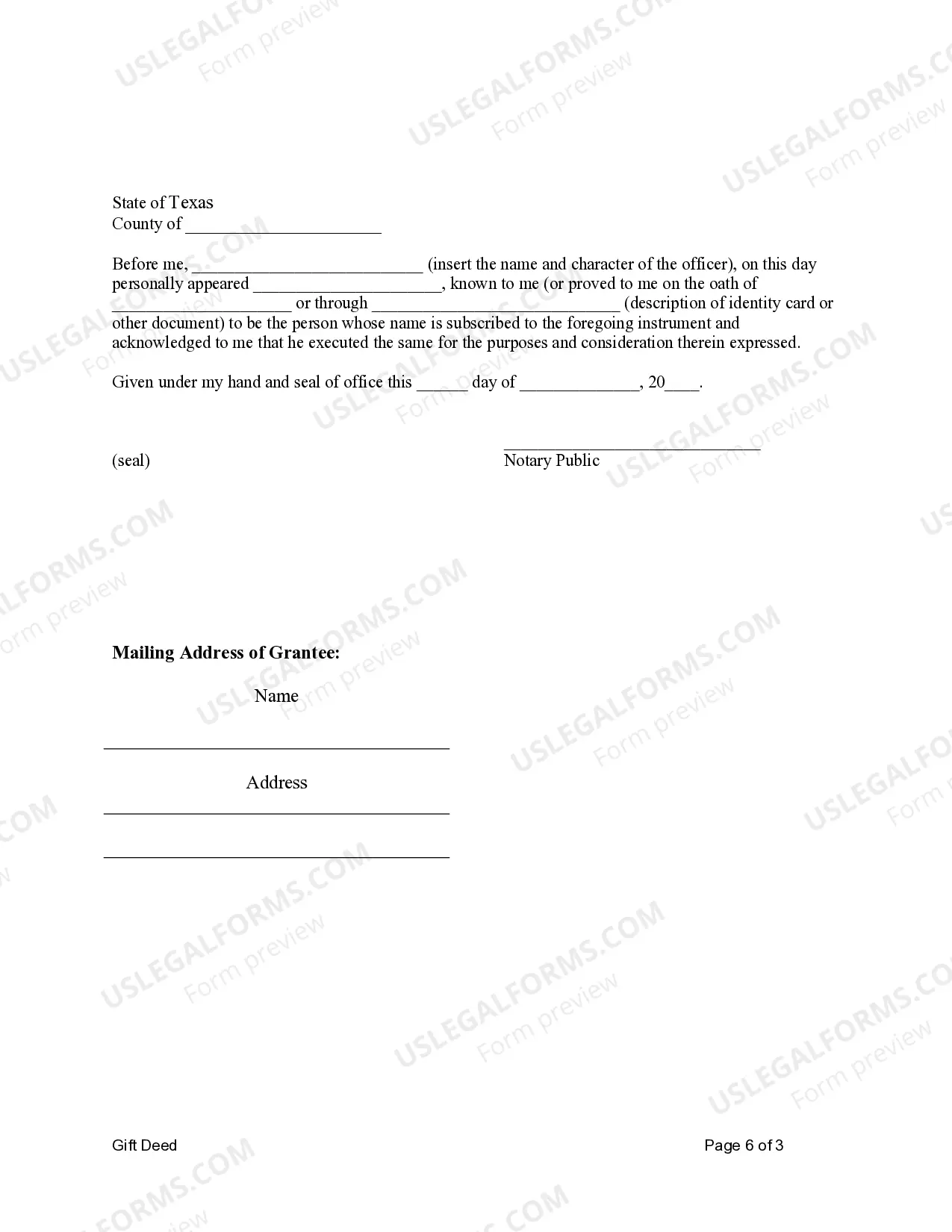

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants The Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used to transfer the ownership of real property from one individual (the donor) to multiple individuals (the grantees) as joint tenants. This type of gift deed ensures that the grantee individuals hold equal shares, with the right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the remaining joint tenants, rather than to their heirs or beneficiaries. In Irving, Texas, there are different variations of the Gift Deed for Individual to Individuals as Joint Tenants, each serving specific purposes, including: 1. Irrevocable Gift Deed for Individual to Individuals as Joint Tenants: This variant ensures that the gift is final and cannot be revoked or undone by the donor once it is executed. It provides the grantee joint tenants with immediate ownership rights and the security of holding the property jointly. 2. Revocable Gift Deed for Individual to Individuals as Joint Tenants: Unlike the irrevocable version, this type of gift deed allows the donor to retain the right to revoke or cancel the gift at any time before their passing. This provides the donor with greater flexibility and control over the property. 3. Conditional Gift Deed for Individual to Individuals as Joint Tenants: This variant includes specific conditions or requirements that must be met by the grantees for the gift to be valid. For example, the donor may require the joint tenants to maintain the property or use it for a specific purpose. 4. Contingent Gift Deed for Individual to Individuals as Joint Tenants: This type of gift deed outlines specific circumstances under which the transfer of ownership will occur. For instance, the gift may be contingent upon the occurrence of a certain event, such as the donor's death or the completion of certain obligations by the grantee joint tenants. Executing an Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants requires the involvement of a qualified attorney or a real estate professional. They will ensure that all legal requirements are met, such as properly identifying the donor and grantees, accurately describing the property being transferred, and adhering to any specific conditions or contingencies outlined in the deed. Keywords: Irving, Texas, Gift Deed, Individual, Individuals, Joint Tenants, Gift, Transfer, Ownership, Real Property, Donor, Grantees, Right of Survivorship, Irrevocable, Revocable, Conditional, Contingent, Legal, Attorney, Real Estate Professional.Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants The Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used to transfer the ownership of real property from one individual (the donor) to multiple individuals (the grantees) as joint tenants. This type of gift deed ensures that the grantee individuals hold equal shares, with the right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the remaining joint tenants, rather than to their heirs or beneficiaries. In Irving, Texas, there are different variations of the Gift Deed for Individual to Individuals as Joint Tenants, each serving specific purposes, including: 1. Irrevocable Gift Deed for Individual to Individuals as Joint Tenants: This variant ensures that the gift is final and cannot be revoked or undone by the donor once it is executed. It provides the grantee joint tenants with immediate ownership rights and the security of holding the property jointly. 2. Revocable Gift Deed for Individual to Individuals as Joint Tenants: Unlike the irrevocable version, this type of gift deed allows the donor to retain the right to revoke or cancel the gift at any time before their passing. This provides the donor with greater flexibility and control over the property. 3. Conditional Gift Deed for Individual to Individuals as Joint Tenants: This variant includes specific conditions or requirements that must be met by the grantees for the gift to be valid. For example, the donor may require the joint tenants to maintain the property or use it for a specific purpose. 4. Contingent Gift Deed for Individual to Individuals as Joint Tenants: This type of gift deed outlines specific circumstances under which the transfer of ownership will occur. For instance, the gift may be contingent upon the occurrence of a certain event, such as the donor's death or the completion of certain obligations by the grantee joint tenants. Executing an Irving, Texas Gift Deed for Individual to Individuals as Joint Tenants requires the involvement of a qualified attorney or a real estate professional. They will ensure that all legal requirements are met, such as properly identifying the donor and grantees, accurately describing the property being transferred, and adhering to any specific conditions or contingencies outlined in the deed. Keywords: Irving, Texas, Gift Deed, Individual, Individuals, Joint Tenants, Gift, Transfer, Ownership, Real Property, Donor, Grantees, Right of Survivorship, Irrevocable, Revocable, Conditional, Contingent, Legal, Attorney, Real Estate Professional.