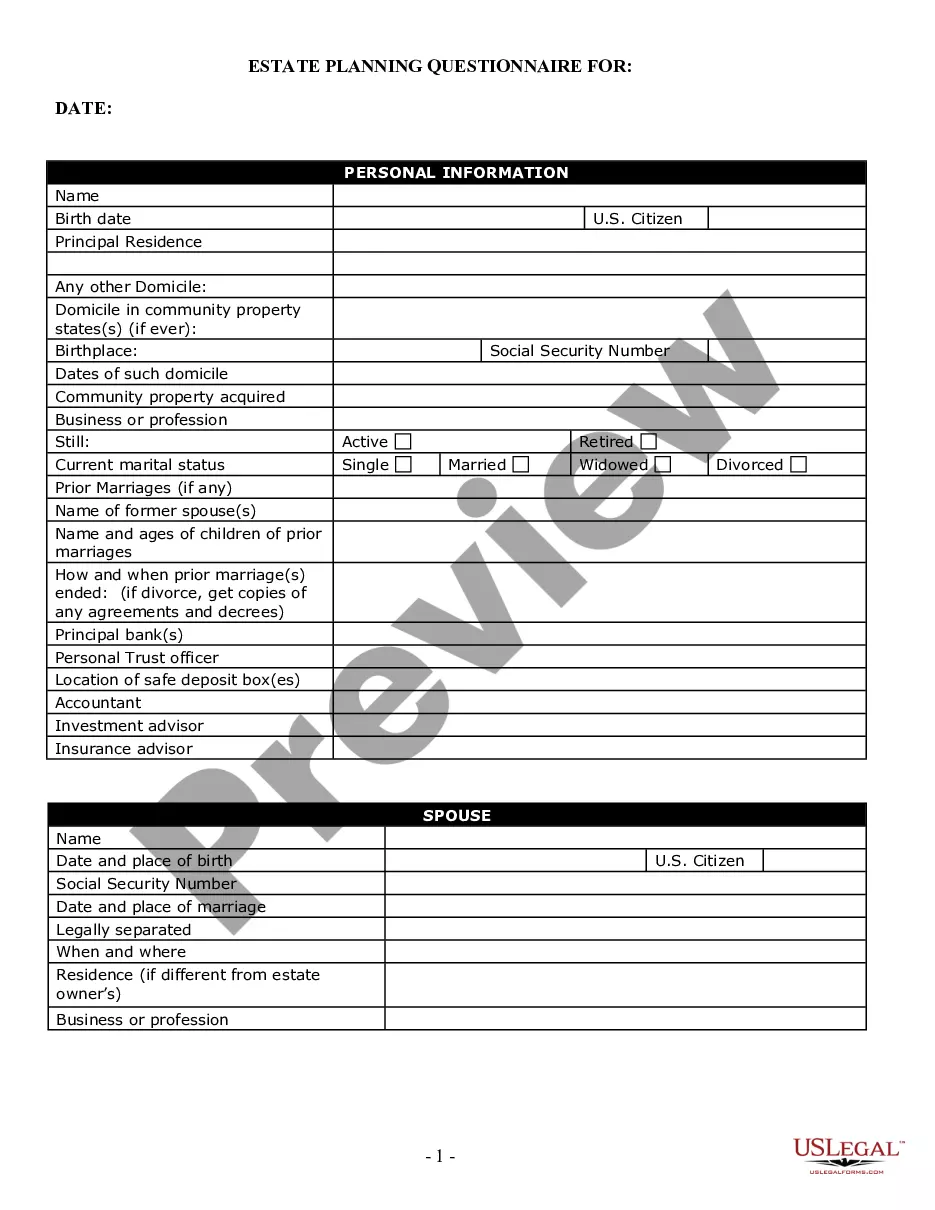

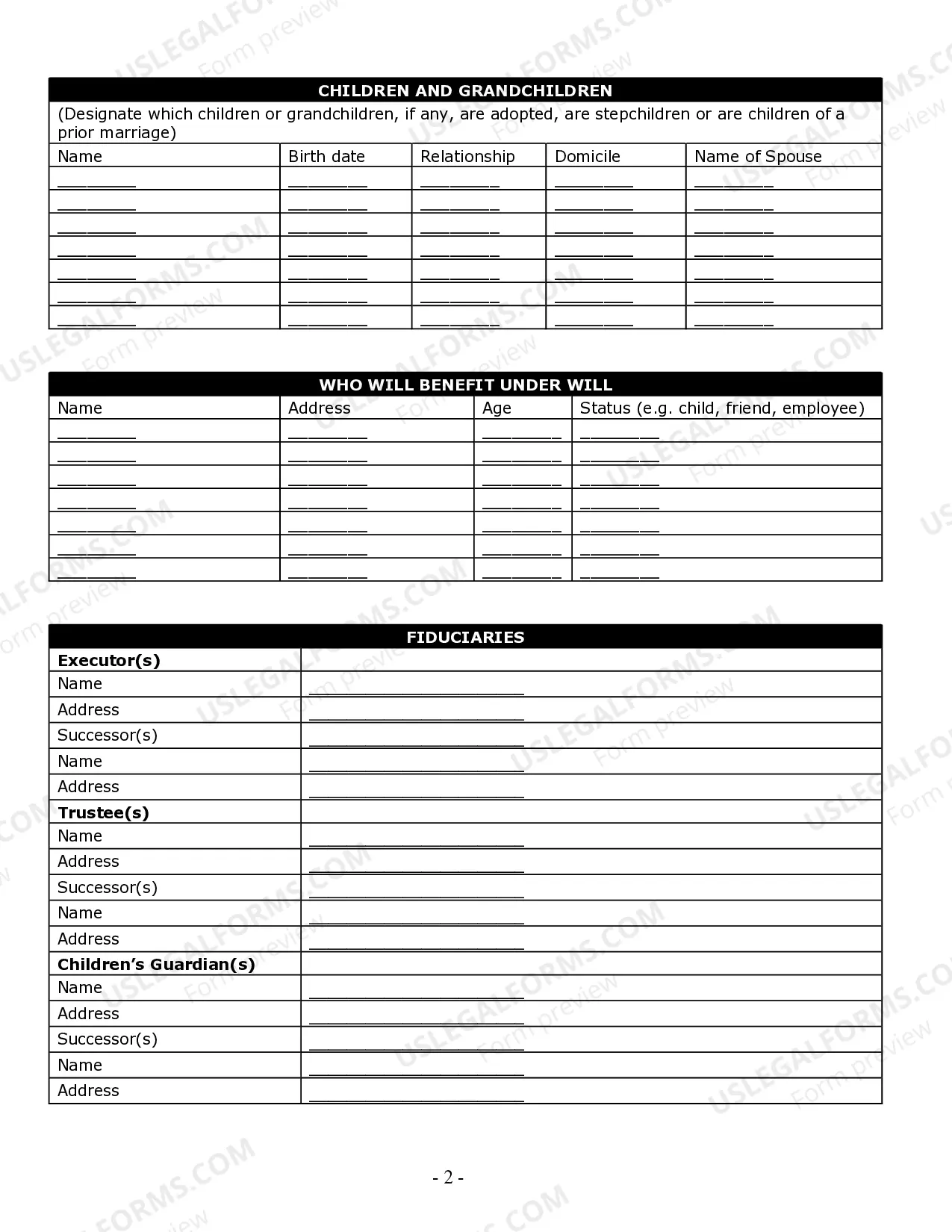

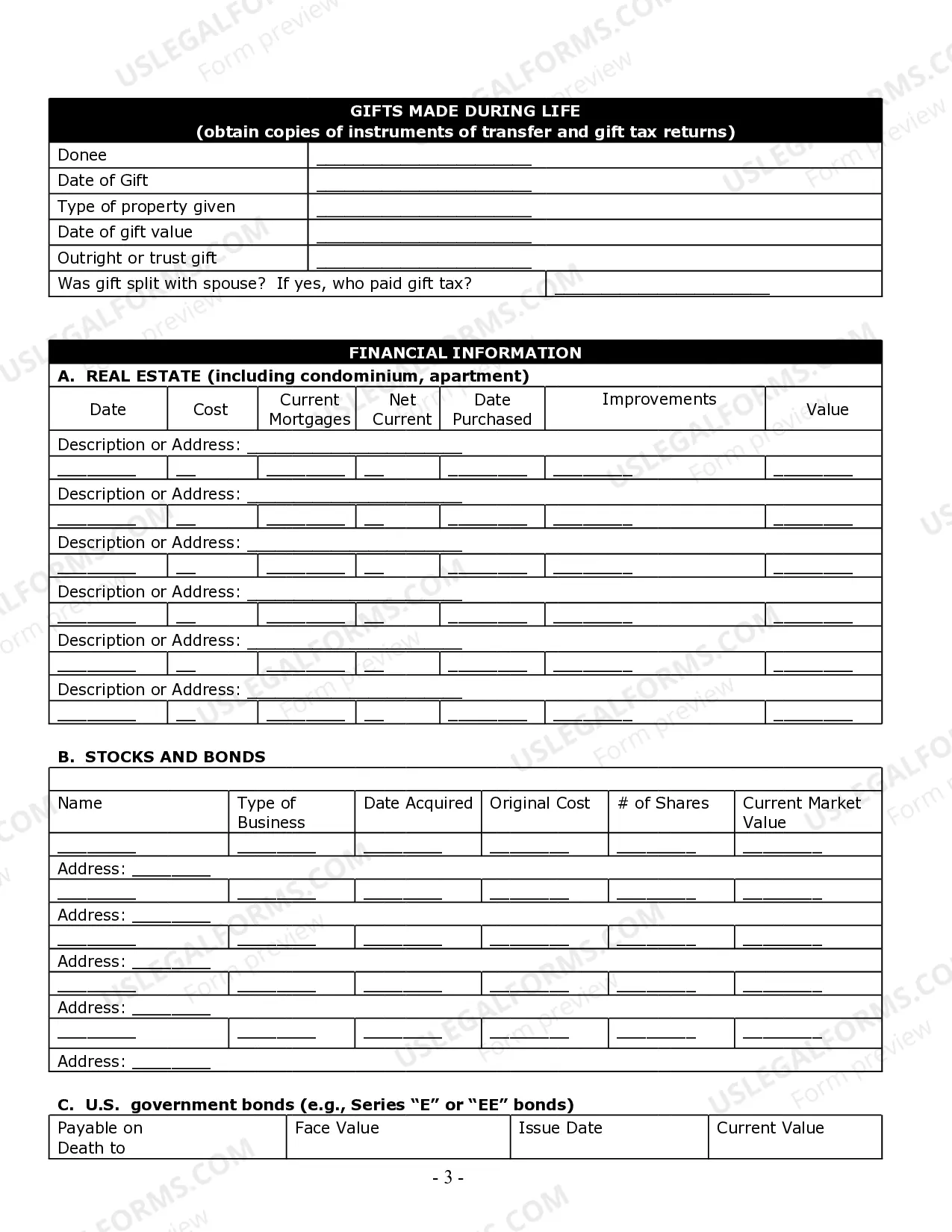

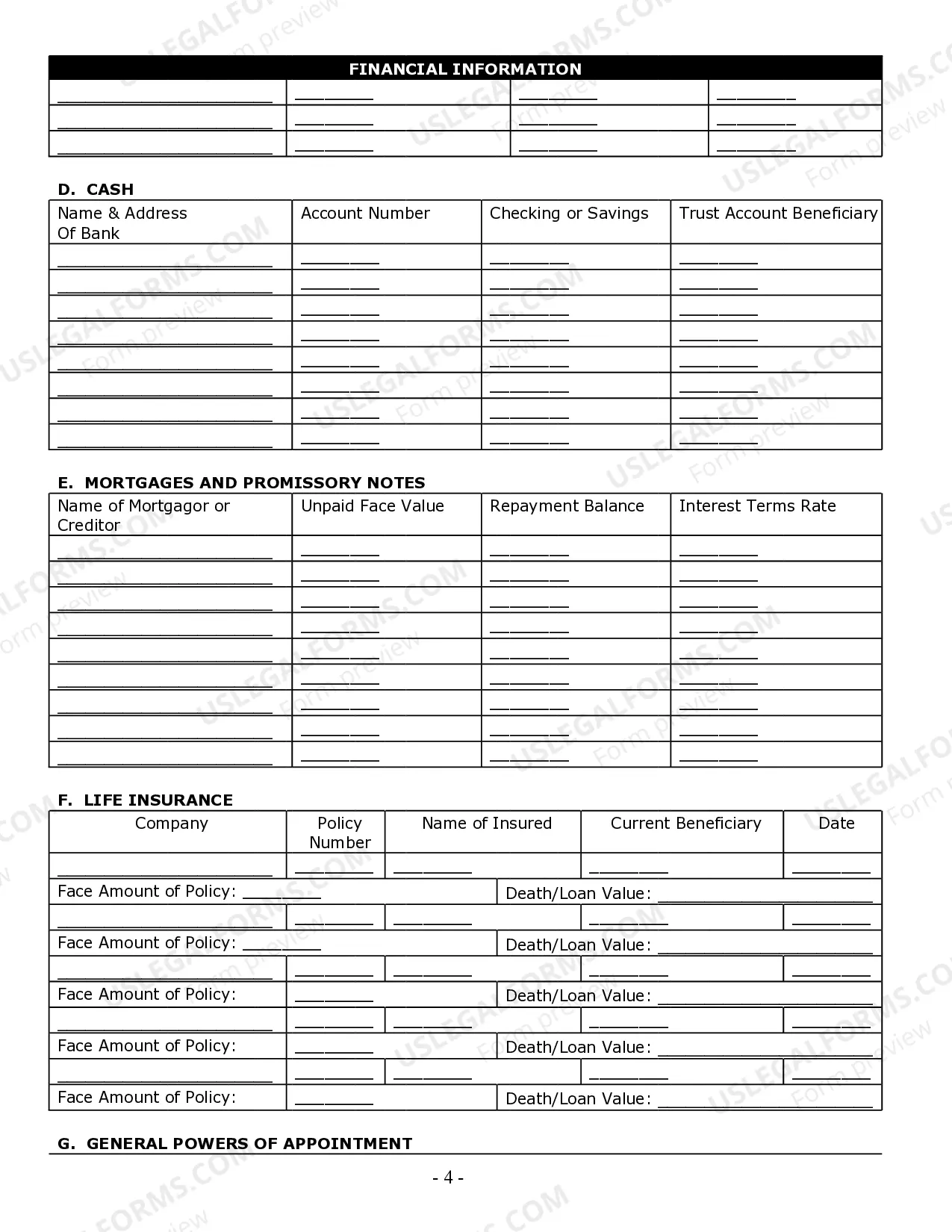

