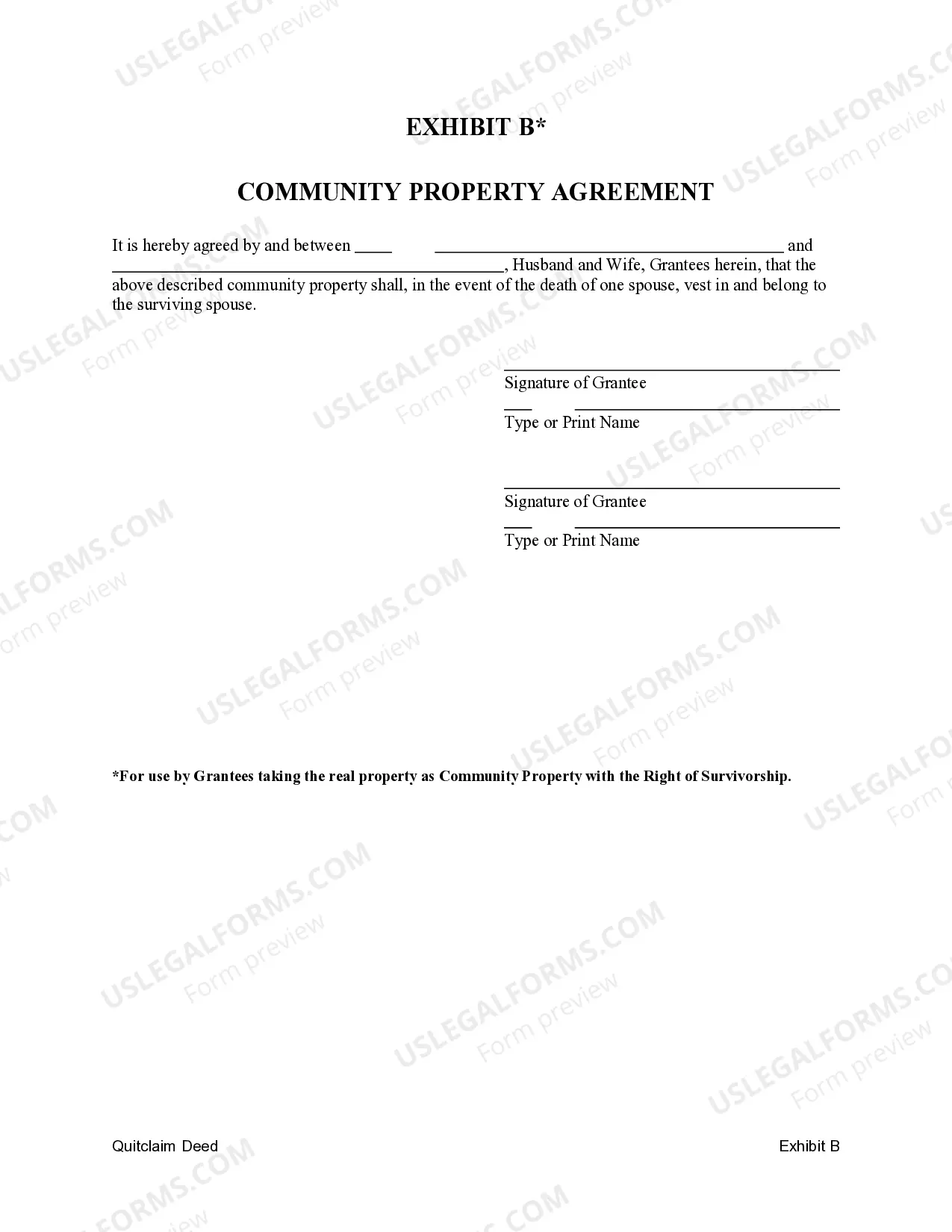

This form is a Quitclaim Deed where the grantor is a husband and the grantees are husband and wife. The grantees may hold title as community property or community property with the right of survivorship.

