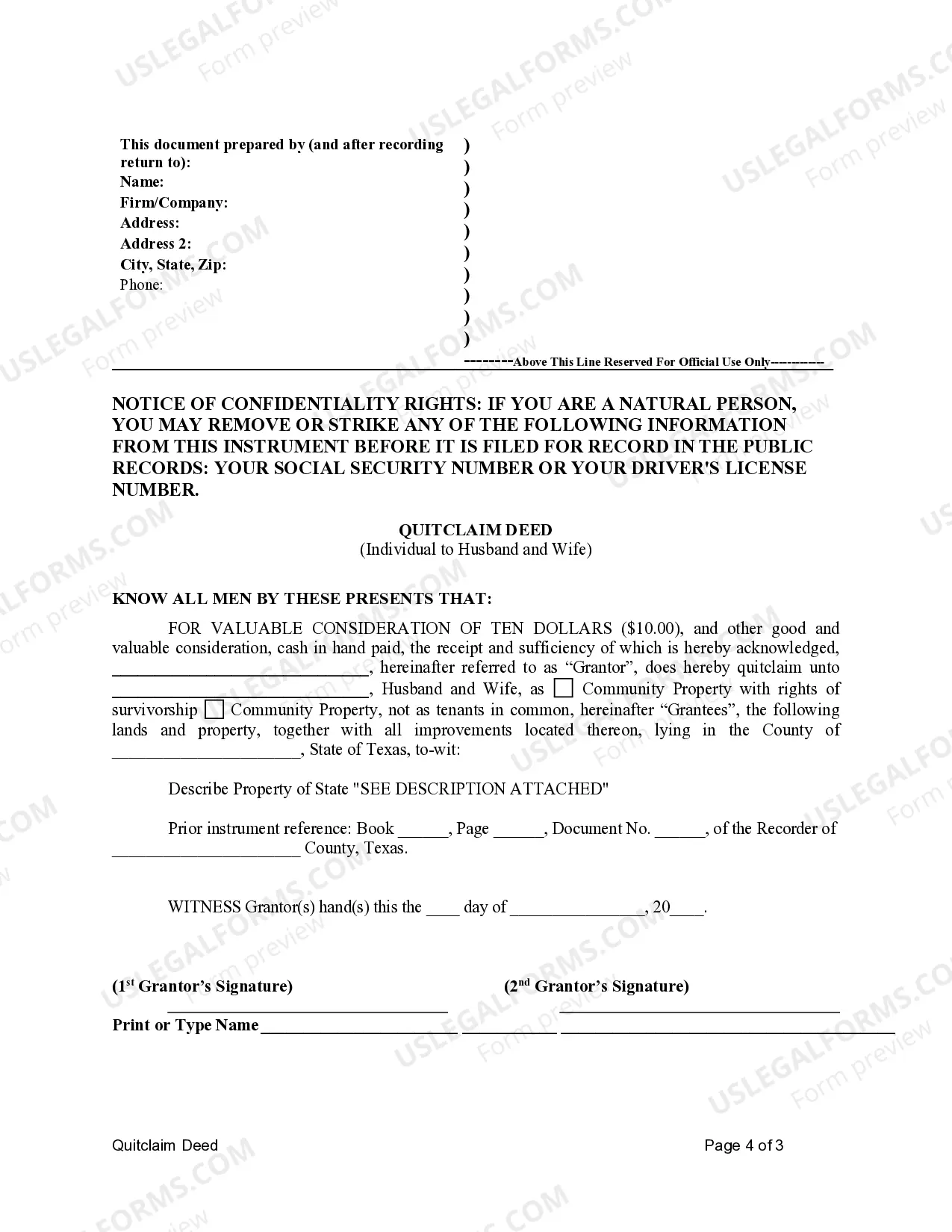

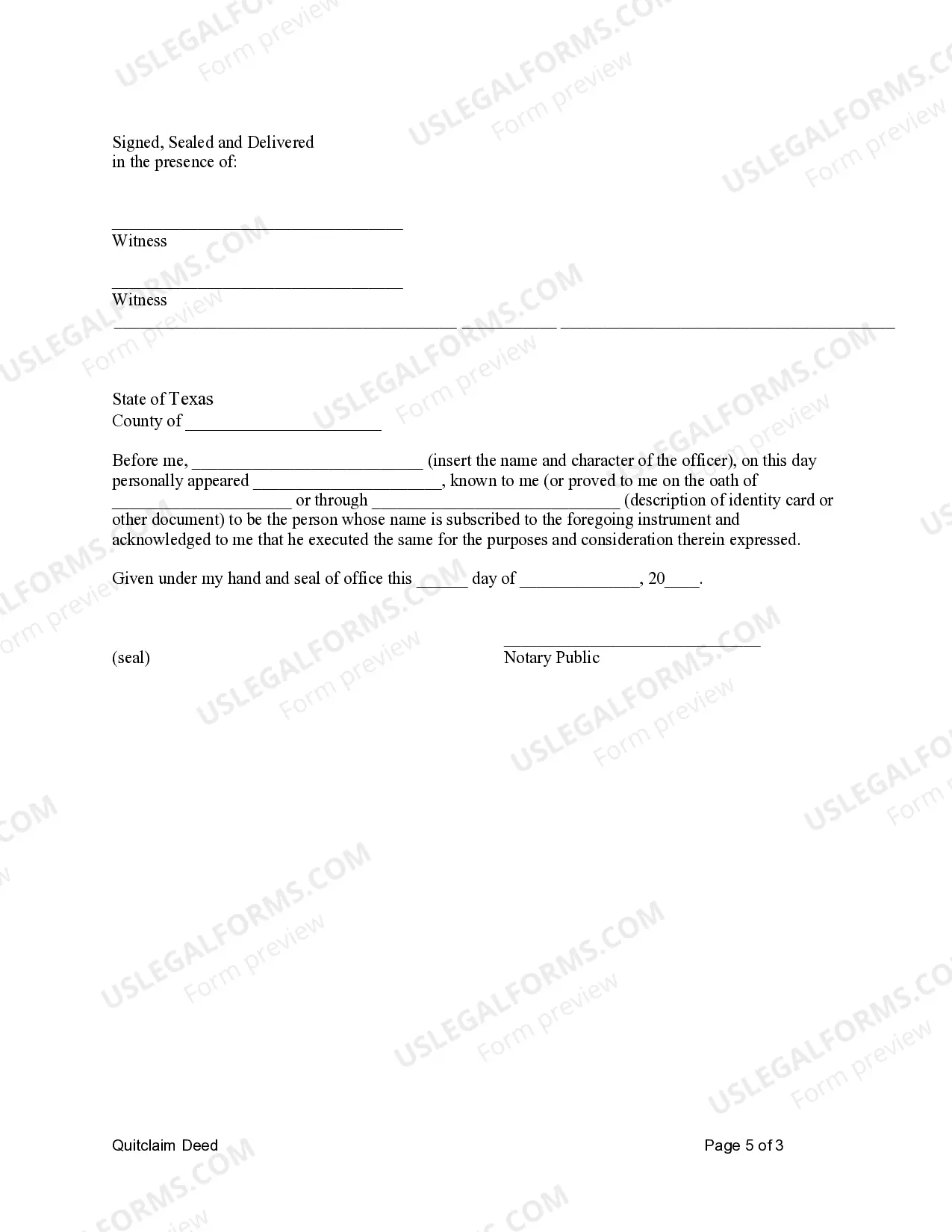

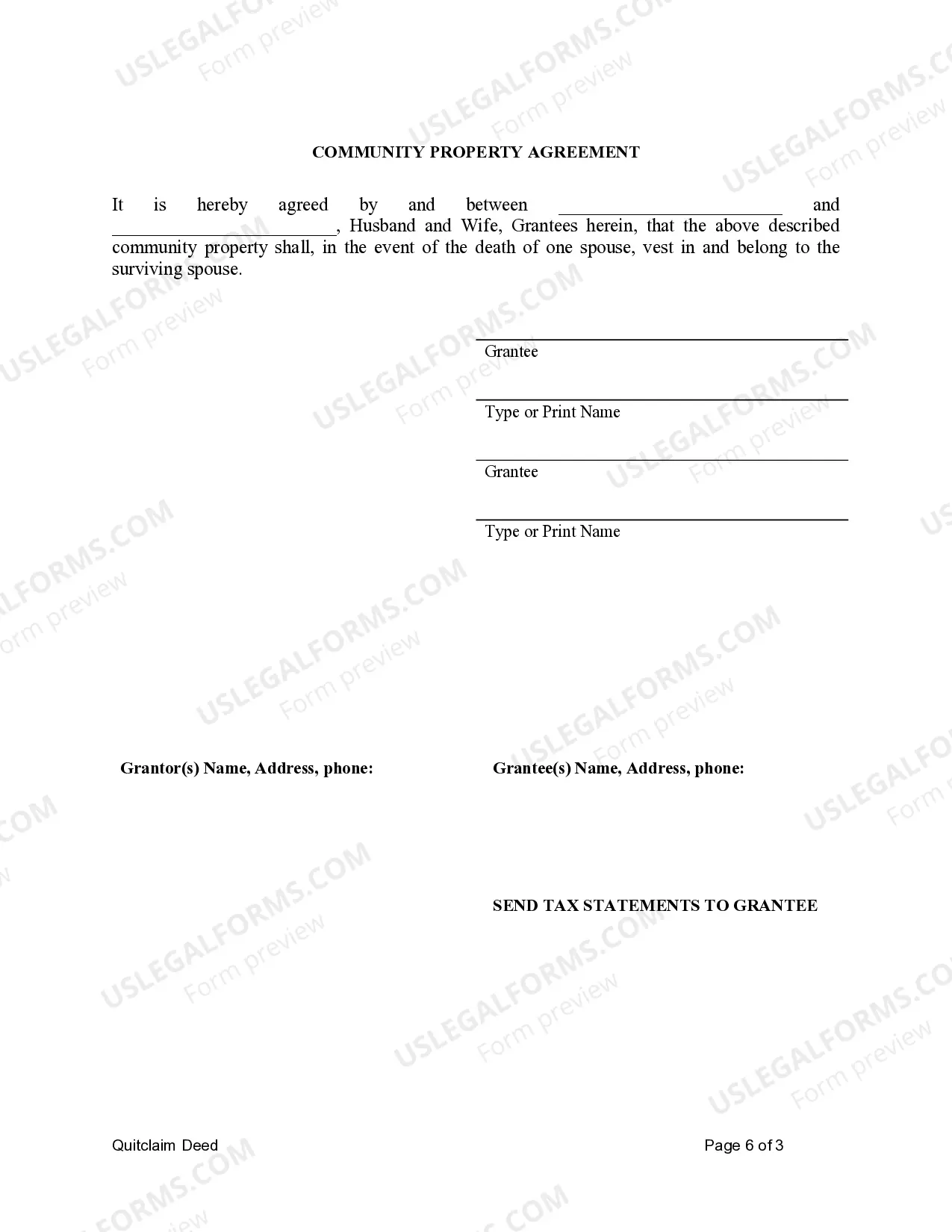

This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

A Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of a property from an individual to a married couple, designating it as community property or community property with the right of survivorship. This type of deed ensures that both spouses have equal ownership rights and that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. There are two distinct variations of the Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship: 1. Community Property: The first type of deed is known as a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property. Under this arrangement, the property is considered jointly owned by both spouses, and upon the death of one spouse, the property ownership automatically transfers to the surviving spouse without the need for probate or any other legal procedures. Community property laws vary by state, and in Texas, community property generally refers to property acquired during the marriage. 2. Community Property with Right of Survivorship: The second type of deed is referred to as a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship. This type of deed combines the benefits of community property ownership with the added advantage