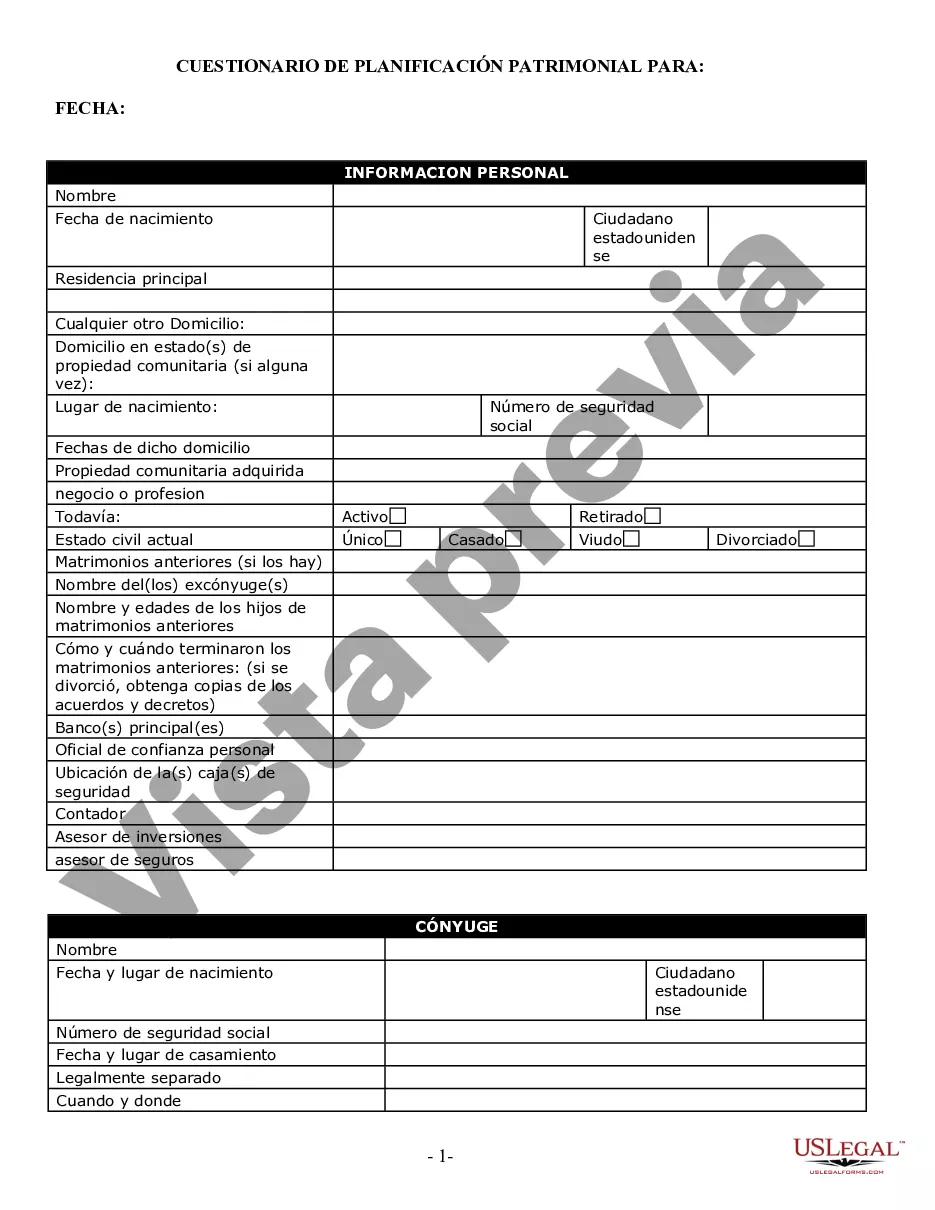

Harris Texas Estate Planning Questionnaire and Worksheets are comprehensive tools designed to gather crucial information and assist individuals in creating a personalized estate plan. These documents play a vital role in ensuring that the estate planner's wishes and intentions are carried out effectively after their passing. Whether you are a resident of Harris County, Texas, or specifically seeking estate planning guidance from professionals in that area, these questionnaires and worksheets can greatly simplify the process. The Harris Texas Estate Planning Questionnaire is a detailed document that prompts individuals to provide essential personal information such as their full legal name, contact details, birthdate, and social security number. It also delves into specific questions related to family dynamics, including the names, ages, and relationships of immediate family members, beneficiaries, and potential guardians for minor children. Moreover, these questionnaires encompass inquiries regarding assets and liabilities. Individuals are encouraged to disclose information about valuable assets, including real estate properties, bank accounts, investments, and personal belongings. In contrast, liabilities encompass outstanding debts, mortgages, loans, and any other financial obligations. The estate planning questionnaires further cover various estate planning components, such as drafting a last will and testament, establishing durable powers of attorney, creating trusts, and addressing healthcare directives. These sections aim to gather precise instructions and preferences for each component, ensuring that individuals are able to express their desires regarding asset allocation, charitable contributions, appointment of executors, and designating decision-makers for critical healthcare choices. Harris Texas Estate Planning Worksheets are complementary documents that work alongside the questionnaire to assess the financial aspects of an individual's estate. These worksheets provide a template to detail and organize financial information, including income sources, expenses, insurance policies, retirement accounts, and business interests, if applicable. By accurately assessing their financial situation, individuals can make informed decisions about estate planning strategies that align with their financial goals and objectives. While there may not be different types of Harris Texas Estate Planning Questionnaire and Worksheets, their content can vary depending on the service provider or attorney offering these resources. Some professionals may include additional sections or supplemental documents specific to particular estate planning needs, such as special needs trusts, complex assets, or blended family situations. It is advisable to consult with a reputable estate planning attorney in Harris County, Texas, to determine the most suitable questionnaire and worksheets for specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Cuestionario y hojas de trabajo de planificación patrimonial - Texas Estate Planning Questionnaire and Worksheets

Description

How to fill out Harris Texas Cuestionario Y Hojas De Trabajo De Planificación Patrimonial?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no legal background to draft this sort of papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service provides a massive library with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you need the Harris Texas Estate Planning Questionnaire and Worksheets or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Harris Texas Estate Planning Questionnaire and Worksheets in minutes using our trustworthy service. If you are already an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to obtaining the Harris Texas Estate Planning Questionnaire and Worksheets:

- Be sure the template you have found is good for your location considering that the regulations of one state or area do not work for another state or area.

- Review the form and go through a quick description (if provided) of cases the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Harris Texas Estate Planning Questionnaire and Worksheets once the payment is done.

You’re all set! Now you can proceed to print the form or complete it online. Should you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.