A San Antonio Texas Last Will and Testament for other Persons is a legal document that specifies the wishes and intentions of an individual, known as the testator, regarding the distribution of their assets, payment of debts, and the appointment of an executor or personal representative after their death. This testament is crucial to ensure that the testator's estate is distributed according to their preferences and to avoid potential disputes among beneficiaries. There are different types of San Antonio Texas Last Will and Testament for other Persons, including: 1. Simple Will: This is the most basic type of will and is suitable for individuals with straightforward estate plans. It outlines the distribution of assets, appoints an executor, and may include guardianship provisions for minor children. 2. Testamentary Trust Will: In this type of will, the testator creates a trust to manage and distribute assets after their death. This may be preferred by individuals who wish to provide ongoing financial support to specific beneficiaries or protect assets for future generations. 3. Living Will: Also known as an advanced healthcare directive, a living will specifies the testator's wishes regarding medical treatment and end-of-life decisions if they become incapacitated and unable to communicate their preferences. This document can also appoint a healthcare proxy to make medical decisions on the testator's behalf. 4. Pour-Over Will: This will is used in conjunction with a revocable living trust. It ensures that any assets not already transferred into the trust during the testator's lifetime are added to it at their death. 5. Holographic Will: A handwritten will created by the testator without witnesses. Although legally recognized in Texas, it is recommended to create a typewritten will with proper witnesses to avoid potential challenges. When drafting a San Antonio Texas Last Will and Testament for other Persons, it is crucial to consult with an experienced estate planning attorney to ensure compliance with state laws and to address specific circumstances and concerns. The attorney will guide the testator through the process, assist in identifying beneficiaries, and provide insights into minimizing tax implications and maximizing asset protection.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Testamento En Texas - Texas Last Will and Testament for other Persons

Description

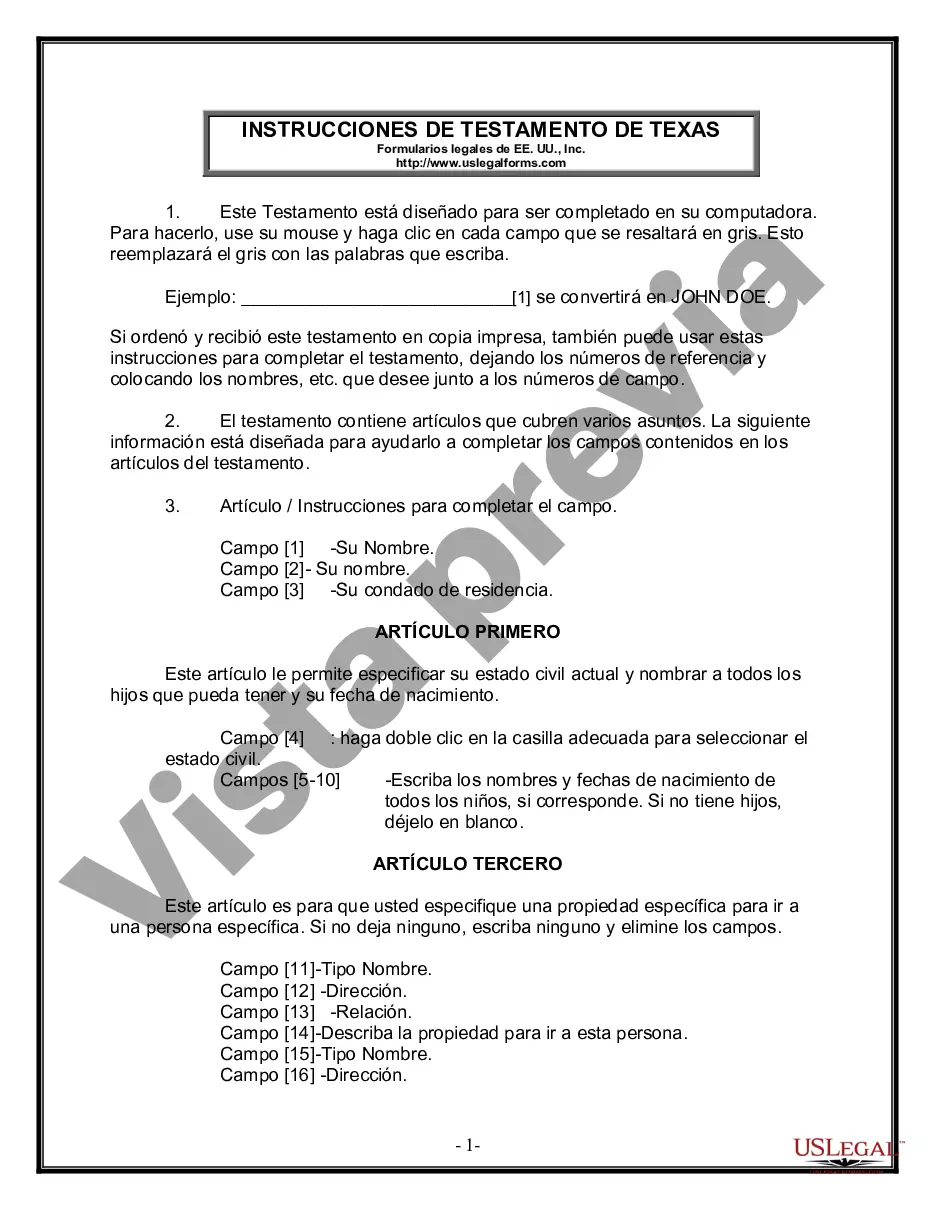

How to fill out San Antonio Texas Última Voluntad Y Testamento Para Otras Personas?

If you are searching for a valid form, it’s extremely hard to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find thousands of templates for organization and individual purposes by categories and states, or key phrases. With our advanced search feature, discovering the most up-to-date San Antonio Texas Last Will and Testament for other Persons is as easy as 1-2-3. Furthermore, the relevance of each file is confirmed by a group of expert attorneys that on a regular basis review the templates on our platform and update them according to the newest state and county laws.

If you already know about our platform and have an account, all you should do to receive the San Antonio Texas Last Will and Testament for other Persons is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you want. Check its information and utilize the Preview option to check its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the proper document.

- Confirm your decision. Click the Buy now button. After that, choose the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Pick the file format and download it on your device.

- Make changes. Fill out, modify, print, and sign the received San Antonio Texas Last Will and Testament for other Persons.

Each template you add to your account has no expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to have an additional version for editing or printing, you can return and download it once more anytime.

Make use of the US Legal Forms extensive library to get access to the San Antonio Texas Last Will and Testament for other Persons you were seeking and thousands of other professional and state-specific templates in a single place!