of survivorship rights. It means that when one spouse passes away, their share of the property immediately passes to the surviving spouse as the sole owner, with the property bypassing probate as well. These types of quitclaim deeds are commonly used in Sugar Land, Texas, as they provide an efficient and straightforward method for married couples to transfer property ownership while safeguarding their rights and streamlining the process for any future transfers or inheritances. If you are considering utilizing a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, it is essential to consult with a qualified real estate attorney or legal professional to ensure all legal requirements and paperwork are properly completed to protect the interests of both spouses.A Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of a property from an individual to a married couple, designating it as community property or community property with the right of survivorship. This type of deed ensures that both spouses have equal ownership rights and that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. There are two distinct variations of the Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship: 1. Community Property: The first type of deed is known as a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property. Under this arrangement, the property is considered jointly owned by both spouses, and upon the death of one spouse, the property ownership automatically transfers to the surviving spouse without the need for probate or any other legal procedures. Community property laws vary by state, and in Texas, community property generally refers to property acquired during the marriage. 2. Community Property with Right of Survivorship: The second type of deed is referred to as a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship. This type of deed combines the benefits of community property ownership with the added advantage of survivorship rights. It means that when one spouse passes away, their share of the property immediately passes to the surviving spouse as the sole owner, with the property bypassing probate as well. These types of quitclaim deeds are commonly used in Sugar Land, Texas, as they provide an efficient and straightforward method for married couples to transfer property ownership while safeguarding their rights and streamlining the process for any future transfers or inheritances. If you are considering utilizing a Sugar Land, Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, it is essential to consult with a qualified real estate attorney or legal professional to ensure all legal requirements and paperwork are properly completed to protect the interests of both spouses.