This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

The Harris Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a crucial legal document that guarantees the efficient distribution of assets and property after the testator's death. This type of will is specifically designed for residents of Harris County, Texas, and serves as a reliable means to ensure the seamless transfer of assets into a trust. The Pour Over Will serves as a safeguard to capture any assets that may not have been explicitly transferred to the trust during the testator's lifetime. By including a Pour Over Will in an estate planning strategy, individuals can ensure that any assets not previously placed in the trust will be automatically "poured over" into the trust upon their death, to be managed and distributed according to the trust's provisions. The Harris Texas Pour Over Will form allows individuals to transfer all of their property, including financial accounts, real estate, personal possessions, and investments, to their designated trust. This type of pour over will provides flexibility and convenience, as it permits the testator to revise and update their trust without having to modify the will itself. By employing a pour over will, individuals can have peace of mind knowing that their assets will be handled in accordance with their wishes and managed by their chosen trustee. While the Harris Texas Legal Last Will and Testament Form with All Property to Trust is a popular variant of a pour over will, there may be other types or versions available. These could include specific pour over will form tailored for particular counties or regions within Texas, such as Dallas, Fort Worth, or Travis County, among others. It is important to consult with a qualified estate planning attorney or trusted legal resource to determine the appropriate form to use, as requirements may vary depending on the jurisdiction. In conclusion, the Harris Texas Legal Last Will and Testament Form with All Property to Trust, also commonly referred to as a Pour Over Will, plays a vital role in efficient estate planning. By utilizing this document, individuals can safeguard the transfer of their assets to a trust and ensure that their wishes regarding asset management and distribution are upheld.The Harris Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a crucial legal document that guarantees the efficient distribution of assets and property after the testator's death. This type of will is specifically designed for residents of Harris County, Texas, and serves as a reliable means to ensure the seamless transfer of assets into a trust. The Pour Over Will serves as a safeguard to capture any assets that may not have been explicitly transferred to the trust during the testator's lifetime. By including a Pour Over Will in an estate planning strategy, individuals can ensure that any assets not previously placed in the trust will be automatically "poured over" into the trust upon their death, to be managed and distributed according to the trust's provisions. The Harris Texas Pour Over Will form allows individuals to transfer all of their property, including financial accounts, real estate, personal possessions, and investments, to their designated trust. This type of pour over will provides flexibility and convenience, as it permits the testator to revise and update their trust without having to modify the will itself. By employing a pour over will, individuals can have peace of mind knowing that their assets will be handled in accordance with their wishes and managed by their chosen trustee. While the Harris Texas Legal Last Will and Testament Form with All Property to Trust is a popular variant of a pour over will, there may be other types or versions available. These could include specific pour over will form tailored for particular counties or regions within Texas, such as Dallas, Fort Worth, or Travis County, among others. It is important to consult with a qualified estate planning attorney or trusted legal resource to determine the appropriate form to use, as requirements may vary depending on the jurisdiction. In conclusion, the Harris Texas Legal Last Will and Testament Form with All Property to Trust, also commonly referred to as a Pour Over Will, plays a vital role in efficient estate planning. By utilizing this document, individuals can safeguard the transfer of their assets to a trust and ensure that their wishes regarding asset management and distribution are upheld.

