This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

A Pour Over Will is a type of legal Last Will and Testament form commonly used in Sugar Land, Texas. It is specifically designed to transfer any property that has not been transferred to a living trust during the testator's lifetime, into the trust after their death. This legal document ensures the seamless distribution of assets and allows them to benefit from the protections offered by a trust. A Pour Over Will in Sugar Land, Texas is a crucial component of estate planning, as it addresses any property or assets that may not have been included in the living trust. By incorporating a Pour Over Will into an estate plan, individuals can rest assured that their assets will be handled according to their wishes and managed by a trust. This type of will eliminates the need for probate court involvement for assets held in the living trust, as it authorizes the transfer of any remaining property into the trust upon the testator's passing. The Pour Over Will serves as a safety net to catch any assets inadvertently left out of the trust during the testator's lifetime, ensuring that all property is eventually distributed according to their predetermined desires. It is important to note that there may be variations of a Pour Over Will in Sugar Land, Texas, based on individual circumstances and preferences. Some possible types of Pour Over Wills include: 1. Simple Pour Over Will: — This is the most common type of Pour Over Will, often used when there are no specific complexities or unique asset distribution requirements. It ensures all remaining property goes into the living trust. 2. Complex Pour Over Will: — This type of Pour Over Will is used when there are intricate asset distribution needs, specific instructions for certain assets, or multiple trusts involved. It provides more detailed guidance for trustees and addresses any complicated aspects of property transfer. 3. Joint Pour Over Will: — In cases where both spouses or partners have a joint living trust, a Joint Pour Over Will combines their desires into a unified plan for asset distribution. It ensures that any remaining property is transferred to their shared living trust. By utilizing a Sugar Land, Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will, individuals can properly allocate their assets, avoid potential disputes, and provide for their loved ones after their passing. This legal document serves as an essential part of comprehensive estate planning to ensure the smooth transition of property to the designated trust.A Pour Over Will is a type of legal Last Will and Testament form commonly used in Sugar Land, Texas. It is specifically designed to transfer any property that has not been transferred to a living trust during the testator's lifetime, into the trust after their death. This legal document ensures the seamless distribution of assets and allows them to benefit from the protections offered by a trust. A Pour Over Will in Sugar Land, Texas is a crucial component of estate planning, as it addresses any property or assets that may not have been included in the living trust. By incorporating a Pour Over Will into an estate plan, individuals can rest assured that their assets will be handled according to their wishes and managed by a trust. This type of will eliminates the need for probate court involvement for assets held in the living trust, as it authorizes the transfer of any remaining property into the trust upon the testator's passing. The Pour Over Will serves as a safety net to catch any assets inadvertently left out of the trust during the testator's lifetime, ensuring that all property is eventually distributed according to their predetermined desires. It is important to note that there may be variations of a Pour Over Will in Sugar Land, Texas, based on individual circumstances and preferences. Some possible types of Pour Over Wills include: 1. Simple Pour Over Will: — This is the most common type of Pour Over Will, often used when there are no specific complexities or unique asset distribution requirements. It ensures all remaining property goes into the living trust. 2. Complex Pour Over Will: — This type of Pour Over Will is used when there are intricate asset distribution needs, specific instructions for certain assets, or multiple trusts involved. It provides more detailed guidance for trustees and addresses any complicated aspects of property transfer. 3. Joint Pour Over Will: — In cases where both spouses or partners have a joint living trust, a Joint Pour Over Will combines their desires into a unified plan for asset distribution. It ensures that any remaining property is transferred to their shared living trust. By utilizing a Sugar Land, Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will, individuals can properly allocate their assets, avoid potential disputes, and provide for their loved ones after their passing. This legal document serves as an essential part of comprehensive estate planning to ensure the smooth transition of property to the designated trust.