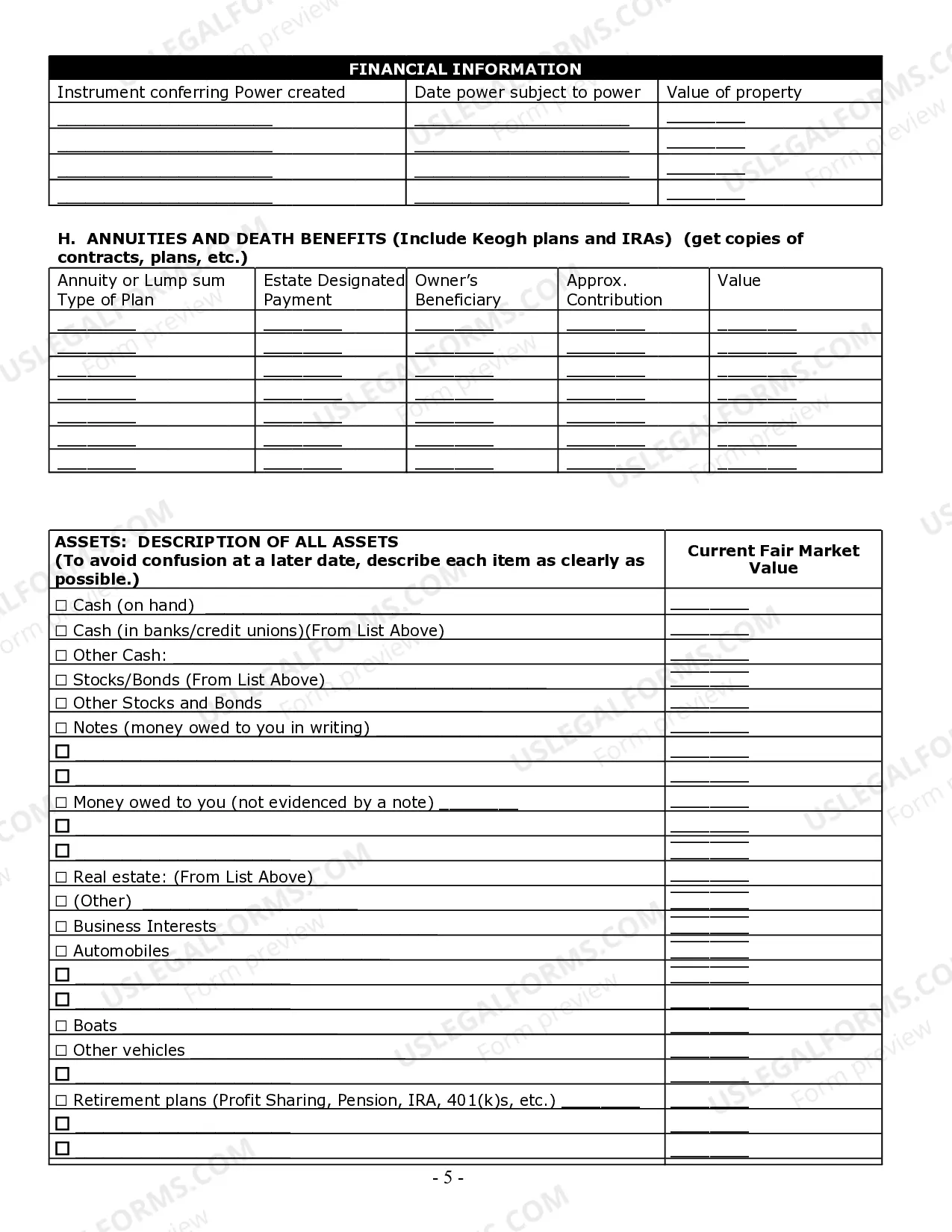

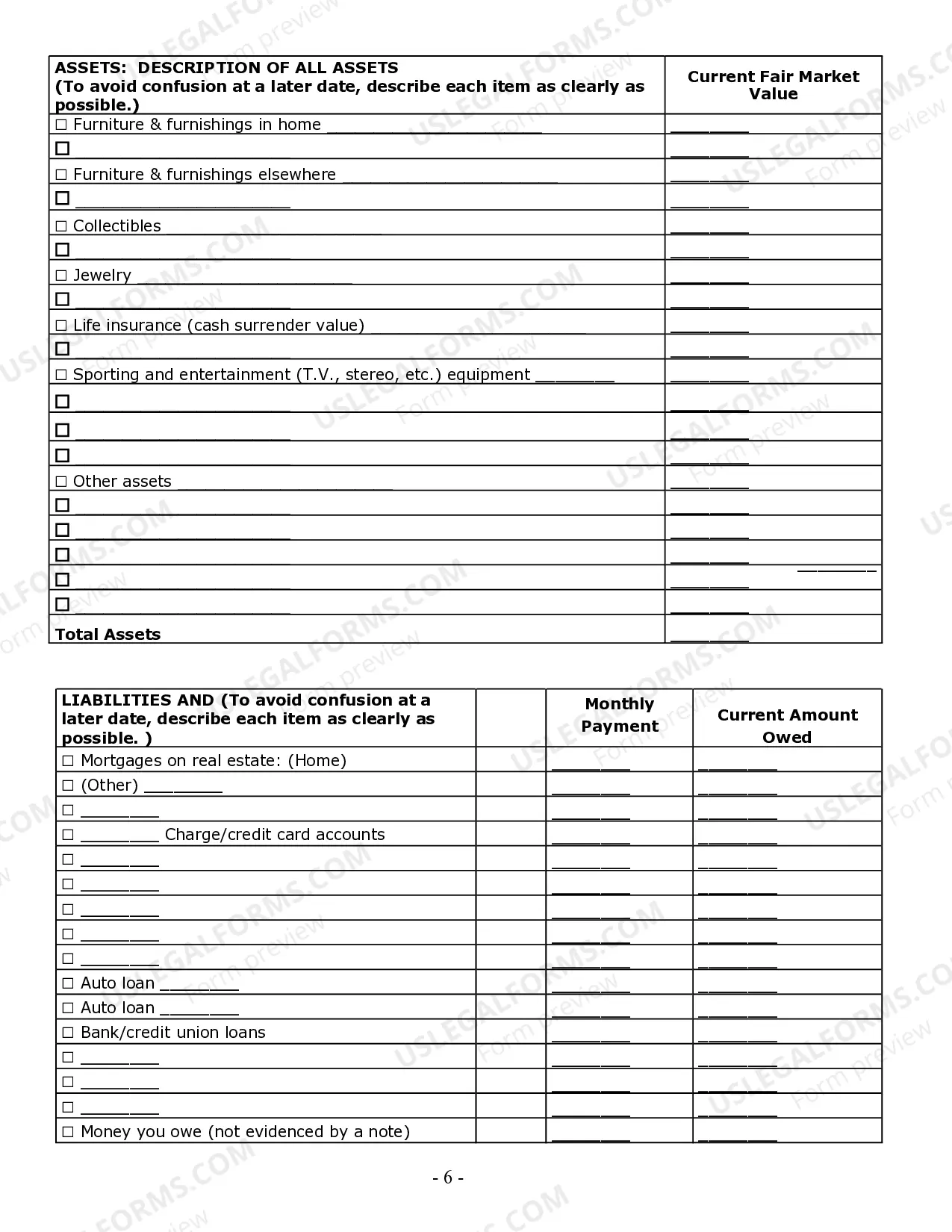

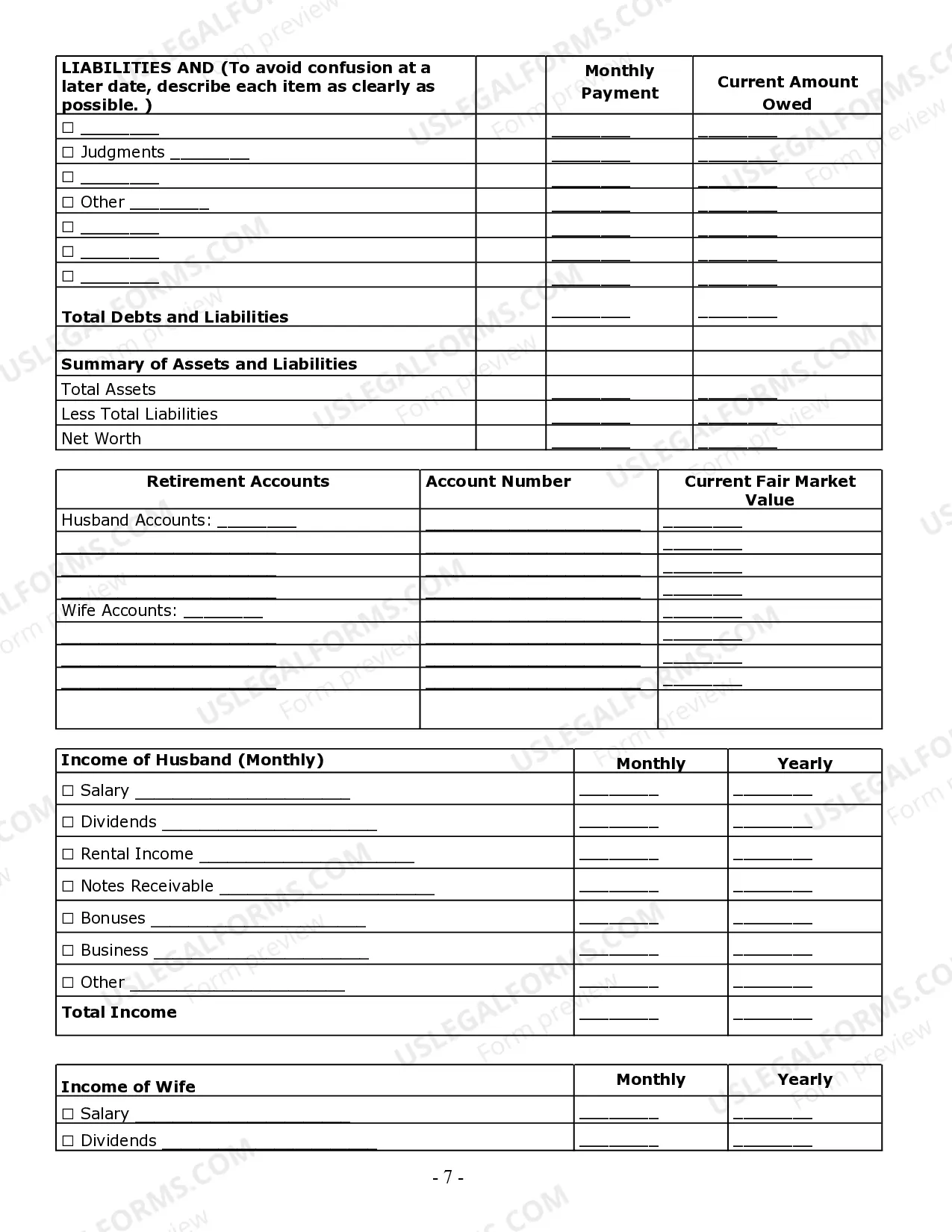

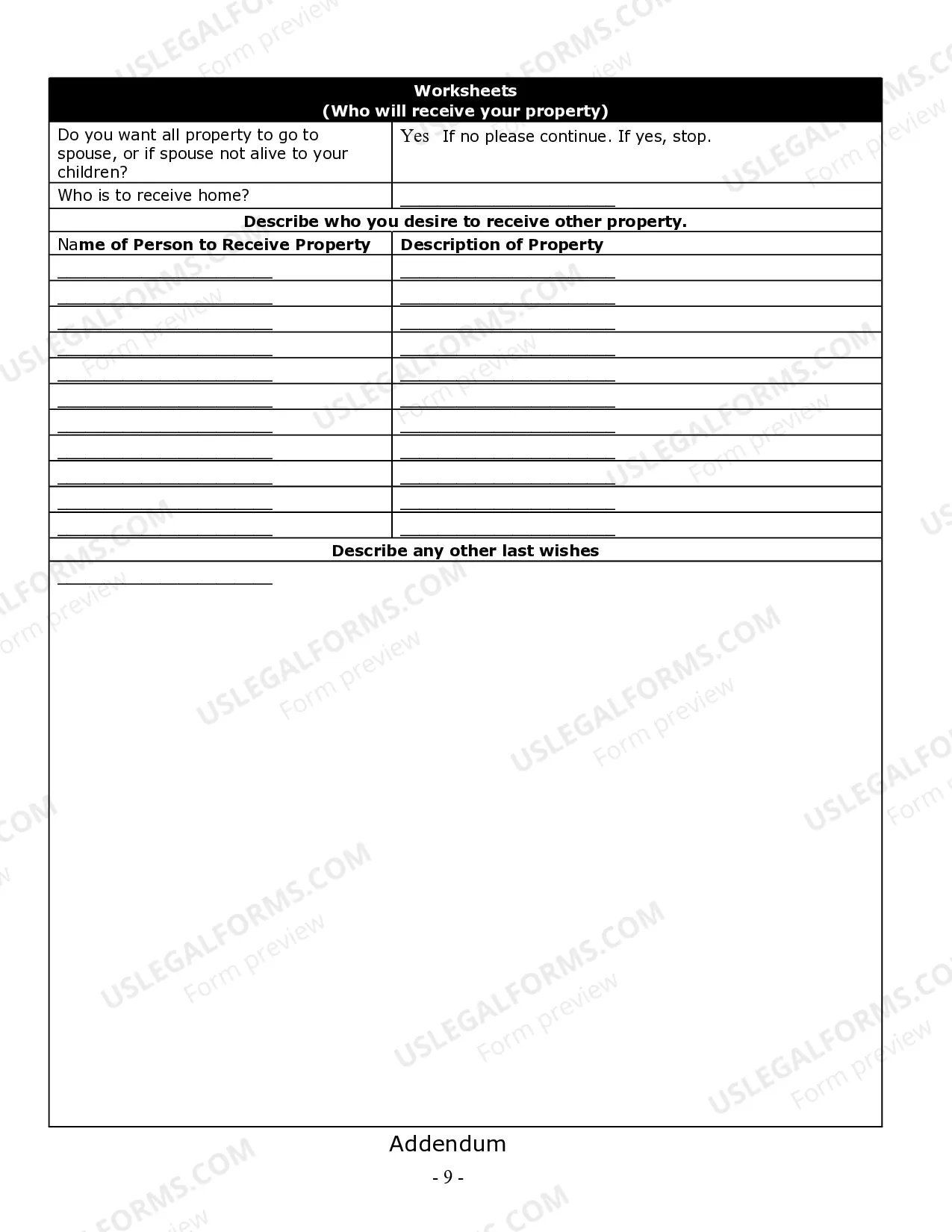

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Irving Texas Estate Planning Questionnaire and Worksheets

Description

How to fill out Texas Estate Planning Questionnaire And Worksheets?

Finding validated templates that adhere to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This online repository contains over 85,000 legal documents for both personal and business purposes, addressing various real-world situations.

All the forms are accurately categorized by usage area and jurisdictional boundaries, making the search for the Irving Texas Estate Planning Questionnaire and Worksheets as swift and straightforward as ABC.

Keeping documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to have important templates for all your requirements readily available at your fingertips!

