This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Lewisville Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that serves as an essential estate planning tool. This type of will allows individuals in Lewisville, Texas, to transfer their assets, including real estate, bank accounts, investments, and personal belongings, to a living trust after their passing. The Pour Over Will acts as a safety net, ensuring that any property or assets not explicitly included in the living trust are automatically poured over into the trust. This process ensures that the assets are managed and distributed according to the individual's wishes, minimizing the need for probate and simplifying the estate administration process. Key elements of a Lewisville Texas Legal Last Will and Testament Form with All Property to Trust (Pour Over Will) may include: 1. Testator Identification: The document includes the identification details of the testator (the individual creating the will) such as their full legal name, address, date of birth, and other relevant personal information. 2. Trust Identification: The Pour Over Will specifies the details of the established living trust that will receive the assets, including the trust's name, address, and any specific instructions for its administration. 3. Asset Distribution: The document provides clear instructions on how the assets should be distributed within the trust. It may outline specific beneficiaries, such as family members, friends, or charitable organizations, and the proportion or specific items each is entitled to receive. 4. Appointment of a Trustee: The Pour Over Will designates a trusted individual, known as a trustee, responsible for managing the trust and overseeing the proper distribution of assets. The trustee may be an individual, a financial institution, or a combination thereof. 5. Guardian Appointment: If there are dependent children, the Pour Over Will may also include the appointment of a guardian to ensure their care and well-being in case both parents pass away. It's important to note that while the Pour Over Will is a specific type of Last Will and Testament form, there may not be variations or specific subtypes of the document tailored exclusively for Lewisville, Texas. However, individuals can consult with an estate planning attorney in Lewisville to further customize their Pour Over Will to meet their specific requirements and unique circumstances.Lewisville Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that serves as an essential estate planning tool. This type of will allows individuals in Lewisville, Texas, to transfer their assets, including real estate, bank accounts, investments, and personal belongings, to a living trust after their passing. The Pour Over Will acts as a safety net, ensuring that any property or assets not explicitly included in the living trust are automatically poured over into the trust. This process ensures that the assets are managed and distributed according to the individual's wishes, minimizing the need for probate and simplifying the estate administration process. Key elements of a Lewisville Texas Legal Last Will and Testament Form with All Property to Trust (Pour Over Will) may include: 1. Testator Identification: The document includes the identification details of the testator (the individual creating the will) such as their full legal name, address, date of birth, and other relevant personal information. 2. Trust Identification: The Pour Over Will specifies the details of the established living trust that will receive the assets, including the trust's name, address, and any specific instructions for its administration. 3. Asset Distribution: The document provides clear instructions on how the assets should be distributed within the trust. It may outline specific beneficiaries, such as family members, friends, or charitable organizations, and the proportion or specific items each is entitled to receive. 4. Appointment of a Trustee: The Pour Over Will designates a trusted individual, known as a trustee, responsible for managing the trust and overseeing the proper distribution of assets. The trustee may be an individual, a financial institution, or a combination thereof. 5. Guardian Appointment: If there are dependent children, the Pour Over Will may also include the appointment of a guardian to ensure their care and well-being in case both parents pass away. It's important to note that while the Pour Over Will is a specific type of Last Will and Testament form, there may not be variations or specific subtypes of the document tailored exclusively for Lewisville, Texas. However, individuals can consult with an estate planning attorney in Lewisville to further customize their Pour Over Will to meet their specific requirements and unique circumstances.