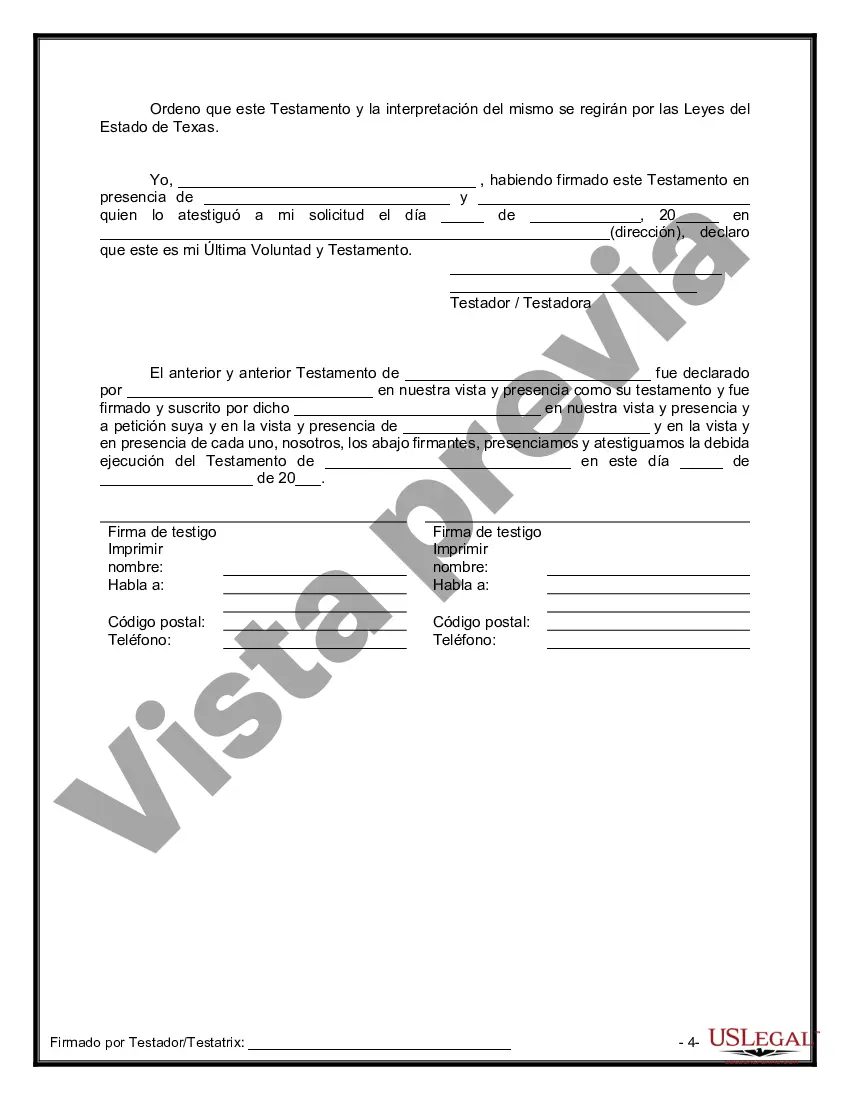

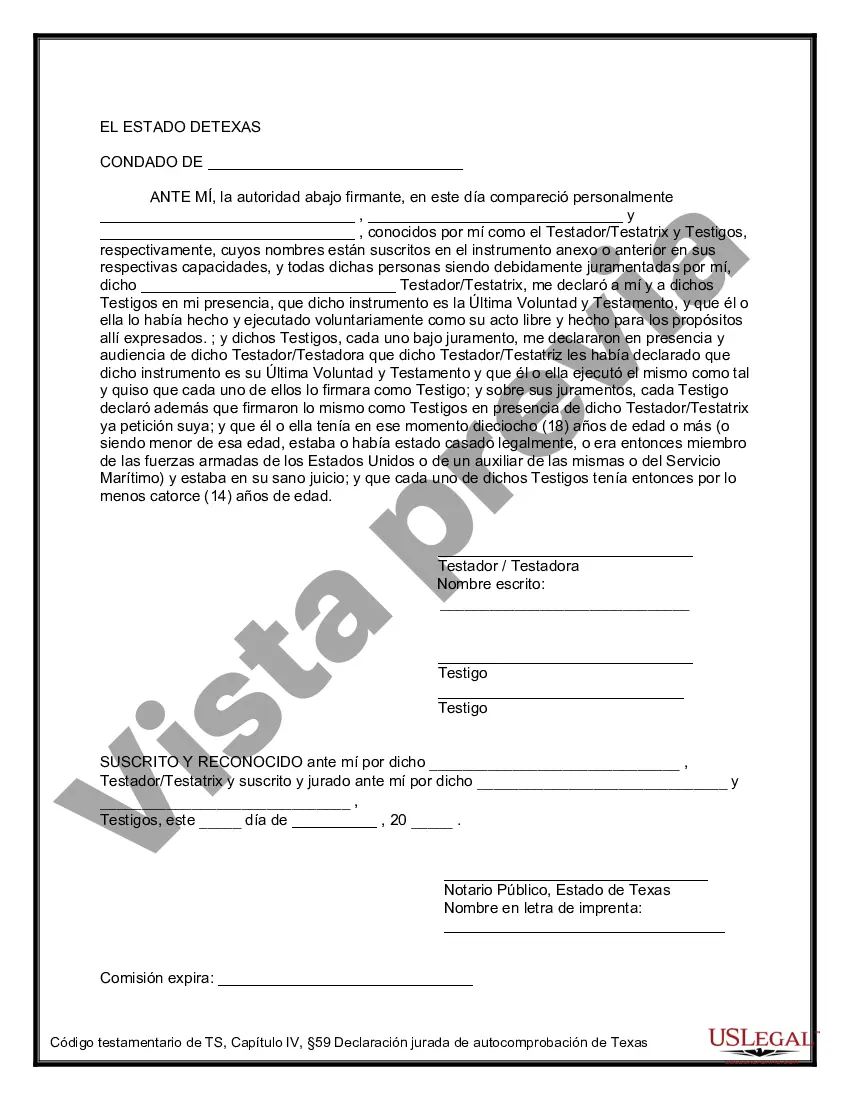

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.