property from all obligations and liens. d. Legal Description: A comprehensive legal description of the property is included to precisely identify the real estate in question. e. Execution and Notary: The Satisfaction of Deed of Trust is signed by an authorized representative of the corporate lender and notarized, ensuring its validity. 3. Types and Variations of Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a. Partial Satisfaction: In certain situations, a borrower may repay only a portion of the mortgage debt, resulting in a partial satisfaction of the deed of trust. Here, the document releases the borrower from the portion of the loan that has been repaid, while the collateral (property) is still encumbered by the remaining unpaid balance. b. Full Satisfaction: This is the most common type, wherein the borrower repays the entire mortgage amount, and the corporate lender releases all claims on the property, providing a complete satisfaction of the deed of trust. c. Subordination Agreement: This is not a Satisfaction of Deed of Trust itself but a related agreement in which a lender agrees to subordinate its interest in the property, allowing another lender to obtain a primary lien position. This agreement can impact the eventual release and satisfaction process when the primary lender's loan is repaid. In conclusion, a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial legal document that signifies the successful repayment and release of a mortgage. It ensures the borrower's property is free from any encumbrances and provides a clear title. Different variations of these documents accommodate scenarios such as partial satisfactions or the subordination of lenders' interests. It is advisable to consult legal professionals or consult the relevant local authorities to obtain accurate and up-to-date information regarding specific forms and requirements associated with a Satisfaction of Deed of Trust — Mortgage.A Satisfaction of Deed of Trust, or Mortgage, signifies the release and satisfaction of a loan secured by a property in Sugar Land, Texas. This legal document is typically executed by a corporate lender, signifying that the borrower has successfully repaid their mortgage, and the debt obligation has been fully satisfied. Here is a detailed description of what a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender entails, along with some variations or types that may exist within this context: 1. Overview of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: The Satisfaction of Deed of Trust, also referred to as a Release of Mortgage, is a legal instrument used by corporate lenders in Sugar Land, Texas, to officially acknowledge the full repayment and satisfaction of a mortgage by a borrower. This document serves as evidence that the debt associated with the property has been discharged, allowing the borrower to clear any potential lien or encumbrance on their real estate title. Once executed, the Satisfaction of Deed of Trust is typically recorded with the appropriate county clerk's office, ensuring the public record correctly reflects the release of the mortgage. 2. Key Elements and Contents of a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a. Identification: The document starts with the identification of the parties involved, including the lender, borrower, and property details (address, legal description). b. Recitals: This section provides a summary of the original mortgage, disclosing loan amount, interest rate, date of execution, and any specific conditions or covenants agreed upon. c. Satisfaction Statement: Here, the corporate lender explicitly states that the loan has been fully repaid, releasing the borrower and the property from all obligations and liens. d. Legal Description: A comprehensive legal description of the property is included to precisely identify the real estate in question. e. Execution and Notary: The Satisfaction of Deed of Trust is signed by an authorized representative of the corporate lender and notarized, ensuring its validity. 3. Types and Variations of Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a. Partial Satisfaction: In certain situations, a borrower may repay only a portion of the mortgage debt, resulting in a partial satisfaction of the deed of trust. Here, the document releases the borrower from the portion of the loan that has been repaid, while the collateral (property) is still encumbered by the remaining unpaid balance. b. Full Satisfaction: This is the most common type, wherein the borrower repays the entire mortgage amount, and the corporate lender releases all claims on the property, providing a complete satisfaction of the deed of trust. c. Subordination Agreement: This is not a Satisfaction of Deed of Trust itself but a related agreement in which a lender agrees to subordinate its interest in the property, allowing another lender to obtain a primary lien position. This agreement can impact the eventual release and satisfaction process when the primary lender's loan is repaid. In conclusion, a Sugar Land Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial legal document that signifies the successful repayment and release of a mortgage. It ensures the borrower's property is free from any encumbrances and provides a clear title. Different variations of these documents accommodate scenarios such as partial satisfactions or the subordination of lenders' interests. It is advisable to consult legal professionals or consult the relevant local authorities to obtain accurate and up-to-date information regarding specific forms and requirements associated with a Satisfaction of Deed of Trust — Mortgage.