Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

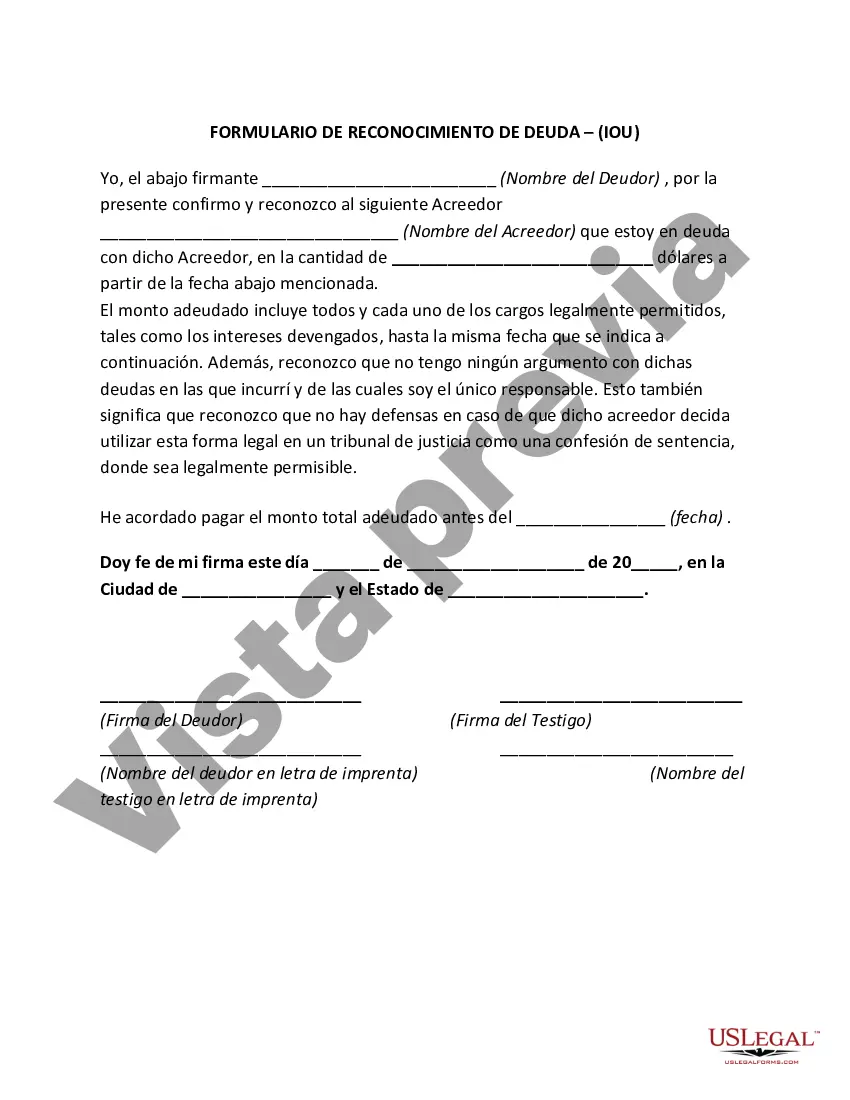

Alameda California Debt Acknowledgment — IO— - I Owe You is a legally binding document used to acknowledge and record a debt or loan between two parties in Alameda, California. It serves as evidence of the borrower's obligation to repay the lender by a specified date. This document outlines the terms and conditions of the debt, including the principal amount, interest rate (if applicable), repayment schedule, and any applicable penalties for defaulting on the debt. Keywords: Alameda California, debt acknowledgment, IOU, I Owe You, legally binding, debt, loan, evidence, borrower, lender, repayment, terms and conditions, principal amount, interest rate, repayment schedule, penalties, defaulting. Different types of Alameda California Debt Acknowledgment — IO— - I Owe You may include: 1. Personal Debt Acknowledgment: This type of IOU is used between individuals, such as friends or family members, who have borrowed or lent money informally. 2. Business Debt Acknowledgment: This IOU is employed in a professional context, where a company or organization borrows money from another business entity or individual. It is often used to maintain a clear record of the financial obligations between parties. 3. Loan Repayment Acknowledgment: This IOU specifically pertains to the repayment of a loan, may it be a mortgage, personal loan, or student loan, and it ensures that the borrower acknowledges their responsibility to repay the funds borrowed according to the agreed terms. 4. Debt Settlement Acknowledgment: In cases where individuals or businesses enter into debt settlement agreements to resolve outstanding debts, this IOU is used to acknowledge the new terms of repayment, including any negotiated reductions or changes to the original debt amount or interest rate. 5. Notarized Debt Acknowledgment: This IOU is notarized by a licensed notary public, adding an extra layer of legal authenticity and ensuring the document's validity and enforceability. 6. Conditional Debt Acknowledgment: Sometimes, a debt acknowledgment may include certain conditions or contingencies the borrower needs to meet for repayment. This type of IOU highlights such conditions and their enforceability. These various types of Alameda California Debt Acknowledgment — IO— - I Owe You demonstrate the flexibility of this legal document in accommodating different debt scenarios, ensuring transparency, and protecting the rights and obligations of both parties involved.Alameda California Debt Acknowledgment — IO— - I Owe You is a legally binding document used to acknowledge and record a debt or loan between two parties in Alameda, California. It serves as evidence of the borrower's obligation to repay the lender by a specified date. This document outlines the terms and conditions of the debt, including the principal amount, interest rate (if applicable), repayment schedule, and any applicable penalties for defaulting on the debt. Keywords: Alameda California, debt acknowledgment, IOU, I Owe You, legally binding, debt, loan, evidence, borrower, lender, repayment, terms and conditions, principal amount, interest rate, repayment schedule, penalties, defaulting. Different types of Alameda California Debt Acknowledgment — IO— - I Owe You may include: 1. Personal Debt Acknowledgment: This type of IOU is used between individuals, such as friends or family members, who have borrowed or lent money informally. 2. Business Debt Acknowledgment: This IOU is employed in a professional context, where a company or organization borrows money from another business entity or individual. It is often used to maintain a clear record of the financial obligations between parties. 3. Loan Repayment Acknowledgment: This IOU specifically pertains to the repayment of a loan, may it be a mortgage, personal loan, or student loan, and it ensures that the borrower acknowledges their responsibility to repay the funds borrowed according to the agreed terms. 4. Debt Settlement Acknowledgment: In cases where individuals or businesses enter into debt settlement agreements to resolve outstanding debts, this IOU is used to acknowledge the new terms of repayment, including any negotiated reductions or changes to the original debt amount or interest rate. 5. Notarized Debt Acknowledgment: This IOU is notarized by a licensed notary public, adding an extra layer of legal authenticity and ensuring the document's validity and enforceability. 6. Conditional Debt Acknowledgment: Sometimes, a debt acknowledgment may include certain conditions or contingencies the borrower needs to meet for repayment. This type of IOU highlights such conditions and their enforceability. These various types of Alameda California Debt Acknowledgment — IO— - I Owe You demonstrate the flexibility of this legal document in accommodating different debt scenarios, ensuring transparency, and protecting the rights and obligations of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.