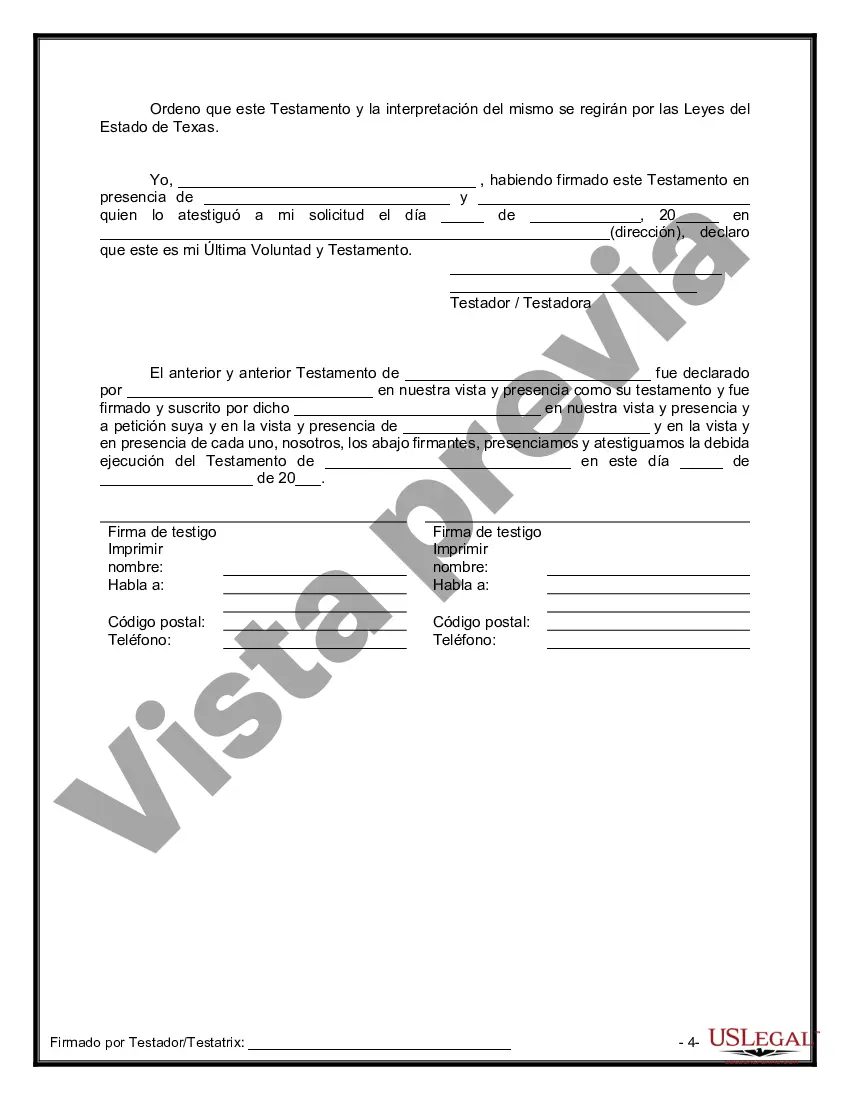

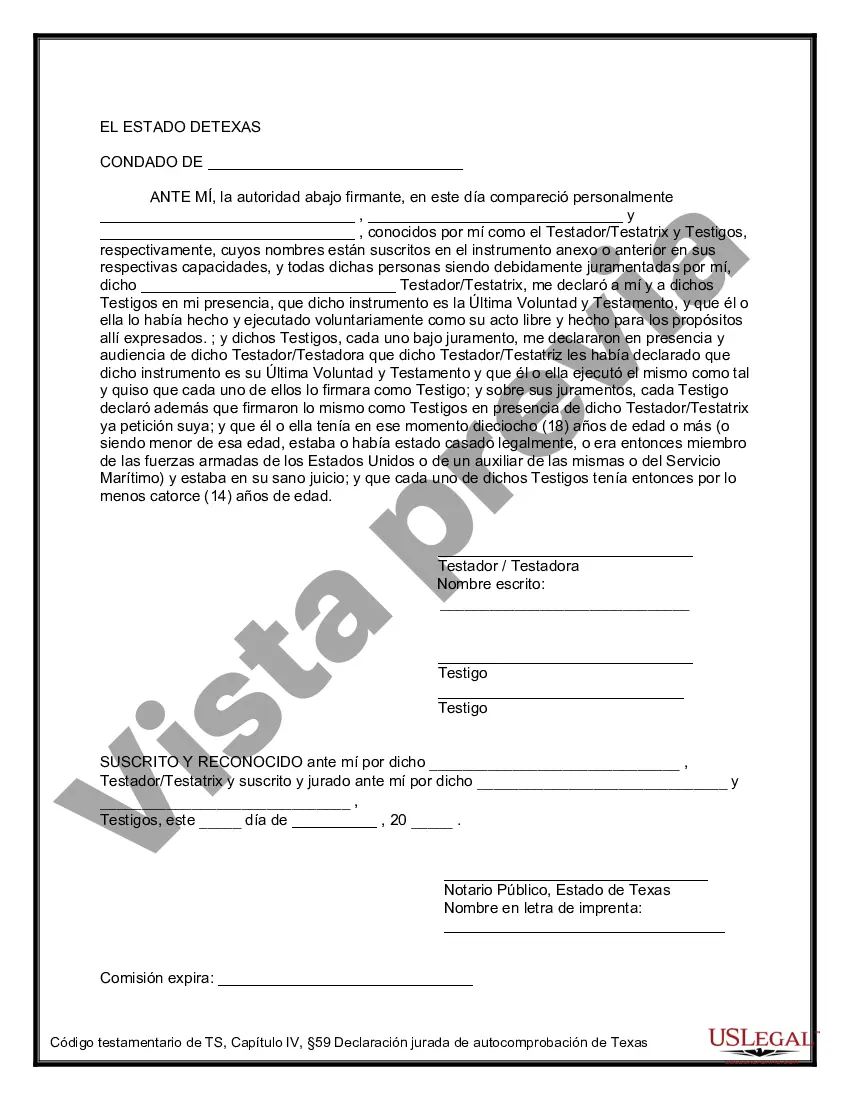

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.