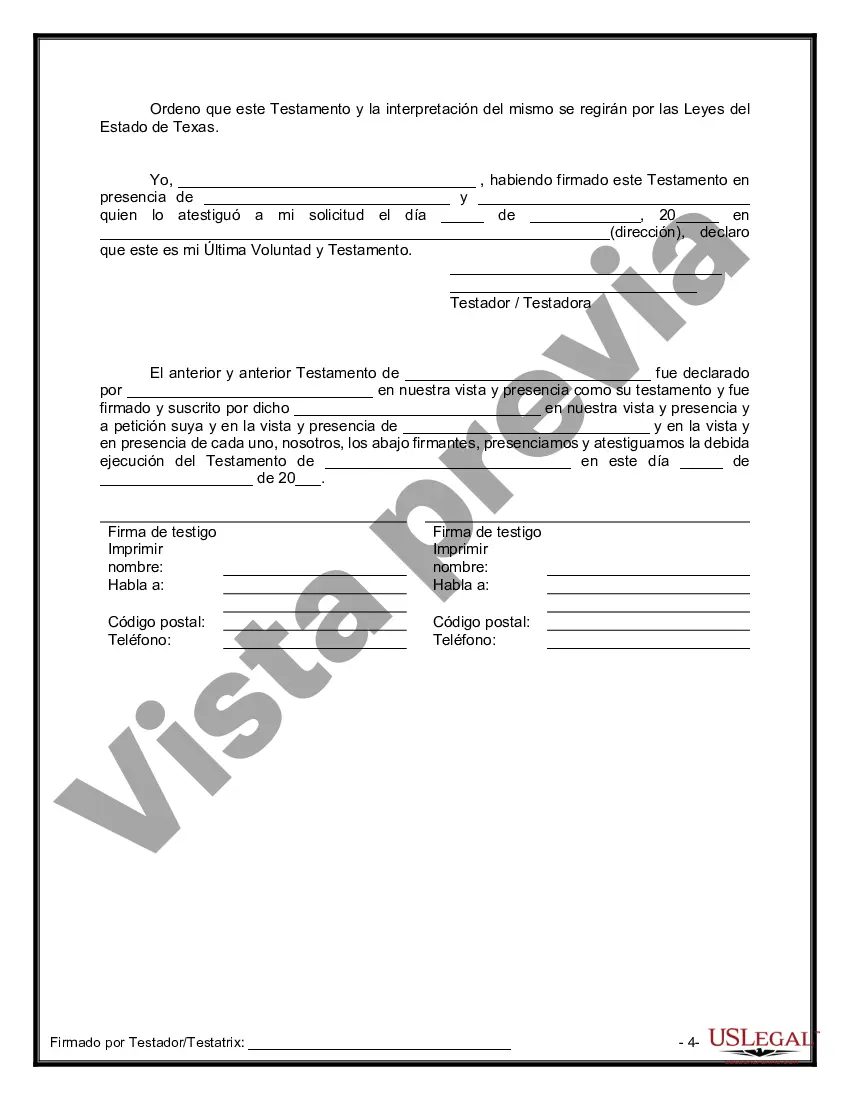

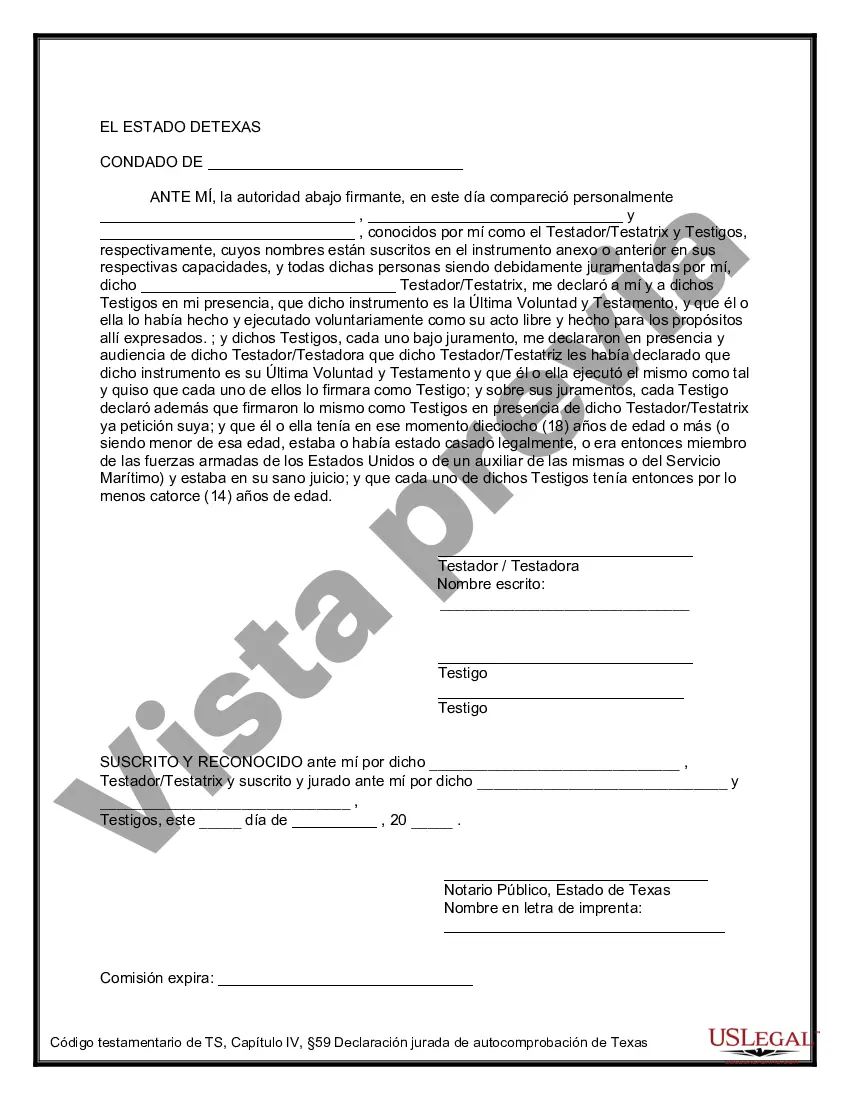

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

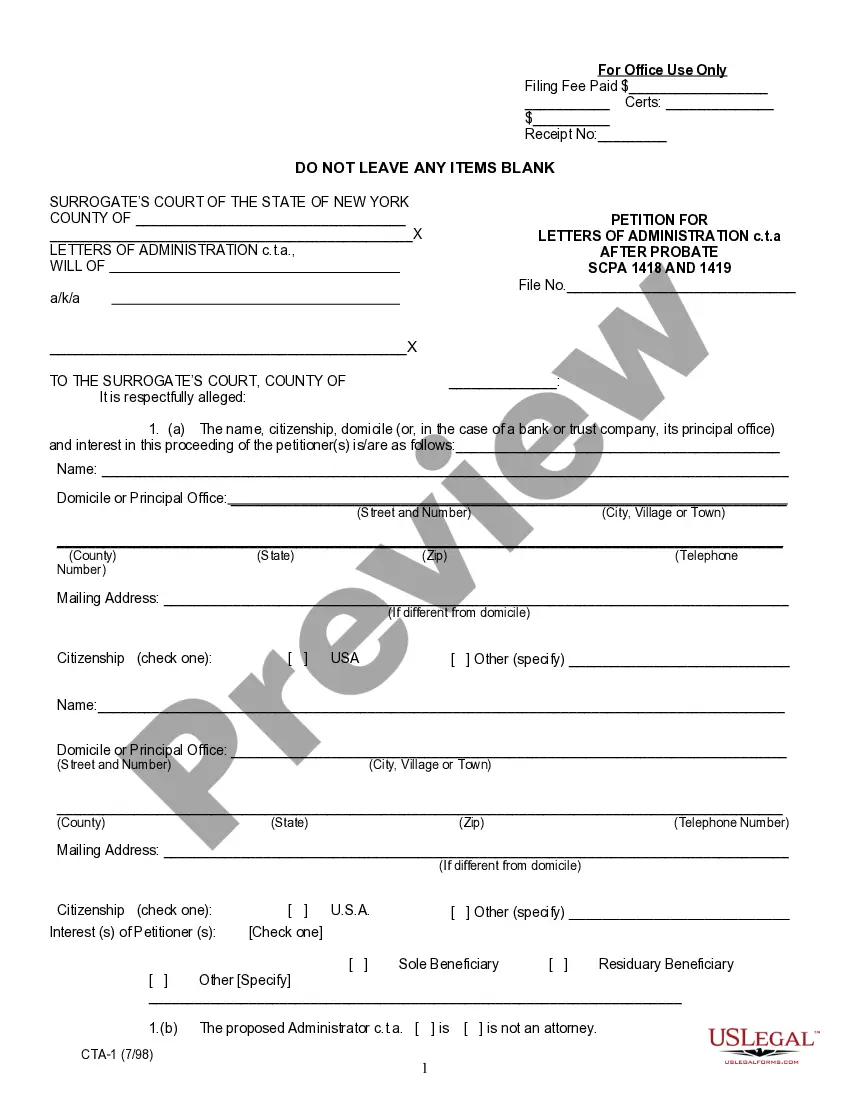

Travis Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a crucial legal document that allows individuals to ensure the smooth transfer of their assets to a trust upon their demise. This type of will helps ensure that all property left outside the trust during a person's lifetime is "poured over" into the trust upon their death for efficient management and distribution. A Pour Over Will in Travis Texas serves as an essential component of estate planning, providing individuals with a comprehensive tool to protect their assets and ensure their intended beneficiaries receive the desired inheritance. By utilizing this legal form, individuals can establish a pour-over provision, effectively stating that any property, assets, or belongings not explicitly placed in the trust during their lifetime should be moved into the trust after death. By executing a Travis Texas Legal Last Will and Testament Form with All Property to Trust, individuals can create a unified estate plan, bringing all their assets under the umbrella of a revocable living trust. This type of will ensures that any newly acquired assets will be automatically transferred into the trust, avoiding the need to frequently update the trust documents. In addition to the standard Travis Texas Legal Last Will and Testament Form with All Property to Trust, there may be variations or specific forms available to cater to specific needs or circumstances. Some of these variations may include: 1. Simple Pour Over Will: This is a basic form of the pour-over will that can be used when the estate or assets are relatively straightforward, and there are no complex instructions or unique circumstances. 2. Testamentary Pour Over Will: This type of pour-over will is employed when an individual wishes to create a trust within their will that will become effective upon their death. It outlines that the specified assets should be poured into the trust, rather than directly transferred to beneficiaries or heirs. 