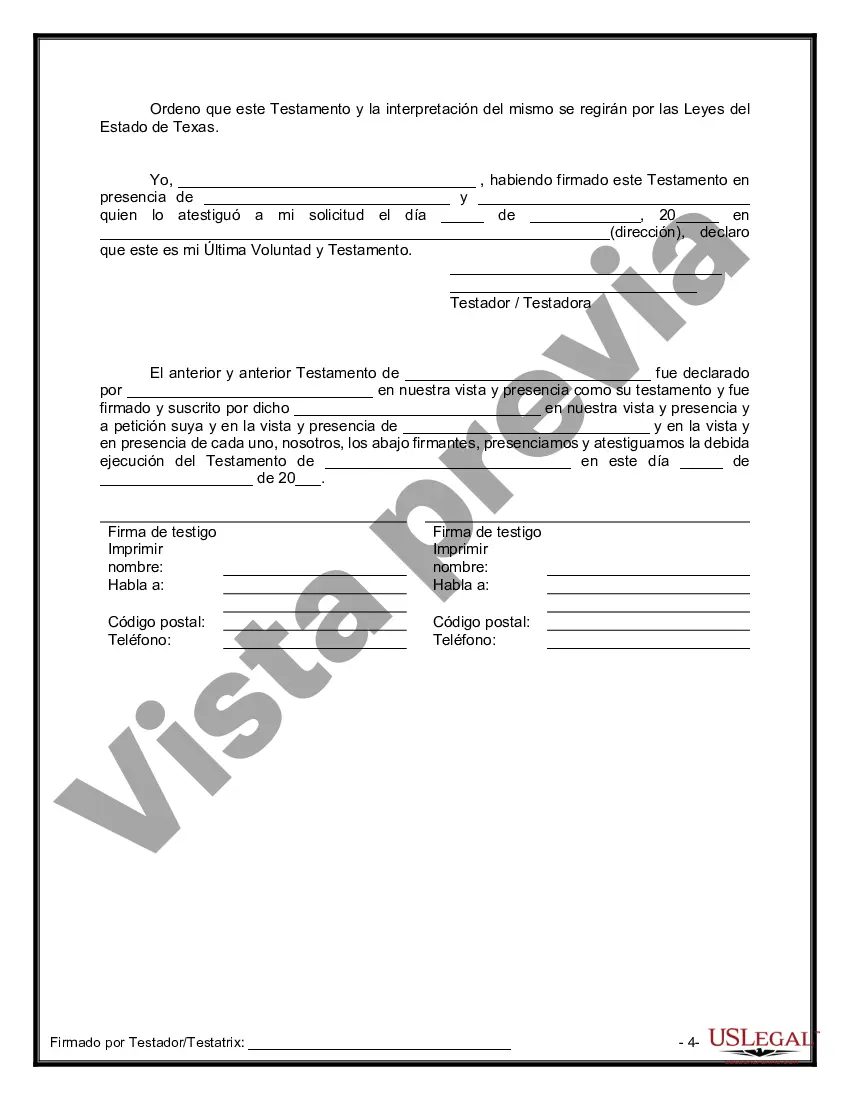

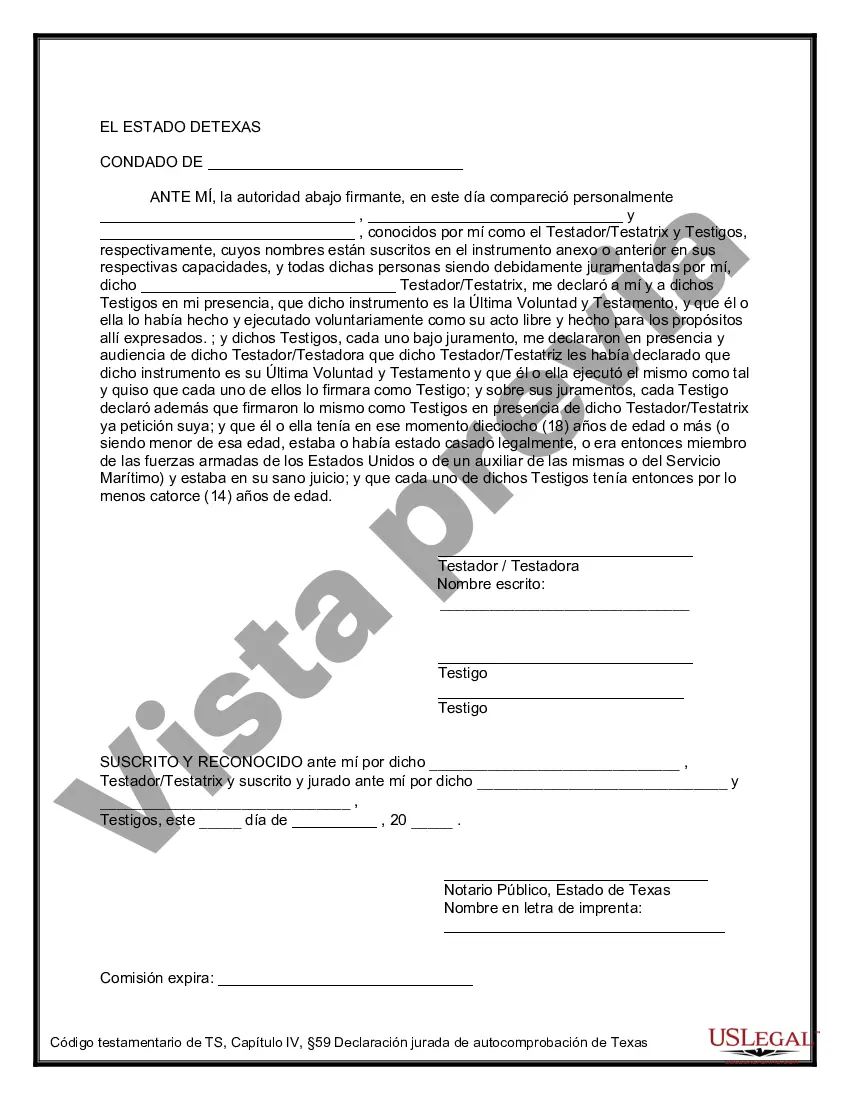

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.