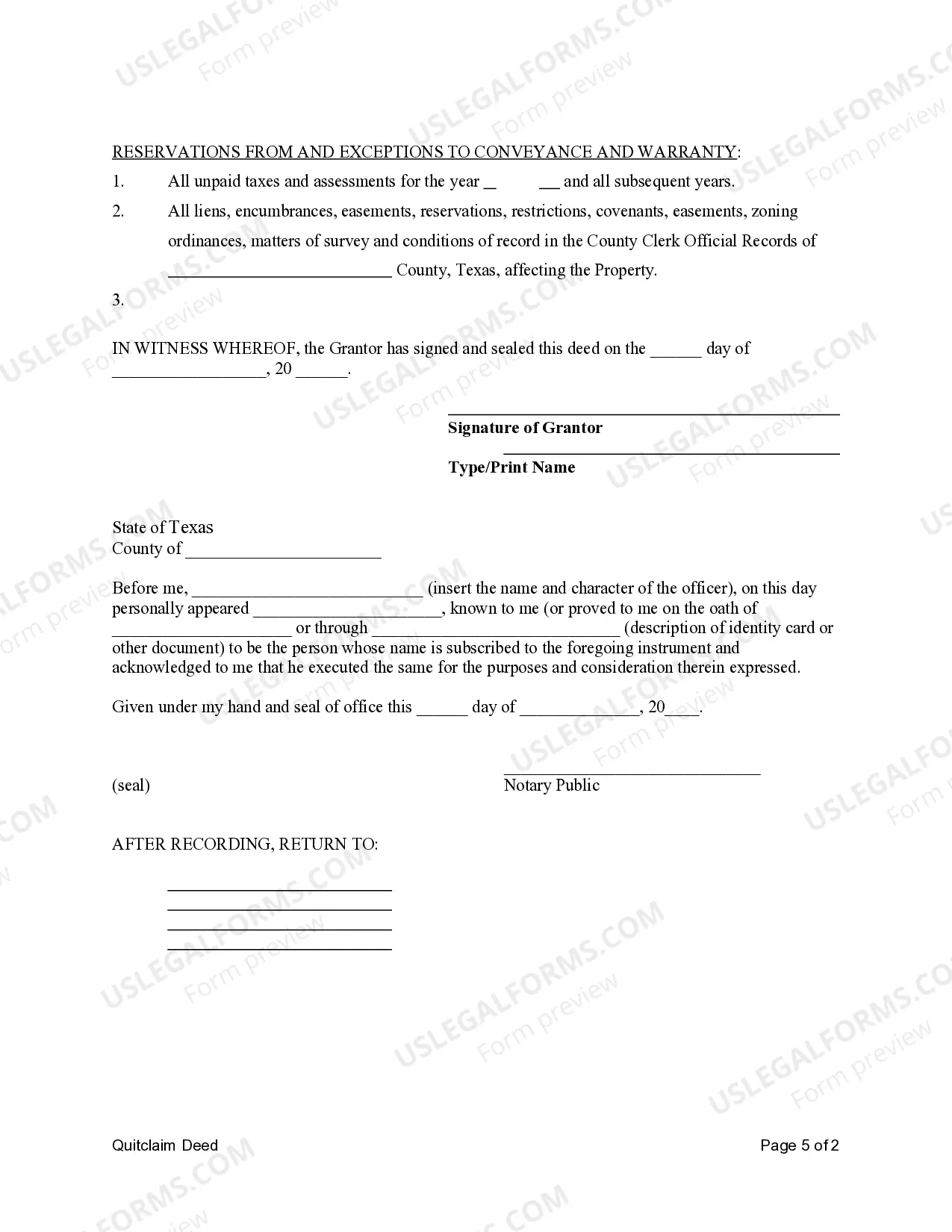

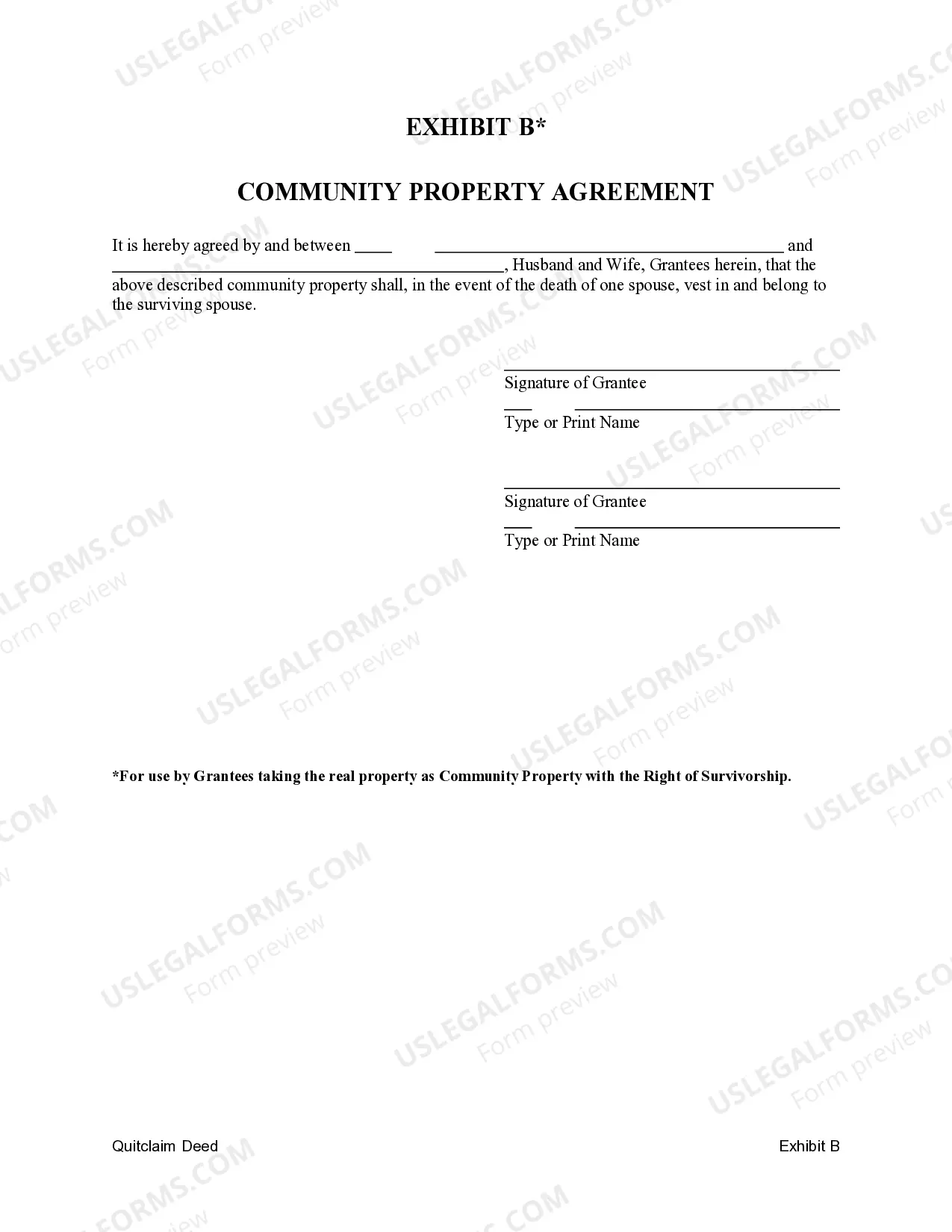

This form is a Quitclaim Deed where the grantor is a husband and the grantees are husband and wife. The grantees may hold title as community property or community property with the right of survivorship.

Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship In Carrollton, Texas, when it comes to transferring property rights between spouses, a Quitclaim Deed is an essential legal instrument. This particular type of Quitclaim Deed is designed specifically for a husband who wishes to transfer property to himself and his spouse as either Community Property or Community Property with Right of Survivorship. Community Property: The Community Property designation signifies that the property being transferred is jointly owned by the husband and wife. Each spouse holds an equal share of the property, and upon the death of one spouse, the ownership passes directly to the surviving spouse without the need for probate. This type of ownership provides inherent protection to both parties involved and ensures that the property remains within the marital estate. Community Property with Right of Survivorship: The Community Property with Right of Survivorship variation provides the same benefits as Community Property, but with the added assurance that the surviving spouse will retain sole ownership of the property upon the death of the other spouse. In this arrangement, the property passes to the surviving spouse automatically, bypassing the probate process entirely. Different Types of Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship: There can be slight variations in the wording and specifications mentioned in the Quitclaim Deed based on specific requirements, but the underlying concept remains the same for both Community Property and Community Property with Right of Survivorship. It is essential to consult with legal professionals to ensure that the correct deed form is utilized, reflecting the intended transfer of property rights. When preparing a Quitclaim Deed, it is crucial to include accurate descriptions of the property being transferred, including the full legal description, property address, and the county in which it is located. Both spouses' names and their marital status must be clearly stated, along with their intent to transfer the property to themselves jointly as Community Property or Community Property with Right of Survivorship. Filing the completed Quitclaim Deed with the appropriate county's land records office is necessary to make the transfer official and to establish clear ownership rights. It is advisable to seek guidance from a qualified attorney or real estate professional to ensure compliance with all legal requirements and to avoid any potential complications. In summary, the Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship allows for the seamless transfer of property rights between spouses, ensuring shared ownership of marital assets and providing significant protection and peace of mind for both parties involved.Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship In Carrollton, Texas, when it comes to transferring property rights between spouses, a Quitclaim Deed is an essential legal instrument. This particular type of Quitclaim Deed is designed specifically for a husband who wishes to transfer property to himself and his spouse as either Community Property or Community Property with Right of Survivorship. Community Property: The Community Property designation signifies that the property being transferred is jointly owned by the husband and wife. Each spouse holds an equal share of the property, and upon the death of one spouse, the ownership passes directly to the surviving spouse without the need for probate. This type of ownership provides inherent protection to both parties involved and ensures that the property remains within the marital estate. Community Property with Right of Survivorship: The Community Property with Right of Survivorship variation provides the same benefits as Community Property, but with the added assurance that the surviving spouse will retain sole ownership of the property upon the death of the other spouse. In this arrangement, the property passes to the surviving spouse automatically, bypassing the probate process entirely. Different Types of Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship: There can be slight variations in the wording and specifications mentioned in the Quitclaim Deed based on specific requirements, but the underlying concept remains the same for both Community Property and Community Property with Right of Survivorship. It is essential to consult with legal professionals to ensure that the correct deed form is utilized, reflecting the intended transfer of property rights. When preparing a Quitclaim Deed, it is crucial to include accurate descriptions of the property being transferred, including the full legal description, property address, and the county in which it is located. Both spouses' names and their marital status must be clearly stated, along with their intent to transfer the property to themselves jointly as Community Property or Community Property with Right of Survivorship. Filing the completed Quitclaim Deed with the appropriate county's land records office is necessary to make the transfer official and to establish clear ownership rights. It is advisable to seek guidance from a qualified attorney or real estate professional to ensure compliance with all legal requirements and to avoid any potential complications. In summary, the Carrollton, Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship allows for the seamless transfer of property rights between spouses, ensuring shared ownership of marital assets and providing significant protection and peace of mind for both parties involved.