3. Joint Pour Over Will: If a married couple or domestic partners wish to create a joint trust to hold their combined assets, they can utilize a joint pour-over will. This form ensures that all of their shared property is transferred to the trust upon the death of either spouse or partner. 4. Specific Provision Pour Over Will: In situations where individuals desire to distribute particular assets or properties to specific beneficiaries or institutions outside the trust, a specific provision pour-over will, can be utilized. This form allows the individual to list the specific bequests while pouring over remaining assets into the trust. 5. Contingent Pour Over Will: A contingent pour-over will outline instructions for assets that are only transferred to the trust if specific conditions are met. This type of will ensures that assets designated as "back-up" or alternative arrangements are efficiently distributed according to the person's wishes. It is important to consult with an experienced attorney specializing in estate planning in Travis Texas to ensure that the chosen type of Last Will and Testament Form with All Property to Trust, specifically a Pour Over Will, accurately reflects individual preferences and aligns with the local legal requirements.Travis Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a crucial legal document that allows individuals to ensure the smooth transfer of their assets to a trust upon their demise. This type of will helps ensure that all property left outside the trust during a person's lifetime is "poured over" into the trust upon their death for efficient management and distribution. A Pour Over Will in Travis Texas serves as an essential component of estate planning, providing individuals with a comprehensive tool to protect their assets and ensure their intended beneficiaries receive the desired inheritance. By utilizing this legal form, individuals can establish a pour-over provision, effectively stating that any property, assets, or belongings not explicitly placed in the trust during their lifetime should be moved into the trust after death. By executing a Travis Texas Legal Last Will and Testament Form with All Property to Trust, individuals can create a unified estate plan, bringing all their assets under the umbrella of a revocable living