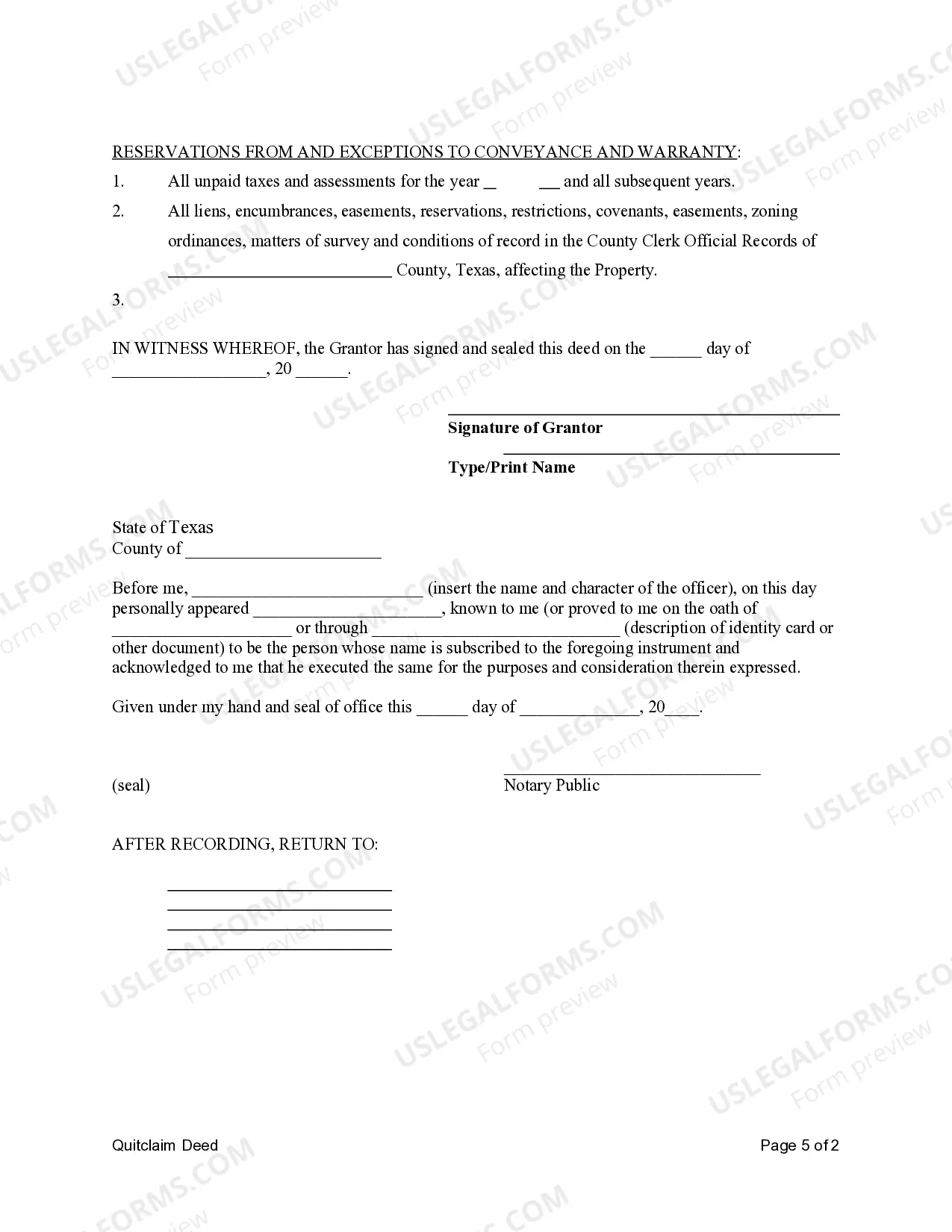

Title: Understanding Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship Introduction: In Sugar Land, Texas, real estate transactions involving spouses may require the use of specific legal documents such as Quitclaim Deeds. The purpose of a Quitclaim Deed is to transfer ownership rights and interests in a property from one party to another. This article aims to provide a detailed description of the different types of Sugar Land Texas Quitclaim Deeds available for husbands to transfer property to their spouses as community property or community property with the right of survivorship. 1. Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property: When a husband wishes to transfer ownership of a property to their wife, designating it as community property, a Quitclaim Deed for Husband to Husband and Wife as Community Property is used. This type of deed ensures that both spouses equally own the property and share its benefits, rights, and responsibilities. In the event of divorce or dissolution of marriage, the property will be divided in accordance with Texas community property laws. 2. Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: The second type of Quitclaim Deed is designed to provide additional legal protection for the surviving spouse in case of the other spouse's death. The Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship allows the property to automatically pass to the surviving spouse upon the death of the other. This type of deed avoids the need for probate, ensuring a smooth transfer of ownership to the surviving spouse. 3. Considerations and Key Elements: When preparing a Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife, certain essential elements should be included: a) Identification of Parties: The names and addresses of both the husband and wife need to be clearly stated in the deed. b) Legal Description: Accurate and detailed property description, including the boundaries, lot number, and any other relevant information that identifies the property must be included. c) Consideration: The document must specify the consideration amount or any other non-financial consideration accompanying the transfer. d) Signature: Both spouses must sign the Quitclaim Deed voluntarily and have their signatures notarized. 4. Seeking Professional Assistance: Due to the legal complexities involved, it is always recommended seeking the guidance of a qualified real estate attorney or a professional title company when drafting and executing a Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife. They can ensure all legal requirements are met, and the deed is properly recorded to transfer ownership rights. Conclusion: Understanding the different types of Sugar Land Texas Quitclaim Deeds available for husbands to transfer property to their wives as community property or community property with the right of survivorship is crucial. By using the appropriate Quitclaim Deed and seeking professional assistance, couples can ensure seamless and legally sound property transfers, safeguarding their interests and securing their rights in accordance with the applicable laws of