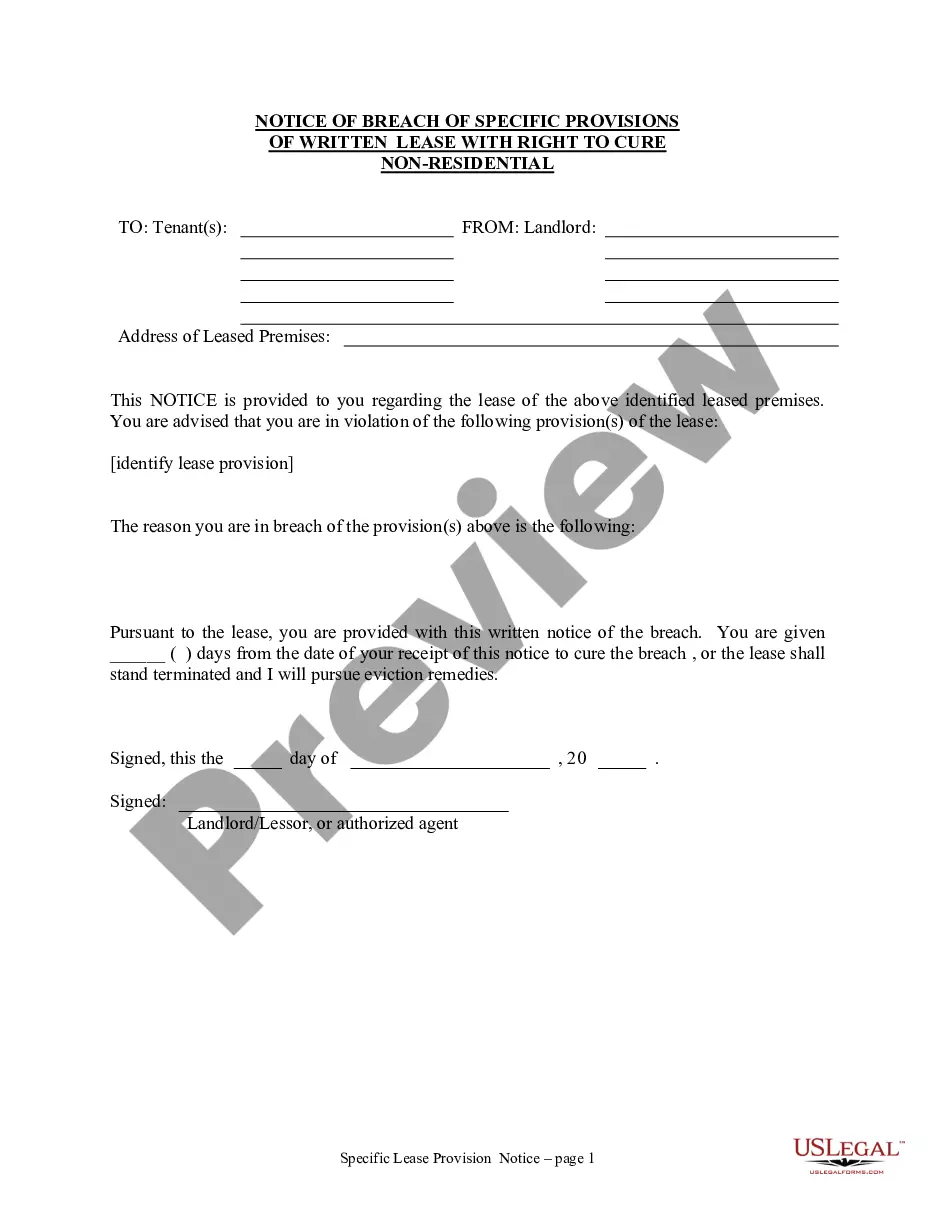

- Review the Preview mode and form description.

- Ensure you have selected the correct one that satisfies your requirements and aligns with your local jurisdiction standards.

- Look for another template if necessary.

- If you discover any discrepancies, use the Search tab above to find the appropriate one. If it meets your criteria, proceed to the next step.

- Complete the purchase of the document.

Form popularity

FAQ

In Texas, a will does not necessarily need to be notarized to be valid. However, having a will notarized can expedite the probate process later on. Using the Irving Texas Estate Planning Questionnaire and Worksheets can help you understand the options available and ensure that your will is prepared correctly, facilitating a smoother transition for your loved ones.

You can write a will yourself in Texas by following specific legal requirements. Creating your own will is possible, but you must ensure that it meets all state regulations to be valid. The Irving Texas Estate Planning Questionnaire and Worksheets are excellent tools to guide you through this process, ensuring you include all necessary information and formatting.

Yes, you can create a will without a lawyer in Texas. The state allows individuals to draft their own wills, which can be effective if you follow the proper guidelines. To simplify the process, consider using the Irving Texas Estate Planning Questionnaire and Worksheets. This resource provides essential forms and instructions to help you develop a legally sound document.

Yes, online wills can be valid in Texas as long as they meet the state's legal requirements. This includes being signed by the testator and witnessed by two witnesses. When creating an online will, be sure to follow the guidelines outlined in the Irving Texas Estate Planning Questionnaire and Worksheets to ensure its validity and adherence to Texas law.

To obtain a copy of a will in Texas online, you can search the records of the probate court in the county where the will was filed. Many counties provide online access to these documents. For a more guided process, consider utilizing the Irving Texas Estate Planning Questionnaire and Worksheets, which can assist you in navigating the steps to retrieving such important documents.

In Texas, a will does not need to be recorded during your lifetime, but it should be filed for probate after your passing. It's essential to ensure that your loved ones know its whereabouts. Using the Irving Texas Estate Planning Questionnaire and Worksheets can help you document your estate planning process and clarify how to manage your will effectively.

If you cannot find the original will in Texas, you may be able to use a copy that can be admitted to probate in some circumstances. You may also need to provide evidence that the original will existed and was valid. In such cases, consulting resources like the Irving Texas Estate Planning Questionnaire and Worksheets can assist you in understanding your options and the necessary steps.

The estate planning process generally involves seven key steps: assessing your assets, choosing beneficiaries, creating a will, selecting an executor, contemplating trusts, reviewing health care directives, and discussing your plans with family. Each step is crucial to ensure your wishes are honored. The Irving Texas Estate Planning Questionnaire and Worksheets provide a structured approach to navigate these vital components.

The most common form of probate in Texas is independent administration. This process allows the executor to manage the estate without court supervision, making it faster and more efficient. Utilizing tools such as the Irving Texas Estate Planning Questionnaire and Worksheets can help guide you through estate planning and potential probate options.

In Texas, you can access certain wills online, especially if they have been filed with the probate court. However, to view a specific will, you may need to contact the court or the executor directly. Additionally, using resources like the Irving Texas Estate Planning Questionnaire and Worksheets can help you understand the documentation involved in accessing a will.