trust. This type of will ensures that any newly acquired assets will be automatically transferred into the trust, avoiding the need to frequently update the trust documents. In addition to the standard Travis Texas Legal Last Will and Testament Form with All Property to Trust, there may be variations or specific forms available to cater to specific needs or circumstances. Some of these variations may include: 1. Simple Pour Over Will: This is a basic form of the pour-over will that can be used when the estate or assets are relatively straightforward, and there are no complex instructions or unique circumstances. 2. Testamentary Pour Over Will: This type of pour-over will is employed when an individual wishes to create a trust within their will that will become effective upon their death. It outlines that the specified assets should be poured into the trust, rather than directly transferred to beneficiaries or heirs. 3. Joint Pour Over Will: If a married couple or domestic partners wish to create a joint trust to hold their combined assets, they can utilize a joint pour-over will. This form ensures that all of their shared property is transferred to the trust upon the death of either spouse or partner. 4. Specific Provision Pour Over Will: In situations where individuals desire to distribute particular assets or properties to specific beneficiaries or institutions outside the trust, a specific provision pour-over will, can be utilized. This form allows the individual to list the specific bequests while pouring over remaining assets into the trust. 5. Contingent Pour Over Will: A contingent pour-over will outline instructions for assets that are only transferred to the trust if specific conditions are met. This type of will ensures that assets designated as "back-up" or alternative arrangements are efficiently distributed according to the person's wishes. It is important to consult with an experienced attorney specializing in estate planning in Travis Texas to ensure that the chosen type of Last Will and Testament Form with All Property to Trust, specifically a Pour Over Will, accurately reflects individual preferences and aligns with the local legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.