Sugar Land, Texas.Title: Understanding Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship Introduction: In Sugar Land, Texas, real estate transactions involving spouses may require the use of specific legal documents such as Quitclaim Deeds. The purpose of a Quitclaim Deed is to transfer ownership rights and interests in a property from one party to another. This article aims to provide a detailed description of the different types of Sugar Land Texas Quitclaim Deeds available for husbands to transfer property to their spouses as community property or community property with the right of survivorship. 1. Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property: When a husband wishes to transfer ownership of a property to their wife, designating it as community property, a Quitclaim Deed for Husband to Husband and Wife as Community Property is used. This type of deed ensures that both spouses equally own the property and share its benefits, rights, and responsibilities. In the event of divorce or dissolution of marriage, the property will be divided in accordance with Texas community property laws. 2. Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: The second type of Quitclaim Deed is designed to provide additional legal protection for the surviving spouse in case of the other spouse's death. The Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship allows the property to automatically pass to the surviving spouse upon the death of the other. This type of deed avoids the need for probate, ensuring a smooth transfer of ownership to the surviving spouse. 3. Considerations and Key Elements: When preparing a Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife, certain essential elements should be included: a) Identification of Parties: The names and addresses of both the husband and wife need to be clearly stated in the deed. b) Legal Description: Accurate and detailed property description, including the boundaries, lot number, and any other relevant information that identifies the property must be included. c) Consideration: The document must specify the consideration amount or any other non-financial consideration accompanying the transfer. d) Signature: Both spouses must sign the Quitclaim Deed voluntarily and have their signatures notarized. 4. Seeking Professional Assistance: Due to the legal complexities involved, it is always recommended seeking the guidance of a qualified real estate attorney or a professional title company when drafting and executing a Sugar Land Texas Quitclaim Deed for Husband to Husband and Wife. They can ensure all legal requirements are met, and the deed is properly recorded to transfer ownership rights. Conclusion: Understanding the different types of Sugar Land Texas Quitclaim Deeds available for husbands to transfer property to their wives as community property or community property with the right of survivorship is crucial. By using the appropriate Quitclaim Deed and seeking professional assistance, couples can ensure seamless and legally sound property transfers, safeguarding their interests and securing their rights in accordance with the applicable laws of Sugar Land, Texas.